Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

Don4

-

Content Count

547 -

Joined

-

Last visited

Posts posted by Don4

-

-

Stopped at 1.6449 so +26.1 and +25 = +25.5 more or less. Not a bad afternoon.My only disappointment is that I was hoping for a losing trade per Don's request as I am very curious to find out why he requested, specifically, a losing trade.

Best Wishes,

Thales

:applaud: I hope all your trades are winners.

Don

-

"If price actually does break above then the move up is often powerful."

I guess I could say the same thing for a short. But you have no way of knowing. Any body could guess. But the truth is everybody here is only guessing! Even Thales. OK back to the program.

Don

-

-

I beg to differ. If you can get rid of that belief, you will be able to learn Thales' system. There are no secrets...Please excuse, if the above sentence sounds harsh to you. I do not want to offend in any way, but have some difficulties with the proper tone in a foreign language.

If I could get rid of that belief I would. But until then I cant. You say that my stops are too tight and I truly dont believe that they are since the are basically at the same place as Thales and you but on a different timeframe.My goal here is not to learn Thales system I find it very informative though. I dont see how anybody can place stops (in forex) and become profitable. I do understand what you and Thales is trying to show here and I am here wanting to learn. So I will continue to be here asking questions and posting pictures.

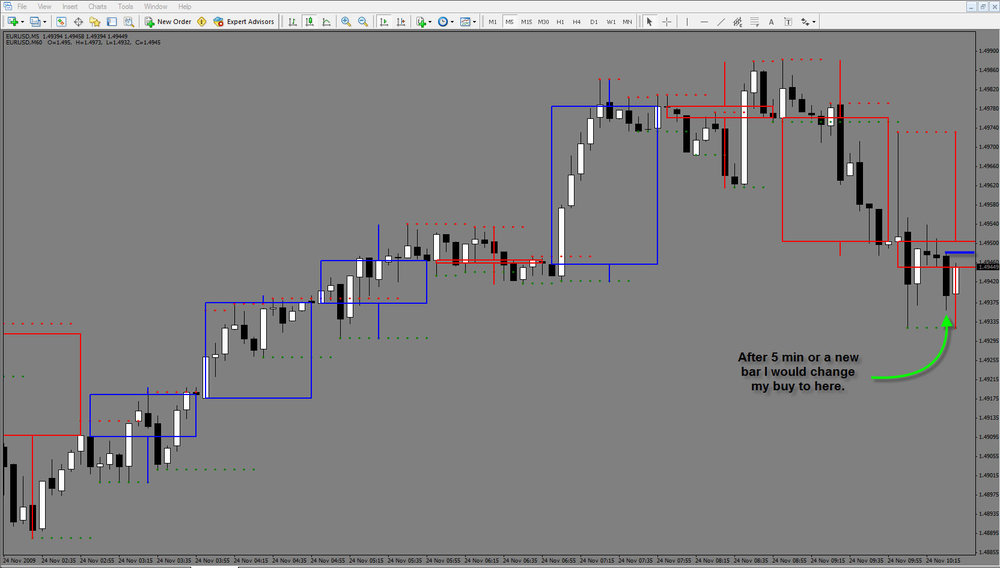

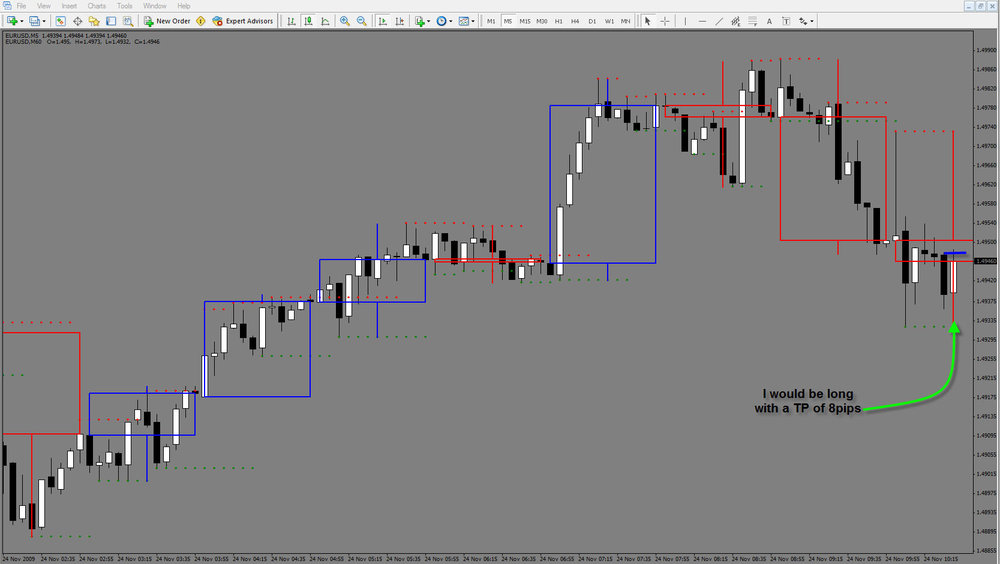

Sorry, Thales but here is a example.

Thanks,

Don

-

"You must learn to manage your trades based upon the size of the initial swing that provided you with the indication that an opportunity existed. If you are trading a small swing and you had an initial profit target of 20 ticks and a stop loss of 15 ticks, then the first 1-2-3 that price etches out against your position may be the indication you need to quit the trade, and possibly even reverse your position. However, if your are trading off a swing that gives you a 40 tick stop loss with an initial profit target of 130 ticks, there will likely be visible multiple 123's etched out at the smallest degrees of price movement."

