Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

471 -

Joined

-

Last visited

Posts posted by jjthetrader

-

-

Dear Eiger,You are right, I should have more patient and wait for the top or bottom to forms before entry and let the story begin start. Thanks for your kind help, your chart is really helpful and I study it many times.

Just a question : do we need a down close for a test bar in an uptrend ?

Winnie

Hi Winnie, let me see if I can help. Eiger can jump on board if need be. First, in an uptrend you do not need a down close. It may just happen that your timeframe has a close by 1 tick higher but a lower timeframe shows that down close. Tom Williams talk about this and how you need to be flexable.

There are so many different kinds of tests and this one would be called a hidden test.

Ok, in the last few posts you were asking about entries etc. I've got a prime example that just happened on the ES.

1. We come up to R1 and find supply. That's no big surprise. So at this point we don't know if it's temporary or a reversal. We pull back a couple bars and stll don't have a clear picture yet.

2. No demand shows up. Perfect, we are now are beginning to see what's happening. Now we can do two things here. a) place a sell order below it's low or b) wait for confirmation.

3. A trap upmove. This is confirmation. If you didn't have your sell order in, no worries, you'll always get a second chance on a retracement.

4. Another no demand and a perfect retracement level, the bottom of the first no demand.

5. This is NOT no supply. We just had supply confirmed in this market. Ignore. This just happens to show up because of my timeframe.

6. Yet another chance to get short and we didn't even need to pick the top! Even since I snapped that screenshot the market dropped another 7 points between the snap and my writing this and that's on the 3rd no demand!

If it's true strength or weakness in the background then you'll have lots of chances to get in which gives you lots of opportunity to confirm the supply/demand dynamic.

cheers.

-

Ok, thanks Chad.

-

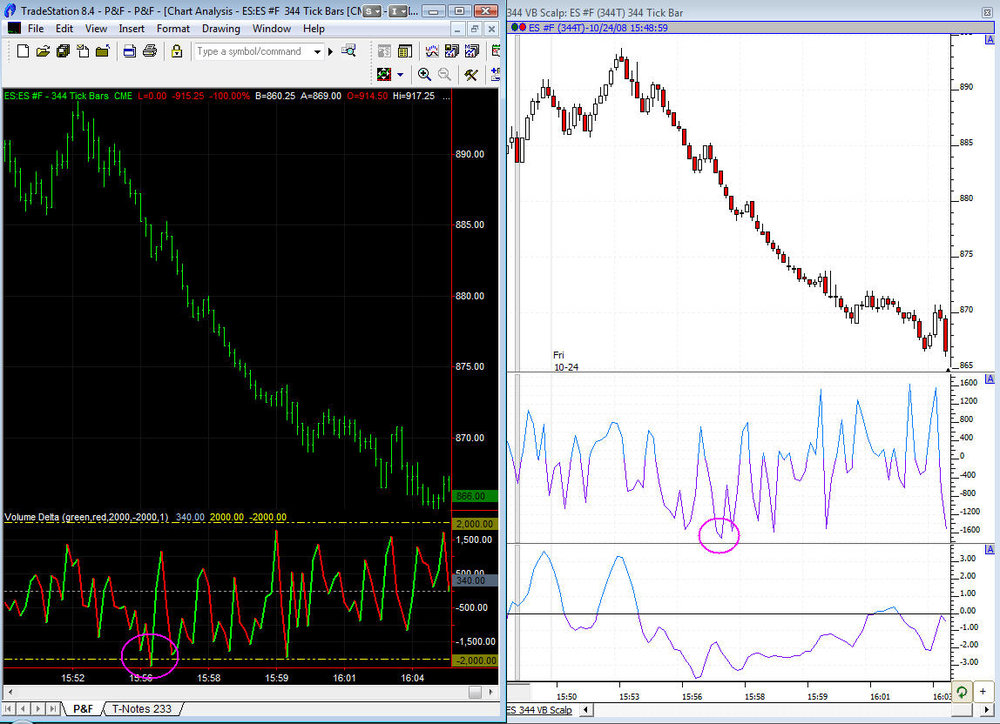

Chad, In the attached pic can you see how the two different software packages get different VB levels on the same timeframe chart and the same data supplier (they're running esignal through TS).

I'm thinking about getting IRT but I'm not sure which is right.

The TS indicator uses your same approach in it's calculation as your VB.

Any ideas?

thanks.

-

No mix up I can assure you, just an out and out scammer.

Good to know.

