Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

471 -

Joined

-

Last visited

Posts posted by jjthetrader

-

-

Hey Guys, I'm not really looking to start a topic here. I was just creating a worksheet for myself to see a couple different R:R scenarios and worst case break even percentages. I figured there's got to be someone else who would appreciate this so here you go.

-

Nial, that's a nice theory. "Price action trading" sounds great but it's a really broad term. What does one actually mean by that? Price is going up thus price action says to get long? What if it pulls back right there as soon as you buy?

Are you talking about breaking highs/lows or about speed of bar formation or something totally different?

Maybe a specific trade you would take with an accompanying chart would explain a lot.

People become very anti-indicator when in fact some are very, very helpful. For example what if you were adept at reading cycles and realized you were topping. You could then ignore any 'price action' that would get you long. It's a matter of balance.

I would love to see what a 'price action' trade actually is though so please share.

-

I would appreciate some kind of respect .I remember such guys as you we had at school long time ago, and I know why I would never meet them again.This is a forum where people help each other in a civilized and positive way.

I would have given you a bit of respect if you had of, in your original post, said I searched google, I tried their suggestions, I contacted customer support and tried their suggestions and still can't connect. Then I would have been more inclined to take a 1/2 hr to write out proper connection procedure for what you're trying to do.

I'll tell you what, if you follow my above suggestions and still can't get it fixed then I will get you setup and running.

-

Perfect answer that helped a lot thank you very muchWell what did you expect really? I see it all the time, a newbie comes in, got his hands on a copy of pirated software and then instead of searching google for an answer, just post here for someone else to do all the work.

Newbie's want all free stuff and someone else to do all the work. That is, by the way, one of the habits of highly ineffective traders.

If you purchase the software then I guarantee customer service will solve your connection problem.

Maybe using pirated Tradestation and pirated owndata isn't the best idea for someone new.

-

do you realize you can't get bckfill with zen and ts anyway? It's not the best combination. I was able to get it running just fine. Did you enter the symbol correctly? If you bought a legit copy of owndata then customer support should be able to troubleshoot you. If you did not then I guess you get what you pay for.

-

do you realize you can't get bckfill with zen and ts anyway? It's not the best combination. I was able to get it running just fine. Did you enter the symbol correctly? If you bought a legit copy of owndata the customer support should be able to troubleshoot you. If you're not then I guess you get what you pay for.

-

I use volume bar charts for my trading and for the past 2 months have been using Zen-Fire with Ninja. It's a fantastic feed. The reason I had to switch was because infinity's data was noticably incorrect as far as printing volume bars. Infinity's price was always right, it ticked away along with zenfire's but when and where their volume came in was abnormal.

So I ran zenfire along side infinity and tradestation. Infinity was the odd man out hands down. On a 1000 volume bar chart infinity would give me a bunch of 'candles' that looked like this - - - meaning 1000 contracts fired of at that one price only. Granted this happens but I was getting a abnormal amount of them. ZenFire printed proper candle looking candles, body, tail, etc. And when watching the time and sales there's no way the volume bar should have printed like this " - ".

Like I said, price data is spot on. Volume is definatly off and possibly tick.

I use infinity AT as my trading platform and love it. They're a great crew over there. I need very reliable volume though for my charting.

-

JJfirst signal I missed, second I took long but I dont entry simply on close num. 4 bar . I want see increase of momentum in my very little 500 V chart - nice move of price and increase ask volume- green rectangle in picture. Profit took after 2 points. I am newbie and I have problem with get out from market. Today I read this thread http://www.traderslaboratory.com/forums/f30/thoughts-from-a-professional-trader-5281.html post num.6 and I think become "1 point king" with half contracts.

http://www.sierrachart.com/userimages/upload_2/1232577874_12_UploadImage.png

Good idea using the volume chart for entry. They show nicely how much volume comes in in a certain area.

2 points is awesome! Don't beat yourself up for not taking more. I used to target 2 points for the longest time until I got better at holding. Plus being able to trade more contracts allows you to scale out and get a nice runner while locking in profit at the same time.

-

Hisame signals long

1,3 demand entry ...note spread and volume

2,4 test (or no supply ??)

Sometimes I think VSA is very easy but sometimes is headache

http://www.sierrachart.com/userimages/upload_2/1232570472_13_UploadImage.png

So you got long at 1 & 2? With strength in the background that was smart. Did you hold all the way intil 3 & 4? Nice work if you did.

