Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

Stocks4life

-

Content Count

6772 -

Joined

-

Last visited

-

Days Won

1

Posts posted by Stocks4life

-

-

MU

holding the gap up watch for a breakout higher

BREAKOUT WATCH for possible breakout above 24.01, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 26.2, 11% Stop: 22.91, Loss: 2.9%, Profit/Loss ratio: 3.8 : 1 - Excellent

source: MU at StockConsultant

-

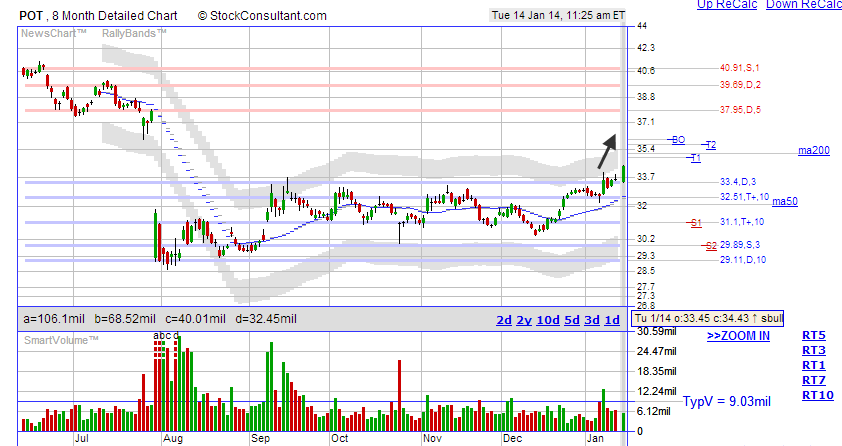

POT entering the gap, good volume

VOLUME 5.66mil shares, +84.4% compared to typical volume of 3.07mil by 11:25 am ET (15-20 min delayed).

High Volume alert!

Typical daily volume is 9.03mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 33.87, no resistance in area just above.

Type: True breakout from double resistance.

Target: 36.08, 4.8% Stop: 33.64, Loss: 2.3%, Profit/Loss ratio: 2.1 : 1 - Fair

source: POT at StockConsultant

-

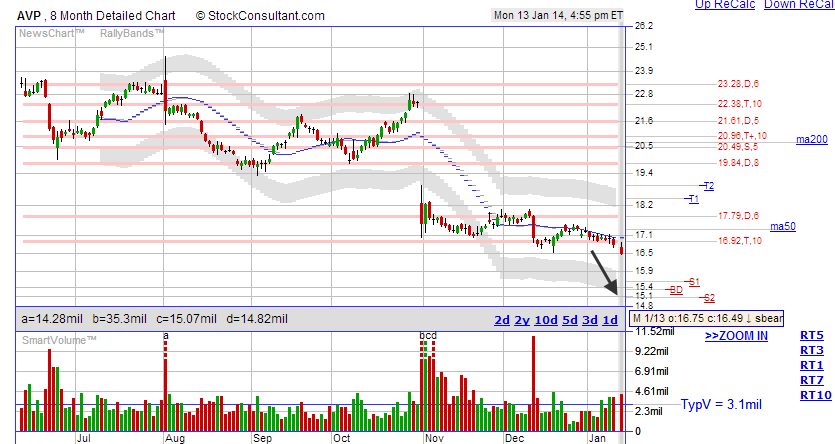

AVP

VOLUME 4.33mil shares, +39.6% compared to typical daily volume over the past 6 months.

Typical daily volume is 3.1mil shares over the past 6 months.

BREAKDOWN CONFIRMED breakdown below 16.66, no support in area just below.

Type: True breakdown from triple support.

Target: 15.33, 7% Cover: 16.96, Loss: 2.9%, Profit/Loss ratio: 2.4 : 1 - Good

source: AVP at StockConsultant

-

SRPT

coming up to the price gap

VOLUME 1.66mil shares, +34.7% compared to typical volume of 1.23mil by 2:25 pm ET (15-20 min delayed).

Typical daily volume is 1.93mil shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 21.37, no resistance in area just above.

Type: True breakout from double resistance.

Target: 25.72, 25.1% Stop: 18.94, Loss: 7.9%, Profit/Loss ratio: 3.2 : 1 - Excellent

source: SRPT at StockConsultant

-

AMRN

second attempt to breakout into the price gap

VOLUME 1.06mil shares, +123% compared to typical volume of 475.3k by 10:05 am ET (15-20 min delayed).

