Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

Z_trade

-

Content Count

43 -

Joined

-

Last visited

Posts posted by Z_trade

-

-

Ines, thanks for sharing! A lot to download, trying to pay for premium but for some reason PayPal restricted payment to RapidShare.

If its not to much to ask, can you break down entry/exit setup or his trading methodology/strategy?

-

Infinity_Tom

I am a trial user for the Infinity At/transact demo and have a few concerns:

Where do you hold orders - server side or client computers?

if I / for instance / have to reboot my computer, Infinity AT lost all my orders/brackets/stops from previous session or its able to pull/recover all the orders like nothing happend?

Is there any difference between demo and live account in terms of quality of data feed?

I've noticed a significant lag compare to eSignal data feed using MC and two data feeds.

Is it possible to place a one click stop limit order using a DOM instead of default stop market order?

Thanks

-

-

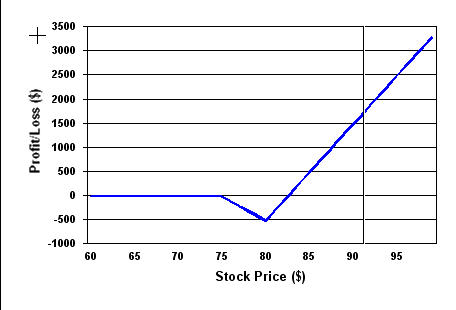

Take a look on NOC Bull Ratio Spread opportunity.

Low volatility, high probability for sharp up move and possibility to get 3:1 ratio with no up front cost, unlimited profit.

Here is a scenario:

V:19

Sell: -1 Nov-07 75.00 Call / Bid 5.10 - Ask 5.35 / x 1

Buy: +3 Nov-07 80.00 Call / Bid 1.60 - Ask 1.75/ x 3

Upside Maximum Profit: Unlimited

No loss occurs if the underlying stock falls drastically instead of rises

Max loss if NOC closes exactly at the strike price of Long call - $80. 75 Call covers the entire price of the long Call options and max loss is a difference between strikes: $500

-

Camtasia studio is an excellent tool to record any activities on the screen, especially using tape reading technique. However you need to be careful while real time trading because Camtasia is very source hungry software. Depends on the size of the window, number of frames per second and memory installed it will dramatically slow your computer performance over time and even freeze after couple hours. Several ways to avoid it – run on the powerful server or just cut recording every hour or so and restart new file.

-

Here is a link for Dll module for data exchange between TradeStation and MS Excel.

-

Are you referring to Muay Thai?Yep, you got it right :crap:, my mistake

-

James

Learning martial arts and self defense system are separate things. It will take life time to master any martial art and you will not be able to sustain an attack or effectively defend yourself for a long time or might be never be able to, street fight completely different than what you learn in martial art boutiques.

You have to decide what your goal – martial art as a life style and long hours training; occasional learning about different kick styles few days a week or efficient protection system.

Arts: Moui-Tai will make you strong, Aikido – many years of training, slow and elegant.

UNIBOS (Universal Combat System) or Krav Maga - that’s your choice if you don’t want to spend some time in Special Forces, but want to have an adequate training.

-

Interesting setup MKP, what was a trigger for long entry? - Break of the line, close above, crossing zero by CCI50? I’m curious to see how traders use 50CCI setup since I remember several presentations on Expo by Woodie and he use to have a heart attack when somebody mention anything beside 6 and 14

-

Walter and PYenner

thanks a lot for detailed explanation and review of MT4, I ve spent some time using it but think its better for me to replicate the indicator for eSignal or Tradestation and stick with what I already know and prefer to use.

Once again, greatly appreciate your contribution.

