Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

alibaba5055

-

Content Count

25 -

Joined

-

Last visited

Posts posted by alibaba5055

-

-

-

He posts his weekly predictions based on his STOPD levels here:

Weekly Outlook | DaytradingBias.com

I want to know whether he has EXPLAINED the method / reasons / logic behind these levels and other stuff that he posts on daytradingbias. Why and how he calculates these and what are the practical importance etc ?

Or we simply have to believe in these levels without having any understanding of what they are and how are they calculated etc. ?

Does those paid pdf books contains the proper explanations or not ? If anyone has got these pdf then can you please answer that.

Thanks a lot

-

Thanks for your valuable replies guys. I appreciate it a lot.

This guy is actually the owner of Neoticker and he mentions that he works a lot with the big institutions and have done lot of research work for them. That's why I thought that maybe I should ask the opinions of fellow traders on the forums about his research work. He has got a few other research papers / reports for sale on that site as well.

-

Has anyone of you used this STOPD written by Lawrence Chan of Neoticker ? Please share your views or opinions about the same.

Special Theory of Price Discovery (STOPD) | DaytradingBias.comAuction Based Trading Markets Are Unfair By Design

Most of the trading markets nowadays are open auction markets. Auction markets are designed to favour players with intimidating position size capacities.

Read STOPD to learn the truth and start to observe market behaviour in a totally different way.

The Structure is Hidden in Plain Sight

Classic technical analysis suffers from fragmented trading setups and incoherent interpretations, making it difficult to apply in real-life situation.

STOPD provides you with a framework to read the markets fluently as if you are holding onto a GPS at a crossroad.

The Key to Profitability is the Exit Not the Entry

Price pattern recognition and trading setups give you trading entries but failed miserably in providing the all important target zones to exit your trades.

STOPD gives you the structural target when price reacts at structural price level – taking out the guesswork and improve your profitability quickly as it can be integrated with your existing trading strategies easily.

Thanks

-

Alibaba,As I stated, it is not scientific. I use price, time, volume when available, and delta if if it gives me an accurate depiction. The more information I have the better. I have expectations of where certain groups of traders will act and where they will react. When the conditions are right, I take advantage of the weak. I suggest you do your homework and practice.

Thanks MightyMouse. It is very interesting.

Tracking the positions of certain market participants as a group. Then Anticipating their probable response at important price levels and taking advantage of it when the opportunity occurs. Although all this is very subjective and I do not think that such stuff could be automated. It is more like the Market Narrative kind of homework exercise which Jim Dalton recommends.

Thanks

-

Keep Two To-Do Lists, One Electronic and One Paper, To Help Prioritize Daily Lists

When you're incredibly busy it's easy to get lost in a massive to-do list. When you're overwhelmed and struggling to see the big picture, productivity blog Day-Time suggests that it's best to keep two lists: one massive catch-all electronic list, and another daily list on paper.Using Outlook as an example, Day-Timer's suggestion isn't anything new, but it's a helpful reminder for the days when getting everything done seems impossible:

Keep two lists: Outlook stores your master task list; your daily to-do list goes on paper. Always enter a task onto a master task list first.

Label your tasks: It's important that every task on your master task list has a category and due date, two keys for determining priorities.

Make your daily list: Check your Outlook Master Task List and choose 3-5 tasks you absolutely MUST get done today. Then choose another 3-5 you'd LIKE to get done.

Prioritize: Order the tasks by importance, taking into account deadlines and amount of impact on the categories in your life like work, home, family, or specific projects.

Write it down: Put your daily list on paper, making sure you set clear-cut descriptions that will motivate you to get tasks done.

It's a pretty simple process and when you're done you'll have a clear idea of what you need to do today, and have a better view of the big picture plans.

-

How to Prioritize When Everything Is Important

How to Prioritize When Everything Is Important

You know that sinking feeling you have when there's too much on your plate? When you try to tackle your tasks by priority, but it feels like everything's important? Don't get overwhelmed—it's a problem that everyone faces at some point or another, and while it's difficult to skillfully juggle multiple priorities and competing responsibilities, it's not impossible. Here's how.

It just so happens that there's a career that focuses specifically on juggling competing tasks and priorities: These people are called project managers. And as luck would have it, I was a full time PM for many years, PMP-certified and everything. In that time, I learned a number of helpful tricks that can help you manage your workload at the office as well as your ever-growing list of to-dos at home, with your family, or with your friends. Here's how you can apply some of those techniques to your everyday life.

-

Hello,I have heard that rescuetime.com is really good. I have not personally used it. I am still getting help from outlook reminders but I dont think you are just looking for that.

I hope this helps!

Thanks for the suggestion Eddie.

