Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

lordbinder

-

Content Count

51 -

Joined

-

Last visited

Posts posted by lordbinder

-

-

http://img525.imageshack.us/my.php?image=pakjistancd6.gif

this is a chart of what happen on pakistan after shotr was ban

-

thoguth the same but the third is on other set of rules unless its a projection of another one

-

candle wisperer, maybe is a dumb question but how you set the 3 zones particuarly the third one

-

Indeed now that I remember, time and sales are available on the TWS but not streaming. Either way download the free version of the quote tracker software you can get the data from IB station, just put the ticker on and select "raw data"

-

the TWS has it or you can use the free medved quote tracker

-

but you ll have access to a computer, not yours but any computer, i manage to virtualize almost all the markets apps I use so they run from a usb device on any computer. But if you dont have access to a computer you have to go with a smart phone or an ultra portable subnotebook

-

even in metastock you can do the formula with 1 line, dividing one by the another and thats it

-

ok, ill check it to see how it works

-

This is the 2 outputs of 4 inputs.....good luck to you...

mr black thats OEC platform, right? how you do to get the time and sales in the way you capture the screen, im not really familiar with that platform and couldnt see that setting

-

I was interested on Interactive brokers tickers, globex if possible

-

I was looking for some tickers if at some point i cant sleep, not neccesarely to trade them but to look at seomthing moving when i cant sleep

-

you got me there midnight, now here is 2,32 in the morning, so this is night session to me

-

I Have the ticker on my station but only as a curiosity. I thought that i could trade it on the night session but you cant. Is there some index futures with more liquidity on night sessions? aside of ES i mean

