Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

ab456

-

Content Count

12 -

Joined

-

Last visited

Posts posted by ab456

-

-

No money is deducted until after the trial period. Our payment processor checks to ensure your credit card is valid but doesn't deduct anything. If you don't want to cancel then you don't need to do anything and will be billed on a monthly basis normally. You can cancel at anytime (if you cancel mid-month you won't be prorated but will have access to our platform until the end of the current bill cycle.)Feel free to email us at support with any questions.

Thanks for the clarification Predictor. That removes all doubts.

-

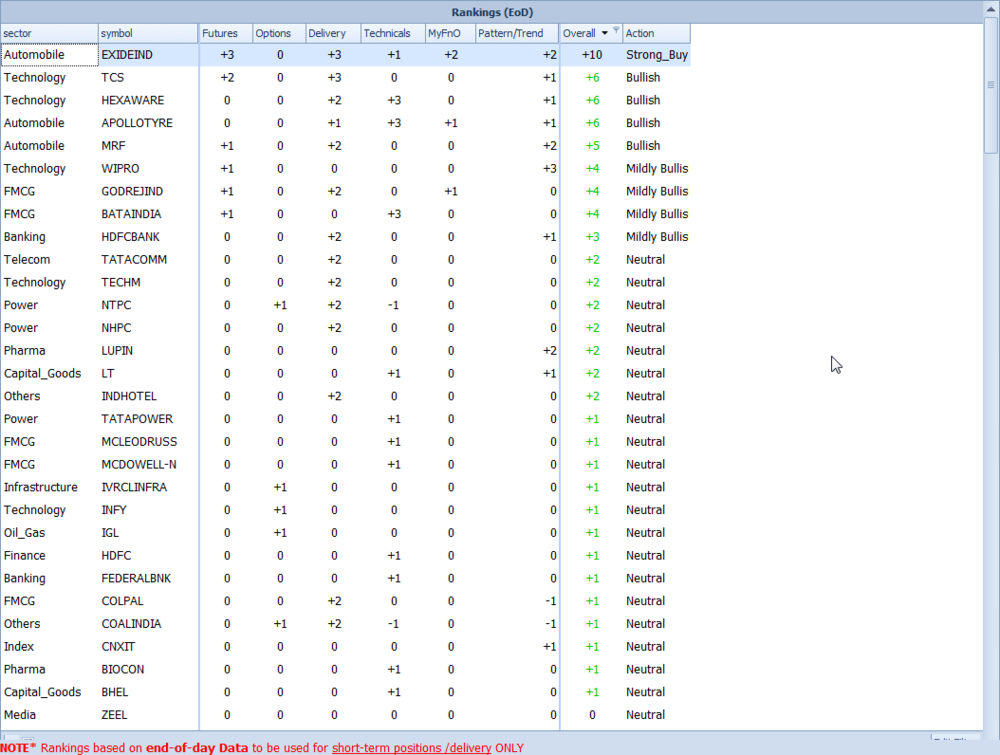

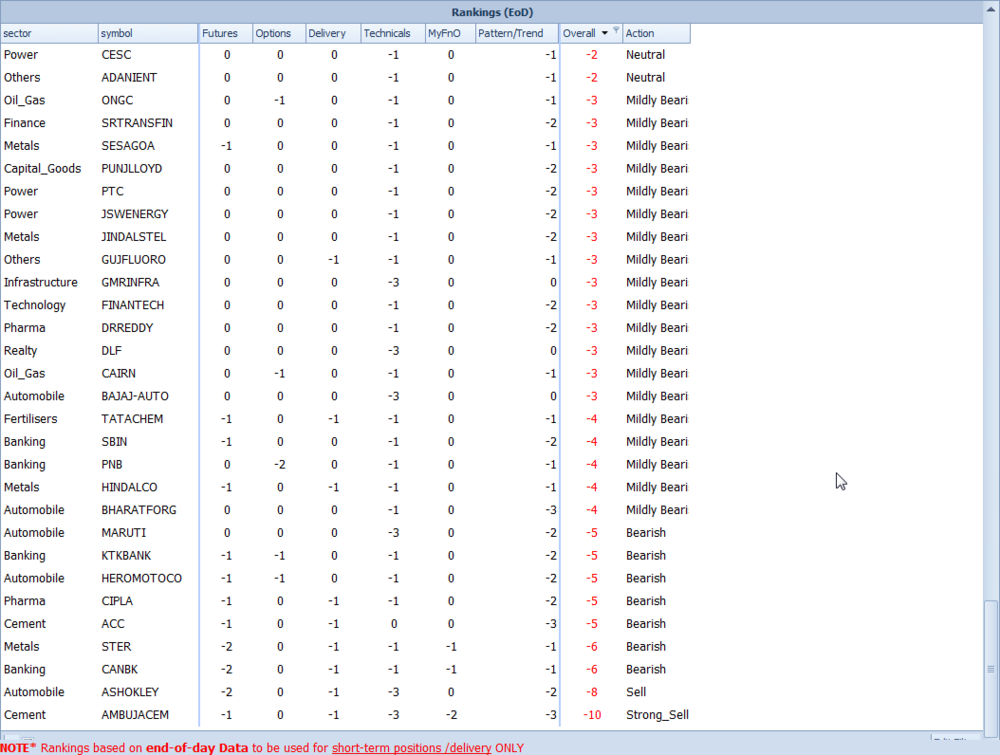

There is a software for the Indian Markets by the name of Myfno which provides a RANKING LIST for the various stocks based on the EOD data. I have attached the snapshots which shows these ranks for todays data.

I just wanted to know that if anyone is aware of such a service for the US Markets, which provides such rankings. I am in no way saying that these ranks actually means anything, but I am just looking for a few ideas in this regard.

So if you know about any such software or website which provides such rankings and give some information regarding the ranking criteria, then please tell the name of that site here.

Thanks a lot

-

I use esignal as my data feed.

-

Wow! 4 Monitors! Some experienced traders like Josh from option sizzle recommends not going more than 2 because it can be distracting with too many information. I kind of agree with him....Has anyone else here have got any thoughts on the ideal number of screens?

I think it depends on person to person. We cannot have a "one size fit all" type of stuff in this.

-

-

Can you please explain what is Spread Betting strategies ?Definition of 'Spread Betting'

A type of speculation that involves taking a bet on the price movement of a security. A spread betting company quotes two prices, the bid and offer price (also called the spread), and investors bet whether the price of the underlying stock will be lower than the bid or higher than the offer. The investor does not own the underlying stock in spread betting, they simply speculate on the price movement of the stock.

Read more: Spread Betting Definition | Investopedia

-

I'm considering adopting this phrase:[ATTACH]34017[/ATTACH]

I might add that... It makes it appear as if you care... really care.

Interesting. Thanks for sharing this

-

As promised, a free trial is now available. Just click the "Subscribe Now" link under AlphaReveal on our site.I plan to produce more educational materials on using our software over the next several weeks. We originally built the Q-Tracker for estimating our position in queue but the real value has proven in elucidating the order flow in ways that would otherwise be impossible. Highly encourage everyone who tries our software to set it to position-pulls-net or executed-pulls-net and use the hot keys to refill it. I think once you see the order flow and order book dynamics working together that you'll start to see why first generation order flow analysis really is first generation compared to our technology.

