Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

humbled

-

Content Count

192 -

Joined

-

Last visited

Posts posted by humbled

-

-

Hi there humbled,It has now been a month. What, if anything, has changed? What remains the same? What steps have you taken to align yourself with the elusive right track?

Best Wishes,

Thales

Hello Thales,

Not trading right now. I have put in time watching time and sales and line on close charts on 1 minute but I can't say I have made any real progress. I notice some reactions that show direction for a few ticks but other than the potential for a scalp (which I am not focused on), I do not have a sense of force from the tape at this time.

Another member here has supplied me a ton of good information on an alternative method which I have been watching as well.

Thanks so much for your concern.

Humbled

-

I want to thank all of the people who have sent me private messages of assistance. I appreciate the support as I hit a difficult trading hurdle.

I am working to do something that most fail at and so I knew in my heart of hearts that I would have to work and struggle to achieve it.

My past trading would take accounts up then down , back and forth. In the process, some accounts did gain and then others would drawdown and show me larger losses. In the end this did not payoff and I had no idea where my balance would be next. Overall, I lost money.

My goal is to produce a consistent income of 10k plus per month. One that would cover my overhead of my family. I did not need to achieve this as a get rich quick scheme, I was willing to give years and years but I knew I was asking for a lot when only using 100k or less in capital. I figured I could build. Start with 1 or 2 contracts and add one

more for every 10k in gains. Over time I imagined that even 5 ES contracts could provide this with consistency. Less than 10 points per week would allow for this target to be reached.

I am willing to use multiple instruments. I knew I was not fast enough to be a scalper of 1 point or 2 at a time. I also found it hard to focus that intensively for long periods of time. It stressed me out. So I was looking to do this with intraday swings. I am even willing to leave a position overnight.

After all of the recent pressure, I am going back to the basics of this plan. It was working to some degree of success. I will built on it and find a way to add the missing layers.

Nothing that was said fell on deaf ears.I am taking it all in finding a path from here. For those that said I always needed to find my setup on my own and built it myself, understand one core belief I had was to find someone getting the results you want and learn from them. Hence the reason I started with Thales and this thread.

I have private reasons why I must succeed that most cannot fathom how important they are to me. All for my family. Maybe that pressure has not helped me any so I will always need to focus some of my attention on the psychological aspects of this. I am sure that has held me back, but when I find consistency, I feel the confidence will build to clear some of this up.

Thank you to all of those that share to help!

Humbled

-

Optiontimer,"Understand I am very confused on what is my best course of action right now".

Information overload- here/everywhere.Maybe go right back to the basics..maybe you missed something.Even in the highest echelons in football every team goes out on a training field and practices the basics.Football is a simple game.Star performers are no exception and are not excluded from this.In trading terms,although we don't need to practice the basics it is very easy to lose sight of them.

" I can't feel higher odds on this trade compared to the last one".

"I am poking in every direction looking for a path to move forward"

Identify the-

Weekly highs/lows

Daily high/lows

Lower timeframe high/lows

If you think of charts as battlefields (btw bulls/bears) then in terms of strength

Weekly H/L's = castles

Daily H/L's = forts

Lower timeframe H/L's = trenches

How reliable/strong is support/resistance?...Castles/forts/trenches.

Trading 101 states that in an uptrend prev resistance becomes support and in a down trend prev support becomes resistance.

What i'm suggesting is that by utilizing trading 101 and assigning a probability to each category of H/L in either up/down trends,then a trading strategy/plan almost begins to write itself.....

Seen in these terms and having clearly marked the 3 relevant price levels described,you can easily assign a probability to any potential trade going in your favour/or not.

You also get to choose which part of the battlefield you operate on,when,and on what side.

And we haven't even employed any other tool at all.Just price and trend.

A professional in any field should never lose sight of the big picture or forget the basics.

Then when you have a clear understanding of what just happened,you have a clear picture of what must come next

-----------------------------------------------------------------------------------------------------------------------------------

This is fantastic sound advice. Thank you very much!

Humbled

-

DbPhoenix,

I am sorry I confused you using the word "edge'.

