Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

165 -

Joined

-

Last visited

Posts posted by unicorn

-

-

Hi all,I have added a little feature which allows you to add a status comment under your username similar to facebook.

cool.

By the way, could you change the post icons to what they used to be;

the "thumbs down" today, used to be a "rotating gear".

A lot of thumbs down show up now, where rotating gears were used.

example: http://www.traderslaboratory.com/forums/24/the-chimp-s-forex-trades-2698-8.html#post22930

Take care.

Unicorn.

-

Hello Walter;

welcome back;

;)

;)it's good to see you around TradersLab.

-

-

profiles will keep building and building if they rotational

Hi subq;

I think there is a missing word in your sentence, and I cannot understand the information you want to convey.

Please add the missing word.

Thanks.

-

I don't know if I will have the time to post more videos on these topics.No need for videos Jerry. They are indeed time consuming.

Plain charts (figures), such as end of day snapshots, and a couple of lines with your comments will do.

Take care.

Unicorn.

-

there are numerous things to consider, but after you practice this for a while, it becomes second nature. Sort of like learning to play an instrument.Thank you Jerry;

I would appreciate a few examples i.e. charts with your comments, at your convenience, as the market may provide them in the following days.

I think that I have understood the theory, but applying it real time is still a challenging task.

Take care.

Unicorn.

-

Sorry,

Sledge, are you joking?

THANKS AGAIN.

:)

:)

-

Post #133Gaps are filled.

Sledge THANK YOU for your effort in re-posting these. :thumbs up::thumbs up::thumbs up:

-

We tried that, but no one participated in the second VSA thread entitled VSA II and continued posting on this one. Therefore VSA II, the thread was scrapped.

That is the reason that after informing people of the existence of the continuation thread, moderators lock the primary (first) thread before it becomes huge. SIMPLE AND EASY.

It is also helpful when the initiator or the main participants of a widely followed thread, are encouraged by moderators to keep a secondary thread with the Key methodology and a list of pointers to the most beneficial posts of the main thread. SIMPLE AND EASY when moderators actively moderate.

So Mr Paul, I for one, am requesting that this thread be closed, and that the moderators (or one of the main contributors) create the continuation thread after posting the appropriate notice.

I certainly hope that the main contributors to this thread see the reason that I am asking this action and are not in any way offended.

cheers.

Unicorn.

-

Hi Tingull (starter of the thread), or whoever moderates this thread;

Is it not time to make VSA thread number 2 (the son of VSA - or whatever) ?

Why are you guys letting threads become huge monsters ?