High Volume alert!

Typical daily volume is 5.94mil shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 2.37, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 2.89, 29.6% Stop: 2.06, Loss: 7.6%, Profit/Loss ratio: 3.9 : 1 - Excellent

source: AMRN at StockConsultant

-

AKAM

filling the gap

BREAKOUT CONFIRMED breakout above 48.09, no resistance in area just above.

Type: True breakout from triple resistance.

Target: 50.99, 5.8% Stop: 47.05, Loss: 2.4%, Profit/Loss ratio: 2.4 : 1 - Good

source: AKAM at StockConsultant

-

ITT

slow and steady breakout

VOLUME 286.9k shares, +2.5% compared to typical volume of 280k by 12:25 pm ET (15-20 min delayed).

Typical daily volume is 636.3k shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 44.05, no resistance in area just above.

Type: True breakout from double resistance.

Target: 46.81, 6.1% Stop: 43.22, Loss: 2%, Profit/Loss ratio: 3.1 : 1 - Excellent

source: ITT at StockConsultant

-

DPZ

breakout watch, long top

BREAKOUT WATCH for possible breakout above 70.93, no resistance in area just above.

Type: True breakout from triple+ resistance.

Target: 74.7, 5.8% Stop: 69.49, Loss: 1.6%, Profit/Loss ratio: 3.6 : 1 - Excellent

source: DPZ at StockConsultant

-

AMRN

making a move into the large price gap. big volume

VOLUME 13.26mil shares, +408% compared to typical volume of 2.61mil by 12:55 pm ET (15-20 min delayed).

High Volume alert!

Typical daily volume is 5.33mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 2.37, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 2.89, 21.4% Stop: 2.18, Loss: 8.4%, Profit/Loss ratio: 2.6 : 1 - Good

source: AMRN at StockConsultant

-

HAR

coming up for a breakout

VOLUME 266.8k shares, +13.2% compared to typical volume of 235.6k by 11:25 am ET (15-20 min delayed).

Typical daily volume is 693k shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 85.51, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 92.55, 9.5% Stop: 82.24, Loss: 2.7%, Profit/Loss ratio: 3.5 : 1 - Excellent

source: HAR at StockConsultant

-

AKAM

may be looking to fill the gap

BREAKOUT WATCH for possible breakout above 48.1, no resistance in area just above.

Type: True breakout from triple resistance.

Target: 50.95, 7.7% Stop: 46.29, Loss: 2.1%, Profit/Loss ratio: 3.7 : 1 - Excellent

source: AKAM at StockConsultant

-

ACHN

price gap breakout

VOLUME 2.12mil shares, +76.6% compared to typical volume of 1.2mil by 2:45 pm ET (15-20 min delayed).

High Volume alert!

Typical daily volume is 1.79mil shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 3.53, no resistance in area just above.

Type: True breakout from double resistance.

Target: 4.15, 19.6% Stop: 3.26, Loss: 6.1%, Profit/Loss ratio: 3.2 : 1 - Excellent

source: ACHN at StockConsultant

-

POT

making another breakout attempt into the gap

VOLUME 3.51mil shares, +4.7% compared to typical volume of 3.35mil by 11:55 am ET (15-20 min delayed).

Typical daily volume is 8.58mil shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 33.38, no resistance in area just above.

Type: True breakout from triple resistance.

Target: 35.56, 6.6% Stop: 32.56, Loss: 2.4%, Profit/Loss ratio: 2.7 : 1 - Good

source: POT at StockConsultant

-

SNDK

VOLUME 1.22mil shares, <b>+280%</b> compared to typical volume of 322.2k by 10:05 am ET (15-20 min delayed).

High Volume alert!

Typical daily volume is 4.03mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 71.04, no resistance in area just above.

Type: True breakout from triple resistance.

Target: 75.14, 5.7% Stop: 69.38, Loss: 2.4%, Profit/Loss ratio: 2.4 : 1 - Good

source: SNDK at StockConsultant

-

FB

VOLUME 69.4mil shares, +14.5% compared to typical volume of 60.61mil by 3:40 pm ET (15-20 min delayed).