All I meant to express was that once my mentor said the comment

The ability that you need to develop cannot be spelled out or spoken out loud in a set of instructions, and least not in a way that would be intelligible to you unless and until you develop the ability to feel the struggle for balance and power that is the market. Without that sense, there is nothing I can do to help you move any closer to your goal than you are now.Other traders started to give advice that agreed. Even the last post you listed,

First, familiarize yourself with the auction market. You cannot succeed without doing this. I can guarantee you that each and every professional trader with whom you are competing understands it thoroughly. "Setups" will not save you. "Setups" are the consequence of trader behavior. The professionals are trading the behavior. The amateurs are trading the "setups", which is why the amateurs are so easily screwed. The 2B, 123, ACD, and every other pattern on God's green earth are nothing more than a distraction unless the trader understands what traders are doing to create those "patterns". And if he does, the patterns become irrelevant.These comments and so many others are a clear indication that I am not on the right track right now. I did not brush these off and use selective hearing. Once Thales mentioned that I needed to have this skill, others validated it on the thread, I stopped to fix the issue. In so many words I was told, no consistency will last if I can't feel and read the pull of supply and demand.

Humbled

-

Thanks Humbled. So you are making money.You doubt the strategy, the entry, no confidence in it etc. Yet you're profitable.

And that despite not having much experience with the method, and still working on the rules and your understanding.

My suggestion is, give it time. Keep thinking about how to improve. Be patient and work hard. Dont' expect every trade or every day or even every week to be a winner.

Don't start looking for secret sauce, or changing the basics principles of what you have been given by Thales.

Understand that the secret sauce is experience, and it can't be rushed. But that it can be slowed down by looking at the wrong things and approaching it in the wrong way. You have been given the right approach.

Also if I may, stop putting problems for yourself where there aren't any. You worry about the entry, but the entry is usually fine. You worry about the method, but you're profitable and only just started trading this way! You worry about risk reward but I think I saw a +16 point winner in this journal, and your biggest loss was about 4 or 5 points.

Seeker,

You are right and I was willing to stay the course, but I was told by many I trust here including my mentor that I am missing the edge. The real edge. As the student that could not be ignored and set this issue in motion. I did not pick and choose when to trust Thales or DB or others. I followed verbatim and they lead me to this spot. If they see a problem in me I had to stop and find a way to resolve it because I don't want to fail only to be back here later asking for a lifeline.

That was part of the issue here. Do you listen only up to a certain point and then put on the blinders? For that reason I have stopped and I am looking to figure out how I will tackle this.

Humbled

-

Humbled,Out of curiosity, what does consistency mean to you? If you have already defined this, then feel free to ignore the question.

I am asking because I suspect that your expectations of what is possible compared to what really is possible might be off. Therefore, it could be that your trading is fine and you are trying to get help to fix something that isn't broken. Sort of like drilling a hole in your head to let the head ache out.

MM

MightyMouse,

Consistency to me is making money week over week. Not every day. Let me add a few more factors. I would not consider it consistent if the losing week was larger than an average winning weeks. This might mean one slip up and the losses exceed the gains. I have had that issue before. It also means some level of confidence built. Being stopped out 5 to 9+ times in a row OFTEN does not seem to match that description in my mind. Maybe I am nuts but that is how I feel. If these conditions are met then I could see adding an extra cars as I grow the account. I can't imagine with the helter-skelter trading I have done, that I can add to and grow size.

I thought I was in the right direction to reach this but was stopped in my tracks and told I was missing the boat on what is needed as an edge.

