Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

PTVtrader

-

Content Count

8 -

Joined

-

Last visited

Posts posted by PTVtrader

-

-

Guys- intra-bar degapping? Are you sure?Just to clarify: you ARE aware that that would mean the trendlines would jump at every bar, right? Or rather- price would jump relative to your trendlines.

Which means you could not draw trendlines, therefore you would not know when you have crossed a TL/ closed outside. And you could not draw an FTT nor a VE either....

So- you are saying that it would be advantageous to trade this method without trendlines and without FTT's..??

The trend lines do not jump at all.. Inter-bar degapping IS superior.

Also take a look at who found this post useful.

To each their own though...

-

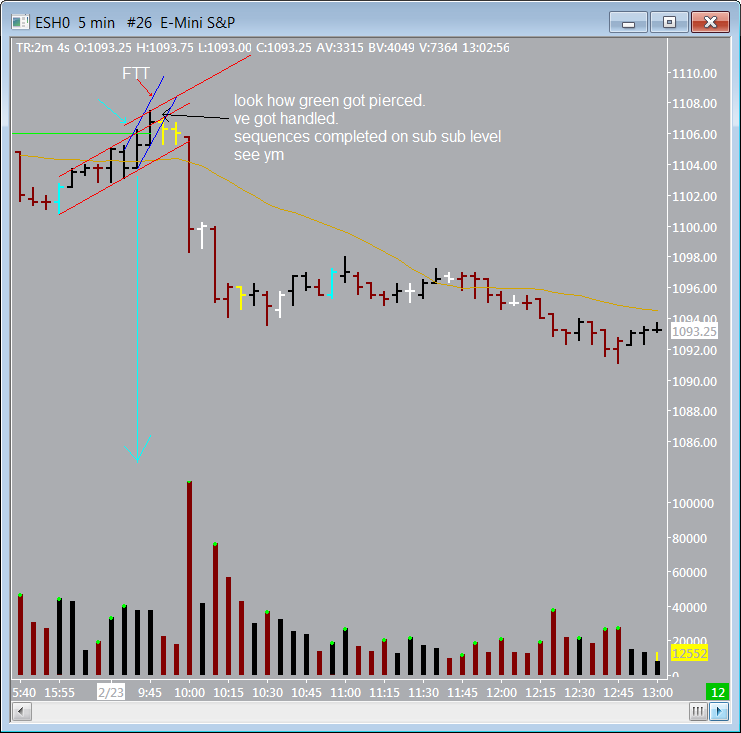

Could someone please walk through their MADA for the opening 7 bars of Tuesday 02/23 ES. (Needless to say, a brisk walkthrough by Spydertrader would be very welcome too.)I'm especially interested in when you know to be short based on sequences (prior to or during the 10am* bar7).

Based on my understanding of gap adjustments, 09:45 bar4 made a new high and was not an obvious FTT of any container (it looks if anything like a P2), making 10am appear to be a FT3.

Now FT3's don't exist if you have correct sequences, hence my question.

Many thanks.

(* Bar open times.)

How do you handle VE's on decreasing volume ?

-

-

This is a quote from JH regarding bbt's, tapes. traverses, and channels_______________________________________________________________________

Quote from jack hershey:

...What is letting you hit the snooze button is the "very quiet" that is assembling itself. The "channel long' that follows is not going to be a "show" or "tell" to many people at all. It will just take 3 traverses, 9 tapes, and 27 BBT's plus some CP4 stretching and tweaking. end quote.

So here Jack is explaining that is takes . . .

1) 27 - building block tapes ( I am taking it that a BBT is the smallest tape possible as 2 bar )

a) dom bbt - non dom bbt -dom bbt = 3 bbt's and they in turn build 1 dominant, or 1 non dominant tape.

2) 9 - Tapes

a) 3 bbt's build 1 tape ( tape = a dominant segment, a non dominant segment, and a final dominant segment ) to complete a set of sequences for a tape.

3) 3 - Traverses

a) There are 3 tapes to complete a full set of sequences to build the traverse.. dominant- non dominant - dominant.

b) A completed traverse is built of 3 tapes, or 9 bbt's ( 3 tapes of 3 bbt's each. )

Combining all the above, will complete the below . . .

4) Channel - completed and built from:

a) 3 traverses ( dominant, non dominant , dominant )

in turn are built from . . .

b) 9 tapes ( 6 dominant, 3 non dominant )

in turn are built from . . .

c) 27 Building block tapes ( 18 dominant , 9 non dominant )

Thank you to JH

post is to help those who have recently begun this work, also to highlight the bbt's

Come on TIKI, your giving away the farm

. There's no reason why gaussians should be ambiguous now :did I say that?: . Just remember when your drawing your gaussians...remember this :

. There's no reason why gaussians should be ambiguous now :did I say that?: . Just remember when your drawing your gaussians...remember this :http://www.traderslaboratory.com/forums/f34/price-volume-relationship-6320.html#post70030 :applaud:

__________________________________________________________________________-

-

They are going to be at Las Vegas (the VP for sure, and possibly their CEO), and even though (at least) two individuals have strongly encouraged Genesis to add a 'Gap Elimination' Option to their software, additional interest for said functionality expressed through direct contact should prove beneficial. After all, The 'opening' gap isn't the only Gap which does not exist.

