Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

2245 -

Joined

-

Last visited

Posts posted by walterw

-

-

this would be a basic thread where some timiming concepts are being presented http://www.traderslaboratory.com/forums/f34/timing-alternatives-3520.html take care, cheers Walter.

-

Walter - there's a few ways to enter:1) Aggressive - have a resting order there to buy.

2) Buy @ close.

3) Buy above the high.

Just depends on how quick you want to get in, of course knowing that you can take some heat, esp. on resting orders.

yeap, I see and obviously that will give diferent RRR`s as well...

cant get more clear than that... thanks Brown.

-

And another from today Walter:3 Min ES chart from 2-27-08 AM session

good good good... so we have in this case a piercing pattern right on old resistance new support (flip)... in terms of "timing" would the swing of the high of the piercing pattern be the place to enter ( above the high of the green candle )... or other alternatives ? thanks Brown.

-

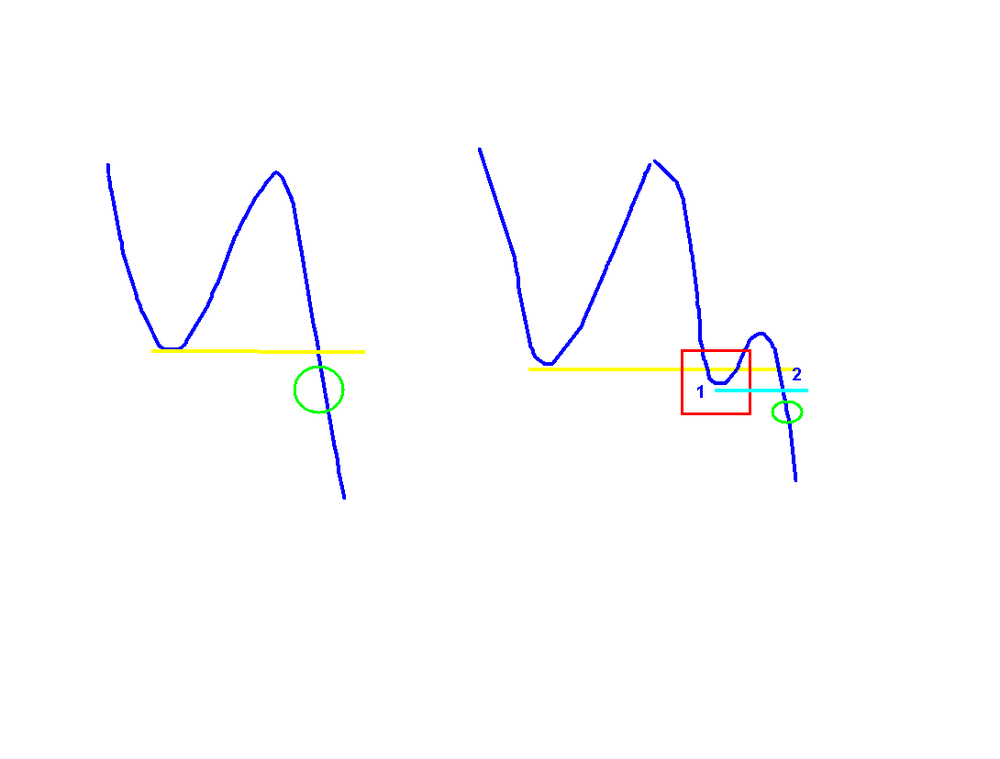

OK let me add a very small detail I am actually using on my timing that can give you a very interesting edge... this is on the case of a "pivot swing" timing... remember I am a scalper myself so its viewed from a scalper point of view, but may also be tested on diferent time frames...

on this case you have the pivot swing type of timing being slightly modified... instead of taking the first break, you may want to take the trade on the second attempt... this way you can avoid false breaks and have more confidence on the entry...

on this chart you can see the concept :

and a real world example :

screen time is the best way to see this timing edge... normally you get a small bounce before doing the real break...

ok... thats my latest 2 cents, cheers Walter.

-

Nice nice charts as usual Brown ¡¡ on this case you whent right into posible setups... on my vocabulary the two type of setups you refer to, would be "coil break" and "flip"... the coil break was the break of that wonderfull rectangle (coil) and the flip would be the re-test of old S&R levels....

Thru candles we can have a complete new set of simple timing methods as also discussed on the corner... one is the close itself of a key candle on a key area setup... the other can be the swing high/low of a key candle on a key level setup... NOW... adding candles to price action readings as Brown gave us this powerfull examples can be one of the most simple and yet efective way to trade the markets....

the setups : coil breaks, false breaks, flips, continuations, extreme reversals are just a few to mention on the setup world that can be so well detected thru the powerfull candle aproach... thanks Brown for great inputs ¡¡ as always it is a pleasure to interact with you ¡¡ more insights will be strongly apreciated ... cheers Walter.

