Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

bigsnack

-

Content Count

37 -

Joined

-

Last visited

Posts posted by bigsnack

-

-

That's exactly right. There are no chart patterns really, it's just your brain trying to find order in the chaos. Order flow will create certain similarities that show up in the charts, but they never develop in the exact same way, so in my opinion it's a waste of time. You know what moves the market? Orders coming in, orders going out, that's it! I would focus on that. When you have aggressive buyers who are stuck in a bad position, and aggressive sellers who are in a good position, that is fuel for a move down. I would focus your research on those aspects of the market. After that you will probably be able to put that information into a chart that uses that information and gives you an edge. My .02 of course!

-

I agree. Technical analysis and candlestick patterns aren’t really going to help you IMO. There are a number of guys recently who have proven they are profitable with verified 1099’s, and they all trade order flow by waiting for volume and delta imbalances and then trading against the guys who are “stuck”

-

I'm sorry to bust in on this thread, but JEH your PM inbox is full

-

Enigmatics - my two cents.This I think is very valuable. What turned my trading around was learning how to spot reversals, waiting for the reversal to be confirmed FIRST (via a HH, break of opposing trendline, price closing above the most recent volume "node", whatever you use.), and then buy / sell the first pullback. Every time I get antsy or over confident, I start thinking "The signs of the reversal are here, I should just buy the low so I can get a better fill" That's when the final stop run kicks in and takes my a$$ out. Overall, I'm probably only catching 30-50% of every trend, but it's a consistent catch. Maybe this approach might help you?

-

Unfortunately it sounds like you are in a crippling situation. I've attempted trading for a living and couldn't do it. Mentally I couldn't take the stress, and this was trading 1 lots on the ES!

Now I only trade for 2 hours a day in the morning, and then I go off to my day job. I'm in much better shape mentally and financially. My daily goal is 150 bucks a day on the ES, and after that I switch to SIM and trade huge lot sizes as a "game" of sorts to blow off steam. I've accepted that this may be my trading reality for years to come, and because of that I do a lot better than ever before. Good luck to you if you decide to continue to pursue trading as a full time career, but I myself couldn't deal with it, even with a win rate in the 70% range and a solid plan. Take care!

-

Same here. I trade to compliment my income, but it is not my sole source. I've contemplated upping size and trying full time, but it makes me nervous. Keeping the 9-5 helps me stay relaxed while trading.

-

Yeah I totally see its place. The thing is, by the time my trading improved to where I expected to get those 2 ticks, I was actually averaging 8-12 ticks per trade. At that point I figured it would be worth it to hang on to the extra car.

-

MM

This was the same conclusion I came to when trying this strategy for myself. I found that my R:R overall was much better if I didn't scale out of the trade so early. I found that all the scale out did was add a little "mental" capital because I had locked in a tiny bit of profit. However, once I realized that if I had kept the second contract on for the full target I would have made way more $$$, the stats convinced me to stop.

Also, if you feel that good about those 2 ticks, why not toss a 20 lot on and take 18 off at +2?

Again, I'm a huge fan of DH, and I think he kills his strategy day in and day out, but the scaling didn't work for me.

I'm big on the -23% target though!

-

BigSnack, picked up that scale method from David Halsey a few years ago, love it

HELL YEAH! I remember watching his YM trading videos and thinking "this is IT"

