Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

72 -

Joined

-

Last visited

Posts posted by Northern boy

-

-

thanks. any for commodities or specific stocks?

-

thanks, more sources welcomed.

-

Does anyone know where to get Intra-day data for Excel? Preferably free, but if not that's fine too. Looking ideally for forex data, but commodities and equities will do. Website I used to use isn't working anymore.

Thanks

-

check these guys out, I'm not sure how reliable they are, says they are an NFA member. this is the only one I've come across through google.

-

I've noticed these options are very hard to find for a retail trader, and I think this is deliberate to deprive you of several opportunities. I can't think of another reason why options on forex would be so difficult to find on the retail level. If you ever do find a provider, let me know.

-

How do you calculate standard deviation of realized volatility from Mean (IV)? Is it normally distributed?

Terrible in math, need help desperately. Thanks.

-

I don't think this is a call that should be made with TA. You need to figure out how much more damage is left to be unveiled in Europe imo.

-

...Until I found out about volatility swaps. lol.

I KNEW there was an easier way!

Their construct and pay off is simple. You arrange a notional amount, a strike (V%), and the pay-out at maturity is: 'notional' * (realized volatility - strike)

there's no premiums involved. They just trade your book.

Google: "Salomon Smith Barney Exotic Equity Derivatives Manual" to read further about the products.

There's: 'Realized', 'Implied', and 'Capped' volatility swaps. If looking to hedge vega, Implied is what you want.

Ta-da! :crap: This drops the standard dev on my strategy at least 5%

ps: Nate, clear your inbox. I can't send you any messages. :p

-

Well first, when are you going to come back to stocktalk? I miss you posting there...Second when are you going to put that high powered canadian brain to 2d futures instead of 3d options? Your wasting alot of mental energy here..

Third...

What will kill your idea here are those "slight inaccuracies", namely transaction cost, the fact you can't buy .25 of a contract, you have to buy 1, and the spread if your not a market maker.

Delta neutral strats sound great theoretically...the problem I found is it seemed to put the strat into practice is that I would have to buy an 1/8th of a contract every 20 minutes, forgetting that I would have to transact with no commision and with the spread neutral or in my favor to really sit delta neutral...Even if that could be done at the retail level..the catch is you still have to buy a full contract and not 3/8ths a contract...So then your really taking a complex directional position then if its basically impossible to sit neutral...

If you can accept that then the even bigger rub is there is obviously someone who sits above your strategy with lower commisions, faster execution and most important with vastly more capital who can fractionalize the strategy as far as single contracts go impossibly better than you because of a lack of capital...They can buy 1/16th of a contract at the aggregate of your strategy while you can not..No edge.

Theta is constant, you can't gain an edge with Theta if you want to be neutral.

The other rub is with Vega...you have to bet against those guys mentioned not just on delta, but against your understanding of vega...Thats a total fools game...Even ignorant understanding of vega can get you a Phd from a top university, someone will have it right that you have to beat...its a fools game.

lol high powered brain, I can't do math for my life. I'm not saying I'm gonna do it (delta hedge), besides I'm pretty strapped for free "investing cash" since my directional bets from last year went to shit

.

.If I knew then, what I know now... Anyway.

I'm not studying options to try and game from them, I was reading about em because I'm trying to piece a strategy together that exploits noise differences in correlating assets. But it has a hole in which I thought options could fill. Maybe I'll ask your help with it later,...

The problems you mentioned with delta hedging, regarding contract sizing.... those are only really problems in the futures market are they not? If you're delta hedging an option in forex or stock there's no problem. As for the problem of commissions... play it on a larger time frame... commission is insignificant then.

Playing roulette with vega... I dunno... but in theory it's a 50/50 risk/reward to the blind isn't it? It can benefit you as much as it can hurt you. And can't you hedge it with the VIX?

ps: Isn't Stock Talk full of spam now? UGh... I wish I was betting directional now.... not then... market bottom? i want money for high beta stocks

:2c:

:2c:

-

Tricky as the delta changes as the option moves in and out of the money. The trouble with any arbitrage is that arbitrageurs trade risks in similar markets. There are several things that can change the relationships of those risks.suppose you sell the option 10% OTM to avoid the biggest delta changes, making your hedging job easier.

Sure neutralizing delta is a job... but for the slight inaccuracies you make... won't the collection of Theta be predominant?

I don't know everything about options pricing, but theta seems to me to be a one way street without any trade-offs. Why can't you just isolate it? I'm sure the sell-side on Wallstreet runs delta hedging programs for every option they sell, unless they're making a directional bet.

So why can't the average Joe?

-

Anyway, I agree with DarthTrader. There's no sense being on the buy-side of options because of -theta. (Unless you know something, or found a system that averages a good return after -theta)

-

To me options are so deceptive and complex that the only way to play them is to be on the other side of that trade so your collecting premium and not paying it out.

I was just wondering why you can't sell an option, delta hedge it, and collect theta(premium).