Humbled

-

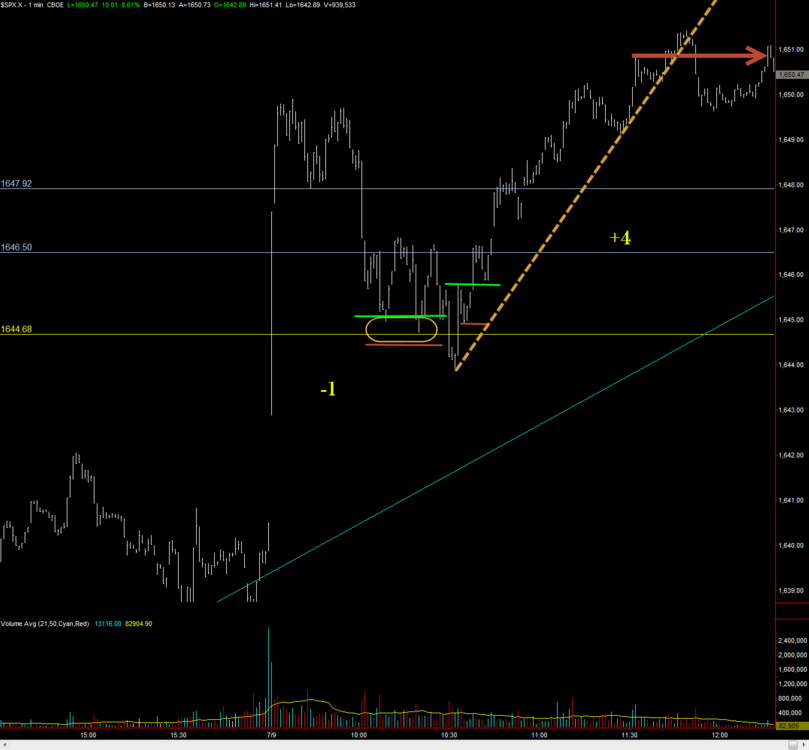

humbled, what were the overall trading stats for this thread? P&L, win%, average win, average loss...I have the impression that the results are not that badHere is my private review form from this last weekend. I will get you better stats. I need to load the data in an application to output this information.

Weekend Trading Review

Week ending 7/5/13

Week Gain / Loss Commission Spent

Week of 6/10/13 $-287.06 60.30 1 car

Week of 6/17/13 $1369.16 68.34 a few 2 car trades that I stopped doing

Week of 6/24/13 $267.34 132.66 1 car

Week of 7/5/13 $430 192.00 1 car

How did I do this week?

I came out positive but feel resistance that the method lacked some clarity at key levels. I am mechanical and just reacting as I am told but confidence is lacking because I am unclear once I reach a level. I am afraid of the 2b pattern because I feel like any slight pierce of resistance can be viewed as one and then I am run over 1 bar or 2 bars later.

How is my plan developing?

I am following directions well. I look forward to the new update Thales gave to me today. The change is now a full planning before the market open to reduce stress. I feel it is progress but I am getting input that suggests this is not enough.

Have I stuck to my plan or did I deviate?

I have stuck to the plan the best I can tell from the rules I have been taught. I am not mentioning it in my thread but I often do a reverse or two each day trying to figure out which direction to take.

How was this week compared to last week?

This week was much harder as I started the week on Monday -5 and struggling at every level to decide the direction.

How many points gained or lost this week?

+8.5

What % of my gain is fees?

45%

What will I do to move forward into the next week? What steps can I take?

I am working to define the day before it starts. This should lower the stress.

How is my progress thus far? (Scale of -10 to +10)

+1 Above the zero line.

I feel I am above the zero but I experienced plenty of frustration in the heat of the decisions. The lack of risk reward causes me to fear the system to some degree. I look forward to improving this along with a few added layers to improve my trading.

What I don’t understand is this shift to saying that this setup is not good enough without being able to sense supply and demand. I can gauge retracements using the 50% level DB has shared. I can use demand and supply lines. I can review swing points. I can talk myself though what is happening. This along with risk reward of 3 to 1 or better should make this plan profitable? WHY is this not good enough? Can’t I add just another layer like volume to confirm an exhaustive turn or a change of supply and demand? WHAT AM I MISSING? Thales acts like I have hit a brick wall because beyond all of the teachings there is a layer of supply and demand feel that I don’t have.

Humbled

P.S. The results were not bad at all it was the indication that all of this is still not enough of an edge without an understanding of supply and demand. I took that to heart and pushed Thales too much for info and he needed to move on. I fought the idea of learning to read the tape.

I am not fighting any more. I am just deciding how to approach this so I do more than create a setup that is nullified. Something that I have been warned about by many that is critical beyond the mechanical approach.... understanding and reading supply and demand.

-

There sure are a lot of these "Help" threads popping up lately.Not counting this thread , as there has been some really good info on this thread, The OP's of these threads should go back and change the titles to reflect what they are really asking:

PLEASE DO THE WORK FOR ME

Gekko,

I did not want anything for free. I busted my ass and failed at consistency and take offense to your comment. I made money and lost money for years. I did not get consistent like I wanted . I did not look for anything to be given to me. My error could have been pushing to be the 1% that makes it consistent as income.

I finally came to TL to try another path. I admit to begging for some assistance to find a clue from someone already getting the results I wanted. Maybe someone like Thales could help me find the areas I was missing. I did EVERYTHING I was told exactly by my mentor Thales but I lacked a sense that a 9 year old could grasp. I am so confused I still don't see what supply and demand clues or direction someone of that age can see but I can't. I am sure it is the pressure of this moment.