Yes, I am looking for such self management / time management tools only.

Thanks

-

Neoticker has a pretty powerful pattern scanner as well -

Why Use Pattern Scanner?

Pattern Scanner, especially its ability to utilize multiple indicators in its scan, is very useful for the detection of complex setups.

Pattern Scanner is also very flexible in terms of its ability to chain the scanning, send its results to quote window, etc. Making it the tool of choice to identify trading opportunities across many symbols.

Checkout the link for the complete topic -

-

Thanks for the very interesting discussion guys.

@MightyMouse, Could you please tell which particular software do you use for breaking down the volume into 4 groups ? Do you use some tick level database tool or if you do it on the chart itself in the form of some indicator etc.

@joshdance special thanks to you for the valuable inputs.

-

Learn to code

Codecademy is the easiest way to learn to code. It's interactive, fun, and you can do it with your friends.

-

Also checkout this list of great resources -

Learn To Code: 10 Free And Fantastic Online Resources To Hone Your Skills

http://www.makeuseof.com/tag/learn-code-10-free-fantastic-online-resources-hone-skills/

Coding. A topic that is avoided by many. Why? Probably because it seems like an impossible and unreachable goal to attain. It is a difficult skill, but if you have the purpose to learn to code, there’s no better time than now. There are an abundance of free resources and tools, all of which are available online. Sure you could take some courses on the topic at a nearby community college, and you might still want to. However, if you’re on a budget, have limited time or just simply want an additional source of quality education, these websites can be a tremendous help.

-

-

For those who are new to the concept of GTD, here is some basic information from wikipedia -

Getting Things Done - Wikipedia, the free encyclopedia

Getting Things Done is a book by productivity consultant David Allen that describes the method/procedure that he created with the same title name, often referred to simply as GTD.

The Getting Things Done method rests on the idea that a person needs to move tasks out of the mind by recording them externally, so the mind is free from the job of remembering the tasks that need to be completed. One can then concentrate on performing the tasks, instead of remembering.

-

CME, burned by MF Global, 'monitoring' Knight Capital | Reuters

CME, burned by MF Global, 'monitoring' Knight Capital

(Reuters) - CME Group Inc (CME.O), which regulates Knight Capital Group Inc's (KCG.N) newly acquired futures brokerage, is "monitoring" the embattled trading firm after an error wiped out $440 million of Knight's capital.

Confidence in the futures industry's ability to safeguard customer funds has been shaken after two financially pressed futures brokers in less than a year have been accused of improperly raiding customer accounts for as much as $1.8 billion, despite regulatory oversight.

Misfiring technology at Knight, a large New York Stock Exchange market maker, caused a rush of orders on Wednesday for dozens of stocks, roiling prices and undermining already weak investor confidence in U.S. financial markets.

While securities regulators are looking into what went wrong on the trading side, the focus from the futures industry is on the estimated $411 million in customer funds that were part of Knight's purchase last month of floundering futures brokerage Penson Financial Services.

That amount is slightly more than Peregrine Financial Group reported having when its CEO last month confessed to stealing from customer accounts for years, in part to keep his company afloat.

Regulators say Peregrine's CEO misappropriated more than $200 million of customer money. The October failure of much larger MF Global resulted in a customer asset shortfall of $1.6 billion, the bankruptcy trustee has said.

CME, which was MF Global's main regulator, has blamed misdeeds by management at both firms for causing the customer losses.

"We are monitoring the situation with Knight," a CME spokeswoman said, declining to provide details.

Knight said on Thursday it is "actively pursuing its strategic and financing alternatives to strengthen its capital base.

CME says it did everything possible to prevent customer funds from being misused at MF Global as that firm dealt with a liquidity crunch following revelations of a bet on European sovereign debt that investors worried would turn sour.

Within a day or two, CME had auditors on site checking MF Global's books, which showed customer funds were intact. Days later, CME found those books were wrong and MF Global had siphoned customer money from protected accounts to fund corporate needs, according to a CME account of the events leading to MF Global's collapse.

Knight bought Penson's accounts on May 31 for $5 million, plus a cut of future revenue, a Securities and Exchange Commission filing shows. Penson had $411 million in customer funds as of that day, the most recent report from the Commodity Futures Trading Commission shows.

It was one of a dozen or so independent future brokers that are only a fraction the size of the Wall street broker-dealers that dominate the industry.

Separately, securities regulators are looking into Knight's trading error, the chief of the biggest U.S. options market said.

"Our understanding is that the SEC and Finra are reviewing what happened yesterday," CBOE Holdings Inc (CBOE.O) CEO and Chairman William Brodsky told analysts. "We're obviously reluctant to get ahead of the regulators on this ... I really think we ought to let the facts come out and then see what happens."

