Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

728 -

Joined

-

Last visited

Posts posted by Dinerotrader

-

-

Everytime I think through whether to use tick charts or time charts I always come back to the same conclusion which is that time charts conceal how price reacts to various price levels within an abitrary bar length and since price is what I care about, watching a time chart would prove detrimental to trading price action.

However, I understand that there are much better traders than myself which use time charts instead of a tick charts but I never can figure out what I am missing. What am I missing?

Range charts seem interesting but again, don't those just end up concealing the price movement?

The only reason I can think to use a range or time chart is if you are trying to conceal a lot of the smaller price movement so that your focus is only on larger swings. But even then, don't you still want to know if price has been just sitting a support for 14 minutes and only travel down on the last 1 minute of the 15 minute bar?

I still stuggle with the decision of what chart to use on a daily basis so I am very interested in other's thoughts.

-

I missed a gimme on the ZS open, so perfection is still something I am working towards. Would have pushed over $1k/ct w/ that ZS trade.I like the ideas that there are "gimmes" in trading. The idea, I believe, is that sometimes the things you are looking for all line up at one point to let you know this is your best probability for a money making trade according to your trading ideas. The question then becomes, does that "gimme" setup occur enough to just wait for it and only trade the "gimmes" with larger lots or do you have to grind out the trades that aren't as well set up and manage the risk with those lower probability setups.

It appears Bathrobe found a way to focus mostly on his "gimmes" so that his win percentage is extremely high. The down side is that he has to watch a lot of okay trades go by and that requires a lot of patience.

Gimmes....I will be pondering that idea this weekend.

-

Wanna hear something funny/interesting? My trade was LONG the GCL.

Thats cool. I just thought you might have traded that.

I bought a stock a couple months back for a quick move over the span of 10 minutes. I made some money and I spoke with my friend just after it and he had just shorted the stock within that period and made money.

Good times.

-

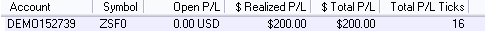

Well, a new record for me, this was great, happy all around.I was happy about my ZS trade, but now I am just sad.

Amazing trading Bathrobe.

-

-

-

If you are trying to sort out those that actually trade and those that don't, you might be a bit discouraged how many don't... Don't believe me? Ask them to start posting in our p/l thread. See what kind of reactions you get.I slowly figured that out when I first found the forum and read through thousands of posts. There aren't that many full timers. That is okay.

I am a bit embarrased that I participate in this forum so frequently and am not a full time trader but I look forward to the day when I can post that I have quite my job to trade as my primary income producing activity. I realize the road is long but I am natually a patient person and I plan on enjoying the journey without knowing when I will arrive at the destination. I have meet some great people on this forum and had some great epiphanies while sorting through all the information out there which are exciting moments.

-

I'll give this a try and see how it affects my decisions. There are certainly a lot of emotions tied to $ and those emotions don't lend themself to trading based on what price is showing you.

-

We really do need some kind of obvious self-designation symbol next to people's names so you can see who:

- trades to make a living

- trades part time for some supplemental income

- trades in hopes of quitting their "real job" to trade full time (thats me)

- trades so they can tell those to whom they are selling trading systems that they do make some real trades

Some "word smithing" on the category names is needed but you get the idea.

-

My charts started freezing again this morning and I didn't have total focus so had to sit today out.

-

Keep in mind my version of bullish or bearish may not be exactly what you've read in books, but basically I want to see some bullish activity to get long and bearish to get short. If it doesn't match a shape on a book or website, I could care less.I'm intrigued. I have watched Nison's candle stuff and read some books. What formations do you consider bullish/bearish that aren't what you would call the "regular" formations? I would think the whole point of books and formations is to pick out anything that would hint at bullish/bearish activity so it can be identified. Maybe you just mean you interpret the actual candles more liberally than the books do. Give me an example if possible.

Thanks.

-

This is great news. Thanks for the update.

-

Sim trading has limitations and some are better than others. It also is a function of the market you are trading - the ES is one of the highest traded markets daily (volume), which means that there are big lines at each level and you cannot assume that if prices touches your level you will get a fill. It's a good assumption that you are at the back of the line and the only way you're going to advance is if that line is depleted and they have to move to a new line. Hopefully that makes sense.That makes a lot of sense. Can you assume on any contract that you will get a fill at the current price?