WHY ?? I have no idea but thanks for the kick while while I sit here on the ground.

Maybe I am a human being and really hurt here. Honestly I am in hell and don't yet know the way out.

Thanks for adding to pain.

Humbled

-

I do not know dbphoenix's work as others do, so I can only assume that this is an accurate statement of his plan:That is as good a plan as any I have ever come across.

Again, I have not followed the entire thread. But from what I have seen, you are looking for patterns to trade. The problem is this: First, you are looking at someone else's patterns. Yes, the patterns are there for all to see, but you are not seeing them with your understanding, just your eyes. Second, because you see them but do not understand what causes them, you are unable to exploit them. Ergo, you have no edge.

And whether you are trading stocks or, as dbphoneix said, playing poker, if you have no edge, you will go broke. It is a mathematical certainty.

You yourself said that you cannot tell whether a reversal or a continuation is more or less probable one from another when price reaches resistance. Well, then you have no business trading. To be clear, no one knows for sure what price is in fact going to do, but if you are going to trade, you had better have a good, solid, well-grounded reason for thinking it is more likely to do whatever it is you are placing your chips down and betting it will do.

That should make clear what option you should take. You can work as hard as you like. But if you work hard at the same thing over and over, your are wasting your work. Its like I told my friend who I spoke of in my last post, "yes, you have worked hard, but you've done a different version of the same thing for seven years. Therefore, you think you have seven years experience trading. What you in fact have is one day's experience, and you done it now for over 2000 days. Now it is time for day 2."

If I were you, I'd make sure that I put day 1 to rest today, and get on to day 2 as soon as I wake up tomorrow.

By the way, you already are a statistic. You need a different plan from the one you've been on if you wish to move yourself from the one column to the other in the register of trading success and failure.

Optiontimer,

I have to thank you for your assistance here. I am starting day 2 this morning. I am not trading. Even though I came out positive in this adventure, I truly had to struggle at each reaction point weighing all of the options on what to do next. None of it came as second nature. Not once did I have confidence which I feel is one of the largest missing pieces.

It truly is funny. I have read 30+ books and even after reading those consistent traders, I never came out with a summary like this thread has. Other than Enigamtics comments, not one person has really talked about what really made Oniel, Trader Vic, Darvas or others which I felt could be boiled down to a define entry criteria with risk reward to a large degree. As Vic Sperando said he took trades with a minimum of 3:1 and many were 8:1 or better. He was wrong often.

I always thought that if I built a system with some help and then reacted with risk reward, I could be consistent and profitable. I thought the edge was a larger winner and a smaller losers along with a sound consistent plan.

This thread lead me in a different path which suggest that consistency comes from feeling or being able to sense the flow of supply and demand. Now I have to decide how to proceed and I am not sure what I will do next.I can query others but I will have to decide how I will approach the market from a "Day 2" perspective.

Humbled

-

TradeRunner is not the most prolific poster, but when he posts, it is usually well worth the reading.:applaud:A couple of years ago, I started a thread here at TL that was in response to a PM I received from another TL member. Here is what it said:

Hi Optiontimer

I am not a good trader. I have good setups, and can make money for a while, but I don't handle all conditions too well - Still giving a fair bit of winnings back, and stopped live trading until I sort it out.

I am trying new strategies all the time. I have many times thought of getting out of trading altogether, because it was not supposed to be like this. I was supposed to learn how to trade, and then make a gradual transition from shift work (nursing) to trading as I ease into retirement in about 4 or 5 years time.

The reality for me is that it isn't happening. I have been doing this for 7 years now. It is not coming together. I am in touch with a trader who is doing well, and he is beginning to teach me to trade currencies on a futures platform, using Donchian Channels and Constant Volume Bars.

I know I can do this - else I would have ditched the whole scene after a couple of years. But something is still eluding me, and I don't want to die without finding out what it is.

If you could also offer any help that would steer me on the right track (if there is a "right track") that would be appreciated. I am not afraid of hard work, and I am not asking for the keys to the Cadillac. I just want my hard work to be in an area that will bear fruit.

I created my thread to try to teach this individual how to grasp certain basics of psrice action, specifically, to make him sensitive to the presence or absence of trend, or more simply, is price going up, down, or is it stuck in a horizontal range.

I am glad I did, because it did help a few traders move forward - not because of the particular system I presented there, but because they were able to grasp the general concept of a trend, and the benefit of entering a trade in the direction of the major trend but during a minor pullback or retracement against that trend. Unfortunately, I was unable to help the one trader who had originally asked me for help.

