Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

humbled

-

Content Count

192 -

Joined

-

Last visited

Posts posted by humbled

-

-

Whatever "feel" I am missing is not due to being lazy. I can assure you I give this my all.

Humbled

-

Hi there 40draws,I remember having read a post by Db where suggested that if a trader really wants to learn to read price, he or she should just sit and watch a line chart all day long "to develop a sensitivity to buying and selling pressure."

However, I believe he also said "but the trader won't do it."

Best Wishes,

Thales

I have done that and will do so again. I never extracted the feel but will work on Ninja replays again.

Humbled

-

I'm a relative newcomer to this trading game, and I mean no offense to Thales, but it does seem to me that humbled is missing a piece. When I read his posts and look at his own explanations for his trades, I am reminded of the following passage from DbPhoenix's essay, "How To Do It":"If he focuses on setups and patterns as gimmicks rather than as manifestations of changes in the balance of buying and selling pressure, then he blocks the process through which he would otherwise understand it and profit from it."

I do not see that humbled looks at the market as buyers and sellers looking for a trade. I do not see that he views the market with an awareness of the ever present functioning of the law of supply and demand. I do agree that other than that, he has everything he needs. I use a 2B set up, but I simply call it a double top or a double bottom. I use the 123 set up, but I simply call it a lower high or a higher low. I use supply and demand lines to clue me in to when the market may be in for a change of pace. I use support and resistance as price levels where I look for a trade. What I have that I think humbled is missing is a sense of what Thales referred to above in his post about candlesticks: A sense of the flow or continuous nature of the market as the constant shifting in the balance, or lack thereof, between supply and demand, those who wish to sell and those who wish to buy.

As I said, I'm new, just coming up on a year since I decided I would try to learn to day trade, so take what I said with whatever size grain of whatever substance you might think it is worth. Whatever it is, the op is missing something. Whatever it is, I hope he finds it.

Good luck!

40Draws,

Thank you for your input. Maybe you can share your view on how you read the market supply and demand beyond the lines we draw. Beyond support and resistance. Beyond the tools that we both use. You are suggesting there is another layer. I am not aware of how to detect it.