-

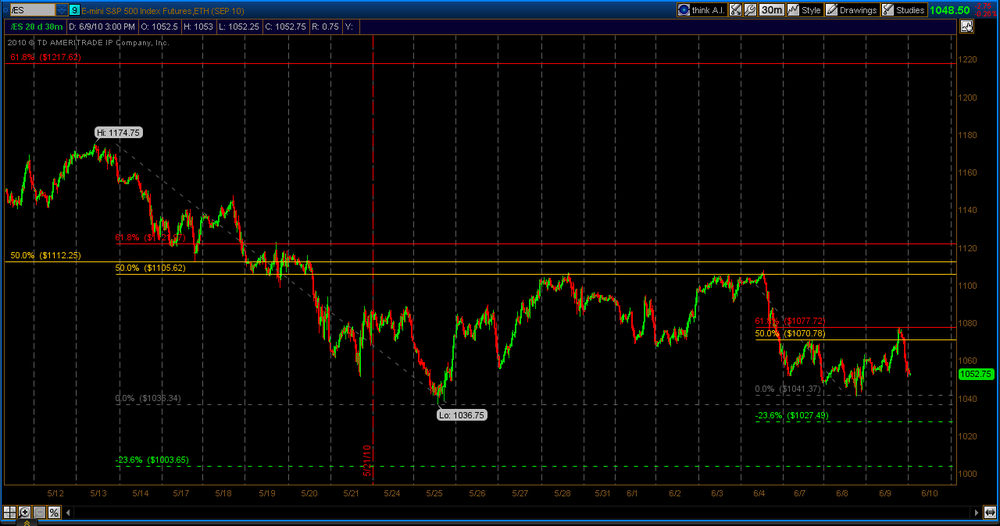

I had a couple people ask me to start a Fibonacci thread so here it is. As you've probably heard me mention in other posts I enter at 50% lines I use a 6 tick stop on the ES and 8 pip stop on the Euro (6E). I trade in contracts of 2 and take half off at +2 on the ES +4 on 6E. I use a target of 23% past highs.Be interest to hear how you trade using fibs.

I recognize this strategy

EDIT: I used to do the same exact thing, but I stopped with the scaling out because statistically it didn't work for me. I will occasionally peel off some at +4 on the ES, but only if I'm not feeling confident for whatever reason. -23% targets are sound and are good places to take profit.

-

While I find a lot of these posts cryptic and maybe they could be more informative (how about a chart?) I still think that anyone who has the nerve to even post their trades has some guts/confidence.Most hide and criticize and I understand to a point -- but still, putting it out there is putting it out there for the world to see.

Especially in an area where people probably exaggerate their ability and performance to no end.

MMS

You are totally right. I'm not out to slam anyone, it just seems like there's an easier way to make 50 bucks in a plummeting downtrend besides averaging down and taking profit at the peak of a pullback.

-

I took a random look at your journal...this is a graphical log of your trades during one fine spring day in 2010.

Interesting indeed.

Risking $5,550 to attempt a $50 profit is not my cup of soup,

but each to their own... carry on, you are doing one fine job.

It looks absolutely laughable when you put it on a chart like that. Different strokes for different folks though I guess!

-

This is a great thread!

My biggest light bulb moment was when it was recommended to me that I try and see price movement as a series of support levels / resistance levels "flipping", as opposed to just viewing price as swing highs and swing lows. After embracing this mantra and staring at naked charts for months afterward, things really turned around for me.

I also noticed that my setups worked best at specific times of the day, so that cut the amount of time I spent watching the charts down considerably. This actually helped me, because it allowed me to focus more efficiently during the time that I was actually watching.

I also have to echo that time played a huge role as well. For me, it took about 18 months of pain and frustration before things clicked more often than they didn't.

-

His entries are great, and he tends to focus on the winners more than the losers, but what trader wouldn't? Whether or not you believe that EL is for real, he has also posted results of some people that took his training, and they were also showing very promising win rates and performance.

This is exactly why so often people that do well in this industry avoid these forums. One day the boredom or the loneliness or whatever gives them the urge to share. Eventually the thread they create turns into a collection of attacks on their methodology or their whether or not they are for real, and the people that believe in their system begin communicating with the original poster via IM. Seeing the futility of the open forum, a private room is created for the people who actually want to try and learn something, and when the open forum gets wind of it they cry foul.

If you have a winning system, I guarantee you could post nearly 100% of your methodology with a blotter of your daily results, and you would get more shit for it than praise. It must be ingrained in human nature. My opinion, of course

-

Right, exactly. At the risk of sounding like a broken record, if you have an understanding of longer term support and resistance, and you wait for those levels to trade, I would say that divergence can help give confidence in getting in. Going long on the first RSI divergence after only wave 1 of a selloff after longer term support has failed is probably not the best of ideas

-

Right, but how many times will RSI or macd show divergence and then the original trend continues?

