Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

1281 -

Joined

-

Last visited

Posts posted by MadMarketScientist

-

-

There's some pretty cool blogs now being posted regularly on TL. Here's a few:

Rick Ackerman

http://www.traderslaboratory.com/forums/blogs/rickackerman/

Gold, Euro, Stocks and more - fundamental analysis

JEH

http://www.traderslaboratory.com/forums/blogs/jehs/

Sharing with you his exact trades and plan on the emini futures

DailyFX

http://www.traderslaboratory.com/forums/blogs/dailyfx/

All the forex analysis you need day to day including fundamental, technical and news

Fastbrokers

http://www.traderslaboratory.com/forums/blogs/fastbrokers/

Fibonacci, Market Profile and tech analysis

MadMarketScientist

http://www.traderslaboratory.com/forums/blogs/madmarketscientist/

Could be anything!

Check them out....

-

"Simple" I think you make a great point. In a way they have to pander to most people's "get rich quick" desire.

Because face it, if you developed a strategy/system and said something like:

"Wins 60.1% of the time, keeps drawdowns to just 15% - 20% of your account, and only occasionally loses more than 4 times in a row!"

You woudn't have many takers, even if that statement probably very much describes a successful trade plan. In a way we maybe have ourselves to blame because we only buy what's really hypey and promises the moon and then read more realistic claims and the impulse is to think "wow, that's not very good"

Probably what we should do is have a b.s. filter -- such as anytime you see 90%+ winners, or Metatrader 'backtested' charts, or a sample size of 3 trades in a screenshot, etc... that you immediately move on. And that would probably eliminate about 99% of these

-

Nice job cable.trader -- looks like you got hot today at the right time and really picked it up especially into that last trade. Well done and thanks for sharing.

-

I think we have our answer -- and no surprise at all. Thanks for the feedback.

-

Given it's your first post I do wonder if this is an attempt to be promotional.

However, I'm going to allow it and see if anyone wants to weigh in - I can tell you the ongoing consensus is there's yet to be a successful EA over any length of time. Doesn't mean it's not possible but there is a lot of optimization that goes into most of them to make it look impeccable until the unexpected happens and you have a massive drawdown. Whether that EA is any different I'll leave it to others to weigh in since I have no firsthand knowledge. I do see they give logins to various accounts that you can monitor so perhaps someone else will look into that and let us know their opinion.

-

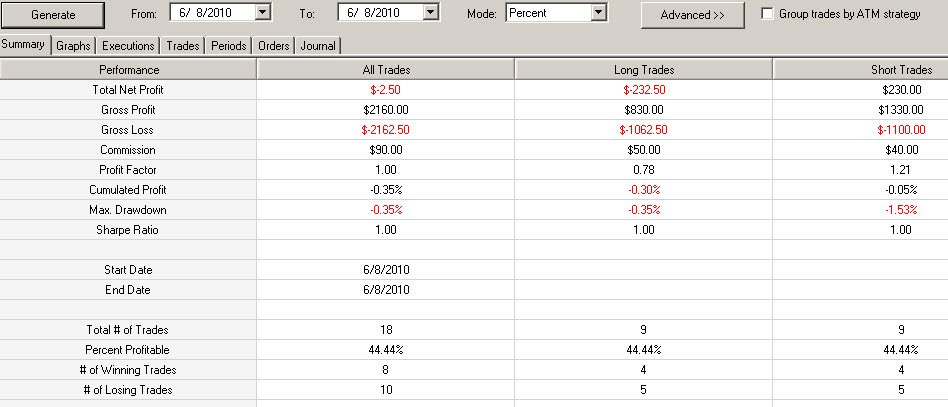

Just getting around to posting my outcome from today -- had a big one -- lost $2.50

Dax was positive, Crude was negative - actually I trade my Crude two ways, and one was really good, the other wasn't but that's why I like to use the two different timeframes. I've found that smooths out my results some as the more I tested them, I realize that on a give day/week/month one might outperform the other and vice versa. By splitting it, I get a smoother equity curve. Sometimes it doesn't spike up as quickly as it could if I used just one timeframe, but then again I limit my drawdown as well. Tomorrow is always interesting because of the weekly Crude report -- I trade before it drastically different than after.