Thanks,

Humbled

-

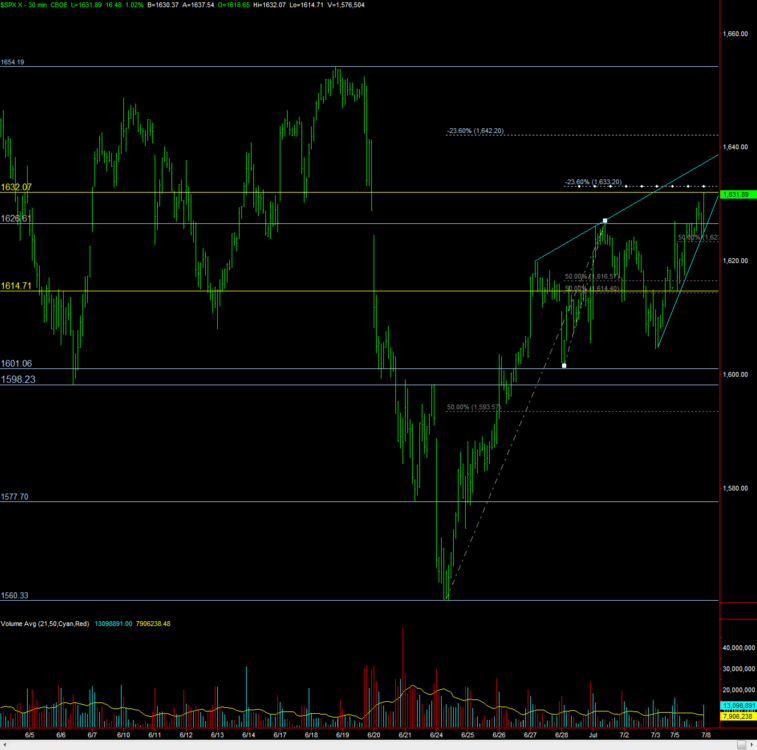

I see 46, 52, 54, 74, 87 and no need for fibs.You have everything you need. Prior highs and prior lows, the immediately prior session's high and low, and the overall trend for context - is it up, down, or sideways. If it is in a trend, has it been consolidating for a day or two? Then look for a potential trend day where the market closes on the extreme in favor of the trend. Has the market been forming a line? Then where is it relative to the high and low of that range? Is it moving toward a test of the high or low (even is a trading range, there are swings from one extreme of the range to the other that can last a few sessions).

If the market gaps up and trades down, look for a potential long somewhere between the prior day's high and it's close, vice versa for a market hat gaps down and trades up.

If it gaps up or down and trends in the direction of the gap, then buy/sell an opening range break or a pullback (assuming you are at all times aware of potential S/R that could foil the trade).

Stop looking for the non-existent missing piece. You need to work on yourself.

Plan your day ahead of time. What are you going to do if price gaps down below yesterday's low? What will you be looking for? What if price gaps open higher? What will get you short? What would get you long?

You have every tool you need. You need no more trips to Trader's Depot. You need to watch and learn how price behaves as it makes its way from S to R and back again. You will make mistakes. You will have losses. But you can do this, but only if you focus on price itself, and how it acts at S/R in the context of its overall trend.

Plan your day ahead of time. It will relax you and reduce the stress you feel from the uncertainty of not having planned your day.

See you Monday after the bell.

Best Wishes,

Thales

Thales,

I did not want to rush to respond to this post. I am still digesting the value of your comments. I appreciate the help. I have killed the Fib use other than the 50% line.

I am working up a plan for tomorrow. Can you suggest an opening range time period to use for my plan?

Humbled and very thankful for the help

-

-

No need to throw "candlestick analysis" here too.This is about highs and lows, higher highs and higher lows or lower highs and lower lows. It is about what price does when it revisits those levels where demand and supply swapped upper hands in the past.

If you go to the Reading Charts thread, and look at my post #1462, you will see a chart.

I direct your attention to the last paragraph of my comments on that chart. Someone had asked me about trading a "pin bar." My answer was it would depend upon the order in which that bar's high and low printed relative to its close. This is because price is not "bars" or "candlesticks" or whatever discreet graphical technique you use to visualize trading activity. Price exists only as the activity of folks buying and selling to one another. As Db would say, "price is continuous," i.e. it is a flow of activity and not a batch of discreet bundles of transactions separated into "bars" or "candlesticks."

As such, what matters is using that information to determine who has the upper hand, and how can I join them?

Best Wishes,

Thales

Thales,

I understand that structure as it is the same as a 123 pattern.

Humbled

-

-

-

Again, I think you need to concentrate on "doing business" in the areas of better risk/reward. Stay away from the small stuff. Use what Thales is teaching you to identify those places.Enigmatics,

I agree with almost every comments you have said to me

. I am just not sure yet how to avoid the choppy ones :crap:

