Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

M.A

-

Content Count

245 -

Joined

-

Last visited

Posts posted by M.A

-

-

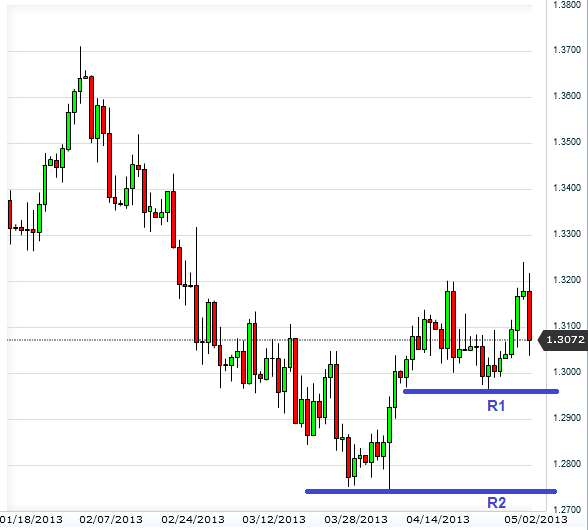

Technically eur/usd's trend is unclear. We have support and resistance levels but there is an equal chance of touching either of these levels.

BUT if you r planning to get some nice pips, follow monday's fundamentals at 14:00gmt. Draghi's speech, most of the times, has high impact.

-

Better data from UK supported GBP to gain significant pips against usd. Expected dovish statements from FOMC also supported this rally. Even though this week has been very good for GBP, UK wont look at it as something "BIG".

-

Eur/usd swung both ways this week. It gained more than 100 pips, in a couple of hours, on 30th April and lost more than 150 pips, in a couple of hours, on 2nd May. Technicals have played minor role in these big moves. Short term traders who are keeping their eye over fundamentals will be gaining much more than short term technical traders.

Technically eur/usd was unable to break any major support or resistance level this week. Support level for next week lies at 4-april low of 1.2956 and then around 1.2750. Resistance, of 1.3200, was broken this week but any big timeframe candle (5hr+) was not closed above 1.3200. So resistance zone is still around 1.3200. Any significant break will cause strong bullish sentiments. Image in previous post is valid for this post too.

This week, Usd/jpy went near 97.00 level but ended week with significant gains. Better than expected non-farm payrolls caused the pair to cross 99.00 level from below 98.00.

-

GBP weakened significantly against usd after touching session highs of 1.5591. Better than expected data from U.S labor department was a strong reason behind usd strength. UK construction PMI was better than expected which stopped further downward moves of gbp/usd.

-

Draghi's comments once again proved to be very sensitive for eur. In this week, inflation figure came from eurozone, of 1.2%, were well below 2% target. Draghi said that ECB is carefully looking at market conditions and ECB could change interest rate, to negative, for commercial lenders. ECB cut the interest rate from 0.75% to 0.5%. Marginal lending facility is also lowered to 1%.

All these measures will help in recovery of eurozone economy, said Mario Draghi.

Today eur weakend significantly against its counterparts. Decline in eur/usd was more than 1%. Technically, pair is likely to find support at 24th-april low of 1.2956. It has already touched the key resistance zone but fundamentals pulled it from there. If eur/usd breaks 1.2956, next target would be 4th-april low of 1.2747.

-

GBP took full advantage of weak usd and rose sharply. Fed policy ahead has limited these gains and investors r eagerly waiting for FOMC. Technically this pair has already crossed 1.5509 resistance level and is heading towards 1.5800.

GBP showed very insignificant change against eur today. At this time, change is around -0.06%.

-

ADP non-farm payroll data and manufacturing PMI were worse than expected which shows no sign of improvement in u.s economy. Eur continued its bullish strength against usd and touched 9-week high.

We can see bearish trend in eur/usd before fed release. Fed release is less expected to be any hawkish due to current weak numbers. I think fed will acknowledge that situation is "not very fine and not as expected and desired".