-

I have to say I disagree about the Welsh Wizard. An out and out scam artist with a similar modus operandi as the "Chief Wizard" (which has been well documented in various places).Do you know the guy? I see you are from Wales too. God forbid, you arent the WW are you? Kind of worried that you have started promoting this con man.

Blowfish, I think you may be misinformed. For one I can guarantee that Tawe is not the WW. Second, the Welsh Wizard doesn't sell anything. He doesn't use indicator or algebraic equations. So who could be be scamming?

You may just have the guy Tawe is talking about mixed up with someone else.

-

Great, thanks. Does that mean it will be added to Market Delta to or does MD already store that info?

-

Very cool! Is this available now?

thx

-

Hello, does IRT have the capacity to plot the volume point of control for each 3 minute bar similar to what a 3min footprint chart would show but in this case it paints a dot on the candle?

-

And signals of the acknowledgement of the trend after main signal

Possible, together beside us to be reduce subjectivity of the method VSA

Hey man, I totally get where you're coming from. You're right that VSA is a methodology and that rules for trading it need to be layed out. My trade example on the last page is an example. If I get that shake-out or spring then I'm looking for my test to enter in on. I'll put my order at the high of the test bar so the next bar picks me up as it moves up. This is just one way I've adapted an entry using VSA. They like the close of the confirmation bar. This is too late for my personal risk tolerance.

In this market, with the stops that are needed you can't just jump in anywhere just because you saw a VSA signal.

Unfortunatly VSA can't be broken down from it's subjectivity. It can't be put into a system because it's dynamic and you have to be flexible even if the close of your bar is off a bit. A system with hard rules can't be flexible.

My advice is to find one VSA setup. Learn it, know when it's valid and when it's not, find out how to enter on such a setup and once it's made you rich you can add a second setup. Master just one. That's all you need to make money. They happen all day everday on different timeframes.

-

JJtheTraderThank you for your opinion

Is possible say that C it's a high volume downbar closing on it's highs. That's strength and simultaneous a test of supply ( volume is high but smaller than two previous) ????

Thank for your willingness to answer . I am pleased

Kuky, volume less than the previous two makes it low volume from a relative standpoint and that's what we're looking at so it was a test.

Either way, futures can have high volume on a test because it's the large players hopping in. It's the cash market where you don't want to see it.

Tawe, excellent example. When I first learned VSA that same pattern always tripped me up. It looks like weakness has come in but it's not. It's effort. Great job.

-

This is my one of first attempt read the market . I would like ask somebody write of opinion on my chartA –buyers entry

B – some sellers

C- I could say is test but I am confused from

B bar and I am not sure about strenght in background

D – narrower spread as previously bar but volume bigger –some sellers

F – no selling pressure

G - I could say up-thrust but I am not sure about weakness in background

H- no demand

I – no demand

J – selling climax

K – no selling pressure

L – no demand

M – effort to fall ,next bar is negative action, we have spring – we have strength in background

N – test

P- test

R – sellers entry

Wow, very nice. I wouldn't argue with any of that. You were confused about C because you didn't know the background. If you look at it, it's a high volume downbar closing on it's highs. That's strength.

And "R" yes that's sellers entering and would be an upthrust.

"N" is a test but we'd go even further to call it a hidden test since it closed up. But drop down to a 7 min and that's a "true" test.

The only one I wouldn't agree with is "F". It appears to be no selling pressure and in fact there may be no real pressure there but after weakness appears this type of bar I'd label as "unable to find a bid".

Good work Kuky.

-

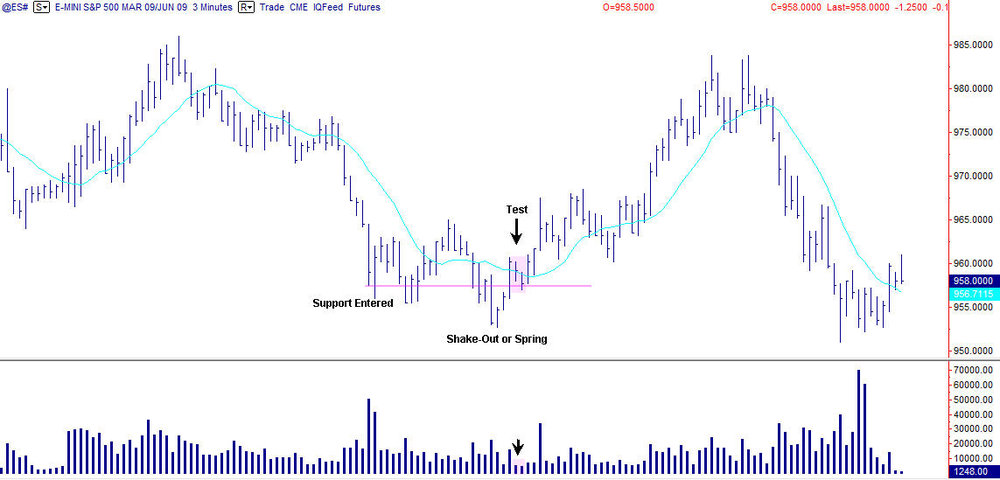

This comes back to Winnie's question a few posts ago. Where do we enter after strength comes in?