-

I personally found that I erased a lot of my trading mistakes when I stopped using divergence to assist with trading decisions. Like with most things that are trading related, the context of when the divergence occurs is key, and I didn't get that when I was exploring using divergence as an entry trigger. I'm sure it works great for the people that have done the research and fit it into their trading plan, but I'm definitely not there with it.

-

I realize now that I didn't really even address the original point of the thread, so sorry about that!

Now I come on here to kill time, and for a bit of amusement. I think I have a hope of finding a small group of people to skype with or something during the trading day to hang with, but I don't even know how to go about that really.

-

JEH,

I definitely know what you are going through, and I feel for you. I spent about 18 months tearing my hair out, lying on a hotel bed in my boxers crying my eyes out, screaming when nobody was home, etc.. At my darkest point, I would take trades expecting to be stopped out every time. The dark side of me was almost satisfied when I would reach my loss limit for the day. Now I am still a small lot piker, but I am comfortable with a little supplemental income until I have the sack to up my contract size. Some things that helped me get over the hump were:

1. I stopped going to trading forums for about 6 months!

2. I made and kept a promise that I would not trade real again until I could go 3 months being consistently profitable on SIM.

3. I analyzed if the way I was trading was actually working for me. Did I enjoy how I was approaching the market? Did I believe in the system I was trying to perfect? When I realized that I didn't, it helped me completely clean the slate and start from scratch on my own, without any pointers from trading sites, vendors, etc.

4. Once I found what I wanted to use to help me make trading decisions, I kept track of every stat I could think of along the way. This helped me realize that my trading signals were actually the most successful during only a very small window of time (7:00 - 8:30 PST). Once I realized this, I stopped trying to look at the market every second of the day, and that distance lowered my stress level and allowed me to really focus when it counted.

5. My trading improved when I did this, but I was still hovering around b/e. I knew I was better off than before, but not quite there. At that point I started scouring the internet with a new perspective. I believed in my approach, so I only searched for information that I thought would improve MY approach. I ignored everything else. That being said, I came across an interview with a trader made famous (or infamous) on another forum. This interview alone was my lightbulb moment. I read it, and looked at the chart, and then saw something that now I can't "unsee". Here is the link ( I apologize in advance if I'm not allowed to post links) :

Trader Y: Parting words from a now retired super-trader

I hope it helps!

-

Tradewinds,

Since you are a big fan of the TICK, I can share my experience with it. I found that I had a really hard time fading big extremes with it, as often I would sell a high tick and then of course there would be another high tick and I would get shaken out. The TICK became very useful when I began using it the opposite way, as a newfound strength or weakness indicator (instead of an overbought / oversold indicator). Key levels for me are +500 and -500 on the TICK. I will often fade a high tick only if we have had a recent close on the TICK below -500, and vice versa. Check it out and see if it helps at all

-

I also watch accumulated volume. Sometimes the /ES turns when the accumulated volume starts to turn or has a bump in it. It happens regularly enough, so that it's worth looking at. The uvol/dvol is of less use, but I still watch it. uvol/dvol often is out of sync with the the advance/decline line, and the price of the ES follows the the advance/decline line. The TICK often leads price by quite a lot. Because the TICK is very choppy and just looks like a jumbled mess on a chart, it is difficult to figure out the patterns. But the TICK does have patterns, it does trend, and it is the best leading indicator that I know of.Agreed! It's like any indicator, you just have to spend enough time with it to know what it's telling you. The TICK is my one indicator crutch.

-

Rally might continue based on these counts...Indeed! I kept my 30 minute chart 50% short up since I didn't quite know what to expect with contract rollover, but even the adjusted short is a goner now after the afternoon. session. Looks like maybe 87 - 88's next?

-

-

sometimes you just have to trust ur instinct.. its payback for all those 1000's of screen hours:) yeah,i see 1060 as res if it hits around 3 hours from the low 42 62 would make sense,,we had some nice little fib turns on the small timeframesHello face melting rally!

Does Anyone Truly Make a Living Solely Trading the E-minis???

in E-mini Futures

Posted

There are a couple of podcasts that interview successful guys, and you can listen to those to see if any of those interviews inspire you to focus your research one way or the other.