Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

2245 -

Joined

-

Last visited

Posts posted by walterw

-

-

Walter,I'd love to find the most efficient and effective way to exit trades, whatever that may be. Currently it is mainly based on visual WRB's as I've found these to be decent exits on the 15 minute chart. A WRB on the 15 is pretty strong in my opinion. Of course, no exit strategy is perfect (yet) and sometimes you exit 'too soon' or 'too late' in hindsight. Part of the game I guess.

Yes I read your entire wrb thread yesterday, found it smart...

One idea that came to my mind was that wrb`s are followed eventually by a small candle, that small candle that follows wrb`s as stated by Nison would first suggest a pause, but not necesarily a reverse on direction, as the trend may resume and continue... so instead of outing at the close of the wrb , my thought was that maybe trailing the extremes of this small candles that follow the wrb could be a way to stay inside... just ideas Brown, very little experience on the subject... only some cronic sick research adiction here.. cheers Walter.

-

That's where I get duped from time to time. A small spread on low volume when it's just a breather or pullback and I think it's no demand.Do yall have any tips for helping me to be more clear on what's just a pullback or "test" as we call it in VSA? I get the concept of no supply and no demand but have trouble being accurate since big volume on a narrow spread usually shows shares handed off to the herd BUT narrow spread on low volume could be just a test OR no professional support.

Thanks

Hi Mike, I personally find VSA very dificult to read as volume data sometimes may get tricky, I always say vsa is for very smart people, still sometimes they get tricked as we do on price action readings... so dont go bald ¡¡ jejej cheers Walter.

-

ok sounds good, so we can explore some new grounds... would this exits be candle based ? or you are interested in exploring some other exit strategies...

cheers Walter.

-

Thanks Brown... I think that your 15 min chart really should be king here... I was really captivated with that chart and its performance... so lets start with the 15 min setups...

I would like to develop some exit strategies more near to my style probably on smaller timeframes, but setups on 15 min look the best as I see that from your experience (wich is very valuable) trying to setup on smaller timeframes could be a futile game...

My first question here... when a hammer doesnt make a mayor follow thru, is it possible to play in the oposite direction ? could that be a good setup ?

also, I am very enthusiastic to see how Nison uses "flips" as part of his S&R context strategies... cheers Walter.

-

Thanks Brown for your great inputs... will be nice to see what type of new hybrid aproach we can make out of this... cheers Walter.

-

Thanks Brown for this new thread ¡¡ it will be very interesting to see where we can get here...

My motivation here is to reduce my cronic scalping to a larger span but at the same time not so large... so it would be a more "larger scalping" aproach...

So far I am very new to candles, so I cant talk with authority on this and I would like to learn from the masters... what I see is that 3 min and 5 min candles can do "something" for my idea, key is to create a good context so this patterns on this small time frames could be more credible...

At this point I am paying a very close attention too dojis and hammers...

Thanks for this oportunity ¡¡ and let the interaction start ¡¡ cheers Walter.

-

-

What a bearish day today! The bears were in full effect!Just in case anyone traded this blindly, all longs should be exited by now!

This one just didn't have it and this was a very convincing close below the 1500 level, which is a major psychological level.

You could also view this inverted hammer as a reason to short. I gotta get to bed here, but the idea being that you have a close below our new resistance (old support that the long was based on) AND we are below the 1500 psychological level. I'd have to see where a realistic profit target would be to see if this is worthwhile or not, but there could be an aggressive setup here.

Side note - days like today are why I really enjoy the day-trading part of this business. Today was just a great day to be grabbing points all over and while I knew the drop was not good for our long here, it was a great money maker on an intra-day chart.

I have a question as I am new to this... when a hammer fails like this example, can the oposite direction be taken as a valid signal ? for example a swing low of this hammer was a nice short to be taken... thanks Walter.

-

Today I readed this entire thread and its loaded of excellent quality insights ¡¡ very good inputs into candle trading... would be nice if you keep updating it as it has a very great educational value thanks Brown and James ¡¡ cheers Walter.

-

Mike : this is one of the versions of adxvma coded by Blu-Ray for TS... cheers Walter.