-

reading previous posts i see someone using the nick "Anonymous" but that people reffer as "PP" and he posted many indicators for VTtrader. Maybe someone that read the entire thread or has/had contact with him know if he was using eSignal too? Id like to know if it will benefitial for me to download these indicators and use with CMS VTtrader (FREE).and, someone here has all indicators he posted in the threads in a zip format?

They're listed here somewhere. You'll have to do a search. I remember the code being posted in VSA I. As I recall that guy didn't use esignal.

Blu-Ray also translated the code in the coding section for other software.

-

I don't even know what everyone is complaining about? DB and Eiger aren't even against each other and I don't think their 'camps' are either. The only ones with an argument are those who are arguing.

I respect DB and Eiger and have learned from both of them a great deal. Lets all try to be thankful that we have access to knowledgable people like this and not insist that the interaction be only a certain way. With as diverse and colourful of personalitis that we have here, we've got to remember we're all on the same team. Now, lets work together to better each other.

-

-

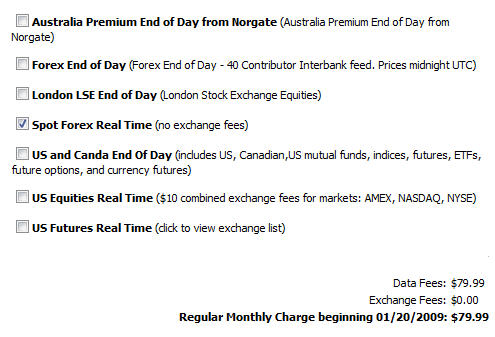

From their website, it seems they are more expensive than esignal, will have to call them up.79.99 RTD and $100 esignal so there's a marginal difference

-

i was comparing with Ninjatrader Gain feed. Its matches on many bars but certainly is not the same

No, forex volume will never be the same from provider to provider. It all depends which banks are reporting the transactions.

There was a rumor of FX getting a central exchange. That would be great news for everybody.

For now you have to seek out the best representation, the one with the most banks reporting. I think esignal is the best in that case.

Tradeguider has switched over to a new integrated data feed and use realtimedata.com now for their FX data. Not sure if it's any good. If anyone tries it out it would be good to know it's quality.

-

hican someone with eSginal data post a few recent charts of Forex instruments? Using 5, 15 and/or 60 min?

or just send me in pm, or just a link here, don't need to post the image direct here.

thanks in advance.

Not sure this is the best place to have posted that but here you go. Can't attach in PM so have to post.

-

He doesn't actually trade all the instruments he shows. You can see he trades 1 or 2. You only need to trade one. It works.

As long as your PC can run tradestation then that's all you need.

-

This system is very demanding and requires the best dedicated internet connection you can buy. You will also need a computer-the fastest your $$ can buy and dedicate it to strictly trading. I was unable to us it because my internet was not dedicated and it only ran at 16MBPS. If you can get FIOS by Verizon I hear that will work.I wasted a lot of $$ over this, I wish Clayburg would state this infomation t those interested in this system.

Good luck

This is untrue. I don't know how you set it up but it runs fine on my older P4 computer which has a shared connection.

It doesn't take anymore processing than a custom indicator.

-

While I applaud jj for making the effort to keep the peace, I'm puzzled as to the justification for this thread. The original VSA thread(s) has been about combining VSA with other "modalities" since post #1: candles, OHLC bars, MP, Market Delta, indicators of various sorts, VWAP, Pivots, SMI, etc. And of course TradeGuider was introduced within the first page.So what exactly is the difference in purpose between this thread and the originating thread?

I agree. I think the folks that felt intimidated posting their mixed badg of tricks in the VSA section got flamed or given a hard time way back in VSA I when it was a whole different beast. The main contributors of VSA I are long gone and there's a lot more freedom now to post openly.

Whenever I post I have usually included my market profile levels, pivot points, MA's or whatever I used to setup the trade.

Maybe it's best to let this baby die or retitle it "Todd Kruger crock or not" lol

-

The one thing I never liked about Todd is that he always side stepped the 'where do I enter?' question. He wanted to educate you to a certain extent but didn't want to go as far as to show you what he does.

If a mentor/teacher won't show you how they actually trade then all you get is more theory. After a while new traders need more than theory.

-

I'm sure 95% of newbys have invested in course,tutorials,etc. & have found them to be less than advertised.I wonder though where 90% of the losers are?Just look at all the testimonials for the thousands of programs out there.I took the bait 2 years ago & am still searching.But as an article i just read said.It's takes more than 2 weeks, 6 months, 1 year to become a brain surgeon.So I figure minimum 3 years [unless you find the right mentor, program]to grasp the traders edge.But as Tom Williams said,if you learn to really be able to read a chart your half way there.Yes, Tom Williams also said to be very careful for the first two years so you're right about that timeline. If you were studying even to be a mechanic you'd be in school for few years plus apprenticeship.