This is why I dont believe your system or any body else's system can be taught, even though you might on a very rare occosion have a few people that truly understand, I dont believe most will. Not that you are not explaining everything, you do! But most of us will not be able to grasp it. I believe your GU trade explains how I feel because if you would have been there you would have exited at best with a breakeven or who knows 40 pips but you wasnt. It seems as that trade was a gift from God.

Thanks,

Don

-

Helllo Marko! Glad you joined this discussion. I have a few questions for you. Where were your stops are they here or are they in your head. Do you move stops as the trade progresses or again are they in your head? As you can tell I really have not had much luck of using stops. And a few times not using stops has killed me. (But I believe with proper money management that can be stopped) Could you post some losing trades?

Thanks,

Don

-

Hi MidK,Interesting note on your short Aussie trade - my data does not show the slightly lower low that IB shows. So, this is one case where your broker's data triggered a trade that would not have been triggered at another broker.

Even so, I see what you are doing, and I'd even agree with the entry (though I would not have traded it), had it occurred sooner. But price really fell into a little chop zone.

In other words, I see what you think you were seeing, but what you think you were seeing wan't in fact what you were seeing. That sentence just gave me a migraine putting it together, so I'll leave it up to you to try to puzzle that out.

Best Wishes,

Thales

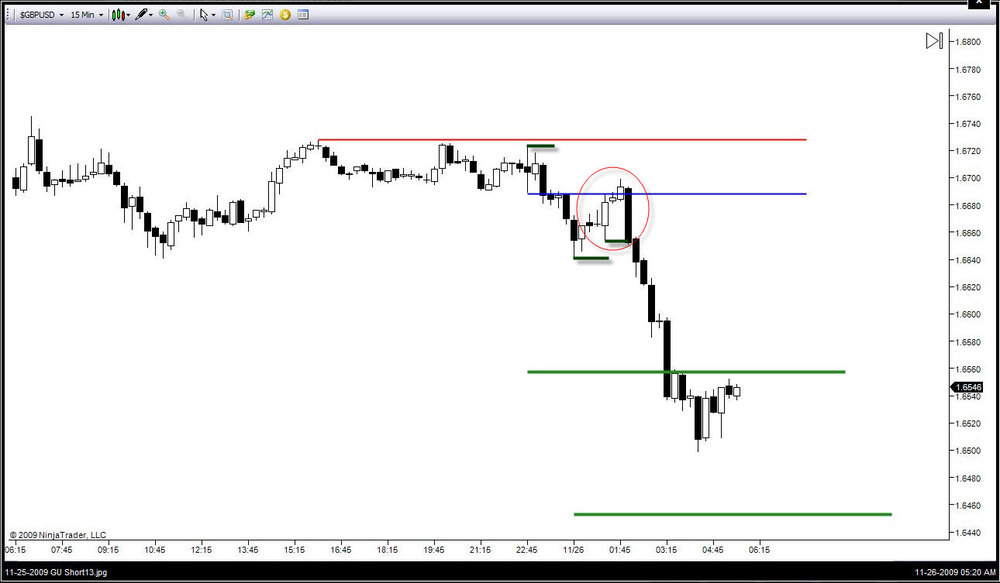

Thales, price on MB trading was the same as IB, (I hope this picture is right.) But forex is a crazy business though!:boxing:

Don

-

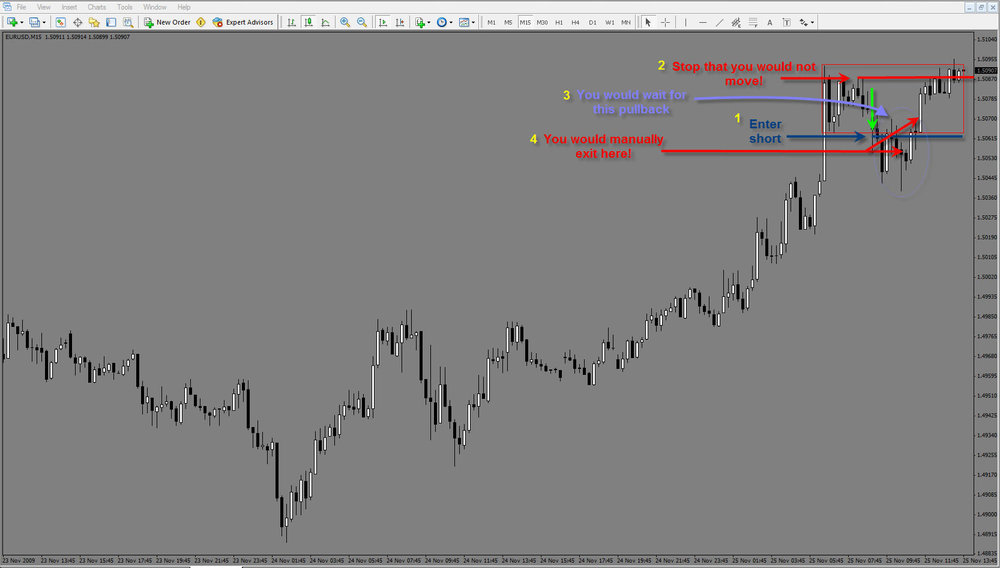

Requires too large of a stop for me.I didnt have this system when I traded futures and in hindsight anybody could look at your chart and say anything but here is my opinion. I do believe Gabe was right. In the way Thales trades. But Im not Thales so you might be right. But just for giggles here is the way I believe I would have traded it.

Don

-

-

Interesting Don, stands a lot of 'conventional wisdom' on it's head. Mind you a lot of 'conventional wisdom' is at best based on certain assumptions and at worse rhetoric that is based on supposed 'truisms' that have become enshrined in trading 'law'.I presume your 160 stop is really an 'emergency stop' I seem to recall from the trades you posted you bring it up fairly quickly? I'll check later:)

I use 2 systems 1 would be like I posted here before that you are talking about above and the other would be like I said. I enter with the same with both trades but the stops are completly different!

Thanks,

Don

-

What do you do if you have a power failure?Or you internet connection gets severed?

I had 2 occasions of loss of Internet connection and I can tell you that I was in BIG trouble?

The loss of power I solved by attaching a UPS to each of my 2 computers.

At one point I had a land line to back up my cable internet connection but unfortunately that option is gone now as most of the phone companies in my area switche dto providind phone service over the internet.

Whe I will get to be positively successful, with larger trade sizes I will look for another solution to the internet connection problem.

Maybe spring for a land line, totaly separate from my home phone or get a wirelless modem that will go through my cell phone.

In any case, I think that trading without stops is suicide and moving your stops after the trade has been initiated is equally dangerous.

I must admit that occasionally I still move my stops but I would say that 95% of the time that was a mistake.

Take care

Gabe

Maybe I can answer your questions like this.

What do you do if you have a power failure? It doesnt matter if I can place a trade I am in with stops. 8tp and 160sl now its safe to say that if I took all the setups that my system gives I would find maybe a few trades in the week that would be losers. Thats why I only take 2 to 3 trades a week with most of them being 2. But I would prefer 1. The less trades that I make the higher probability of a profit. The more trades that I make the higher probability for failure. So, does it really matter what system I use? I would have to say no, but I want to get my 8 pips as soon as I can. Even if I am not around my computer to see it.