. I am just not sure yet how to avoid the choppy ones :crap:Humbled

-

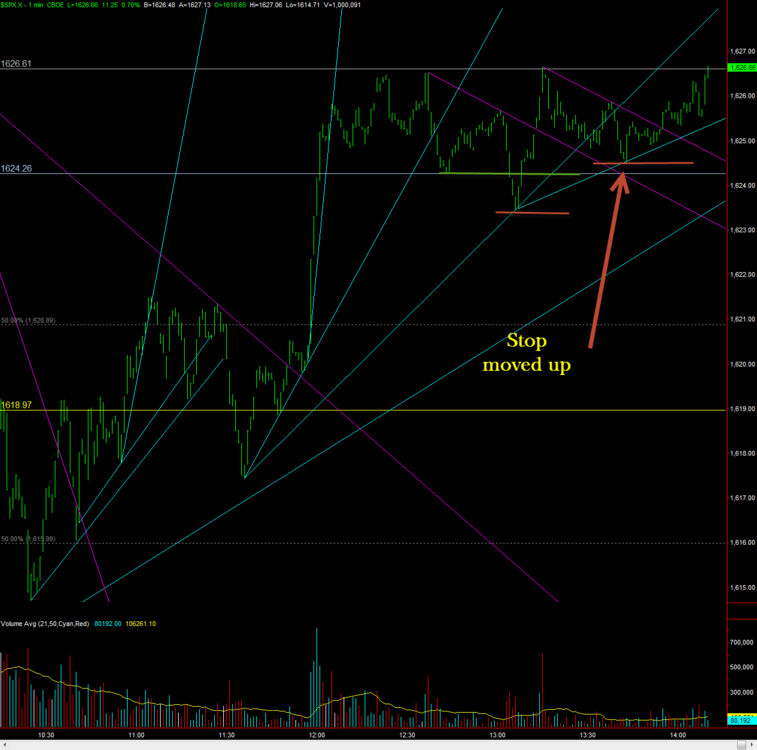

The double top 2B was the trade. Nothing wrong with your long, and you did well by getting out when you did. Unfortunately, you exited not because of what price was telling you, but because you felt uncertain and unsure and the losses are starting to sting too much.When that happens, I find it best to stop trading, take the money pressure off, and paper trade, at least for a few days. Re-set yourself and get back to watching price without the added pressure of a diminishing equity.

Best Wishes,

Thales

Thales,

After reading that comment again, does your comment assume that a break of a demand line alone is not enough reason for an exit or is it just the parabolic angle of this one?

Humbled

-

The double top 2B was the trade. Nothing wrong with your long, and you did well by getting out when you did. Unfortunately, you exited not because of what price was telling you, but because you felt uncertain and unsure and the losses are starting to sting too much.When that happens, I find it best to stop trading, take the money pressure off, and paper trade, at least for a few days. Re-set yourself and get back to watching price without the added pressure of a diminishing equity.

Best Wishes,

Thales

Thales,

oops, I just read that post after I had already finished that last trade.

You are right, it is actually less about the money. The sting is the high count of losses in a row and the very small micro scalp gains when they work. But the outcome is the same. I will take the advice. I must admit even one trade like the last one takes some pressure off.

