Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

31 -

Joined

-

Last visited

Posts posted by Karish

-

-

There are lot of discussions here on the difference between institutional / unfiltered and retail data feed (such as IQ / esignal) quality. Can someone with access to institutional data feed share with us the differences between them.

cheers,

-

Scott, thank you very much for the very valuable information. I had my guesses about how these prop shop work and you confirm many of them.

My belief is that even if I cannot play this game myself, understanding these players behavior and intention can assist me in building my own strategies / indicators to present their activity.

The other group I'm trying to understand/analyze their behavior are the so called "smart money" who execute part of their strategies at limit and not for MM, HST business. We cannot see them directly looking at Volume Delta, but their footprint is there.

-

Scott, Thanks

As these shop doing most of their business in the limit side of the book they play Market Maker role, is the money they are sucking out of the market is it coming out of the overall MM business ,or in addition their practice cause for unfavored execution to liquidity takers?

-

Here is the part that is difficult to explain: they didn't necessarily want those first orders, they were just placeholders. They would then cancel order and see if other algos followed suit thus allowing the orders further back to move forward. They would cancel orders/add new ones until they felt they were in just the right place in the book and then let them rest to execute or get pulled if the market moved the wrong direction.

Scott

Scott,

If I understood you correctly, a lot of the logic you describe above depends on knowing the location in the bid/ask queue. Currently, when I send my limit order I do not know my location in the queue, how do they?

Many Thanks

-

This may happen if you are using win7, if this is the case google "tws win7" and you will find the change in the command line

-

As in bar chart choosing different bar period generates different signal, also in PnF charts setting box size & number box for reversal would generate different signals.

I am wondering if someone is able to identify the magic calculation between the asset and its box size and, box to revers

-

-

Now somebody like Blowfish, who is a heck of a lot better at programming than me, should build a VWAP of the days Cumulative Delta Volume and Price averaged together......that one I will gladly back-test!!!

Just read now why the discussion about NT started.:helloooo:

Interesting Idea FT, I plan to test two VWAPs analysis for Bid /Ask and to see if the relation between both VWAPs has value.

Regarding your idea, If you have Neoticker I can program it, just need more detail on the idea

-

And there is the issue, NT does not support a constant delta type bar. (I should say I have not used it for years so this may not still be the case, it would not surprise me as NT is remarkably flexible and open).This explains it, current NT version has volume, momentum and others. In addition they have a kind of API which can be used to build what ever you like superposition bar.

-

Thx for clarification , I would than recommend to feed the created CVD to NT UDS - user defined symbol and create a data series which is the actual underline contract CVD, this newly created series can be displayed by using all kind of bars supported by NT.

Use price series synced to this Series. Little long but achievable.

Hope it helps.

-

You can get CVD in Neoticker in a snap - calculate using DayTotalBidTrades, DayTotalAskTrades CVD.

To display indicator as candlestick in the indicator setup, Meta style display as: candle, and you got it.

-

Thx BF,

One of the theory's tenants is that during weak order flow that liquidity provider will trigger Stop Loss, any idea if we should categorize it as part of their inventory balancing or it is just making easy money?

-

Pardon for my lack of knowledge, can you please explain why during the process of distributing large stock block, the algo provider need to buy inventory. Even if they do need to buy some inventory during the distribution process in order to minimize their effect on the stock price, one would expect that the algo process would clear the unnecessary inventory along the process, and not to carry to much to the end.

Thanks, Karish

These algorithms, in the process of filling a trader’s order, end up buying or selling more quantity that is really needed. This excess quantity, in the hands of the algo-trading providers, then becomes “inventory”. -

madspeculator , Thanks for your educating post,

In relation to liquidity takers / providers you said that:

2. FulcurmTrader’s (FT) thread gives the author the impression that FT is tracking the activities of liquidity providers.FT is using CVD to spot liquidity zone where the CVD measures the market orders (aggressive traders order flow) in the market,

Is it correct to say that CVD is measuring the liquidity takers (commercials?) as the market order takes liquidity out of the Limit order book pool. But once they took the resting limit orders, they are left with the inventory which happens to be the liquidity provider once the market is visiting this zone afterward

Thanks

Karish

-

Very Interesting observation, can you please elaborate on Commercials behavior regarding the +40 points profit target zone.

Thanks

-

thx for clarifying blowfish, I though that commutative bar is referring how a new bar is contracted.

-

Thx FulcrumTrader

Can you explain what do you mean by cumulative delta bar

-

I found this post on "Re: Tradestation Just Lost My Business... Looking for a New Platform/broker" interesting and have nominated it accordingly for "Topic Of The Month June, 2009"

-

It seems to me that making sense of the order book is as much art as science

I can't say it better actually, I am looking at trading as a mixture between science and art, where the indicator part is the science and the interpretation is the art, to be a good trader one must master both. Dalton calls it in it's book "Market in Profile" the usage of Left & Right brain.