Or you internet connection gets severed?

Like last night, sorry about that!

,Don

-

I had a -40 tick stop on this trade. If you want to trade without a stop, go ahead, its your money. I'm not sure why you appear as angry as you do, but I would refer you to the following two posts:1)

2)

The second half of this position is still open and still holding for PT2. And here is the chart I posted of the GBPUSD trade that you attached to what strikes me as an impolite post at best, and confrontational at worst.

I would think that anyone who has both read and paid attention to my posts in this thread from the beginning would agree with me in saying that I am extremely consistent for a discretionary trader.

-Thales

First, I would like to apoligise about what I wrote but I was not angry when I wrote it. But reading it again I can see how you thought I was. Sorry!!

With that said I think you are doing an amazing job with this system. You are a polite person and very,very humble.

With that said I think you are doing an amazing job with this system. You are a polite person and very,very humble. Thanks,

Don

-

My hard stops are nothing mysterious. The initial stop that is attached to my entry order is one tick above/below the last reaction prior to my entry trigger. I always have at least one profit target, usually two, sometimes three. I will set my OCO limit order or bracket order for my second profit target. Once my entry is triggerd, I manually enter my firt profit target imit order.Before the trade is triggered, I have a level at which if price moves that far in my favor, I will move my stop to break even. An old one eyed trader from Texas I know used to call it "the trend killer level." It is a level at which there is potential support/resistance to kill the move in your favor. (Take a look at the attached chart. The dotted Magenta line is my "trend killer level" where if price touches it, I want to protect myself form outright reversal against me with a break even stop. I extended the line so you can see from where it came).

Some trades, there is nothing between my entry and my first profit target. In that case, there is no trend killer level, and I will simply watch price as it makes its way toward my first profit target. I will move to break even once price moves 10-20 ticks in my favor. Each trade is different, and it depends upon how price is moving.

Once my first profit target is filled, I will definitely have a break even stop on the remaining position, and I will typically start to trail it with a 5 tick move for every additional 5 ticks in my favor.

This works for me. You have to find what works for you. All I know is that I hold it as no badge of honor to hold a 10 or 20 tick profit into a loss. I see folks all over the place trying to squeak 2-4 ticks/trade out of the ES. Why should I feel bad to take 10 ticks of a one time 20 tick profit on the 6E? Why would I want to allow an open trade equity of 20+ ticks roll back to a -10 tick loss? For what?

I know when I am playing for 100 ticks. I know when I am playing for 20 ticks. I am not going to get upset if I take 10 ticks of a 20 tick move that the runs for 100+ ticks without me. I am not going to get upset if I am playing for 100 ticks, and I get stopped out with +30 if price is going to go all the way back to -20 before rolling for +100.

You have to take what the market gives you, and get out with what you can.

Best Wishes,

Thales

This is the reason that I dont use stops. Or place them very, very far away. Did you even read this post above. You had to of since you wrote it. But it would seem as though you avoided everything that you wrote. Why! What made you avoid all of this?