-

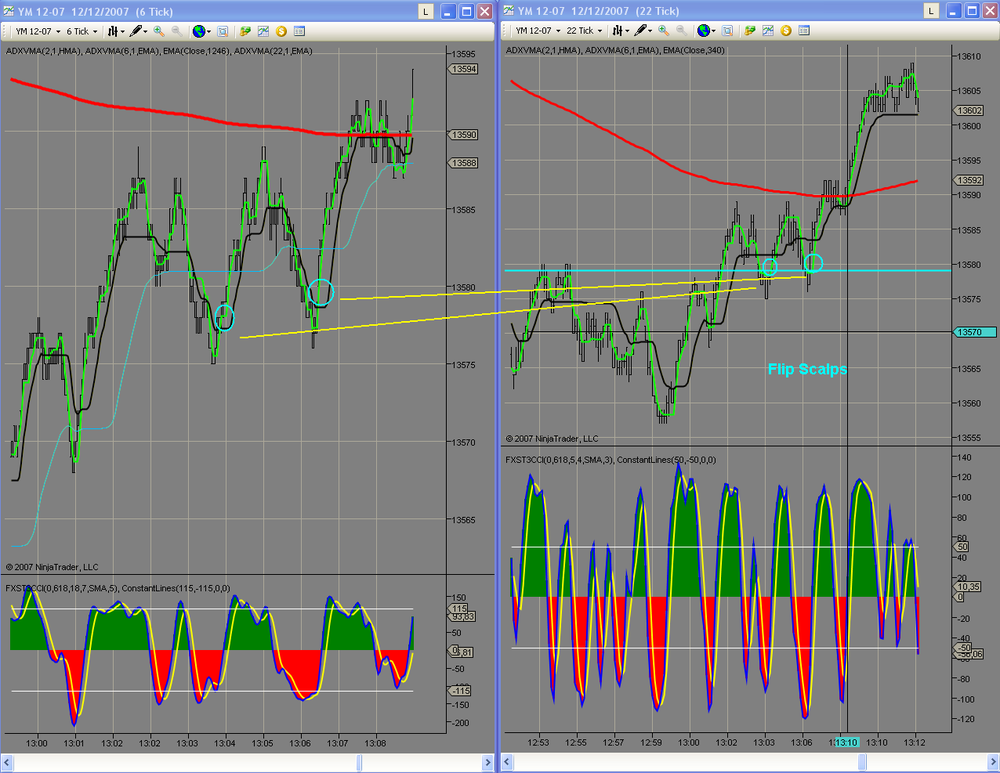

This is one of the S&R setups I will try to focus today... when we get to test an S&R key level expecting a bounce, BUT that bounce doesnt follow thru, we can expect a break of the level.... now instead of timing the entry after the break or in the break itself where you can get to much slipagge, I time right before the break... this can help for a tight stop management as well... good trading today ¡¡ see ya on our new chat room ¡¡

cheers Walter.

-

I started to study Nison last night... Awesome ¡¡ thanks Brown ¡¡

for my longer term trading that I plan to develop, no doubt candles will be my choice... simple and efective stuff ¡¡ cheers Walter.

-

Very special day for the chimp as he hits 2000 posts ¡¡ after 1 year and 18 days, with 59 threads started he is really glad to form part of the TL family ¡¡

He learned a lot thru collaboration and many thanks for your support dear fellow traders ¡¡

Now he is ready for another 2000 posts ¡¡ cheers The Chimp.