-

Wow lol long time since i posted up here! I'm not an afficionado on indicators so can you explain how an oscilator like the CCi differs from the MA crossovers? I understand the MA crossovers and used them like almost everyone when I first ever started trading but quickly found them to be lagging so dropped them except on my long term swing trades.What are the advantages of using your timing with a CCi?

NIck in terms of average crossovers, not any regular averages... I use a combo of hull with sma... you also have the vma aproach as well...

cci can be leading and readings can be very simple... but the final product is very similar...

Remember that if the setups concepts are not the right ones, even on good timing methods you will lose money... you first need good setups and then implement the timing method that suits your personality... cheers Walter.

-

Thank you very much for starting this thread Walter. I am very interested in the various timing methods traders use to enter trades. $TICK is one of them for me but I also use the 10 period CCI on a 5min to time entries. Will look forward to reading about your techniques.I use CCI hooks to wait for price retracement. If I see a long setup I am reading price bars and volume but will have a tendency to wait until the CCI is hooking upwards. (similar to how I use TICK) I use CCI only for this purpose.I asume James you are using the cci hook at the end or almost at the end of the bar... is that the case ?

cheers Walter.

-

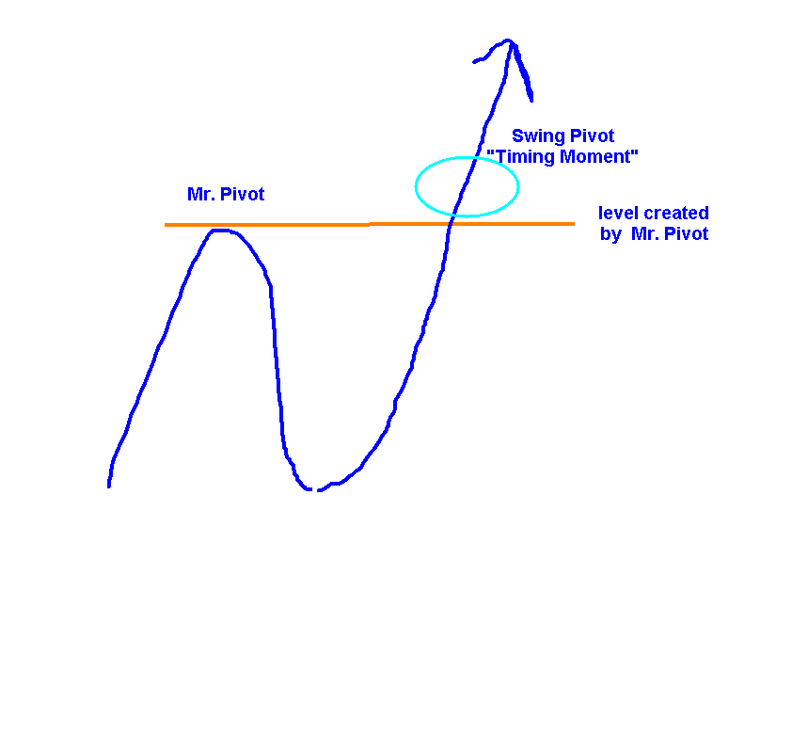

Markets are permanently doing "pivots"... that famous "V" shape... so you can use those V`s to organize your timing moments...

For example lets deal with two scenarios where we can take two diferent types of timing methods :

1) The Pivot Swing Timing

in this case you enter a trade with the criteria of swinging an x pivot... some kind of a break trader...