There is a nice progression of a bottom being formed that we like to see in VSA. This is a 3 min so you may want to add the bars together to see a larger timeframe.

Strength first enters and we get an automatic reaction. We see a couple of those no demands that Winnie described. We know not to be looking short here.

They retest the lows and push a bit to fool people into shorting the low. Again we're long biased already. So we get a nice little rally off that false move. There was no real testing going on at this point so I'd rather wait and buy higher if I had to.

Then we get Eigers favorite, a spring (or shake-out). On the way up out of the spring we get a test of the initial high volume bars low. I had an order sitting above the high of that first low volume downbar marked and then moved it down to just above the high of the second low volume downbar (no supply). It picked up my second order and away we went. I had a 10 tick stop to put me just under the low of the test.

Hope that helps.

-

Eiger, What I posted is factually correct. I have watched Todd and Tom analyze lots of charts, and they look brilliant until they get to the hard right edge, where then their abilities drop off precipitously. Are you better than Todd Krueger and Tom Williams?Several people have thrown out personal attacks on me for daring to challenge VSA on a VSA forum. So, this forum is only for cheerleaders of VSA? Nobody gets to question the basic premise of a technique? Somehow, I would have thought that such a challenge would be healthy, even constructive, but some of you seem to be so afraid of anyone questioning your basic assumptions that you have to attack the questioner, or "arguing ad hominum" as they say in debating circles. There's a word for that in english: immature.

Your facts are funny. When did you ever see Todd Krueger or Tom Williams trade live? What a joke. Plus who says they're the experts on it?

Next, it's not that we dislike you questioning the basis of VSA, it's that this forum is to learn about VSA and the one you should post your doubts about in is "VSA Crock or Not". You just seem to be derailing the thread. Post over there with your bum buddies.

Eiger, ignore this dick's challenge. No real trader has to prove anything to a sim trader.

-

Dear all,If we find an wide spread dn bar with ultra high volume and next bar is an up bar with lower volume. We will suspect the dn bar has some demand in it, otherwise the next bar shold l be dn , am I correct ? If the trend is dn, should we buy or sell ? Usually , I find the next up bar after the ultra high volume dn bar is a no demand bar, this make me very confused . IF we combine this two bar(the ultra high volume dn bar and its next bar: a lower volume up bar) , it should has strength. However if we only take consider the lower volume up bar only , it is a no demand bar(should be a sell signal). What should I do ?

Thanks

Winnie, it's the testing that goes on after climactic action, like you described, that gives you your answers. This big downbar could just be the beginning of support coming in. Price may still need to go lower. A test of this high volume would be your entry signal.

The 'no demand' you're speaking of often shows up in a reaction bounce after an event like you described. Professional money does not want to take price any further without a test. This isn't your best bet short either since we look for no demands after weakness has appeared and what you described is potential strength.

Hope that helps.

-

Not to distress. VSA as any other way to trade subjective, and wins more lucky, this not saint grail and possible not the most best method (excuse me, i am, dont speak english)Another non-constructive post. This is not the thread for comments like that. It is for those who are interested in VSA to learn, not be discouraged. Go to the crock or not thread if this is your mindset.

-

Please take look at the chart and give me some suggestion ?thanks for your time

Winnie, the bar you marked as weakness isn't really weakness. Volume is just barely over your marked average. Some supply came in in that area but not enough to change the direction of the market. And the 'uptrust' isn't really an upthrust. Yes it's lack of buyers but where's the selling pressure or follow through? With volume like that it doesn't exist.

All rallies need to pull back. Check out the volume on your downbars. Both are lower than the previous two. Your original inclination of the no supply bar was correct and a perfect place to look for an entry.

-

My problem with VSA remains the same, namely that it all sounds so logical in hindsight, but I have yet to see a VSA "expert" who can use it in real-time without getting egg in his beard.Have you ever seen ANYONE trade VSA at all? Please don't add doubts like that into people who are trying to learn to read the market using price and volume. VSA is a very viable way to trade and very profitable. Please keep your crock or not stuff over there.