He had initial success, and then the same difficulties arose, and so he moved on. He came back with a system that worked. Then it did not work well enough, so he gave that up. He spoke of quitting trading altogether. He may have done that, but I think, though it is not very clear to me, that he found another system, and that that he is now trying to make that work for him. He says that he finally understands what I was trying to get him to see about trends and pullbacks, etc. I hope he has. I really really hope he has. But, I have my doubts.

I guess the point of all this is that the plight of that trader and humbled are very much alike. What each has tried repeatedly, and each time resulted in failure, to attempt to plug himself into a pre-fab system, an easily identified and repeatable pattern that requires nothing more than a "buy on green, sell on red" engagement with the market.

More importantly, each disregarded advice that attempted to point them toward plugging themselves into the flow of the markets.

It is an unfortunate thing that good advice, the advice that might actually give the trader a chance to succeed, is not at all the advice that the trader who is struggling wants to hear. I've not read this entire journal, but I did go through the discussion of the last few days. What interested me the most is that the posts I thought to be the most helpful, from TradeRunner, from Thales, from dbphoenix, went "unthanked" and "unliked" by the op, while others, the one's urging the op on, the one's taking issue with the good advice offered, were often "thanked" and "liked" by the op (to be fair, there were a couple of good posts from Steve46 that the op did acknowledge).

Well, I don't know exactly why I felt moved to post this, other than I've read this book before, and I (and a few others) can see exactly how its going to end, even if the op and his entourage think it is still a work in progress. The best thing I can do is point out this passage from an "unthanked" and "unliked" dbphoenix post that says in a few lines what I have babbled on for several paragraphs and probably failed to communicate:

In other words, the op needs to do something other than the same thing he has been doing. If it did not work the first 100 times, it is not going to work on the 101st.

Optiontimer,

You make some very good points. Understand I am very confused on what is my best course of action right now. I have thanked posts that gave me framework ideas how to approach the issue. The broad strokes of just saying "order flow" was a little much for me to digest. I understand the concept. It has been suggested that I need to develop a feel or sense of the flow of the market

I can show you the trend on a chart but feeling or being able to measure a reversal from a pause is a crap-shoot for me. If I stack up all the reasons to take a trade I can do that, but asking me if my feel says we are moving up next ,I might be able to answer from that exact spot but it seems to be nullified 30 seconds later.

I am trying to wrap my head around all of this so I make the best decisions moving forward. I admit I am not sure what is best. Maybe it is clear to some but as you can imagine I don't want to make the wrong choice.

I can read higher lows and higher highs. I can see breakouts and breakout failures. I see supply and demand in the charts but it is done using mechanical means. I have no sense of what will happen next. If price hits an area of resistance and a signal forms I just know that if the reasons align I can take that trade. I can't feel higher odds on this trade compared to the last one.

This process was working fine in this thread until the comments started to focus on tape reading. I can tell you I was hesitant at first because it was not being explained. I am willing to do whatever it takes but I am trying to figure out where to step next as the minefield seems to show in every direction.

I don't want to be a story of failure so imagine I am taking in everything I can to save myself. I want this more than anything so imagine I am poking in every direction looking for a path to move forward.

Humbled

PS. Put yourself in my shoes. I don't want to be a statistic.

-

I have to agree with this last statementOnce I saw how I could simplify my own approach I asked myself, "will I still make money"?

It didn't change a thing....I do use "aids" but only to help me see where things are headed in a general sense...after that you use your common sense....participants act like a school of fish, price moves and the school moves with it....if there is sufficient interest, it becomes momentum and that school of fish just keeps on moving forward...if not then they change direction...you watch long enough and you can see WHERE they are going and WHY they turned at this place (price) or that place (price)....

I don't like the idea of watching short time frame charts but here is one idea that appeals to me....put a short time frame chart in place and a longer time frame chart next to it....watch that and see how price swims along from place to place....referring to the longer time frame to pinpoint the price "reference points". On the short time frame you can see how multiple tests of a price create S/R and on the longer time frame how this activity creates key reference points that are often in play the next day....

Good luck

I guess one more thought....again I generally agree with DB but with respect to price movement it ISN"T black or white....up or down....actually what works is to notice that price trends (up or down) then pauses (and moves sideways)....this run/pause model is how our markets work.....people get an idea (I'm going to buy or sell) then they stand aside and wait (for news or whatever)....the real question is .......once the market has paused "is it going to resume the previous trend, or is it going to reverse......when you get to that point in your development, (and you can answer that question) which is similar to DB's comment, THEN you have something...