-

I've been very happy with IB and speed of executions -- if anything I think any delay comes on my end.

However, I can also say I have some funds being traded through Mirus Futures & ZenFire and when comparing fills have been impressed - some of that could be due to their hardware/internet perhaps being faster than mine so not 100% it's the broker but another good option.

-

daedalus,

Good questions. I'm trading on CL 5 contracts total -- I trade 3 with one entry point, and 2 with another. The strategy I use is similar, I just enter at different places - helps to smooth my equity curve because some days one is very good, the other lousy and it kinda smooths it out. On the Dax right now just 1 contract since it's a hefty $25 EUR per point and while I can make $1,000 Euro in a day that means I can lose that as well so right now just 1. Forex usually 1 full size or 1 futures contract.

No big forum conglomerate here, just like you real traders. You'll see I'm sure some of my bad days coming up as well but thankfully I usually have more good than bad.

-

All of us are probably in the market at one time or another -- or really, probably at all times for something market/trading related.

Books

Seminars

Websites

Signals

Hardware

Software

Training

Brokers

Datafeeds

You get the idea. Most of you have used a lot of the above, we've done surveys where the average trader has spent $5K+ on the above, many $10K+

We need your help in knowing what's good, great, or crap.

You can post reviews in two places on TL:

Inside our forums:

http://www.traderslaboratory.com/forums/f92/

Which includes several sub-forums for some of the specific categories above

Or, in our Reviews Module:

http://www.traderslaboratory.com/forums/reviews/

Help out your fellow traders and get your opinion known. Needing to know if something is worth your dollars or eurodollars? Than post and ask and the TL community will let you know.

Thanks - see you in there!

-

This is super popular outside of the U.S. (we have some restrictions here and do not have the tax advantages) and we wanted to give you a home at Traders Lab to discuss any and all of your Spread Betting strategies, successes, failures, brokers, etc....

Start posting and sharing here:

http://www.traderslaboratory.com/forums/f246/

There's also a sub-forum in there for those who use Contracts For Difference (CFDs) in case that's an interest.

See you in there!

-

Nice job Dinerotrader!

I had a similar result today with Crude/CL. Since late last week it has been doing great, and has pulled me back to a new equity high after a drawdown since we rolled into the July contract. Right now, knock on whatever it's back to normal. I traded Dax Futures today as well, and have a rule not to take a trade during their lunch hours in Europe.....oops, that was a great trade so I missed some profits there but I have to stick to my rules. I lamented it for a few minutes, snickered a bit then reminded myself it's part of my trade plan. These are the things that get people to derail from their plan - when it isn't perfect but I've learned the hard way to remain stubborn with my rules. They pay off in the longer term. I also put on a forex trade but it's still open and outcome undertermined....

-

Arguably, using technical analysis on longer term charts is even more powerful because you don't get some of the day to day or hour by hour noise you get with day trading. So you can definitely take a swing or position trade off of technicals.

It's simply a matter of bumping up the timeframes you're looking at -- it's like someone looking at a chart on a 1 minute, 5 minute, 89 tick chart, etc... vs. looking at it on a 4 Hour, daily or weekly chart. By doing that, many times the same technical approach works, it's just the time horizon has changed considerably.

As for the way I look at things, my specific approach which may not fit your criteria, the last time I had a buy signal on ANN was the break of $16+ and it had a nice run, right now I would only be looking for a new buy once it pulled back to the 18.50 - 19.00 range and bounced off that level before entering -- otherwise for me on a swing basis it hasn't met my criteria yet for a new buy.

-

My thought would be this.

You didn't share the stock symbol that I saw - that would help to get more opinions.

But, if the only reason you're buying is because it has gone up a lot for the past year, than I would say you don't have nearly enough reason to be buying. You sound like you are looking at this like a fundamental play, not one based on technical analysis.

If that's the case, I would think you'd want to have a lot more analysis on WHY you think it will continue to go up for a swing trade, besides the fact that it has been rising. Granted, momentum does count for a lot, and there could be many very valid reasons it has climbed, and could continue to do so, but I think your analysis should be much deeper than it is so far.

-

Here's your chance to weigh in firsthand on your experiences with your broker(s) of choice. Or the ones that maybe didn't handle your account quite the way you expected.