The amount of DOM tricks can be played are not endless & I think it is possible to master this art.

By combining DOM and T&S it is possible to find tradeable patterns (using art) and to have higher level of market understanding.

Large traders cannot hide their foot print even with iceberg, so if you do not see them in DOM like the "WALL" you will find them in the T&S. If you see them in the DOM meaning they would like that everyone will see them ask yourself why and act accordingly.

-

5. Right section, Similar to the DOM ladder on the left side, this only shows the biggest wall amongst the 5 levels of each side, plus the immediate inner pair.TAM, it is clear for me to look for the wall by looking for large amount, however it is not clear to me what behavior to look for at the inner pair, can you please elaborate.

Thx

-

My personal observation on DOM are similar to the following Jack description:

It will happen when the WALL appears. What is a WALL? This is the collective limit ordes of a lot of traders who are the next group the price will move away from after a while. BBid/ BASk pair move to the WALL. And the WALL is too BIG for the timing type traders to breach. Some of us know that. We see the WALL as the limit of the trend movement of the profit segment we are currently taking.It is large amount of limit orders which you see their hands and constantly refreshed.

I cannot approve/negate your thesis of the existence of a hidden WALL, I have never search for this pattern in the DOM, as if they are stealth in the DOM we need to look somewhere else to find them.

-

You have to watch closely DOM for some time to train your eyes on DOM movement just than it will become apparent to you the difference between game players and the WALL. Usually when price will get closer to game players they will disappear, hence you know they are fake. On the other hand real WALL will become apparent at actual S/R and would stay, a pull back may occur. In strong trending market price would stop at the WALL for sometime till all resting limit order eats up and only than the move proceeds.

-

Thanks jack for enlightening information, can you please explain

1. What are the four games played on the DOM

2. What do you mean by prefixing bid/ask with the Cap B

Karish

-

In http://en.wikipedia.org/wiki/Skewness there are two calculations as a measure of skewness suggested by Pearson :

(mean - mode) / standard deviation

3 (mean - median) / standard deviation

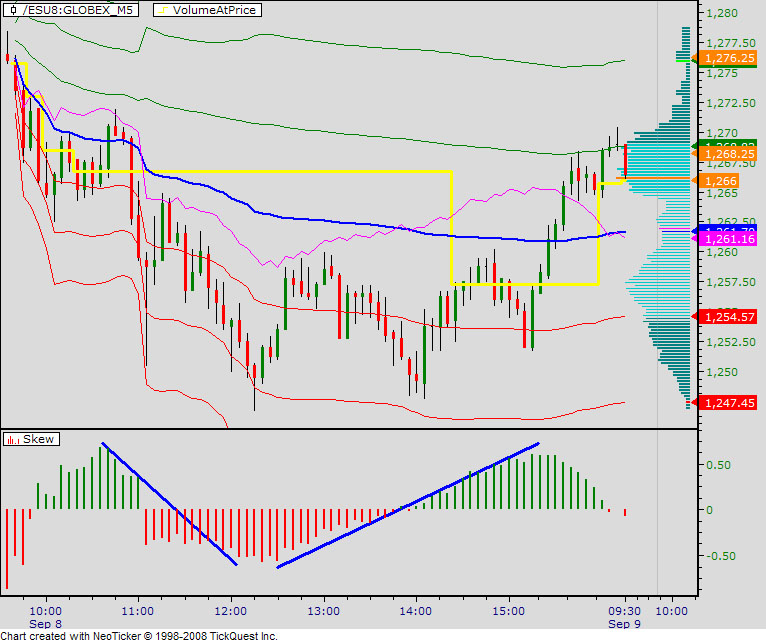

the first one is using with PVP I was using till now, the second approximation is using the median instead of PVP. I switch the calculation using median and seems it provides similar qualities as the 3CM method. The Skew does not change abruptly as PVP change but change gradually along the day, this provides a nice head up when PVP is about to jump, the skew slope is a good proxy for the market direction and in some cases provides nice heads up that a change is on the way.

The attached picture is yesterday ES action, in the first pane the purple line around VWAP (blue) is VWAP+Skew*SD, The yellow is PVP, the second pane displays the actual skew

Delta Volume in Intraday Trading

in Technical Analysis

Posted

Blowfish thanks for the info on CME Top of Book, I down loaded example file they had and compared it to my cache data collected during normal operation from IQ. I compared BB and BA data and no doubt its not the same, main diff is in the amount of updates. I will do thorough analysis and share my findings.

Karish