-

but you don't know what I'm doing. I'm not just shorting volatility on its own... I was looking for an option as a hedge for a strategy I want to improve. What's wrong with using options (particularly a butterfly) to bet against price finishing where it started? I think my sharpe ratio is better off with it than without.

You really think that probability is useless? That, with enough data, the stochastic process doesn't break even. The distances for price to travel and the frequencies in which they should occur relative to one another don't matter? On what time frames even? Maybe the larger the time frame, the less efficient. But how much less efficient? The market isn't random, but it's not stupid either.

I'm not leaving behind that logic unless you prove me wrong. I'm not driving myself crazy trying to debunk my common sense either for something that would be a pain in the ass to prove lol.

-

well you could go long a straddle every day, but it would cost you a lot of commission to reset that option position every day to protect you from something that will hardly happen.. your software isn't that bad is it?

-

what the hell are you talking about?

-

Ok I found it, was a long butterfly call. I was looking for something that went positive on theta exponentially. B-E-A-utiful .

thanks for the help

.

. -

What exactly are you trying to hedge? There are plenty of ways to short volatility, especially in terms of hedging. But I think writing straddles and strangles on the SPY might be a good start.yeah I think a short strangle near-the-money works... I'm not used to options :doh:. I'm just using the options simulator at http://www.888optionsnet.com and that strategy so far fits best for me.

I'm hedging an improbable stochastic... for example the probability that a stock trades between 30 and 32 ten times before it breaks to touch 33 is very low. So I wanted a low risk, low probability, high reward trade to hedge against this.

See, a far otm "VIX" put would work too if it actually did index volatility.

-

more ideas welcome

-

Thanks for the reply Frank. I don't believe the purpose of the VIX as a 30-day fear gauge is what I need though...

I'm beginning to think that writing a strangle deep in-the-money is in fact an option with the odds I'm looking for.

-

this is actually only relevant to a particular approach and useless in general, so if a moderator could delete this thread that'd be cool

-

I'm looking for a way to short volatility in a quantifiable manner, (so not just writing strangles or straddles earning fixed premiums).

I'm not looking to simply short volatility either, it would need to be in the nature of an option. In essence, I want to profit from an improbable(<5%) decrease in volatility in order to hedge a strategy which is successfully long volatility most of the time(>95%).

Buying puts on the VIX would be lovely, but as far as I can tell the VIX is garbage and just negatively correlates the indexes more than anything... it doesn't seem to care much for volatility in price to the upside.

My knowledge of options is limited but if you know what I'm looking for go ahead and say it and I'll understand. If it's doable on an intra-day level, even better. If this method isn't common knowledge then I'll just get creative. thanks.

-

Nevermind, I'm an ass. C and D are irrelevant.... lol I'm going to bed.

-

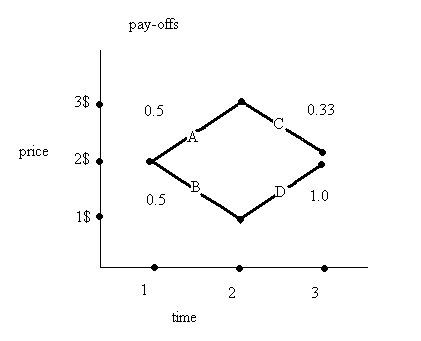

here's my probability tree, roll with me.

note: P denotes "probability".

also, Each event in the tree is independent of each other.

Stock(X) trades at 2$. If pay-off A = B, than instinctively P(A)=P(B)....

Now, Stock (X) trades at either 3$ or 1$. Pay-off C ≠ D, than instinctively P© ≠ P(D) if the game is fare.

But if the market's development in (P)A = (P)B , and the directions are inverse of each other...

Than shouldn't the directions that are equally inverse to each other in C and D mean (P)C = (P)D?

That would imply that:

Pay-off A = B, and (P)A = (P)B

but

Pay-off C < D, and (P)C = (P)D

If this is wrong, please tell me why (P)C > (P)D

but

if this is right, than WHAT THE HELL ARE WE DOING????????????????????????????

(lastly, I thought one might say that starting point C is > than starting point A. But finishing point A is > than finishing point C. So although trajectories are inverse, the resistance they both meet are equal,

and P(A) = P(B) = P© = P(D) )

-

Well first off, are you Dee from Stocktalk?To answer your question the "programs" are evaluating NQ at the millisecond level...not minute to minute...

I do agree with you overall though...basically at the retail level we negate the 3rd dimension of "volatility". Your simply giving that dimension a name.

This idea though is something that hardly has not been studied. Just google "volatility surface" instead of reading about useless 2D "volatility".

are you Nate from stocktalk? lol. I'm quite sure this is an issue that isn't new, I'm bringing it up because new as well as experienced traders don't take time to consider this, and it plays a huge factor. I didn't know it had a name.

Intra-day Data for Excel

in Automated Trading

Posted