-

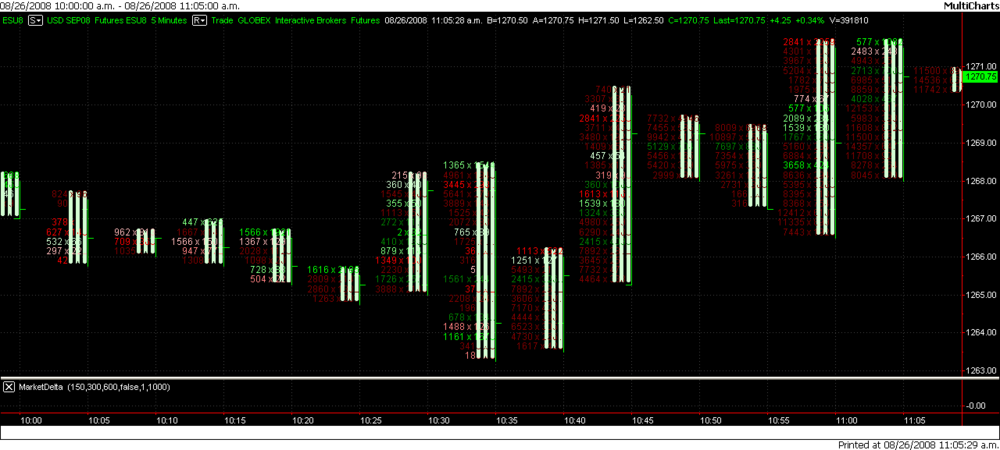

Here it is, on the multicharts code Im using

[LegacyColorValue = TRUE]; {To draw line break blocks, today's close is compared to the high and low of the previous block. A block is drawn only when today's close exceeds the high or low of the previous block. If today's close is higher than the top of the previous block, a new up block is drawn in the next column from the prior high to the new high price (today's close). If today's close is lower than the bottom of the previous block, a new down block is drawn in the next column from the prior low to the new low price (today's close). If the close fails to move outside the range of the previous block's high or low, then nothing is drawn. In a Three Line Break chart, if rallies are strong enough to display three consecutive blocks in the same direction, then prices must reverse by the extreme price of the last three blocks in order to create a new block: If a rally is powerful enough to form three consecutive up blocks, then prices must fall below the lowest point of the last three up blocks before a new down block is drawn. If a sell-off is powerful enough to form three consecutive down blocks, then prices must rise above the highest point of the last three down blocks before a new up block is drawn. Since Trade Station cannot display Three Line Break Charts, I have written this PaintBar in which UP block colors rotate between white and yellow, and DOWN block colors rotate between red and magenta. Each time the rules call for a new block to be drawn, the PaintBar colors change, indicating the new block. The chart is best viewed when setting the bar type to "line on close". John M. Snyder April, 2001} Variables: FUBarHigh(0), FUBarLow(0), SUBarHigh(0), SUBarLow(0), TUBarHigh(0), TUBarLow(0), FLBarHigh(0), FLBarLow(0), SLBarHigh(0), SLBarLow(0), TLBarHigh(0), TLBarLow(0), UpCount(0), DownCount(0), UpNew(0), DnNew(0), UpRev(0), DnRev(0), PlotHigh(0), PlotLow(0), Color(0); If Close > UpNew Then Begin If DownCount < 3 Then Begin If UpCount = 0 Then Begin UpCount = UpCount + 1; DownCount = 0; FUBarHigh = Close; FUBarLow = UpNew; SUBarHigh = 0; SUBarLow = 0; TUBarHigh = 0; TUBarLow = 0; FLBarHigh = 0; FLBarLow = 0; SLBarHigh = 0; SLBarLow = 0; TLBarHigh = 0; TLBarLow = 0; UpNew = FUBarHigh; DnNew = FUBarLow; PlotHigh = FUBarHigh; PlotLow = FUBarLow; Color = 7; End; If UpCount = 1 Then If Close > UpNew Then Begin UpCount = UpCount + 1; SUBarHigh = Close; SUBarLow = FUBarHigh; UpNew = SUBarHigh; DnNew = SUBarLow; PlotHigh = SUBarHigh; PlotLow = SUBarLow; Color = 8; End; If UpCount = 2 Then If Close > UpNew Then Begin UpCount = UpCount + 1; TUBarHigh = Close; TUBarLow = SUBarHigh; UpNew = TUBarHigh; DnNew = TUBarLow; PlotHigh = TUBarHigh; PlotLow = TUBarLow; Color = 7; End; If UpCount = 3 Then If Close > UpNew Then Begin FUBarHigh = SUBarHigh; FUBarLow = SUBarLow; SUBarHigh = TUBarHigh; SUBarLow = TUBarLow; TUBarHigh = Close; TUBarLow = SUBarHigh; UpNew = TUBarHigh; DnNew = TUBarLow; PlotHigh = TUBarHigh; PlotLow = TUBarLow; If Color = 7 Then Color = 8 Else Color = 7; End; End; If DownCount = 3 Then Begin UpRev = FLBarHigh; If Close > UpRev Then Begin UpCount = UpCount + 1; DownCount = 0; FUBarHigh = Close; FUBarLow = TLBarHigh; SUBarHigh = 0; SUBarLow = 0; TUBarHigh = 0; TUBarLow = 0; FLBarHigh = 0; FLBarLow = 0; SLBarHigh = 0; SLBarLow = 0; TLBarHigh = 0; TLBarLow = 0; UpNew = FUBarHigh; DnNew = FUBarLow; PlotHigh = FUBarHigh; PlotLow = FUBarLow; Color = 7; End; End; End; If Close < DnNew Then Begin If UpCount < 3 Then Begin If DownCount = 0 Then Begin DownCount = DownCount + 1; UpCount = 0; FLBarHigh = DnNew; FLBarLow = Close; SLBarHigh = 0; SLBarLow = 0; TLBarHigh = 0; TLBarLow = 0; FUBarHigh = 0; FUBarLow = 0; SUBarHigh = 0; SUBarLow = 0; TUBarHigh = 0; TUBarLow = 0; UpNew = FLBarHigh; DnNew = FLBarLow; PlotHigh = FLBarHigh; PlotLow = FLBarLow; Color = 6; End; If DownCount = 1 Then If Close < DnNew Then Begin DownCount = DownCount + 1; SLBarHigh = FLBarLow; SLBarLow = Close; UpNew = SLBarHigh; DnNew = SLBarLow; PlotHigh = SLBarHigh; PlotLow = SLbarLow; Color = 5; End; If DownCount = 2 Then If Close < DnNew Then Begin DownCount = DownCount + 1; TLBarHigh = SLBarLow; TLBarLow = Close; UpNew = TLBarHigh; DnNew = TLBarLow; PlotHigh = TLBarHigh; PlotLow = TLBarLow; Color = 6; End; If DownCount = 3 Then If Close < DnNew Then Begin FLBarHigh = SLBarHigh; FLBarLow = SLBarLow; SLBarHigh = TLBarHigh; SLBarLow = TLBarLow; TLBarHigh = SLBarLow; TLBarLow = Close; UpNew = TLBarHigh; DnNew = TLBarLow; PlotHigh = TLBarHigh; PlotLow = TLBarLow; If Color = 6 Then Color = 5 Else Color = 6; End; End; If UpCount = 3 Then Begin DnRev = FUBarLow; If Close < DnRev Then Begin DownCount = DownCount + 1; UpCount = 0; FLBarHigh = TUBarLow; FLBarLow = Close; SLBarHigh = 0; SLBarLow = 0; TLBarHigh = 0; TLBarLow = 0; FUBarHigh = 0; FUBarLow = 0; SUBarHigh = 0; SUBarLow = 0; TUBarHigh = 0; TUBarLow = 0; UpNew = FLBarHigh; DnNew = FLBarLow; PlotHigh = FLBarHigh; PlotLow = FLBarLow; Color = 6; End; End; End; Plot1(PlotHigh,"High Bar",Color); Plot2(PlotLow,"Low Bar",Color); -

