Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

4271 -

Joined

-

Last visited

Posts posted by brownsfan019

-

-

Interesting question about the need for math skills.

I think you'll see both sides of the pendulum if you read about traders and managers - some will be crunching so many numbers that it could make your head swell and some may use very basic math functions. And then everything in between.

Do you need a high degree of math intellect to be a trader? No.

Is it going to hurt if you are a PhD in Math? I doubt it.

I will say this though - I think you should have a love of numbers to do this job. You will be looking at numbers all day, even if not doing math functions directly. I've always loved the markets, numbers, compounding, etc. but for my day-to-day trading actual math functions are primarily done by the computer at this point.

-

If you've ever tried to explain what you do and feel like you are talking to a brick wall, you'll appreciate this video:

http://www.xtranormal.com/watch/7107529/

Note - cussing in video so do not click link if you are offended by cussing.

-

I sold everything at 2.60 so I only made 11% when 2 days ago I was up 42%. There are so many ways to screw up in this game.Come on DT, get out at the high!

You probably just got so bored w/ trading a stock after rocking in Crude for a bit.

-

I've been having an issue since the new release - if I draw a line, select it and Ctrl-C/Ctrl-V is usually duplicates it, but has recently caused an error which gives me the option to close the program or continue. Continuation is futile; the charts keep building, but nothing else seems to work. I can clear it with a shutdown & restart of OEC.Vista 64bit.

Anyone else?

I do not get the same errors.

No such problem using Windows 7 (32 bit), I rather use a right click/copy/paste though.Last Prod and demo are fine.

I also prefer to right-click as well, but the ctl is fine here too.

-

-

aren't u supposed to be promoting open ecry platform?Funny how some are around here.

Glad to see you are a fan of mine emg! Just another to the list.

Do you enjoy being that petty? Waiting for me to post so you can make some dumb comment? How long you been waiting for that?

:rofl:

-

As the LLS wraps up their Light the Night fund raising campaign, the 30% off deal at Old Navy, Banana Republic and the Gap is back.

Coupon is good Nov 11 - 14.

You save some money for Christmas shopping and the LLS gets some end of year donations.

Enjoy!

-

So speaks the OEC marketing shill.You are funny macd. You bring up OEC in a thread that has nothing to do with them. You give inaccurate information.

All I did was set the story straight so those that may be reading this understand how it really works, not what you think happens.

Please point out where that information is wrong. Please show me that the information I was given was wrong and that your information is correct.

Can you do that or will you just resort to name calling?

If you've got nothing, can you just give it a rest or is this how you plan to spend your evening?

-

Another item that traders should check is whether their stops are placed natively on the exchange, or held on the brokers server (or even worst, on your own platform) for queuing.For instance, that hard stop with OEC isn't actually in the market, on the exchange, but resides instead on OEC servers for execution upon being hit.

Good luck with that in a fast moving market.

Good example of why people that don't use the software should really just keep their comments to something they know - here's how OEC handles stops. Not quite the same picture you are attempting to paint here.

Next time maybe take the time to verify your information being presented here instead of just random guessing.

-

Since there's at least one person giving inaccurate information on how OEC handles stops, I emailed my OEC contact asking for clarification on how stops work.

From the source:If the exchange supports stops/stop limits (for the given product) OEC sends those to the exchange.The only stops we would hold on our servers would be:1. Synthetic stops (ie trailing stops). And this implementation is pretty good as many platforms do these client side.2. Multi-legged brackets (“Strategy Order” (Thumbs up) on the DOM ). These work client side.3. The exchange may not support stops (natively), so OEC may synthetically create a stop order for the client on our server.If someone places a stop in the DOM, if the exchange supports it for that contract, it goes to the exchange.Contrary to what you may have heard from others on this very site, that is how stops are handled. In a nutshell, if you place your stop on the DOM and the exchange supports stops, it's at the exchange. Now if the exchange does not support it, then there's not much OEC can do at that point but I'm sure there's a couple here that will find fault with that as well.

Just another example of why you should contact your broker directly (regardless of who the broker is) and get the answer yourself. While forums are nice, there's plenty of misinformation presented either due to lack of knowledge or wanting to put down a broker for the sake of putting them down.

-

Truly a legend in your own mind, no doubt.Make sure to update us here on your accusation.

Thanks.

-

This thread is a great example of what is going on around here... I post about the topic, no mention of OEC or anything yet MACD wants to chime in and take it off topic.

Just another example of a thread that could be a good one to discuss but the personal attacks continue.

-

Yep. I'm not a shill for them either.Seems you like them a lot and post "updates" on a regular basis.

OEC should be paying you or TL for your persistent goodwill on their behalf.

Are you the same Chris M who works for them or something?

I work a lot w/ OEC and post the updates here. Most appreciate it but there's always someone that loves to give their opinion where it's not needed. Do you even trade at OEC?

And I am not the same Chris Micciche @ OEC. You are more than welcome to contact OEC and confirm this for yourself. Their 800# is 800.920.5808. If you want names, PM me and I will tell you who you should ask for.

It's kind of flattering just how much you and Tams stalk me around this site though. I'm not sure why you two seem to have this man crush on me, but you do. Maybe it's time to find something better to do with your time?

-

Good luck with that in a fast moving market.

Yep, never an issue here.

But good try.

-

Another item that traders should check is whether their stops are placed natively on the exchange, or held on the brokers server (or even worst, on your own platform) for queuing.For instance, that hard stop with OEC isn't actually in the market, on the exchange, but actually on OEC servers.