Humbled

-

-

-

Seeker ,Some good points here. Let me address them

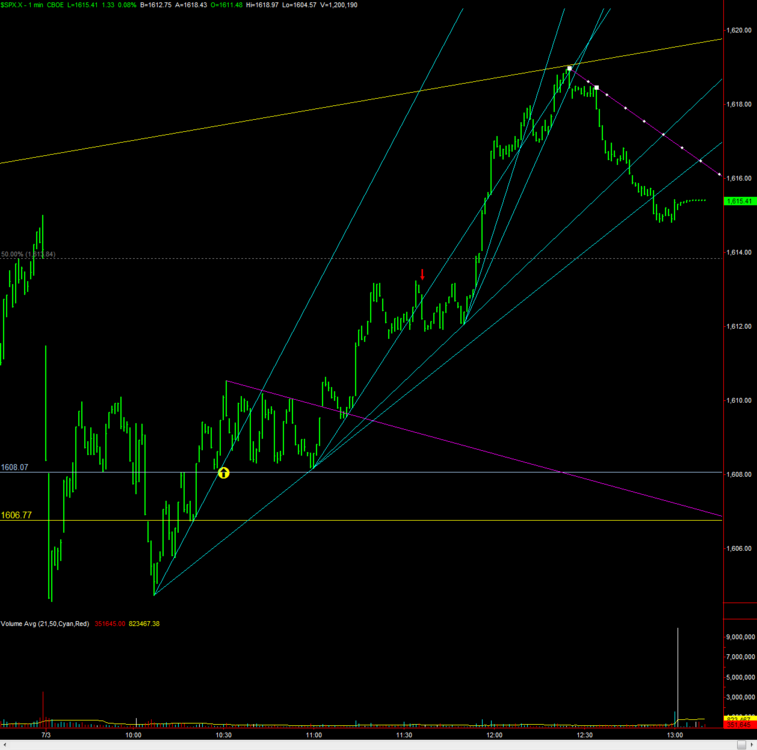

My plan as Thales directed so far was to look for a Trader Vice 123 or 2b pattern VERY close to a key level. I was allowed to use 5 minute charts until we got close. I then was told to zoom in and take my entry on a one minute time frame. I have applied this approach verbatim or at least as close as I could.

As I experienced these trades I was given examples of when Thales cut them short, when he allowed the trade to work and when he saw things that suggested that a loss should not be taken. I have done my best to attempt to react like that but its not learned yet.

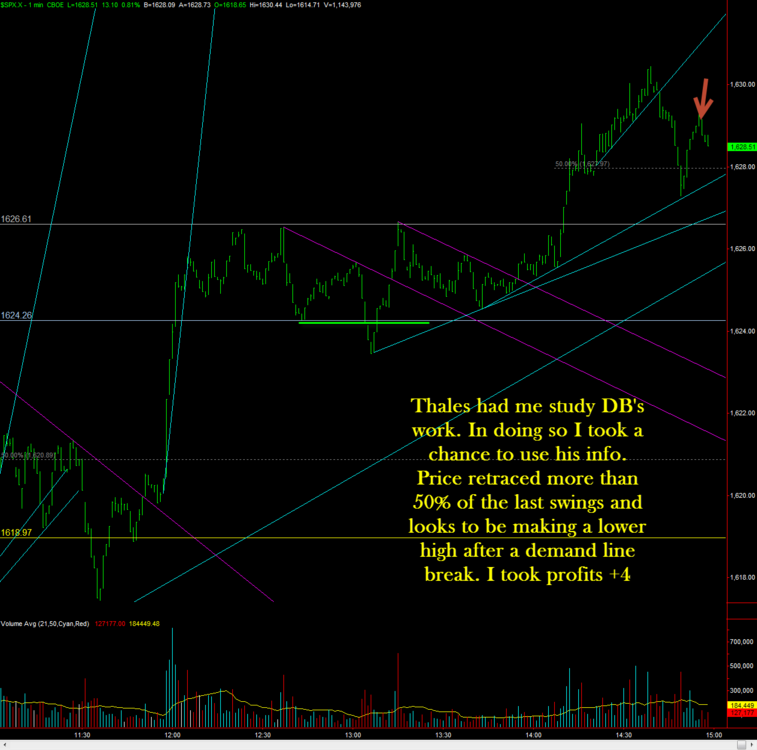

Thales suggested that I read DB's work and start to work that in. I am learning that as well right now.

What you are seeing is the frustration of me trying to execute a pattern that occurs all around these key levels. It occurs several times in both direction at one of these levels. Without the filter to define which ones to omit and which ones to take, I feel like a pin cushion. I am sure as I understand more of what Thales has wanted me to learn I will find many of these attempts filtered.

I am watching 2 min and other time frames trying to read volume and observe. On Thales own suggestion he said I could observe volume but he also mentioned he does not use it. As he shares more I can understand how to control the abundance of signals and decides on direction. In the absence, while Thales is away I am doing the observing he mentioned

As for the 1 minute comment. I admit it is very fast and I find many false signals but I have followed the plan. The poor exit is a mixture of my attempts to read what Thales meant from previous posts. Thales has given me many pieces of the puzzle but I am struggling to put them together.

I must admit I studied Thales history and the trading of his daughter who started at 9 years old and has done very well. I noticed many comments that she managed trades with a stop or a target and did not get in the way of the trade but I have not arrived at that point yet. I have attempted to adjust based on Thales responses. He must have a reason for teaching me this way.