Ill check them, I actually am a client of QT, but I hade a minor delay lately, support solved it a couple of days ago, but the quest for a renko chart on multicharts remains

-

I keep looking for a renko script, i already decided to get to know the easylanguage myself to do it, but as I was looking for it again, i found a 2001 TASC script for a 3 line break

-

yes in some countries you get the college education in a different manner, take for example my country argentina. A bachelor degree here takes at least 5 years and its a combination of a bachelors and masters on the USA. And you have only 2 optional subjects that grant you credits, you can take them all if youdlike but they wont take them into account when you go past those 2. And you have to give a thesis for the final stage

The funny thing? most of the best classes are optionals...

-

optional classes are of paramount importance in the american college system, I went to college on the states )im not american). And most of the material on the classes its pretty dry, unless you get a great professor. I found one of those professor and ended up as an AP on Bonds analysis and trading since I was on it since 16 with my granfather.

Look for optional courses on the subjects you are interested in, most of the times some of those optional classes are more interesting than the ones you are forced to take.

As it was mention the networking is by far one of the most important reasons to attend a good university. But if you are good at what you do, eventually you get where you want to go college or not

-

thx I knew the problem was the use of the short but dint know how to solve it. I know its just a signal and an indicator but it was all i could find, there is renko for metatrader esignal and amibroker but couldnt fund any for easylanguage

-

answering to myself I just found this 2 indicators, but trying to compile on multicharts gets an error

TRADESTATION EASYLANGUAGE CODE:

{Renko-Adaptive indicator (based on ATR)

Written by konkop 07.03.2002.

*********************

Attention: set MaxBarsBack (f.e. =30) in this study according with

MaxBarsBack value in the Renko_Adaptive strategy

for correct step-by-step calculations of the buy/sell levels

*********************}

Inputs: K(1),

Smooth(10);

vars:Brick(0) ,DN(0), UP(0), BricksUp(0), BricksDn(0);

Value1 = AvgTrueRange(Smooth);

If BarNumber = 1 Then Begin

Up = H;

Dn = L;

Brick = K*(H - L);

End;

If BarNumber > 1 then begin

If C > UP + Brick Then begin

BricksUp = IFF(Brick = 0, 0, Floor((C - Up)/Brick)*Brick);

UP = Up + BricksUp;

Brick = K*Value1;

DN = Up - Brick;

BricksDn = 0;

End;

If C < Dn - Brick Then begin

BricksDn = IFF(Brick = 0, 0, Floor((Dn - C)/Brick)*Brick);

Dn = Dn - BricksDn;

Brick = K*Value1;

Up = Dn + Brick;

BricksUp = 0;

End;

End;

Plot1(UP, "Up");

Plot2(DN, "Dn");

TRADESTATION EASYLANGUAGE SIGNAL:

{Renko-Adaptive signal (based on ATR)

Written by konkop 07.03.2002.

*********************

Attention: set MaxBarsBack (f.e. =30) in this study according with

MaxBarsBack value in the Renko_Adaptive indicator

for correct step-by-step calculations of the buy/sell levels

*********************}

Inputs: K(1),

Smooth(10),

Short(false);

vars: Brick(0) ,DN(0), UP(0), BricksUp(0), BricksDn(0);

Value1 = AvgTrueRange(Smooth);

If BarNumber = 1 Then Begin

Up = H;

Dn = L;

Brick = K*(H-L);

End;

If BarNumber > 1 then begin

If C > UP + Brick Then begin

BricksUp = IFF(Brick = 0, 0, Floor((C - Up)/Brick)*Brick);

UP = Up + BricksUp;

Brick = K*Value1;

DN = Up - Brick;

BricksDn = 0;

End;

If C < Dn - Brick Then begin

BricksDn = IFF(Brick = 0, 0, Floor((Dn - C)/Brick)*Brick);

Dn = Dn - BricksDn;

Brick = K*Value1;

Up = Dn + Brick;

BricksUp = 0;

End;

{Trade Rules with or without short trades}

If Short = false then begin

If Up > Up[1] then buy at C;

If Dn < Dn[1] then exitlong at C;

End;

If Short = true then begin

If Up > Up[1] then buy at C;

If Dn < Dn[1] then sell at C;

{If C < Dn[1] then exitlong;

If C > Up[1] then exitshort;}

End;

End;

-

anyone know of a renko charts script for multicharts or tradestation?

-

-

thx it works now

-

I got an error when trying to compile on multicharts, anyone tried on it?

Ban On Shorts

in Beginners Forum

Posted

not only inverse there is ultra shorts, so if one can get into a down movement it can easily be achieve