Steve46,

This post added some clarity to this discussion. Thank you for sharing. I have just added it to my trading log along with many things I have learned from this heated discussion.

Humbled

-

All of which comes much later. And if you'd like to take Humbled under your wing and tutor him to the point where he can is able to do what you suggest, great. Otherwise, it's unlikely that he will be any less confused than he already is.What Humbled does, of course, is entirely up to Humbled. I've explained all of this in as much detail as I can, elsewhere.

Db,

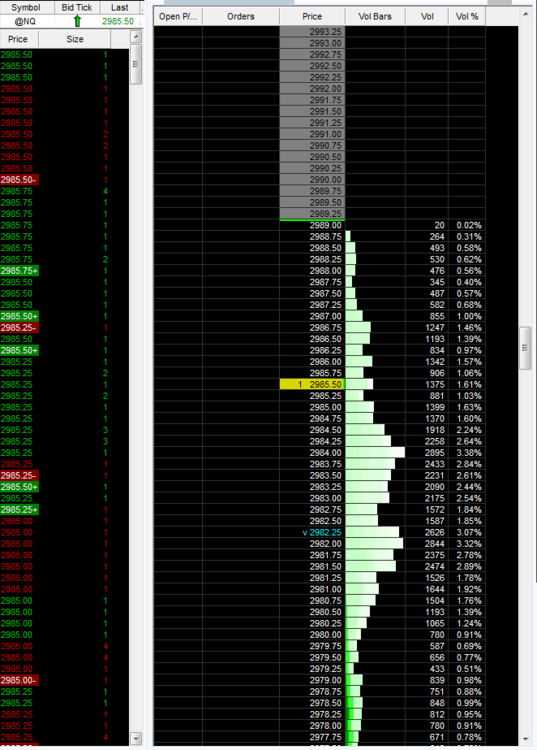

You have made it more than clear that the only answer that exists is to just watch Time and Sales. I believe at this moment that is the only value I can extract from your advice other than packing it in. I am reviewing the T&S option now.

Humbled

-

And Humbled, what Enigmatics had to say above is the hallmark of a "consistent" trader!-MadSpeculator.

Yes Enigmatics has shared concrete information with me that I am reviewing right now. It is people like Enigmatics and yourself that have given me options to grow from. There are differences but I am reviewing those now.

Thanks again,

Humbled

-

DBPhoenix:I know you are a revered member of the TL community and a lot of struggling traders value what you have to say. So, when you say

I feel you are doing a disservice to all those traders. Not knowing how you define “complex”, I can’t comment on it; but all financial markets are complex systems (see the characteristics I have outlined in my earlier post in this thread; also refer to Hayek’s essay on complexity).

However, saying that a market is “extremely simple” is misguided. The right analogy is not of a simple produce stand, but one of multiple produce stands in close quarters all vending the same products competing for customers and making inventory decisions. There is nothing simple in the dynamic of each produce stand. But, the aggregate patterns that emerge out of that “system” is indeed simple.

The above might seem like nitpicking on detail, but the implication of this differentiation is very important when one is trying to “observe price with intent” as you have said elsewhere before.

Not everything said in a messaging board is bullshit, although for both the ignorant and arrogant it might seem so!

Humble: I am sorry to have hijacked your thread. I will refrain from commenting on other people's post henceforth.

-MadSpeculator.

MadSpeculator,

Your posts are excellent and received as a voice of reason in an area where people have very strong opinions. I am the student so I am listening and appreciate your input.

I chose this. This is all on me. I could have studied my Peter Brandt book and looked to build consistency on weekly and monthly charts but I wanted to learn to extract consistent profits on a weekly basis.

I have actually used your post as an outline of how I will replay and work to learn this.

Thank you so much for being here and sharing.

Humbled

-

-

DbPhoenix,

For someone who has done this before and did not see it, is there a way to validate if I do find something. Maybe if I start a thread of occurrences that I see, could that be discussed?

Humbled

-

Humbled:I rarely post on TL but wanted to share a few of my thoughts in the hope that it might be of help to you as you decide your next steps.

Your effort is applaudable; however, you have expended all your effort in what is the most difficult methodology in trading -- trade based on price patterns. I know of no [yes, I said no] CTA or traders, who make a living, that trade based on “pure” price patters. Unfortunately, most of the debutant self-teaching traders trade price patters and they fail.