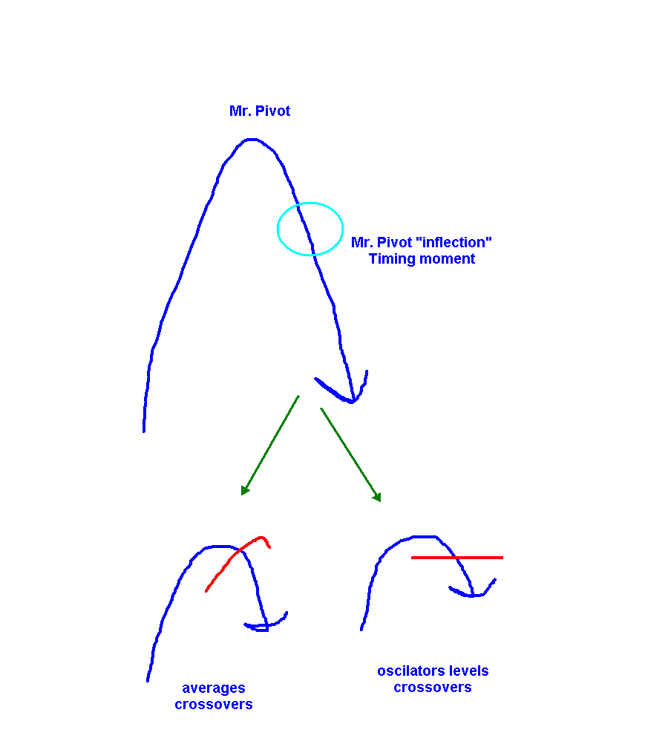

2) The Pivot Inflection Timimg

In this case you are timing right on the V formation actually, you can use averages crossing themselfs or oscillators crossing levels like I use to do with cci... ( you may want to check the flip thread, lots of cci timing examples there)...

So those are two types of timimg methods you may use acording to your strategy needs... cheers Walter.

-

Hello my dear fellow traders.... this will be a simple thread where I will start to discuss some of the simple timing methods I use and have in consideration...

Its no brainer and its nothing new at all... but may be very nice to give some light for newbies in terms of how to organize their "click" moment...

Timing for me is the click moment when you press you mouse button and send an order on your dom... trading soft etc...

but timing can also be more than that, its your straregy of "when" "where" on the entire price action picture you do enter a trade... thats an entire arena that will depend on the type of strategy you will trade...

In this little compendium, the idea actually is to give some hints on how to enter a trade based on x simple criteria... previous to that you actually need a setup... I am NOT discussing setups on this thread at all, just diferent type of timings that you can use "After" an x given setup...

so there we go.... I am not being 100% active as before, so be patient for answers in case of questions.... cheers Walter.

-

Walter-Can you elaborate on other "simple timing methods" Very interested in learning more about that!

Sledge

Sure Sledge ¡¡ maybe I can start a new thread about that... lately I am not having much time but I will try to get that asap... take care... cheers Walter.

-

thanks walterw, i like it on my charts, quick & clean divergences.did you also notice that it has a slight upward bias? at least it looks like this from the up & down distribution of the indicator.

did some searching through the code, but nothing suspicious found ;-))

cheers,

cosmic

most volume based oscillators have more + presence, thats why + or - its not the issue as the divergences you can capitalize on... watch for strong momentum conditions may get tricky... works very good on cycle days... cheers Walter.

-

Nice charts there James, I also see some powerfull hammers right on this key levels... personally I am testing them on historical data and a hammer on the right context may be a 80% winner most of the times...

CCi could also be used on 50 and 100 lines crosses as agresive anticipation timing tool... thanks for inputs... would be nice to add more examples on a daily basis during some weeks ahead on this same thread so we can hammer our small brains with this succesfull stuff...

this is what I mean James with hammers on proper places :

nice stuff keep them coming.. cheers Walter.

-

Not sure which book, but both Dalton and Steidlmayer may have mentioned it. Regarding the chart I am simply showing stopping volume. Divergence is one thing but I am reading the bars and relationship of volume.That is a 10 period CCI.

Hi James, are you using cci on some particular way ?... cheers Walter.

-

Ok here is the $64,000 question, we all know that when a trend is drying up, that volume decreases- but the real question is- WHEN? You see decreasing volume but unless you become an expert chart reader- you won't know exactly when the turn in trend will take place!oh yes Sledge, reading volume its not easy... in terms of timing I would use some other easy simple methods... volume can be used as setup info, but not for timing.... 64.000...mmmm maybe more... once you master timing, you are in bussiness... cheers Walter.

-

Walter,I've been trying to learn more about price action and trading with it. You mentioned price action being king espcially via candles. Can you suggest a book or article on candles that and how it provides info regarding price action?

David

we have the candle corner here on TL, powered by the legendary Brownsfan, a candle profesional among us... literature would be Steve Nison... cheers Walter.

-

Wow, was it really him who posted this article? "We're not worthy!!!!". Great to see you back walterw! Thought you went on a long vacation.Wellcome back Walter..We definitely missed you

Thanks guys I am very happy to be back as well... cheers Walter.