Traders are always looking for the best brokers -- whether it's to save on commissions, fast and accurate fills, better spreads or just better service. And, there's no better way to figure out which one might be for you, or who you should consider replacing your current broker for.

Here's the place on TL to weigh in and make your voice heard on brokers -- forex, futures, stock, options, etc... Doesn't matter. Let us know what you think.

-

This is the home at Traders Laboratory to discuss anything to do with either Spread Betting strategies, which have grown very popular (primarily outside the U.S.) due to some of their tax advantages, as well as spread trading which are ways to do some reduced risk futures trading.

If you have questions, comments, suggestions, strategies or any advice than this is the place on TL to share that. Thanks and we look forward to your contributions!

-

brownfan - yes, sounds like a great idea -- I can see it was super popular and trailed off a bit but let's bring it back.

I will try to come in here and post on occasion as well, especially when anything interesting happens in my trading.

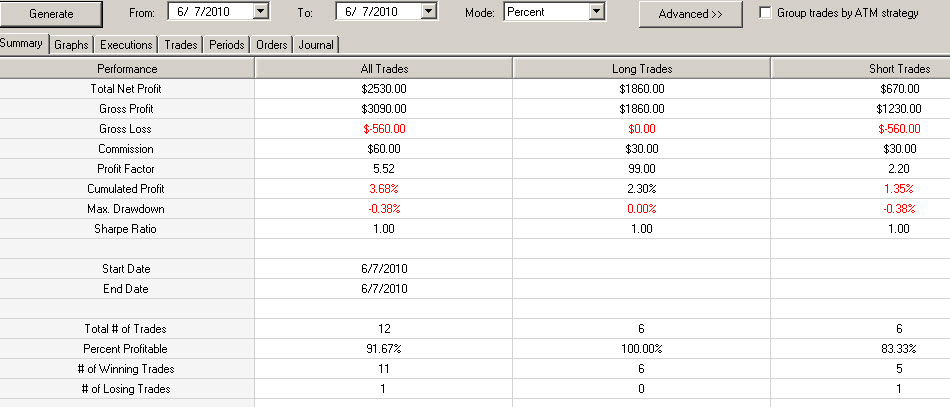

Here's my Thursday trading -- ended well but intraday I had a fairly large drawdown going at least compared to my normal -- I was down as you can see about 5% on the account, and what saved me was some great trading after the 11am Crude inventory report - up to that point it was rough going - I had a number of profane things to say about my trading until it all turned around.

Friday for me was a perfect day -- Dax, Crude, forex futures -- though of late this is more of an exception, I'd say over the last couple of weeks I'm below my averages though fingers crossed the last couple of days rebounding is a good sign that I might be pulling out of it.....hopefully....

-

Congrats on putting it out there and posting your results. Takes guts to do since not every day is going to be pretty -- but might go a long way in helping you stick to your system with discipline. I look forward to more. Thanks for the contribution.

-

Hello- while I used TS2000i in the past it has been many years so I'm going to answer what I can based upon what I know now. I'm sure others can weigh in or even correct anything here that I believe...

In the new TS 8x you do not typically set the values as it's a known value.

As for Commission I would either fill in the Commission or the Slippage section 1/2 of what you expect your round turn pip spread to be on the trade. So, if you are testing it based upon a full size contract - meaning 1 pip = $10 then you should put in $15 (per side) since likely your spread is 3 pips = $30. Of course if you pay more or less for spread costs adjust accordingly. I'm assuming that would cover it depending upon where you trade ($20 if 4 pips, $10 if 2 pips)

If a mini of course that you're tracking at $1 per pip then just chop the zero off the above for the 1/10th size.

Default trade amount I would just go with 1 and not do any adding of additional units in same direction. You're trying to test I assume the results of 1 -- whether mini or standard.

The Maximum contract/shares per position shouldn't matter as long as your strategy doesn't add additional units, and you are using the Fixed contract size of 1.

Hope that helps you...

Hi!

I'm newer on trade.

I've a problem. I have an old Tradestation prosuite 2000i and i wish to do backtesting on my FOREX data, but i don't know how to set the correct parameter.

e.g ( for 1 lot 100000 with pips value 10) how:

Daily limit? Min.Move? Point Value?

and PLEASE, in "Format Strategy" (Tradestation) how to set:

Commission (per Unit or per Transaction)?