-

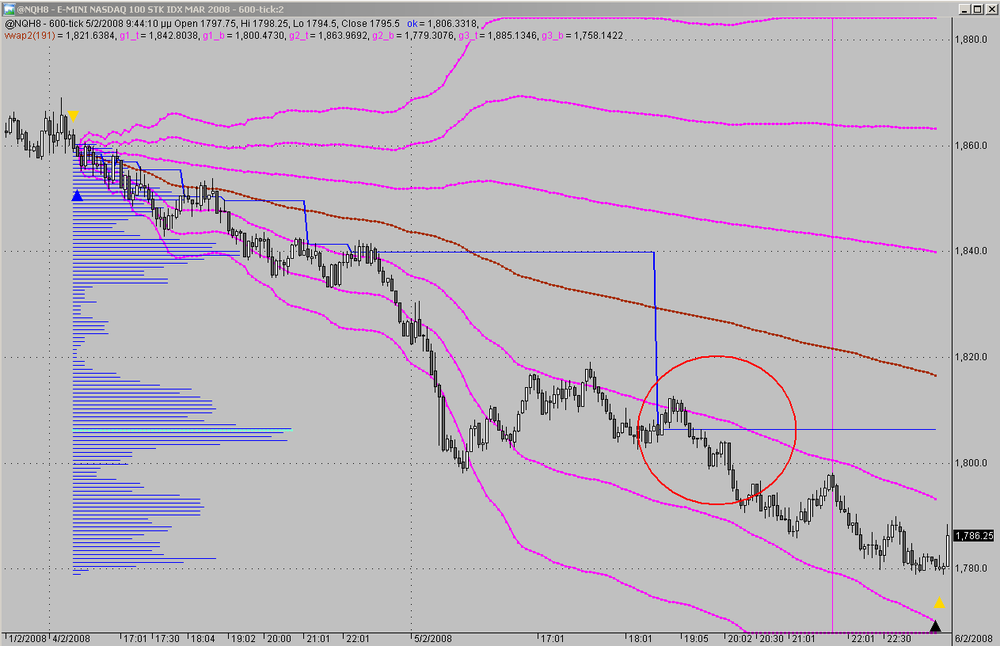

As I indicated in the first post, this is a difficult trading region, but can be very profitable if you get it right.

Same answer as above, you can play the oscillation back to SD2 or wait for a breakout back to the VWAP.

Thank you Jerry;

I do have another question, posted due to its relevance in section X, position trading.

Take care.

Unicorn.

-

Yesterdays distribution would always be more important than today's, early in the trading day during the period when today's distribution is still developing.Hi Jerry;

When watching yesterday's and today's probability function and statistics, and both lead to the same trade assessment, the decision is easy.

How do you deal with situations when one trade assessment contradicts the other?

Do you go with today's assessment or yesterday's ?

I guess yesterday's statistics over-ride during the morning and noon.

How do you decide in the afternoon?

What is your thought process?

cheers.

Unicorn.

-

Hello TinGull and moderators;

How is it possible to delete charts from past posts, when the edit button disappears after 1 hour? :frustrated::frustrated::frustrated:

The only similar deletion was by a moderator to one of walterw threads, when all attachments were deleted. :crap:

The remedy was to restore the thread from the backup; Soultrader decided against that action because the newer posts (since the backup) would disappear. :pc guru:

Well, this time IF you guys move FAST ENOUGH, it will not matter if you lose the grand total of 10 posts that were posted all day today.

PLEASE GO AHEAD AND RESTORE THE THREADS.

Unicorn.

It appears that nobody cared to answer my previous post on this matter, this morning. http://www.traderslaboratory.com/forums/6/mentally-using-mp-946-4.html#post29809

I wonder why. Nobody cares or moderators don't moderate?

:confused:

:confused:

-

Hi PivotProfiler;

what is it that pissed you off and led you to delete the charts from the VSA thread?

and the "mentally using MP" thread ? :thumbs down::thumbs down::thumbs down:

-

I was able to get a few good ideas from listening to the TTZ room and piecing together their approach. If there is interest, we can start a thread detailing this methodology.Yes Sinatra;

I would appreciate a thread on this methodology.

Please go ahead.

cheers.

Unicorn.

-

Well, take a look at the chart below.All the pivot lines have converged to the POC. In other words, only the POC can be seen. This happens when the range is narrow, the close is in the middle and price was evenly distributed. Take another look at those last two words: Evenly distributed. Now, an even distribution of volume and price should result in near zero to zero skew. Notice how close the VWAP is to the POC. We have almost no skew. Put another way, the VWAP and the POC are 1 pip off from being the same.

The orange line above Yesterday's high is a Naked POC. Wed did not make it back up to the POC so we now have a Naked POC. The blue line is a 2 day VWAP. As stated before, the narrowness of the profile (one line) should mean that tomorrow will be more volatile. Not so coincidently, tomorrow (Thursday) is rate decision time for the ECB.

Where's the beef?

Is there a reason that pivotprofiler has deleted his attached charts?

Same in the VSA thread... Nice going...

I hate to see traderslab catching the disease of other forums.

-

When price action is near the PVP, price is sandwiched between the VWAP and an SD or betwen 2 SD's. You might notice that price will tend to oscillate back and forth for a while between the VWAP and the SD, across the PVP line or oscillate between the 2 SD's. The market is thinking. Do I want to go back to the safety of the high volume zone where most of the trading has taken place or am I adventurous and want to discover new territory in the abyss of low volume. Just wait. Wait for the market to decide what it wants to do, before you decide what you will do.