Personally I had a mentor, an actual trader, and that made all the difference in the world. You gain all their experience in a short amount of time. It's better than any course you could ever buy.

True that most things fall short of people's expectations but people come into this thinking it's going to be easy and they'll make a million bucks by tuesday. Not only that they don't take the time to learn what the course taught and just jump into the next thing.

-

I have spoken to Todd whilst he was at Tradeguider, as I have mentioned before he knew what he was talking about. If you listen to his 30min video you will notice he does not engage in bar by bar hindsight analysis, he always referenced Wyckoff and Richard Ney. At least you will get a good head start on Wyckoff and Todd is always willing to help unlike TG where the only interest is to sell the expensive software. This plus the info. here on the Wyckoff forum should provide background to reading price/vol relationships. Follow your own instincts, give it a try $199 is not such a big deal, just small overheads to set up a business.

The alternative is the $1000 SMI course.

I have to agree with Monad. The cost isn't that bad. Although this thread isn't necessarily for disputing things (the crock or not thread is). Since Todd's mixing it up with candles I guess it fits.

I have to say I'm sort of intrigued. He doesn't market it to the nines like TG, he's not full of crap like TG, he seems to have a legit emit educational series.

In the beginning, as a trader, we're looking to get things for free right? If we're not brining money in yet then we don't want to be forking it out. This is common. People want real-time data for free, you see requests all over the internet on how to do it. But there comes a time when you realize that you're getting what you've payed for. You can only get so far with free stuff, even this forum. If only 5% of people are making money then how did this forum get all of them? lol. Some folks aren't actual traders and just regurgitate what they've been told or what they theorize.

Unfortunately this industry is like the weight loss industry. There's so much marketing and crap out there that we think everything must be that way. This is not true. There is a time and a place for everything.

My first criteria that must be met before I continue with educational material is does this person trade and have they been successful? We know Todd traded in the past but does he still and has he been successful? We don't know that one.

Last year Joel Pozen was selling his "VSA" course for $5,000. Turns out he doesn't actually trade and wasn't mentored by Richard Ney at all. If he was the real deal then it would have been worth the money but he wasn't so people got ripped off. Everyone on this forum was all horney about him saying wonderful things. So when everyone dogs on Todd Kruger we have to find out for ourselves what is true. However, he wants $40 to ship a DVD to Canada. I get the feeling he's gouging.

-

Thanks, JJ. I am working on my website today (despite good trading conditions!), so it was a happy diversion.What do you use to convert text to a pdf file. I have found a place of the web that does it or free, but since I will have a large number of articles on my website, I need something more reliable. Will it do powerpoints and excel files, too?

It'll do anything! I'll PM you.

-

Eiger, you're so generous with your time and knowledge. I've attached your last post on reading the background in pdf format for those who would like to print that for frequent referral.

-

Thanks. I was curious about this as I am playing around with a few early entry ideas, but haven't found anything reliably worthwhile yet. FWIW, I typically take the entry on the close of the No Demand or Test. I don't wait for price to break the low or high for confirmation. If there is clear SOW or SOS in the background, I view the No Demand or Test as sufficient to confirm the lack of buying or selling--whichever the case may be.Eiger

Eiger, that is the prefered technique at getting a better price but an ability to clearly see the background is needed. For those that are new this is the hardest part. Plus I've seen a 'no demand' bar followed by a 'no demand' bar followed yet again by a 'no demand' bar. One of the guys who taught me price and volume always used to say "the market can go up all day on low volume".

TradeGuider is very misleading in this as well. They say always wait for confirmation (the down bar) but to never take a short on a downbar.

For those new I would suggest taking the short on the downbar. At least this way you get a bit of mementum on your side to possibly get your first contract off the table. I've been much more successful this way than on the close of the potential no demand.

Spread Betting a Scam

in Spread Betting & CFDs

Posted

For the most part I'd call it a scam in the same sense as a casino. The house has an advantage. They will play lots of games with you if you're successful. They'll lock you out of the platform, quote your stop even if the market didn't, things like that. Firms have even said that if you're winning then they assume you're cheating and that's their excuse for locking you out. It's happened to more people than just me. How would you feel if your broker refused to get you out of a trade?

I've closed all my s/bet accounts and just trade direct access. I would advise against s/betting. But then again most people lose so they won't even notice the tricks.