-

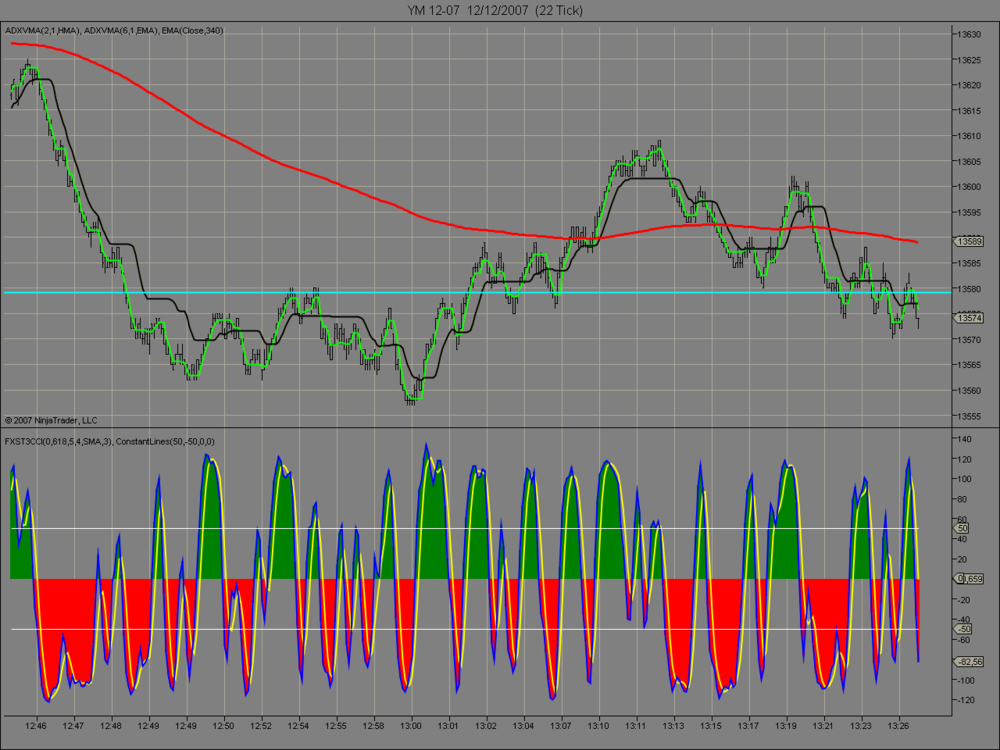

Hello fellow traders... Pipper asked me to show what chart I had been looking today for my scalping... So I will attach here the 22t principal

I will have to make a confession... Its a little trick not suited for new scalpers yet and not recomended at the begining of this posible learning curve, as it could create confussion to the trader... I also do follow a 6 Tick chart for "very specific timing"...

This things are not easy to diggest at the begining... but once really grasped they are really fun... see ya tomorrow on the chat... cheers Walter.

-

You may invest on the chimp banana republic national bonds, they cut coupons every week at 1% rate... best deal ever, guaranteed by the UN , bonds for food comision... cheers Walter.

-

jejeje :haha: :haha: :haha: ok lets compete, who gets to $5000 first...

-

Thats a nice new benefit from TL ¡¡ would be nice if this could also be done on our futures acct as well ? jejeje... cheers Walter.

-

yes it would be swing of a bar that is testing some of this key levels...

-

Hey walter do you use your normal trigger for this trade? A couple of entries occur to me.Limit at the line.

BO back below the line

BO of the bar that penetrated/touched the line.

I'd go with the first but suspect you might use the last

BO stands for ?

-

Thank's for you help, I understand playing with the DOM is the key.I use ButtonTrader myself but I think it is very diificult to take 4 ticks where there are only 5 ticks to take.

This is the reason why a video help us, imho.

For ex : JPG (nice guru on this nice forum) made a video with DOM, I think it is possible after your day target will made.

Give me time agon and I will try to make one... really if price was hit, you will get filled, when you see that you did not get filled and things get lazy, thats where you want to exit manually... I kind of understand what you are meaning on getting filled on so small range... sometimes happens, sometimes not... thats why I get out with +2 or +3 sometimes and still is good bussiness for me... cheers Walter.

-

Hi Walter,Sorry for my Tarzan english by advance.

First, a big thank you for all your threads and all your videos very interesting.

But I have a small question, you say take 4 ticks in some places where between the upper and lower V, there are only 5 ticks.

What kind of front-end do you use to accomplish this feat ?

Would it possible to make a live video where we could understand how you take position and how you get out. I know it's difficult with the concentration, but perhaps a live simulation after you have made your daily target.

Thank you again for all your work.

I use a DOM where you have a lot of features to get some exits automated once I entered manually... If I load more volume some things I do it manually... I am afraid making a video of this will not be possible as camtasia uses excesive resources... but basicly agon, you tell the DOM how many ticks profit you want from where you entered and he will do it automatically for you, if things are not getting there, I get out manually... playing with the DOM its key there... cheers Walter.

-

Hi Walter,The videos are great!! Thanks so much for taking the time to share this information. I'm really enjoying this stuff and look forward to seeing new videos. These videos are answering the questions I have about support and resistance. Thank you.

Hi Walter,You mentioned about using tight stops, typically how large is your stop? Are your stops a few ticks behind the support and resistance line? How do you determine how much to risk on each trade as a scalper? Thank you.

Thanks Nyc, I will try to normally take a stop on -4 -5 max.. now one trick I got is that when things dont go my way I get out with 0 -1 or -2 stop... that helps a lot... the textbook stop should be below/above entry pivot, but when you develop some discernment that things are not working you may want to tight even more your stops... cheers Walter.

-

Thanks ¡¡ I feel better now... cheers Walter.

-

Hi James...was wondering where did the casino go... when there is no session I need to gamble somwhere jejeje... cheers Walter.

"S&R" Scalps

in Technical Analysis

Posted

you should plot 2 of those with dif parameters like 2 and 8 maybe... try that... cheers The Chimp.