-

GBP showed mixed moves today. It rose sharply against usd but weakened against eur.

gbp/usd found support at 1.5470 (expected was near 1.5415) and touched the highest point (1.5566) since 14th-feb. Tomorrow's release from Federal reserve will have high impact on usd so I am currently on hold for any usd-pair.

-

In my previous post, I talked about downward move with a minor possibility of touching 1.3200 level. Today fundamentals supported this "minor expectation". Eur/usd went to 1.3186 from 1.3076 within 2 hours (110 pips).

This move is mainly due to strengthening euro on interest rate cut expectations from ECB. Even though unemployment rate was a little lower than previous month but it was as expected. So it didnt have any bad impact on eur.

Eur also remained significantly higher against other rivals today.

-

Dollar remained lower against rivals when trading started on monday. Strong fundamentals from u.s were very successful in offsetting those losses initially made by usd.

Technically eur/usd is now expected to go to 1.2956 after touching 1.3100 resistance level. Strong u.s data caused bullish trend to stop. At the same time there is also a minor possibility that pair continues its bullish trend to touch 1.3200 (16-april high). Following chart shows current trend and expected moves.

-

Disappointing U.S estimated GDP has weakened it against rivals especially against jpy. Difference between highest and lowest point for today is 180 pips so far !!!. Difference between today's opening and current price is around 140 pips.

Technically pair is heading rowards 15th-april and 5th april low of around 95.80 level. Investors (including me) should concentrate more on technical side and less on fundamental side.

-

Usd/jpy has made another :crap::crap::crap:

Usd/jpy has made a dive to 98.23 level and hopes for 100 this week and this month almost died.

Two strong fundamentals coming but not strong enough to take it to 100 level.

-

U.Ks better than expected estimated GDP strengthened it against rivals. Even U.S data for jobless claims had no affect on gbp/usd. This pair has gained 171 pips so far. It has been highest point since 19-feb.

GBP has already made significant gains in this week and tomorrow will most probably be slightly bearish for this pair.

-

Eur/usd is continuously facing resistance near 1.3100 level strong bearish move on 19th april. Once again, today, eur/usd failed to reach 1.3100 and came back strongly after u.s jobless claims figure came better than expected. Jobless claims fell by around 16k.

Same with the usd/jpy. Fear of "100" continues. It is becoming interesting now. If I display emoticons according to usd/jpy moves. It will be like :-

:doh:

:doh:

:crap::spam::spam::spam:

:crap::spam::spam::spam: -

BBA approvals came as expected and stregthened gbp. CBI distributive trade survey came weaker than expected but had a little affect on gbp.

GBP remained slightly stronger vs usd today. But end of the day seems to offset the small gains and gbp/usd may enter into negative territory.

-

Usd/jpy has been very dodging since 8th april when sentiments about usd/jpy, to touch 100 level, starting to become very strong. BoJ's decision to ease monetary policy was considered strong enough to touch 100 level but this prediction failed and technical analysts won who were expecting a long dive before reaching 100.

Usd/jpy has already taken a long dive but it is still in no mood to touch 100 level. Instead it is moving near to 100 level and most of the times it has moved against fundamentals. See the image below and u will have an idea of behavior of usd/jpy's movement since 8th april.

-

Another expected weaker data from U.S which should have pulled usd/jpy but it didnt. Usd/jpy went up.

This was a pure technical game and fundamentals were ruled out of this bullish move. Current move has made it very clear that usd/jpy will, most probably, cross 100 level this week.

Eur/usd fell sharply on worse than expected PMI data from germany. Technically this pair is following a bearish trend with small bounce backs at key support levels. Attached image shows those levels in blue colors. Red color represent key resistance levels which could begin a bullish move.

-

Slightly upward trendy but sentiments r bearish due to strong technical support. Today's weak bullish trend was due to weak u.s data. I dun think fundamentals will have any high impact on this pair and it will, most probably, go down to the support level (image in previous post).