Typical daily volume is 70.47mil shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 59.18, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 64.13, 10.6% Stop: 55.87, Loss: 3.6%, Profit/Loss ratio: 2.9 : 1 - Good

source: FB at StockConsultant

-

ROVI

BREAKOUT CONFIRMED breakout above 20.49, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 21.76, 4.9% Stop: 20.27, Loss: 2.3%, Profit/Loss ratio: 2.1 : 1 - Fair

source: ROVI at StockConsultant

-

DECK

strong breakout on good volume

VOLUME 680.6k shares, +66.4% compared to typical volume of 409.1k by 11:55 am ET (15-20 min delayed).

Typical daily volume is 1.05mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 87.11, no resistance in area just above.

Type: True breakout from double resistance.

Target: 94.85, 8.2% Stop: 84.68, Loss: 3.4%, Profit/Loss ratio: 2.4 : 1 - Good

source: DECK at StockConsultant

-

C

nice breakout, good volume

VOLUME 12.23mil shares, +60.7% compared to typical volume of 7.61mil by 11:25 am ET (15-20 min delayed).

Typical daily volume is 22.38mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 53.61, no resistance in area just above.

Type: True breakout from triple resistance.

Target: 56.54, 4.6% Stop: 52.89, Loss: 2.1%, Profit/Loss ratio: 2.2 : 1 - Good

source: C at StockConsultant

-

LUV

breakout off a month long base, volume picking up

VOLUME 5.72mil shares, +26.8% compared to typical volume of 4.51mil by 3:05 pm ET (15-20 min delayed).

Typical daily volume is 6.26mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 19.11, no resistance in area just above.

Type: True breakout from triple resistance.

Target: 20.36, 5% Stop: 18.94, Loss: 2.3%, Profit/Loss ratio: 2.2 : 1 - Good

source: LUV at StockConsultant

-

ETFC

a slow and steady up trend

VOLUME 3.12mil shares, +4.9% compared to typical daily volume over the past 6 months.

Typical daily volume is 2.97mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 19.78, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 21.17, 6.9% Stop: 19.36, Loss: 2.3%, Profit/Loss ratio: 3 : 1 - Good

source: ETFC at StockConsultant

-

ECT

big resistance gap breakout watch with good volume

VOLUME 100.6k shares, +80.8% compared to typical volume of 55.64k by 1:25 pm ET (15-20 min delayed).

High Volume alert!

Typical daily volume is 103k shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 7.99, no resistance in area just above.

Type: True breakout from double resistance.

Target: 9.17, 15.3% Stop: 7.6, Loss: 4.4%, Profit/Loss ratio: 3.5 : 1 - Excellent

source: ECT at StockConsultant

-

LVS

trying to continue higher, good start on the volume today

VOLUME 544.7k shares, +57.1% compared to typical volume of 346.6k by 10:05 am ET (15-20 min delayed).

Typical daily volume is 4.33mil shares over the past 6 months.

BREAKOUT WATCH for possible breakout above 79.67, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 84.06, 6.4% Stop: 77.84, Loss: 1.5%, Profit/Loss ratio: 4.3 : 1 - Excellent

source: LVS at StockConsultant

-

BRCM

trying to fill that gap with the latest breakout

BREAKOUT CONFIRMED breakout above 29.59, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 31.17, 5.1% Stop: 29.17, Loss: 1.6%, Profit/Loss ratio: 3.2 : 1 - Excellent

source: BRCM at StockConsultant

-

MPAA

keeps on moving higher, good volume

VOLUME 189.1k shares, +37.4% compared to typical volume of 137.6k by 3:40 pm ET (15-20 min delayed).

Typical daily volume is 160k shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 19.16, no resistance in area just above.

Type: Continuation breakout from single resistance.

Target: 21.17, 10% Stop: 18.46, Loss: 4.1%, Profit/Loss ratio: 2.4 : 1 - Good

source: MPAA at StockConsultant

Breakout and Gap Stocks

in Stocks

Posted

HPQ makes the move

VOLUME 4.97mil shares, +118% compared to typical volume of 2.28mil by 10:25 am ET (15-20 min delayed).

High Volume alert!

Typical daily volume is 14.27mil shares over the past 6 months.

BREAKOUT CONFIRMED breakout above 29.1, no resistance in area just above.

Type: True breakout from double resistance.

Target: 31.14, 5.2% Stop: 28.8, Loss: 2.7%, Profit/Loss ratio: 1.9 : 1 - Fair

source: HPQ at StockConsultant