After all, The 'opening' gap isn't the only Gap which does not exist. More on this in Las Vegas.

- Spydertrader

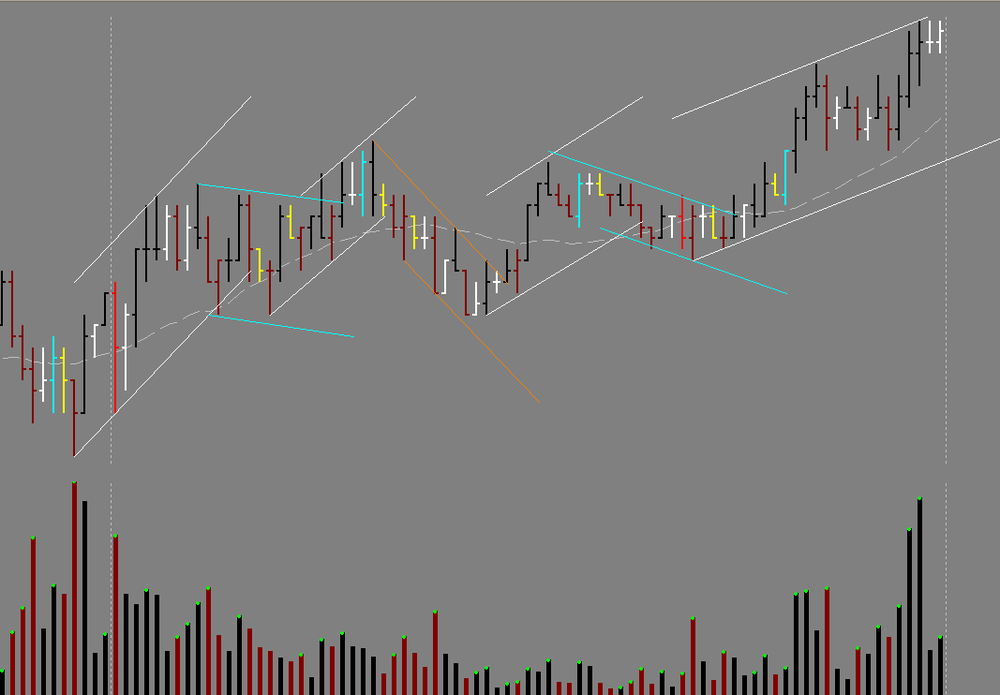

all interbar gaps removed. :shocked:

-

-

Indeed, the question Is how much of a turn do you need to see to confirm a change in the force .....err I mean flow (old starwars habits die hard).

Personally, I don't think its about confirming the change in force. I believe cum delta is about comparing price swings to previous price swings. Does this HH have a higher delta than the previous HH? Does this HL have a higher delta Then the previous HL? What happens when you get a LL but delta has a HL and vice versa? Works on all timeframes

.

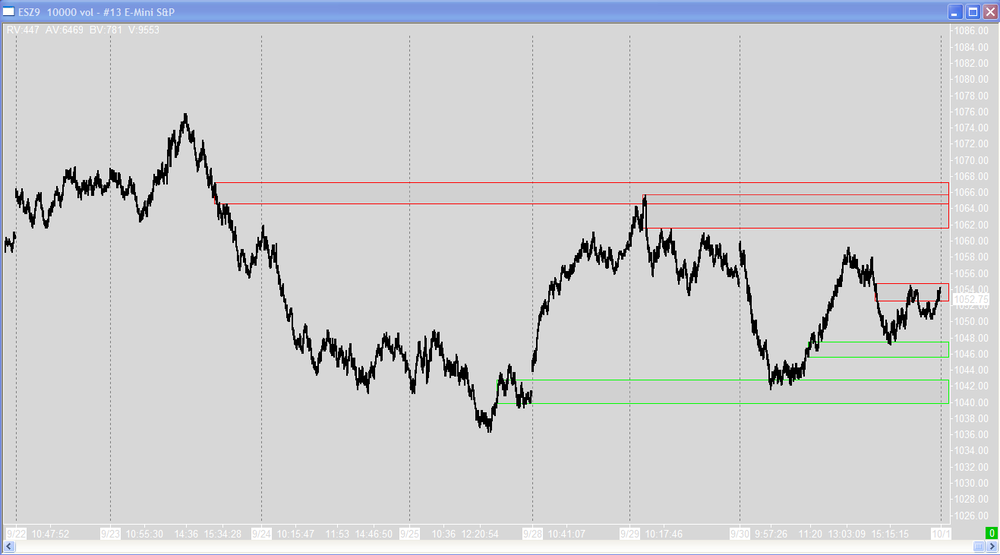

.http://www.sierrachart.com/userimages/upload_2/1253202337_83_UploadImage.png

The Price / Volume Relationship

in Technical Analysis

Posted

interbar degap | Screencast-O-Matic - Free online screen recorder for instant screen capture video sharing.