Does your DOM ever freeze? My DOM froze up today so I couldn't trade or do anything for about 5 seconds and price moved past my buy so I couldn't tell if I was in or what..., needless to say, I was freaking out.

-

Dinero - couple things -1) Don't get too excited about that ZS profit unless you plan to hold overnight. I was hoping it would fail on you so you learn a lesson. Do NOT let that profit fool you into thinking you can routinely hold the ZS overnight. I know how that profit looks, but keep in mind it could have been the same or more in negatives.

I totally agree. I put how much I made from that trade so readers of this thread wouldn't think I had made the $243 of today's ZS profit. When I got out right at the open in the evening for a profit, I would rather have had a big loss from it so it stuck in my mind more. I plan on NEVER holding overnight. That was certainly a mistake.

2) ES fills - if you are entering via limit orders, you should assume that price MUST trade through your level to get filled. Ex: if you are buying 1051.50 price will need to touch 1051.25 to assume you got filled. It doesn't have to touch it long, but it does need to touch it. On your sim trading, place your entry 1 tick above/below your ideal entry and that will mimic live trading. Same with exits. That's part of the issue I have with the ES - price must go against you 1 tick to get filled on your entry and price must go past your exit by 1 tick to get your exit filled. That's 2 ticks price must travel against you in order for your orders to ensure being filled.

That makes SIM'ing the ES so deceiving. I will have to reevaluate my ES trades.

-

Super busy with other stuff today. $243 of that ZS profit was from yesterday's close out of the position after hours. Expecting some reversal moves from the ZS since it was at the top of its range helped out in catching some of the bigger moves.

I am only trading 1 contract for all trades.

Fills question

Do you ever get filled in live trading if you put a limit at the current price on the ES or does that never happen?

-

-

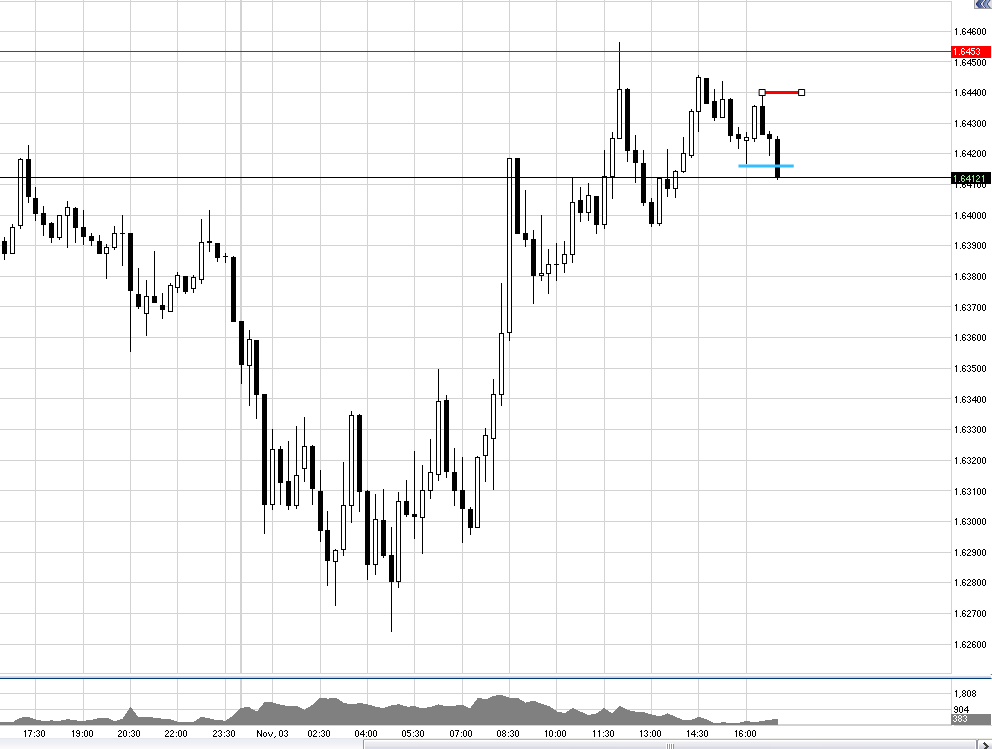

Quick shot of the daily ZS. The last 3 days have been a quick move up to the top of the range. Reversal?

