Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

humbled

-

Content Count

192 -

Joined

-

Last visited

Posts posted by humbled

-

-

-

Congrats on your profits! I took a very similar trade in the SPY.Blue line is yesterday's volume POC (Point of Control)

Red line is today's volume POC

Once the early morning dip was bought up, I waited for the break above today's POC and to see if it would maintain support. The 5min candle on that break was very strong. The next couple of candles remained "inside" with support of today's POC. Sell volume waned, giving cue to the bulls to fill the gap up to yesterday's volume POC.

Thanks Enigmatics,

I am reviewing now. Thanks for posting. Trendlines are my next layer to add.

Humbled

-

-

-

-

Thales,

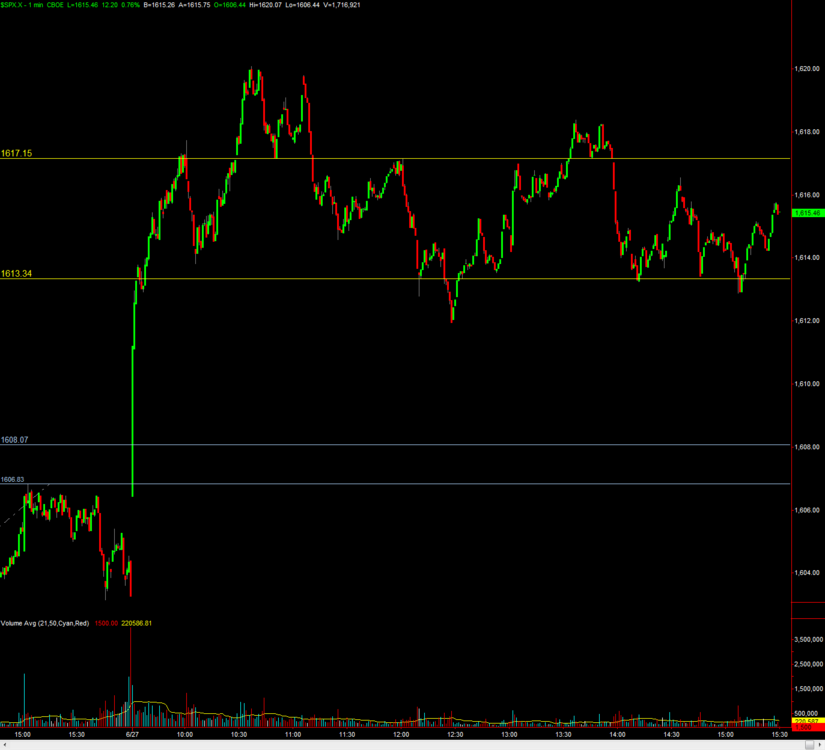

Please let me know if this chart size is better. You said you had some issues viewing my charts before.

It would also be nice to know if I have similar levels to what you have. I believe I am following the rules verbatim.

Humbled

PS The volume under the chart is the SPY. I am just observing it.

-

Hey humbled,Keep doing what you have been doing. Mark your levels before the open, but don't get so attached to those levels that you miss new levels of importance as they develop. Don't stop trading, but do try to see if you can find ways to see entries closer to those levels. If a level is at 10, and the next level is 17, and you think the market is going to head higher, you want to get long as close to 10 as you can. If you wait until 13.5 to enter, not only are you risking more to make less, but you are entering right where you do not want to be entering - the middle of nowhere.

Post your charts, and I'll see you after the close tomorrow.

Best Wishes,

Thales

Thales,

This is an important post and will go into my thinking moving forward.

Mark your levels before the open, but don't get so attached to those levels that you miss new levels of importance as they develop.

Is this what you mean? I saw these in real time.

Humbled

-

Here is your chart with a few notes and markings of my own. I placed white stars near my comments/annotations so that you could find them.Here some things to consider as you study today's chart: I see no problem with your first long. I myself got long at the first test of 1598. This test was to be expected, and that is why I posted soon after the open not to be in a hurry to take a 123 short. The market gapped open above resistance, and a two legged pullback to test it as support is common. However, it was a short-lived trade for me, and I took it off at when price was turned back when it traded 1600, the level where the first leg of the pullback found support - you should be able to make out a little 123 down right there.

I did not take your second long. I could make a case for it, however, so I do not have a problem with it per se. I did not take it, because at this point, we had seen a series of lower highs and lower lows. Price had tapped under 1598, and at that point, I was watching to see if I should get short on a test of 1598. I did get short as price again found resistance at 1600, and for the second time, visible on tick charts as well as your one minute chart, a 123 down. I covered that short just about where you were getting short (there was a stage 2 trendline break as well as a prior 5 minute ES double bottom pattern - a common aptter I p[ointed out in your journal on another day - you should make a note of it ) , and I got long not too long afterward, probably a few minutes later than when Enigmatics was buying, as I bought after price broke back above 1598 and tested that level - a tick chart would show you the way between 12:11 - 12:13. Price finally started establishing a series of higher highs and higher lows, and I stayed long most of the day, with a stop at 1597.

Today's price action was similar to yesterdays' - gap open, back and fill to test resistance as support, and then a choppy series of higher highs and higher lows. This is a common daily pattern on both the SP-500 & the Dow-30. You should make a note of it.

Thales,

Thank you for this post. I am working to expand from the ideas you mentioned here.

Humbled

-

Price is not even close to a key level today so no trades will be executed. Thales had mentioned to be aware as other levels are built and I do see some today building but I am unsure on how to judge the value of each.