Hello Jerry;

when skew exists and price breaks through the sd1 curve against the skew, we enter a trade against the skew.

( price < sd1 < pvp < vwap

OR

price > sd1 > pvp > vwap )

I have the following questions:

what is the appropriate course of action when the pvp is between the sd1 curve (first standard deviation) and the sd2 (second standard deviation) curve and price breaks through the sd2 curve?

i.e. when

price < sd2 < pvp < sd1 < vwap

OR

price > sd2 > pvp > sd1 > vwap

a) we enter a trade against the skew

b) do nothing

and why?

Additionally, what is the appropriate course of action when the pvp is between the sd1 curve (first standard deviation) and the sd2 (second standard deviation) curve and price returns to the sd1 curve

a) we enter a trade against the skew

b) do nothing

and why?

Thank you.

Unicorn.

-

I didn't have much discussion about trading at Old PVP's except for the post in the HUP thread. There is a complete discussion of PVP trading at the[thread=2232] "Trading with Market Statistics VII: Breakout Trades at the PVP" [/thread]thread. In that discussion and in the HUP post, I point out that entering trades at the PVP is not a good idea. It doesn't matter whether the PVP is old or new, touched or untouched. The basic point is that if the skew is large, ANY PVP represents a dividing line between the high volume area and the low volume area. If you take a trade at the PVP in the direction of the high volume area and it turns out to be wrong, you can be wrong big time with a large breakout into the low volume area against your entry. If the skew is small (VWAP~= PVP), the volume is the same on both sides of the PVP. Then you might as well flip a coin. Bottom line, don't enter trades at the PVP, new or old. (This is in sharp contrast to the Enthios style of trading).Thank you Jerry.

I do have another question, that due to its relevance is posted at the Position Trading thread - section X.

cheers.

Unicorn

-

Well if you read the position trading thread, you saw I used the previous days volume distribution data to decide on a trade for today. That's an example of using a longer time frame for today's trades.Hello Jerry;

On certain days it appears that using the previous day's volume distribution data, is better suited to the price action, to decide on a trade even in the afternoon.

Have you developed a process to identify when this course of action is appropriate

OR

do you have a means to recognize this fact early in the day, and thus not switch to using today's volume distribution data?

Thank you.

Unicorn.

-

I don't trade these, but I see no reason why market statistics data could not be used for these, as long as volume data is available.Thanks Jerry;

How important is that the daily volume be greater than 100,000 contracts, as mentioned earlier?

EurUsd usually exceeds that; but GBPUsd hovers around 40%~50% of this requirement.

-

this is part of the POC's appeal, IMO. the market has an interesting habit of touching old POC's. .

Yes, I agree with you on this. Old POC's or PVP's do get touched. Again you will have to wait until we discuss this in a future thread. NEWBIE isn't ready for that yet. He only knows about today.

Hi Jerry;

I am going through your threads for the second time to absorb the nuances of your method.

I have not found the topic that refers to "Old POC's or PVP's do get touched. "

I suppose that the HUP in section XI, is the proper location, but I find that the information presented there is limited.

I would appreciate your advise with respect to this topic.

Thank you.

Unicorn.

-

Hi Unicorn,On this last trade i saw one error :

- your firts SD' s entry (even if good after) is wrong cause the skew is near 0 so not short trade

I see your point Alex;

Thanks.

-

Volatile for sure, but you don't want to be trading anything with large spreads .So cooter how about giving us a list that you consider liquid and I will take a look at the volume distribution function.

Jerry,

what do you think of currency futures GBPUSD EURUSD; how suitable/appropriate is the market statistics method for trading them?

regards,

Unicorn.

-

Merry Christmas and a Happy New Year to all.

Delta Volume in Intraday Trading

in Technical Analysis

Posted

what is the timeframe on that chart?