Why is trading price patters difficult? In my opinion, there are two reasons for it:

- Financial markets are complex systems. The characteristics of a complex system are:

-

the behavior of any individual market participant is independent of the aggregate behavior of the system;

-

they consistently produce classes of patterns, but it is impossible to predict when an instance of a patterns belonging to a class might occur, or the exact pattern of that instance. For example, during the tech bubble everyone knew there will be an impending correction (a class of pattern), but predicting when that correction would start (instance of a class of pattern) or how the pattern would look (exact pattern of the instance) was not possible;

-

Given that instances of a class of pattern are dissimilar, it is impossible to describe them algorithmically. This has a huge implication on using statistical methods on price and volume; The statistical methods should be used only on classes of patterns generated by the system; but I digress.

-

Patterns occur at different scales: micro, macro, and everywhere in between.

[*]Price pattern is a first order approximation of order flow. I define order flow as the result of the effort made by “buyers” and “sellers”, each trading to fulfill their objective (whatever that objective might be).

A Price patterns is a visual instance of a class of pattern. It is impossible to predict when they might occur; and no two price patterns belonging to the same class of pattern are similar. Since price pattern is a first order approximation, a price pattern can be “confirmed” only ex-post.

Based on my reasons listed above, the only way to trade “pure” price patterns is (a) mechanically; and (b) relying solely on probability and money management to extract profits from the market. However, because of 1.b and 1.c, this methodology of trading is very difficult and traders who follow it usually fail or alter the methodology.

Fortunately, modifying a methodology based on “pure” price patters is relatively simple: Filter your trades based on trend. However, trend should not be based on price action as is always suggested in books [if you do this, you end up introducing a second order approximation]. Trend should be defined as the direction of price movement conditioned on the price action around the last identified target [e.g. support or resistance level].

The above definition of trend introduces a very important class of pattern: Price action around key support or resistance levels. These patterns occur often, are very tradable, and provide a good reward-to-risk ratio. Furthermore, we are not interested in the exact pattern of the instance of this class of pattern, but the outcome: are the support or resistance levels accepted or rejected; and we update our strategy based on that outcome. Almost all CTAs and traders who make a living trading trade based on these class of patterns [examples include scalping for a few ticks based on “reading the tape”, intra-day position trading using order flow (this, by the way, is my style), trend-following, or swing-trading].

Identifying trend as defined above will give you the “feel” for the market other traders are taking about.

Although Thales has done a fantastic job of guiding you, I have to disagree with his latest suggestion that you take a sabbatical from the market. When DbPhoenix talks about observing price, and noting repeated behavior, he is not taking about price patterns -- He is a wyckoffian, and Wyckoff warned his students against trading price patterns; I am sure DbPhoenix heeds to his teacher’s advice.

So what does all the above mean to you? Here is a plan of action (given that you are an intra-day trader):

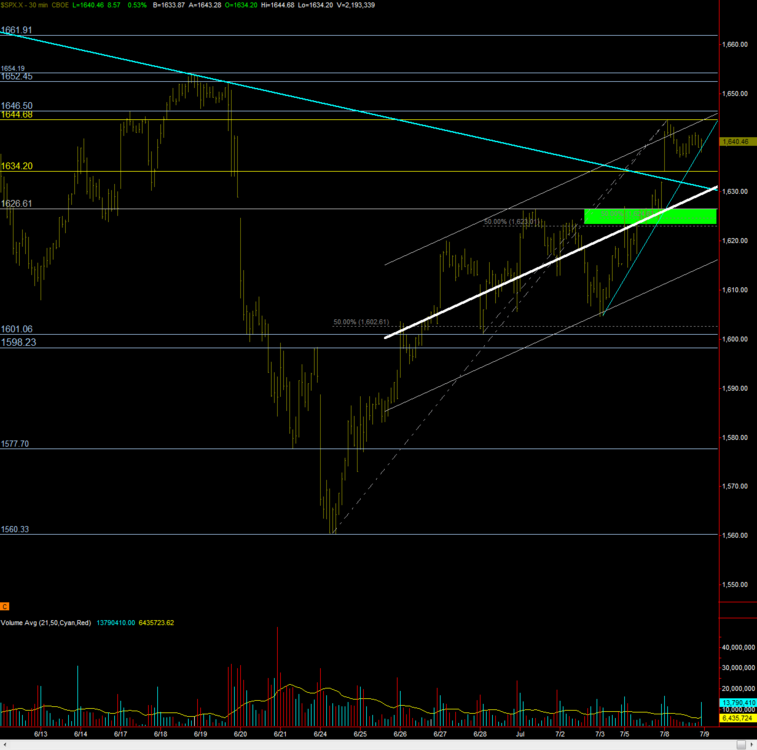

- Do not turn-off the chart and look at T&S as you are being advised. You will go crazy. There is a easier transition;

- Set your chart to 30-min bars.