-

As expected and written in my last post, U.S home sales data came worse than expected. Once again, bad day for those hoping level 100:crap:. It went to 99.89 just to tell investors that it could reach 100 but then who would follow in such an exciting way. It is becoming a psychological war and strategy game between usd/jpy and investors. Usd/jpy is winning so far:haha:

If we look at upcoming fundamentals, there very low chance of 100 level unless some unexpected better than expected news comes out of U.S, strong enough to take pair to 100 level. Very low probability !!!!

-

A few important fundamentals and possible results in coming week.

1- Home sales data from U.S. It is expected to be slightly better than previous data. VERY IMPORTANT, if u r also usd/jpy follower. It will definitely have high impact on usd. If it is better than expected then usd will be bullish.

Existing home sales will be released on monday 3:00pm and new home sales data will be released on tuesday 3:00pm

Previous data for home sales was worse than expected. If u want usd/jpy to cross 100, pray for home sales to be better than expected

.

.2- Core durable goods order. Previous data was worse than expected. Expected is same but actual may be worse. Another bad sign for usd/jpy followers.

3- Press conference by BoJ. Lets see what they do.

-

GBP/usd is expected to show some decline in the start of week. As shown in the image, major support is expected near 1.5030 level. Strong downwardish moves by gbp/usd r indicating a dive towards this level.

It took 6 "5hrs" candles to reach a weekly high but just 2 candles to offset all the gain. then it took around 9 candles to go near week-high but again it took 2 canldes. Bearish moves r very strong and so is the impact of weak fundamental data from U.K.

-

This week has been "failure to touch key levels" week.

Usd/jpy was unable to touch key level of 100.

Eur/usd has been bearish all week but remained successful to hold above key level of 1.3000.

GBP is showing range bound action. It went up on monday and tuesday then came back rapidly on wednesday. It found support and went up again on thursday. It continued to gain strength on friday but came back before touching week-high. Main cause of strong bearish moves is worse than expected economic data from BOE.

So what do expect in the coming week?

usd/jpy- already told in previous post. It needs solid fundamental support. Reistance level is ......... Forget about it. Psychological level of 100 is more important. Wait for it to break and then hopefully a bullish trend will start which will cross 101.

eur/usd- At this time this pair is at 1.3050. Resistance zone is around 1.3100 and then at 1.3230. Support zone is around 1.2975 and then at 1.2915.

gbp/usd- GBP may continue to weaken in coming week but it will mainly depend on BOE. More policy easing will definitely weaken gbp and we will see expected decline.

-

Eur/usd is my favorite pair but it looks like, I am getting more and more involved in usd/jpy. Maybe at some level, I also want it to touch 100. I think most of the currency traders have similar wish.

Coming back from 99.94 to 95.83.... wasnt it a bad news for most traders who were expecting rocket after 99.87 resistance. ( I wrote 90.87 and 90.00 levels a few days back which was a typo).

Is this the correct time to hope for 100? or is it still a NO? Another important question is which factors will support it to take it to 100.

First two questions depend on the third one. As in the previous week, we didnt see any solid fundamental support (even though technicals were supporting 100) which pulled pair back to below 96.00. Monetary easing policy program has already started and a major part of this program is purchase foreign bonds. But releases from Japan's finance ministry shows that net value is still in favor of sales instead of purchase. Net bond sales r lower and shows a declining trend since jpy is weakeing. Net value in favor of purchases will strongly support this pair to cross 100.

Another important factor is U.S fundamentals. Last day of the previous week, bad U.S data is considered to be the only reason behind bearish usd/jpy. So investors will be looking at U.S data too.

-

As most rivals of usd, gbp also lost more than 0.75% today to usd. This loss is mainly caused by weaker than expected uk jobs data. Another important factor was BOE minutes.

Hourly chart shows breach of major support. This breach has opened doors to more bearish moves. But I would wait to see a little more pips downwards. As shown in image, technically, support level is already breached and we can enter for a short gbp/usd.

Expectations from Majors

in Forex

Posted

As expected, Draghi's speech defined eur/usd's direction and it is now touching minor resistance level of 1.3106. By looking at current situation, we may see further move towards 1.2999.

Another reason why I am strongly bearish on eur/usd is because trend line is broken (see image).