--

When we sign up, the money gets deducted in advance or the first 14 days are without any money charge and we need to make the payment only after we find it useful and want to subscribe ?

Thanks

-

202 $, isn't that a bit too low ? Considering the kind of profits that they are making.

-

You may want to checkout the live commentary done by Lawrence Chan of Neoticker on this site - Daytradingbias.com

-

Hi !

I am starting this journal because I am having a Hard Time in Trading! I am not being able to trade in a Systematic Manner. I have got a lot of ideas but they are scattered all over the place! I hope that starting this journal will force me to write down my Exact Trading Rules very clearly and follow them during real time market hours. I will be able to develop a step by step trading game plan with clear rules / guidelines, so that I do not get confused during real time trading action "which happens a lot currently with me". This journal will make me more responsible, accountable and honest with myself.

I am in the markets for the past 3-4 years. I have gone through a lot of study material in the form of books, Internet articles, trading forum material etc. I have found that Market Profile concepts based trading makes the most sense to me. But the biggest difficulty and the biggest edge with market profile is that it cannot be blindly automated in terms of 100 % mechanical rules “which is possible with many other kind of trading concepts".

I think one really needs to understand the Auction that is going on in that trading instrument, in order to use the MP concepts in trading. The questions like -

What is driving the market currently?

What is the state of the market?

What is the attempted direction?

Is the market facilitating the trade in that direction?

Which time frame players are in control?

What are the important Reference Points within which the current auction is going on ?

etc.

All these things form the Context / Background / Larger Picture, for that trading instrument. And all the buy sell decisions are very dependent on the Context.

I use NeoTicker and Market Delta as my main trading platform and Esignal as data feed.

I am not at all sure how long will I be able to update this journal, because I have a habit of procrastination and I try my best to find some reasons in order to avoid the work that I really needs to do ! This is part of my current behavior which is having a very severe negative impact on my life. But still, I would definitely try to write at least 1 post a day for the next few days. Let us see how it goes

Any kind of comments or feedback is most welcome. Please feel free to ask or say anything you wish.

Regards

Rankings for Strong and Weak Stocks and Futures

in Market News & Analysis

Posted

One very old article from Neoticker Blog -

Formula 101 – #11 Case Study 1 End of Day Trade Plan | NeoTicker Blog