- An obvious pattern you will notice is that price goes above the high of the previous 30-min bar or below the low of the previous 30-min bar. Lets exploit this pattern and try to define the trend based on what happens around those points.

- Look at T&S as price approaches/penetrates the previous 30-min bar extremes. You are looking for patterns that signals acceptance [which means price will continue in that direction;] or rejection [which means price will reverse AND head towards the other extreme of the 30-min bar].

- Also take note of conditions [T&S patterns] when price is rejected at an extreme but cannot make it to the other extreme of that 30-min bar.

- Sometimes, the current 30-min bar becomes an “inside bar” relative to the previous 30-min bar, in which case, you don’t do anything.

Do this for couple of weeks, and you will get a “feel” for the market. Build on what I have outlined above. You will also notice that you will find entries that are different from the price pattern based entries you currently use. When you reach this stage, you have all the tools you need to reach the elusive “consistency” you are seeking. And you will never question “if everyone who becomes consistent can see behind the curtain” for you, my fellow trader, will be “seeing behind the curtain” too.

All the best!

-MadSpeculator.

MadSpeculator,

In reading your post, I see this as being a viable option. You have shared a way that could work well for me so I am considering it right now. In fact, I see no reason why I should not. I think this framework could at least direct me to the spot that shows the signs I am looking for as my last experiencing at just staring was met with frustration.

I want to thank you for stepping in to help. I really can't express how valuable this assistance is to someone like me who wants this more than almost anything in the world but finds consistency just out of reach. I have spent years on the roller coaster and it is time to turn this into a business.

Once again, thank you for sharing and assisting me.

Humbled

- Financial markets are complex systems. The characteristics of a complex system are:

-

I want to say thank you to everyone who helped here. I started this thread to get help from Thales after reading about the training of his daughter starting at age 9.

I made an assumption that the method he taught her would be fairly simple to follow and would allow me to copy that consistency after years of complex methods and inconsistent results. Unfortunately, I did not consider that Thales taught his daughter (9 to 12yrs old) tape reading. I never envisioned a child sitting and and studying price at that level of depth. I did not think it was done with "feel" or with a "sense" of what price will do. I had assumed it was a reaction to a pattern or behavior to look for.

As many will see I followed the instructions in this thread regardless of preference. I would have been happy to build a consistent method that did not require micro precision on one minute charts.

I will consider the option Thales has laid out for me as I have no other option but success. I do question if everyone who becomes consistent can see behind the curtain.

I wish all of you good luck

Humbled

PS: Once again thank you to Thales for showing me all he could as I pressed very hard for clarity that I guess just can't be explained. The evasive nature of this one area of tape reading got in the way.

-

It is not possible to have given any more effort than I gave so all I can do is consider my next options.

Thank you Thales for your time.

Humbled

-

Enigmatics,

Please continue to post your volume reviews on the SPY as I still have volume on watch.

Humbled

-

-

I would summarise DB's "plan" post like this:1. Stop trading

2. Observe price

3. Notice repeatable behaviour

4. Write plan base on (3)

5. Test plan

6. Make adjustments

7. Trade plan

Is this what you have done?

TradeRunner,

I did stop trading for weeks to observe price and did replays. That was step #1&2

I never extracted any "feel" but i did notice patterns like the 2b, double bottom. H&S and such.

I did write several plans to trade the right shoulder after a spike down and the 2b's as I was tried to buy the area being held as support and the spike downs would chop me to death.

Even with those adjustments I still came out with so many losses I admit I felt exhausted from the pain and moved to longer time frames.

I think the frustration got me. Maybe I did not do enough time with it. I can tell you I never felt anything other than watching the reactions and praying once I entered they did not spike outside the range to take me out.

Humbled

-

-

Humbled Trading Log

in Traders Log

Posted

Mickeybh,

What if I am looking to swing trade? I would like to hold for larger gains.

Humbled