Thanks,

Don

-

-

-

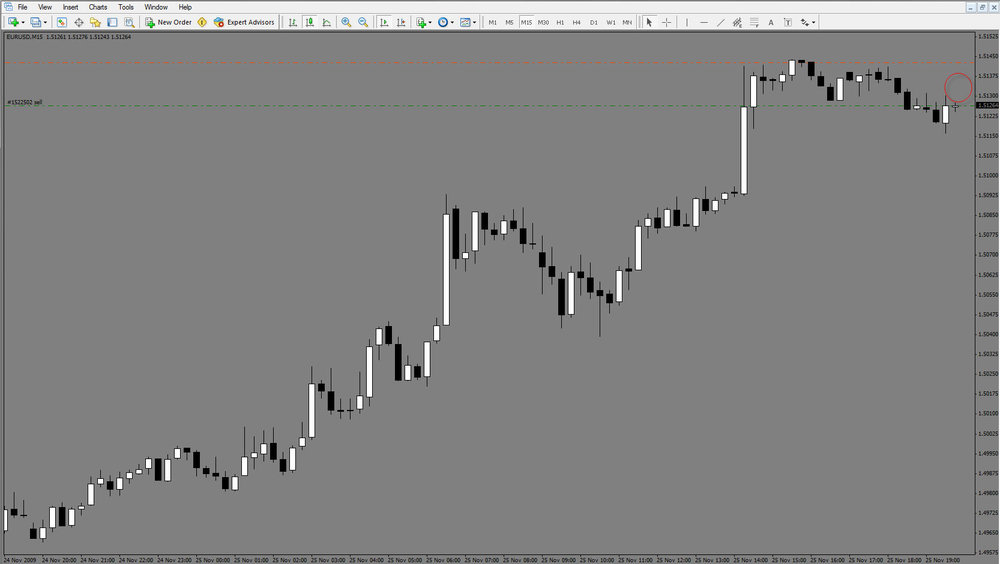

You might be right, but unless it breaks 1.5142 well I just looked over and it did.

-

-

-

Yes, I agree with you on that. But you never really answered my question. Sometime next week could you post a trade showing where your stops auctually are instead of where you would get out manually. I am not trying to argue. But it would give me some piece of mind! I am in no way trying to do with what you are doing in your system. But I think it would be very interesting for others to see.

Thanks,

Don

-

Thales, would you have a stop in the market or would you have a larger stop waiting to exit manually.

-

Thales, I would say that you moved your stop by now, is it somewhere around 1.6587.

-

Sorry guys, I do that alot it might be because of the stroke I had a while back:doh: But I will start a new thread so that I will not clutter this one up.

-

Forex is a beast, and I find it highly unlikley that anybody can tame it using tight stops. Although, I guess there can be exceptions (Thales). But it doesnt work for me! What I want to show you is not necessarily the setup but money management. It is true that I lost $21,000 trading it was $6000 in futures and $15000 in forex. But I knew what I was doing(yea right). The truth is that I didnt know what I was doing. So with that you can read this post with discretion.

-

Hi Don,I still don't fully understand what you are doing. If it is just anticipated fractals (previous bars h/l broken??) then you would certainly be getting many many more trades per day than Thales would - wouldn't you? For example, on that chart you posted here, how many trades does that give you? I know the thermal imaging sensing hindsight goggles are on, just answer the best you can though.

With thanks,

MK

Yes, as I said in that post I would. Is what you are wanting, is for me to tell you how many signals I would have had in that chart? Hmm, I dont understand. Sorry!!!

Reading Charts in Real Time

in General Trading

Posted

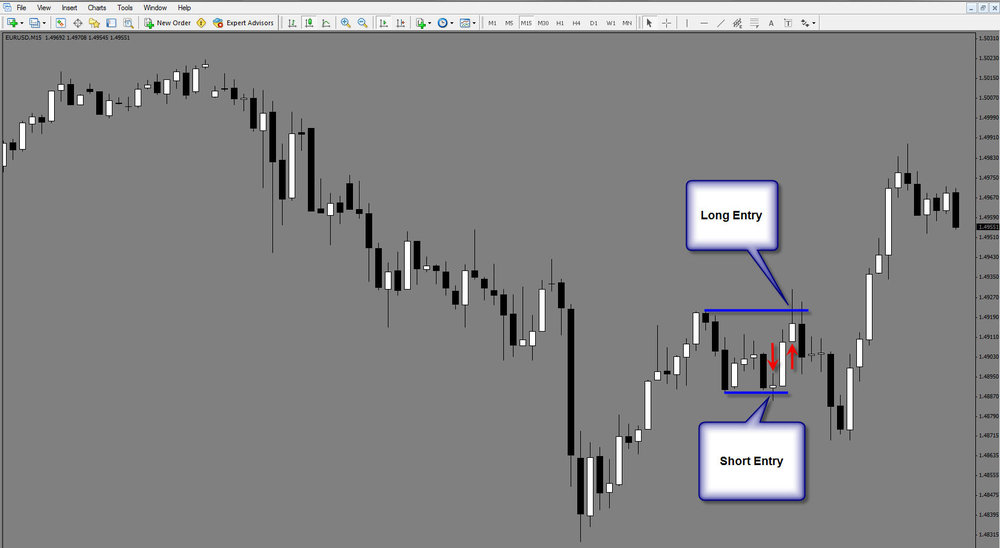

Ok Thales, Maybe I should give your system a honest try. I truly dont believe that I was knocking it but I have never had much luck with stops. I want everybody to know that I will be using a demo on a 5min timeframe. And that I will only be trading eu. So with that said here is my first trade.

Don