Slippage (...)?

Margin (...)?

and... in "Default trade amount" what must I insert?

and ...in "Maximum open entries per position"? and "Maximum contract/shares per position"?

Please, please, help me!

-

True on the dieting industry but there to, you know there are ones that can be very effective (you know, like eat less and exercise more) but they take a lot of work. So certainly, the easy way out is always the simplest for a marketer to promote. It probably is just as much our fault that that appeals so much (vs. doing the work

And, I think we all know with a lot of hard work there is a way to get success in trading.

The question are there some short-cuts or automations that can get people there quicker. Plenty want it to be so, hence the overwhelming popularity of these EA's vs. actually have to work hard at it - and I completely get the appeal. I wouldn't mind trading some hard fought hours for some away time while the computer is doing it's magic.

-

I do though I have also mixed in the BP (British Pound Futures contract) as well.

Mostly I do swing trading of the GBPUSD since I do a lot of daytrading elsewhere it is too much to juggle but I like the market for swing trading. Spreads are very reasonable, I feel it moves more reliably than the EURUSD, and usually just one extra pip spread for a lot better movement. I'll also occasionally if I have time take a daytrade on it, usually looking for the 25-35 pip target range, most of my swing trades tend to be 75 - 200 pips.

For me it has been the most consistent pair -- others seem to go through phases where they are amazing to trade (GBPJPY) but then falter where this one is steadily reliable.

-

We posted the live training webinar replay "12 Commandments of Trading" that was held just recently. It is probably particularly useful for those of you starting out in your trading. Much of these lessons were learned the hard way (many painful trades

so it could save you some effort and grief along the way. You can watch the replay here:

so it could save you some effort and grief along the way. You can watch the replay here: -

There's a LOT of forex traders out there and we need some more conversation going on in this forex forum. I know you all have a lot more to say about it. So, in that spirit I'm kicking off this thread in hopes some of you who trade the GBPUSD will start posting your analysis, your approach, how you trade this highly popular currency pair. Anything to do with GBPUSD. And, if you prefer the EURUSD, or the EURJPY or you name the pair, how about starting a new thread to discuss that one and let's start sharing thoughts/trades/experiences on these pairs?

-

I should have added something to that -- and even make it easier -forget living up to the off the chart claims of instant riches - - is there any that even maintains some semblance of profitability?

A couple recent ones I recall seeing a ton of promos on - Fibonacci Killer -- it's a dog but I'm sure many were sold.

There is one now being pushed called Forex Kagi - I was messaged by someone that it's just an ebook using a simple trend following indicator (lagging) but you'd never guess it from the incredibly slick sales page and videos - and it tried to sell you a robot after the first sale starting at $97 and each time you said "no thanks" he told me it kept knocking the price down all the way to $7 - about 6 or 7 price reductions....the only other one I think I ever saw at least some positive comments, maybe short-lived don't know was fap turbo but have no idea if it held up. Heard some reports that brokers had "broken" the strategy since too many were using it and would widen the spreads when it had trades trigger.....

Still, there has to be something right that at least is above $0 right

-

Like most of you, I get bombarded with emails promoting forex trading EA plugins.

They promise the moon, whether it's 99% winning trades, or turning $1000 to $100,000 in no time at all. I've heard they tend to sell hundreds to thousands at a time - quite a business.

Of course, we know where all that leads in reality -- as virtually all of these tend to be over-optimized, curve fit systems that have settings that are customized with the benefit of hindsight and they typically fall apart going forward.

I would like to know from any of you -- have you used any of these EA's with any success? Or, if you have used any that were a total failure weigh in on that as well. Might save a few people from buying it as well.....

Have an IPhone, IPad, Blackberry or Android Phone???

in Announcements and Support

Posted

You can search your app marketplace for "Tapatalk" and with this great app you can actually ready and even post in Traders Laboratory right from your phone (or iPad!)

It does a great job of simplifying the interface so if you're on the go check it out. There's a free version and an inexpensive one with more features.

Just search for "tapatalk" next time you are looking for a new app to download.

Then, just search for Traders Laboratory once you're in the app and you'll be all set.

Enjoy!