A good time for some reading and plan development.

Humbled

-

-

Db says it so much better than I can ...http://www.traderslaboratory.com/forums/wyckoff-forum/15386-trading-price.html

And this is a link to another Db post at another forum ... read not only what he says, but look at that date.

Db's posts are invaluable. You may think I'm good, but I'll tell you this: I have a folder of Db's posts from various places bookmarked in my favorites going back a dozen years or more - how many of mine do you think he has? If he has even one, then that is more than I think he has.

Best Wishes,

Thales

Thales,

Yes when I bought the stuff from DB years ago I did a short period watching DOM/matrix window (1 week maybe a little longer) . I wondered if I lacked the attention to detail to notice it. Maybe more time would have passed I would have seen it.

You did suggest the DB books and I am reviewing them but as you probably notice I am working to keep the focus on the exact areas to grow and trying to avoid finding more stuff to dig into which has been a trap for me since I started. In fact if anything people should notice in this log I am adding almost zero spin or adjustment to the method presented.

I actually think the presence of too many methods and options hurts most. Formulating a simple method seems to be the answer for me. Maybe it is that I know my limits now and find myself splitting off in too many directions.

.

Humbled

No less than 10,000+ hours of trading study and experience leads me to the stripped down trading I am showing here. I am down to bare studs building this structure.

-

Great contributions, Enigmatics. As a matter of fact, I reminded humbled in a PM this morning that he ought to renew his efforts to study DB's book, which I am sure covers exactly what you are sharing in your examples.And this wasn't the first time this was brought up here in his journal:

So, Enigmatics, if you have the time, and if humbled doesn't object (it is his journal, after all) I think it could only help him going forward if you could share some of your volume studies here.

humbled, I understand you feel overwhelmed and that you feel you have so much to learn, but what you are trying to do is learn how to judge strength of supply and demand in the market. S/R and price action patterns, e.g. 123's, 2B's tell you where to look for this battle (S/R) and how to determine which side is currently dominant (price action). But yesterday and today you yourself admitted to uncertainty and confusion - and there is nothing wrong with that - we've all been there. Don't immediately try to incorporate volume analysis into your trading decisions. But do observe volume for a time. Don't dismiss it out of hand simply because I tend not to use it. And for what its worth, I do use volume on daily and weekly charts. I guarantee you that it provides useful information with respect to supply and demand - and supply and demand is just as operative on intraday price action as it is interday.

Best Wishes,

Thales

Thales,

Enigmatics is welcome to post and I am happy to observe and grow from his posts. Reading the DB stuff as I write this

Humbled

-

In my opinion, price-only trading can be extremely tough business for beginners. I know what it's like when you're first starting out though. There's only so much you have the ability to focus on and analyze while you're attempting to "frame" your trades. Just looking at candles seems much easier.The guys who are consistently profitable doing it have a better feel for the flow of the market, it's breadth, and trend identification. Many of the beginners who start out doing it end up in trades like the first two longs you took today. The trades start out winners, but end up losers because you were on the wrong side of the market. You end up in false breakouts or breakdowns, etc. etc. etc ... I'm sure you're familiar.

For me personally, that's why I started investigating various forms of volume studies. I got sick and tired of candles "lying" to me.

Enigmatics,

Thank you so much for these comments. I see value in what you have to say and will review the chart now. I have a reason for not adding any additional layers beyond what Thales has shared. As a student here I am not interjecting any ideas on what I know from prior experience as I will end up where I did before- Inconsistent and with a lower account balance. This is the reason I have not added one single idea beyond the original advice Thales has supplied. I am not playing stupid to hurt anyone but to be honest, I lost for more than 5 years straight in my attempt to day trade.

I have put my heart and sole into trading and still could not come out consistent so at this point I am just doing what I am told. I will never be the "big thinker" trader on a macro basis as I am not an academic type of person but on a technical basis I will do what I am told until I succeed.

Thanks for your help. I find value in the volume chart and hope to be able to add this layer asap.

Humbled

-

-

After that confusion around the pivot I found myself unable to decide what to do any longer.

Time for a break to wait for another pivot or another day.

I am sure psych had some issue in this day as I know I had lost my confidence to some degree on my last entry.

- 9.5

Humbled

-

A 2b was formed just under the key level 1598. I am not sure if I should execute directly into the line but I still had the gap in my mind so I took it.

I am not trying to trade this much as a desire for action. I am trying to follow the only rules that I find some clarity in so far.

Humbled

-

Under the 1598 I now had a valid short signal and took it.

Humbled

-

I saw a possible reason for short at 1598 SPX but no entry pattern,

Humbled

-

Stopped out on a break of the low.

-

I did get stopped out but I also had to re-enter based on the 2B pattern.

Humbled

-

A very small pattern at a key level here at 1598 SPX

-

-

I should have had a larger gain but I "hoped" it would close higher and stalled on the exit.

Humbled and keeping it honest

-

If it works for you that's what matters.....from your posts however it didn't seem that way today...otherwise I wouldn't have posted myself...Good luck

Steve.

I am shocked I am positive today. I had many moments of mental battles working to read the price action. In the end I will build rules from these experiences.

Humbled

Humbled Trading Log

in Traders Log

Posted

I had a bias just now after slight highs were made under a level. I went long directly into the line. I am not sure if this is the right thing to do. Thales may consider this as a rule break.

Humbled