-

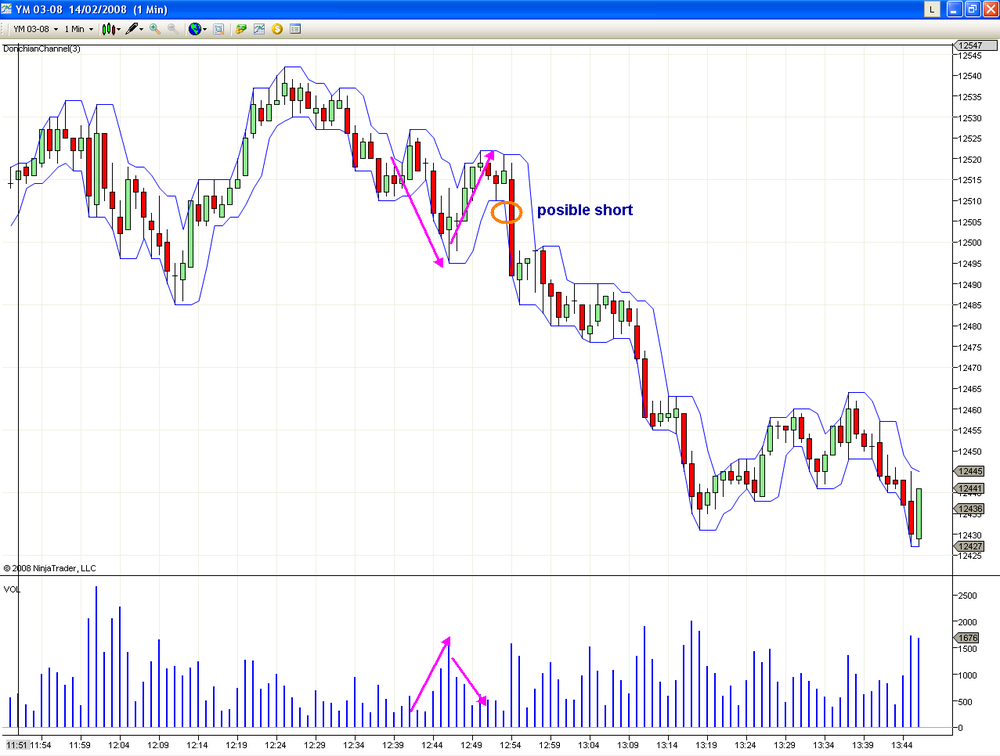

I always liked this great article... if we had to apply to intraday a YM 1 min would look like this :

pullbacks are clearly identified by small volume... well not much of a volume trader myself, but on this hyatus I am taking being reading some of this good volume stuff... still for me, price action is king... (specially revealed thru candles) maybe Martin could add some more articles on this thread, that would be awesome... cheers Walter.

-

To all my fellow traders I have to anounce I will be out of the forum and trading for aprox. two months as I will be going thru some persoanl issues...

When I come back I will be very active again on the interaction as the chimp usually does... so see ya soon all... cheers Walter.

-

hello James, this looks very nice ¡¡ as usual TL is getting even more cool ¡¡

My bug : I am not able to enter the chatroom, tells me to login, login doesnt get you there... sorry for the inconv. hope all this doesnt give you to much headache...

Thanks for all the work James... cheers Walter.

-

-

-

Tomorrow I will be doing some flips and abc`s on ym... so I wanted to share some setups we had today and how this would be followed tomorrow..

I will be using a 22 t chart with the classic keltners and cci, will look like this :

probably a video will be the best way to explain a little how this works... continue on next post... cheers Walter.

-

Gualterio querido/estimado,Gracias por todo el trabajo duro. Gracias por su corazón abierto. Y gracias sobretodo por ser usted.

Mis respetos más beest,

Richard III

(Nuevos software, hehehe de la traducción.)

Thanks Richard ¡¡ wonderfull language ¡¡ cheers Walter.

-

Long ESH8 1502, Target Filled: 1505.25 for + 3.25 Pts GAINTrade Setup: NQ Price action and VoL. Osc. +45

New Balance: $12,311.50

Out Flat.

Ronin do you follow NQ leading moves ? that osc +45 wich one is ? thanks Walter.

Timing Alternatives

in Technical Analysis

Posted

well nice setup and timing thru candles and key S&R levels presented by Brownsfan... the Flip (S&R changing roles) is a very simple way to aproach the markets, in this case its interesting to see it on a 3 min scale...

I add this chart wich has one of Browns examples, notice on the same day how we got another clear flip on ES

for more concepts on flips this thread http://www.traderslaboratory.com/forums/f34/the-flip-trade-support-and-resistance-1714.html it has some good info, now it is more a scalper type trading, on 3 min we can go for more longer trades...

another example :

maybe we should start a ES candle flip thread... cheers Walter.