-

Another view of the GBPUSD ... you identified a breakout, though perhaps not one of the significance for which you are looking, and if you were to look closely, the short at the degree which you are looking at would have been two bars earlier.Thales

I see what you mean. I tried to get the swing sizes right on this one. I suppose if a triangle is forming you would surpass taking a trade since your breakouts are now going to run into recent swing tops on both sides?

-

-

-

However, if you eyeball currency charts, the best moves occur around the Frankfurt and London opens, followed by the New York open, and then by the Tokyo open. Of course news releases also produce good volatility and range expansions. The Asian sessions seem to produce a disproportionate number of tight ranging periods, which of course explains the success of those breakouts that occur during the early hours of the European session (price cycles between periods of rest (range contraction) and volatility (range expansion). Europe and New York tend to be periods of volatility, while late New York and early Asia serve as periods of rest.Thales

Maybe a dumb question. What time is considered the open for London, Frankfurt, New York, and Tokyo? I would like to at least be aware of when I should see the open of those markets begin to influence price/volatility.

Thanks.

-

Dinero - I'm glad you are sim trading and learning these new markets. Being stuck in a position in grains after the RTH close is just asking for a heart attack. So lesson learned, but I have to ask - how late were you trading this that you still had a position this late? I suggested it before and I stick by it - be done w/ this market by Noon EST. I know moves can occur later, but as you've seen that first 1.5 hours provides plenty of movements to make money. I know it doesn't seem like long, but 1.5 hours on the ZS can feel like hours on the indexes w/ the movements.As for the CL, it's not for the faint of heart and requires some practice. It also can move quickly w/o waiting for you. It will take some practice to trade this market and if it's not for you, no biggie - there's plenty of other markets out there.

I am not sure what happened. I normally am watching the charts during trades. I took this one and set my stop and profit target and had to leave my computer. I forgot the close time and came back with an open position and from what I can tell my stop should have triggered. Not sure.

I couldn't get to my computer until 13 minutes after the ZS open which was very annoying since today was a great trend morning and had some good setups. Your right about just trading the first 1.5 hours of the ZS. I'll try to refrain.

On the ES, I am trying a bathrobe approach at trying to look for smaller profit targets and seeing if I can find where on the chart I have the most confidence in price moving my way. Going for 4 ticks profit for some reason has been working many times over for the last 2 days but ultimately, I want to only be taking a few of those trades with many more contracts. My first goal is to just pay for my lunch everyday.

If I get my evening currency trades more refined I will try to post these here also.

-

-

Perhaps you ought first to consider why so many fail at something so easy. You are looking for a solution without first knowing the problem.I try to spend a lot of time considering why so many fail and there seems to be a handful of various reasons that are apparently very hard to overcome since, like you said, most fail. I will try to think through this more and post a concise answer.

This thought has me worried for you. It seethes danger. Banish from your thought the concept that trades must be "filtered." You will end up with the many who fail. Guaranteed.I understand what you mean in some ways but in general, the act of filtering trades is fundamental to having a reasonable entry point. I wouldn't think you would recommend anyone enter at random points on a chart (even TRO filters his trades) and just try to manage your way into a reasonable trade.

You would suggest, as you did in your post, that you find a "L, HL, LL" sequence of price action which would give you better odds for the price going the direction of your entry. So I suppose you are saying that there is a balance between random entry points and trying to determine a "holy grail" entry point which you need to strike and you appear to be suggesting that the "H,HL,HH" sequence is enough to get you the edge and further "filtering" will not only be a waste of time but it will likely keep your from taking profitable trades. Let me know if I am following you correctly or if I am way off.

I will work on taking your challenge of posting a chart each day, for a week of the EUR/JPY. I will do my best to do this each day.

Thanks.

Reading Charts in Real Time

in General Trading

Posted · Edited by Dinerotrader

What a move! Like usual, I stepped away from my computer before the big move. Once I saw it had made that huge move I switched to a 1 minute chart and looked for the 1-2-3 breakouts with much smaller targets and was able to pull out 14 ticks with 2 trades. I was going to try to post a chart as it was happening but the price movement was so quick I couldn't get anything up. Nice call Forrest.

Make that 21 ticks. The pound just keeps movin'.