Maybe the addition of Supply and Demand lines from DB's work will add to the setup. Maybe I will be more confused. I can't say yet.

Seeker if I had my druthers, of course I would ask for exact directions. Why. How. A totally transparent view but clearly Thales has shared in a process that he feels will help me.

I can tell you at this point something is missing as I fumble around each key level switching back and forth in a rush to read what the market is saying. Maybe after some clarity is added my frustration level will drop.

Humbled

PS. I actually think I have done a pretty good interpreting what has been said if you read all of the directions I have been given but I have simply shared the whole experience including the pressure of low accuracy and lower reward trading.

IMO this post sums up the progress and issues I have run into so far. After review of the Supply and Demand Lines, I believe these can add an additional layer of directional help.

Humbled

-

If I had had a chance to pick someone from whom I might learn how read price and my choice had been between me and Db, I'd have picked Db.The man is head and shoulders above nearly everyone who has ever participated in the anonymous world of internet trading forums. He is, without a doubt, my superior.

Best Wishes,

Thales

Thales,

What a nice thing to say about DB but I am pretty sure I made a good choice.

Humbled

-

just saying, I kind of agreeing with seeker here...one of the most important rules in trading is to be consistent.........not flip flop as your analysis might just be good when tested long enoughTradingwizzard,

You and Seeker both gave me some thinking to do today. I might be better doing this journal in private. I think limiting my input to Thales voice and keeping the blinders on might be necessary to keep me from running off the path. When I am getting stopped out so many times I start looking around and that can get me in trouble.

I am not sure yet.

Humbled

-

-

-

-

Instructed by whom?.........................Thales has been working with me to construct a method here on this thread.

Humbled

-

Instructed by whom?.........................Thales has been helping me.

Humbled

-

1. Approved InstrumentsSPX Cash Only via ES Emini Trades

OK. Why? And if I seem abrupt, it's only because I want to get things moving, as I'm sure you do.

DbPhoenix,

I was instructed to take all levels from the SPX Cash index. I post these each night or morning before the market. I attempted one trade in Globex and it was suggested that I did not have a clear picture of my level because the cash index was closed.

My guess was that Thales wanted to protect me from low volume overnight stuff. I did not question it as I am sooooo appreciative of the help and thankful for the direction after such struggle.

Humbled

-

For years I've criticized people -- and not in a good way -- for neglecting to read a thread before they butt in with their redundant and irrelevant comments. But I'm going to do just that, partly because of time, partly because you asked for my help, and partly because previous posts aren't necessarily pertinent. I'm sure you've received plenty of good advice, but you're going to have to go deeper than that in order to turn things around.First, what is your trading plan?

DbPhoenix,

I just forwarded a PM with a download link to my current work in progress.

Humbled

-

Very advanced? Now that made me smile. It's as basic as one can get. Unfortunately, traders have been so bedazzled by all the bells and whistles that have been shoved at them over the past eighty years than they literally cannot tell up from down. Silence all of that and ignore virtually everything that one has read or been told and give reality an opportunity to emerge. It's a choice between the blue pill and the red pill.DbPhoenix,

Thank you for showing up here. Your method is not advanced to me but I often have to read and re-read to get the information distilled down. That is a function of my own comprehension.

If you review my thread you will see that Thales is coaching me and has suggested that I learn your stuff as part of it. I am currently working the Supply and Demand lines into my entry method. I will be posting charts with my application of your eBooks and welcome your input.

At this moment I cannot tell up from down but I look forward to having my eyes opened.

Humbled

Humbled Trading Log

in Traders Log

Posted

Thales,

No I just wanted you to know that I did try the idea of watching price before like DB had suggested. I did not avoid it or skip it. I took as many steps as I could on my own before asking for help.

You did not say anything , I just wanted to be clear that the missing "feel" has been something I have been searching for.

Humbled

PS. I am trying a 1 second chart as the 1 minute is not speaking to. I put up a line on close chart and I will keep it on watch.