-

Thanks Eiger - but, in the past, when db put up similar 'wycoff' explanations in this thread you SCREAMed !!! Please watch the double standards...I disagree with zdo. Wyckoff is the basis of VSA and Eiger mixes them both together (two sides of the same coin). Db however does not care to speak of "VSA".

Eiger, keep up the good work. I lurk on this thread just to read your posts.

Eigers a saint to put up with you guys who participate on the negative side of the 'crock or not' thread and then come here and ask his opinion. Give him a break or at least some praise.

-

Your last sentence is correct. Apart from that, there is no gamble at all in taking an early entry. Have a look at Sledge's post here (posts #46 with the chart and #54 with the entry details). He explains a very early and aggressive (but spot on) entry. There was a test later on, where I went long, so I waited for confirmation. Each to their own, one must trade whatever style or strategy he feels fit. But I doubt the smart money are going to wait one hour to get a trade on if they see the signal is there...First of all I'm not going to assume I should get in early on a trade just because it worked once for Sledge.

Second, the smart money doesn't wait for signals, they create the signals. The second bar, the confirmation, is them locking you out. That is the VSA way to trade.

The original question was about VSA. I was answering that. I wasn't answering how to gamble your money away. That's a different thread.

-

I'm not sure it is per definition riskier. It depends on how you define 'risk'. What if the test you observed happened on a 1 hour bar. Are you going to wait for the next bar to close? If so, you might enter when price has already made it's turn and presuming you want to put your stop below the low of the test, that might been a hell of a lot more risk as opposed to entering on the test itself and having a very tight stop.I'm not criticizing your or someone else's approach. I'm just saying the 'risk' is determined not only by the probability of your trade, but also by the stop size and the position size you are trading. Each trader must find out what style suits him best, and whether he likes to wait for more confirmation (hence sacrificing the best entry) or enter aggressively with a tight stop, but -perhaps- a higher chance of getting stopped out.

I was just speaking from my experience. Too many times the trade didn't pan out if I didn't wait. If you're a 1hr bar trader then yes you wait one more hour. The reason it's riskier to jump in without confirmation is because you're not even looking at a valid signal so you're basically jumping in on a bar that looks like a test bar should but may not be at all. THe next bar could easily break the tests low and would prove it's not a test.

So yes, if you are a gambler then by all means don't wait.

It's always riskier to jump in early because you don't have probabilities on your side. Risk isn't totally determined by money management.

-

Eiger,Thanks for another very important and educational post.

Just to clarify things (if not for myself then other novice VSA'ers), am I correct in assuming that a 'bullish' test is only seen as a positive test (ie signal to go long) AFTER the next bar closes up ?

Regards

Tawe

Yes. There must always be a confirmation for this to be valid. If the next bar were down this would be a failed test.

If you wanted in early you could try and take a limit entry, after the high of that test bar is broken, somewhere within the range of the test bar. But this would not be how Tom teaches it. This would just be one way to trade it. As always, getting in before confirmation is much riskier. Better to wait for a worse price and have more confidence.

-

Today was a pretty interesting day with a lot of VSA indications, and, of course, opportunities in the ES on the 5-min chart.Thanks for all your hard work Eiger. It takes a lot of time to do up chart examples with explanations. We appreciate it.

Sebastian better watch out because I'm sure TradeGuider will be recruting you soon and giving him the boot! lol.

-

-

Hello, thank-you all for these great threads on VSA. I am reading through both 1 and 2, so much to learn. If I may have a question, how much relevance do people place on the close price, specifically on the intra-day charts where it is not really a close at all? What would be the effect of using this sort of analysis if there was no close price placed on the intra-day chart and traders only looked at the high/low range with volume, no open or close? Would the VSA/Wyckoff method lose much if 'close' on intra-day bars was not considered? Thankyou - MaryHi Mary, personally I don't get too fundamental about VSA and thus the close only gives me an indication or sorts. Multiple bar closes give you a better idea. If 3 bars are closing off the highs that's more of an indication of something than 1 bar happening to close off the high. We have to read it as a whole and not put too much emphesis on any one factor. Close in relation to other closes tell you a great deal. Great question.

[VSA] Volume Spread Analysis Part II

in Volume Spread Analysis

Posted

Ok, for 3 min they took a break from pushing. With the trap upmove two bars previous this still means little. With weakness in the background this is just a downbar with low volume. I'd still short it! ;-)