And never had 1 problem with it.

Good to see you are back to bashing OEC macd, been awhile. Do you and Tams take turns?

-

Once again... always someone ready to chime in and bitch about something w/ OEC, even when it's something good like this. Many have requested free demo accounts and here they are.

:doh:

Cue someone to complain that you must have a live account to get this for free now.

BTW, where are all the complainers about the 'unstable' platform in the other thread? Where did they go? It was happening 'weekly'. As a matter of fact, MACD you were one to say 'thanks' to that person for posting that very complete analysis.

And here you are ready to bash OEC once again.

-

Browns,It makes sense that your broker's procedures, and of course trading volume, are critical in how your stop functions. But why would it matter if you're swing trading vs. day trading? The system (for lack of a better word) doesn't 'know' whether you've held your postion a couple hours or a couple days....or does it know?

Thanks to everyone for your patient answers.

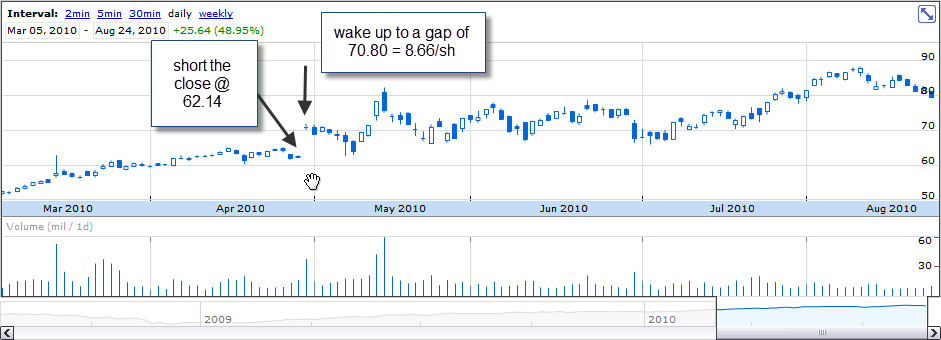

Simple - overnight gaps.

You will not see many intraday gaps if trading a liquid instrument.

Swing trading stocks however and you can wake up to a little nightmare...

This is BIDU - if you shorted the close there, you wake up in the hole 8.66/sh. Odds are your stop was taken out even though you probably planned for a much smaller stop loss.

You simply won't see that type of a gap on an intraday chart.

-

Every trade I place has a hard stop - ie it's on the DOM and sitting there as a market order ready to fire when I am wrong.

I do believe in risk-reward. If you risk 5 pts to make 1 pt, you will eventually go broke I have no doubt.

I do believe that your stops should be based on market conditions/formations whatever you want to call it - meaning that a random 1 pt stop does not make sense to me. The stop should go where if it triggers, it means you were wrong which to me means placing it out of the possible 'chop' stuff. As a reversal trader, that means my stops are usually just outside the HOD or LOD.

Hard stops force me to exit a losing trade and allows me to move on to the next trade w/o hesitation. A trade does not become an all day hope, multi-day prayer or my next investment. Simply I am not able to get emotionally attached to a trade or think that I have outsmarted the market.

-

From here:

Starting on September 1, 2010 OEC will be offering all Direct Live Accounts free access to our Simulation Environment. Details on how to access will follow.I know that is something many on here and other boards have asked for, so good to see that OEC has listened!

-

Update since last update: Software running as expected

-

So, no matter the content you post to each of my threads and that's not stalking?This love/hate thing with Urma really has you going. Just let it run its course and someday you will find someone to obsess over even more than you obsess over Urma.

Kind of like Tresor does with me.

Kind of like Tams does with me.

Kind of like Urma does with me.

Sometimes the best advice is to take your own Pat.

-

-

The only problem with futures, is that you can not bid 100 shares... So for someone new, even RIMM is too risky, sice the volume is low, and the slippage is way too high.Would be better to trade SPY or QQQQ for someone new. It is like trading index, but you can size the position.

Yep, that's why I said eventually move over to futures.

There's also the PDT/$25k issue for some and if that's the case then futures or forex is the only option to daytrade.

-

Hey laurus,Thank you for the support.

Since writing this post I have decided to trade one market exclusively, but I have not yet decided which one. It will most likely be the e-mini S&P500, crude oil or possibly EUR/USD.

Best regards,

HighStakes

I think you've chosen 3 good markets to choose from - but also three very unique markets so make sure you study each very closely before making your choice on which to focus on.

For example....

ES: Highly liquid, esp during EST trading hours, can get very range bound / choppy at times but when it catches a trend it will go.CL: My personal favorite as I think you get great moves every single day. Even the range bound moves here can be substantial when compared on a dollar to dollar basis to other markets.6E: Personally I have a love/hate with this thing as many times the substantial moves occur while I am fast asleep so I awake to trading a tight, range bound market. When you do catch a trend here it can be substantial.IMO you've got 3 very different markets there and it will come down to your risk tolerance and what types of moves you are looking for. I would not choose the ES purely based on total volume traded there daily as that will not be an issue for a very long time for you starting out so don't use that as the basis for your decision. I get tired of reading how new traders focus on the ES purely b/c of the liquidity there even though they will be trading 1 contract to start.

Drawing Tool Hiccup

in Open E Cry

Posted

You could try a reinstall, but I cannot replicate the error on my end.

I can't even recall the last issue I had, so I would say the program continues to improve - although at this point I don't need much to do my job.