Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

tradinghumble

-

Content Count

7 -

Joined

-

Last visited

Posts posted by tradinghumble

-

-

wave,Neoticker is by far an awesome product with respect to features and the ability to mix and match multiple time frames, bar formats, and products all on the same chart, BUT:

I have a decent background in programming and whoa, coding in Neoticker was completely confusing. Finally when I got to the coding stage and tried some systems, I realized I had some data feed issues (with IB) that coud be corrected in Neoticker. I quickly asked a question on the forum and was told that most users have a professional feed and most users are "professionals". After a month, I gave up. Although the product is great, coding is not intuitive. I moved on to RightEdge because it gave the ability to program in C#. After a year of mucking around, th product is still in its infancy but if you are a good programmer (really good) you can do anything with that software (although not out of the box). That means you can right plugins for any datafeed / broker etc. Having said that, I recently switched to NinjaTrader and here is what I have found:

In less than a week, I had all my years worth of indicators in RightEdge transferred over. It is extremely simple to write custom indicators in NT6. It also supports C# (which I learned on the fly). If you are motivated enough, you can write your own datafeed and broker interface fairly simply but they support many out of the box, IB is one of them. Their chart trader feature is invaluable asis their trade management feature. So far the CONS for this platform is the baility to access/ view multiple products on the same chart. Specifically being able to trigger off of market internals to enter/exit YM for example. However, this is coming I am told.

Bottom line, I think NT is worth a look, its free to play/sim with until you want to go live, and they tend to respond quickly enough to their forums.

hope this helps...

Wave, don't mean to steal the thread here but it seems you have spent a good time on NT - please feel free to PM me if you prefer. My question is on playback, can you actually playback multiple days in sequence? I've actually seen some replay files in their forum but it's only for one day ... some of my indicators need at least 2 days. Thanks.

-

-

Thanks for the advice Torero. I actually have a trading plan in place but yes, I've been having problems following it by the book. I'm currently reading Mark Douglas. I'll post my trading plan here when is done. Thank you.

In this case, your focus should be on discipline in conjunction with strategy building. Create a business/trading plan and detail the actions (how many trades per day, max. stop loss, max. drawdown you're willing to accept the fact that the strategy failed etc).From your post, you're already trading live while not having discipline as well as not having a final trading plan and strategy intact. Should move to paper until you know all the performance results, nuances of your new strategy. Once you find that it's overall profitable, then start with 1 contract to get the confidence as well as gain discipline. No amount of chart analysis will help without get a grip on the psychological side in order.

Good luck!

-

Thank you so much for the feedback, I've decided not to focus on my entries/exits as this is not necessarily my focus at this point. I can pick good entries and sometimes (good exits). My goal as of lately has been to:

- make sure I can clearly follow the movement during the day -- what some people call to be "in the zone"

- be more disciplined with my stops (my account would've been huge right now had I been more disciplined)

- stick to one charting platform, settings and indicators (I'd prefer not to use any)

- get to know 1 or 2 instruments really well

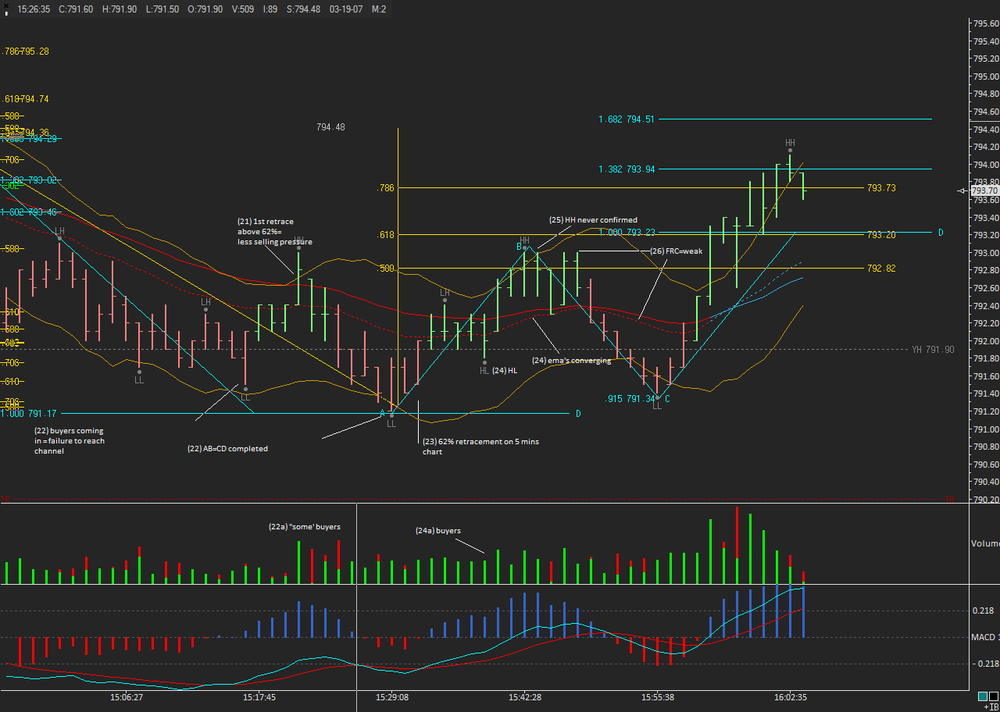

The following is my annotated chart for last Friday where I show two of my entries... stops are not noted.

http://charts.dacharts.com/2007-03-16/sharp2be_4.png

Thank you for your feedback. I'd appreciate if you had any suggestions on how to become more disciplined regarding risking too much... I sometimes get excited and enter more contracts than I should.

Regards,

tHumble

TradingHumble,When conducting chart analysis, it is sometimes more effective to start with you’re trading strategy (signal, set-up, entry, stops, targets....) and validate each component to see the effectiveness and efficiency of how well the strategy was able to identify and successfully execute the necessary trading actions.

By trying this approach, you are then more able to know where to begin looking to focus on refining the strategy based on the components that are deteriorating or need to be adjusted according.

Some traders will be able to give you feedback and comments on your charts, but until you share the details of how you execute to enter and exit, the comments may not assist you in improving your trading plan or trading strategy.

-

Hi friends, this is one of my favorite bb sites, I've learned a lot with the articles posted here. I've decided to share my trading chart for today and some of my thoughts around what was happening at the time... that's not to say that I've done everything right (I didn't) but didn't lose any money either :-)

Please feel free to criticize my thoughts... thanks !

-

Just wondering if anyone has the eSignal code for the TTM Trend.

Thanks.

Please Help with ESignal Indicator/Formula - Price Pivots

in Technical Analysis

Posted

Hi everyone, I'm looking for an eSignal indicator that would plot price pivots similar to the attached picture (Ninja) -- just wondering if you come across such indicator. Thanks a lot