-

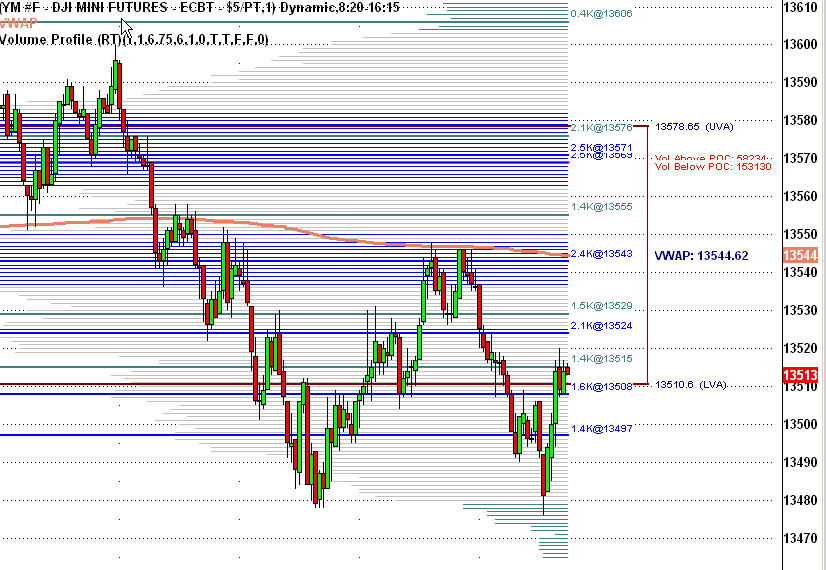

Dmcst

eSignal -> under the file share, EFS studies, look for price profile and volume profile.

-

:question:

My question would be kind off topic but I am a new user of this platform /MT4/ and would love to participate in research.

Is this software has no features as a very basic and necessary for me like global cursor to truck a price across multiple timeframes/charts and tick charts or it’s just my inexperienced first impression?

-

Have you tried Enthios room on MIRC? Its more like real time setup calls. He posts screenshots on his blog with remarks and its free.

-

Here is what you get from TI or Felton for the 5K - *magical* Stochastic located on top of candlesticks and *magical* MACD... and don’t forget their generosity - they give you 10 pages word document with market term definitions and very basic indicator setups.

Stoch: 5,5,1 and MACD: 4,12,1

or

Stoch : 6,5,2 (High, Low, Close, 6,5,2,1,0,0) and MACD: 4,13,1 depends on the platform you use.

Have fun!

-

I am not condoning the use of torrents but I am looking for a particular TV show that is a little harder to find (for me at least).

but I am looking for a particular TV show that is a little harder to find (for me at least).If you looking for TV shows the http://www.eztvefnet.org/frontpage.php and

http://tvrss.net/shows/ among the best. They have show chronology and RSS subscription for an automatic downloading.

Also, try isoHunt.com, the search engine for most BitTorrent sites.

The TorrentSpy.com ordered to track visitors for MPAA and recently blocks searches from US visitors.

-

Walter, as always, very informative new strategy, thanks for sharing!

Interesting concept you demonstrating, on your last chart the longer term MAs are compressing, creating high density area that is clearly show market in consolidation/squeeze.

-

I would add Burj al-Arab hotel.

a must see documentary from Discovery - Megastructures Worlds Tallest Hotel:

http://www.newtorrents.info/down.php?p=Megastructures.Worlds.Tallest.Hotel.WS.PDTV.XviD-SomeTV_[http://www.NewTorrents.info].torrent

-

Russell Index contracts will be listed at CME Group through the SEP 2008 expiration.

The alternative probably would be S&P SmallCap 600 futures

-

-

Hey Walter

You should probably start Wikipedia of trading strategies by Walter

This bands idea covered in books and video by Raghee Horner and Mark Mcrae in his SureFireForex. You may want to take a look for improving RRR for your icon trade.

-

.. My question here : did you take the trade with the turbo crossing -100... ? because that could be considered agressive..no, I did not get into trade by using -100 tcci cross, I just marked it on the chart for the research. This observation came from one of the help documents on the woodie website and looks like it gives the trade better chance.

Have a good flip trades!

-

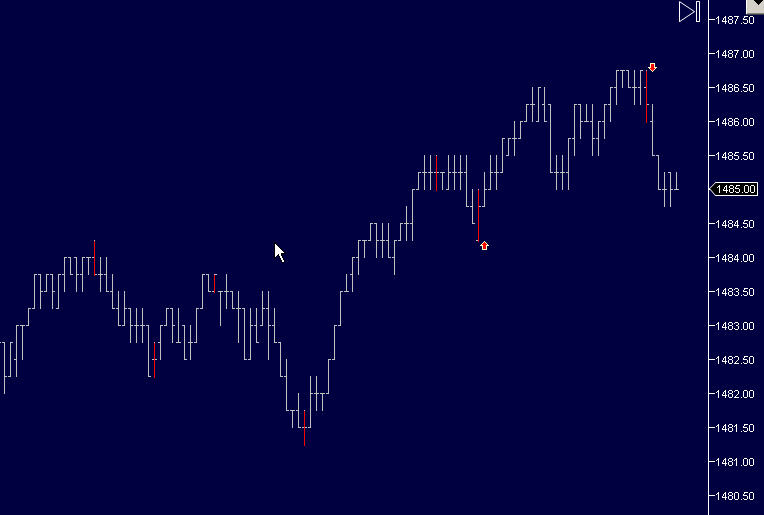

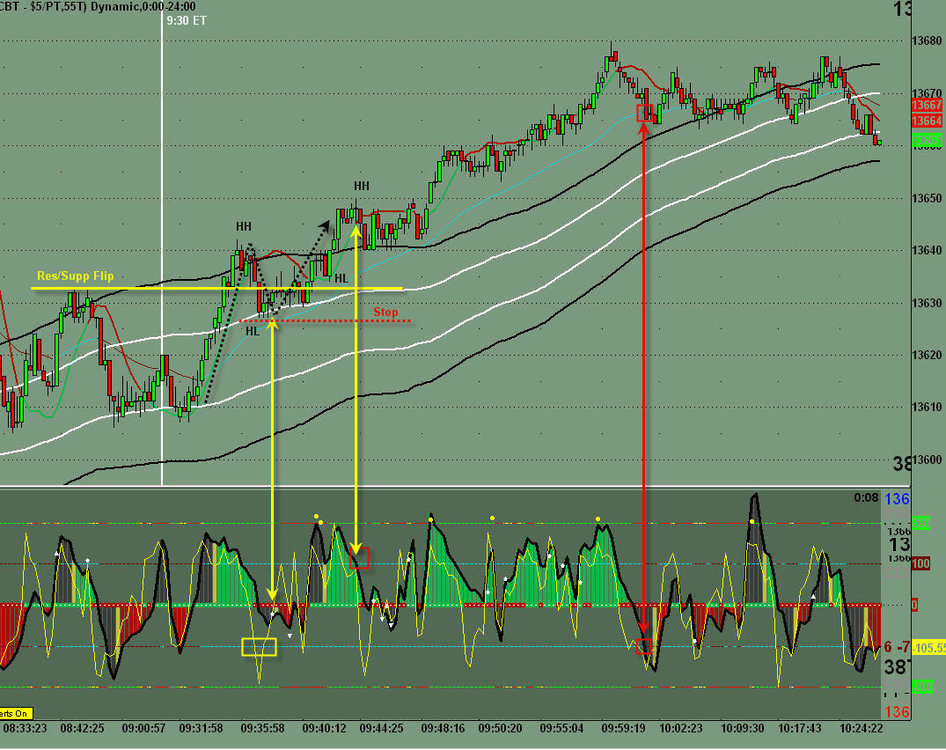

Morning Flip trade using one time frame and pretty basic objective rules.

The market have not crossed a white upper KC after retrace to the down side; the entry could be taken by using sound and visual alert for the turbo cci, warning for possible zlr type of trade. Exit for the ½ on the +100 cross to the downside and the last 1/2 – runner on the cross of -100.

Please notice that I’m using simple moving average for Keltner channel calculation.

-

Walter, as always, your detailed explanation and road map for the *perfect flip* are excellent.

Today was another good day for flip trades and as Im new to the Woodie methods and his sets of CCI indicators, I m looking for the turbo CCI, mentioned by Walter and it indeed helps a lot for the zlr type of trade, if not using faster timeframe.

Have a good flip tades!

-

On eSignal chart I put all the setting Walter using. The sub window is a Woodie CCI bottom indicators set. The flip trade to the downside with 1/2 exit on the -100 cross and the other 1/2 on the 0.

For some reason my Tradestation chart I m using for trading looks different. Keltner channel, I would say, more accurate even though the calculation is the same. The retracement goes inside the inner band, but tradestation shows clear outside momentum.

Have a good Flip trades, Ztrade

Book Recommendations

in Beginners Forum

Posted

Books by Martin Pring and Joe Ross.