Knight Capital, one of the largest firms that buy and sell stocks to provide liquidity to the markets, blamed a "technology issue" for the problem.

-

Hi Pred,Have you given thought to changing your level of fitness instead of confining your goal to just weight loss.

There are forums for fitness/sports prep/ swimming/ bodybuilding etc where Posters would be more than happy to assist you in a very useful manner.

Even just reading some of the threads will open you to interesting possibilities.... such as the psychology of changing engrained habits ... best methods of burning calories and building muscle ... benefits of 5 or 6 small meals per day .... difference between food groups etc.

What is better to trade on for example .... slices of toast smothered with butter and delicious strawberry jam (yum yum gluten, fats and sugar), or a small bowl of banana, blueberries, quinoa and natural yogurt ( yummy rocket fuel)

I am sure that you know to ease slowly into major changes to diet and exercise because the initial reactions from your body will not be favourable ... but this period will pass.

Perhaps give consideration to some simple yoga exercises (youtube is best source)

once again take them slowly.

goodluck

I agree, the goal should be to gain overall fitness, rather then just loosing weight.

-

41 Years After The Death Of The Gold Standard, A Look At "How We Ended Up In This Economic Purgatory"

As we await the latest developments out of the Eurozone and Washington, I take a moment to look back on this very important day in history. If you want to understand current events, then you first have to understand history. How did we get here? More specifically for financial markets, how did we end up in this mess -- this economic purgatory? The answer boils down to a simple proposition on the philosophical level, which I will leave to the reader to identify because my doing so would likely ruffle a few too many feathers. So I will keep the discussion on the concrete-bound level. However, I am willing to say that the political philosophy that drove us to the current state of affairs was responsible for the respective concrete measures implemented over the years. The crisis in confidence that we observe today resulted from cumulative effects of those measures.

This being August 15, 2012, students of the history of monetary economics no doubt are aware that this is the 41th Anniversary of the breakdown of Bretton Woods. It was on this day 41 years ago that President Nixon defaulted on the promise to exchange gold for paper dollars presented for exchange by foreign central banks. Aug 15th marks the anniversary of the collapse of Bretton Woods and the gold-exchange standard that was established after WW II. (Notice that dollar debasement has been bipartisan over the years: Republicans Nixon and Bush and Democrats Carter and Obama have all presided over major declines in the value of U.S. money.)

The current crisis in the global monetary system pales in magnitude to the sundering of gold from central banks' fiat paper currencies in 1971. That is, we are not witnessing the wholesale dismantling of an entire monetary system. What we are witnessing is a loss of confidence in the current monetary system, which, of course, is equivalent to a loss of confidence in central banks' ability to restore stability. However, the decision to renege on the gold-exchange standard that was made 41 years ago is still reverberating today. In *fact*, many or most of the problems observed today are the direct result of wrong-headed discretionary monetary policies.

What was it that made the current morass inevitable once the paper dollar was severed from gold?

The answer is simple: fiat paper money that is not grounded in any objective standard can be manipulated at the whim of the issuer. Without the requirement to exchange fiat money for gold or some other commodity, the central bank can issue unlimited amounts, thus making its value subject to extreme volatility and, as we have seen, perpetual debasement.

Complete article here -

-

I used to go to rock climbing during summer breaks..more than 15 years ago...some sports might be pretty dangerous, epecially if you do it for a living...

It is scary to look just at the pic itself !! If you know then please tell, if he was using some life saving instruments or was he climbing without such protection ?

Thanks

-

In my views, in the context of Trading, discipline is certainly necessary but not sufficient. It needs a combination of many different factors to be consistently successful in this game.

In regard to other fields, I would say, it depends. There might be some profession which does not require a lot of intelligence / smartness / imagination / creativity blah blah blah... which is more like a mechanical type of work,, there one could be successful based on discipline.

-

yes thanls I am very much awatre of Berkley's DBN... do you have it? u can email me at dmz163

thats my prefix at yah hoo

Sorry but I do not have it currently.

-

Hi !

Which software do you use for managing your "Tasks to be done" lists ? I have tried using Excel and Mind Maps, but they are not very efficient at it. While searching for the solution, I came to know about "GTD - Getting Things Done". I wanted to know if you guys have any experience with this ? Which software do you use for managing your priorities properly ?

Thanks for any input

-

Thanks for the contribution Szymon

Any new updates on this..

-

Thanks for the interesting discussion.

-

The updated link for the above mentioned Technical White Paper by Oracle is this -

http://www.oracle.com/us/products/database/berkeley-db-v-relational-066565.pdf

Thanks

Suggestions

in Announcements and Support

Posted

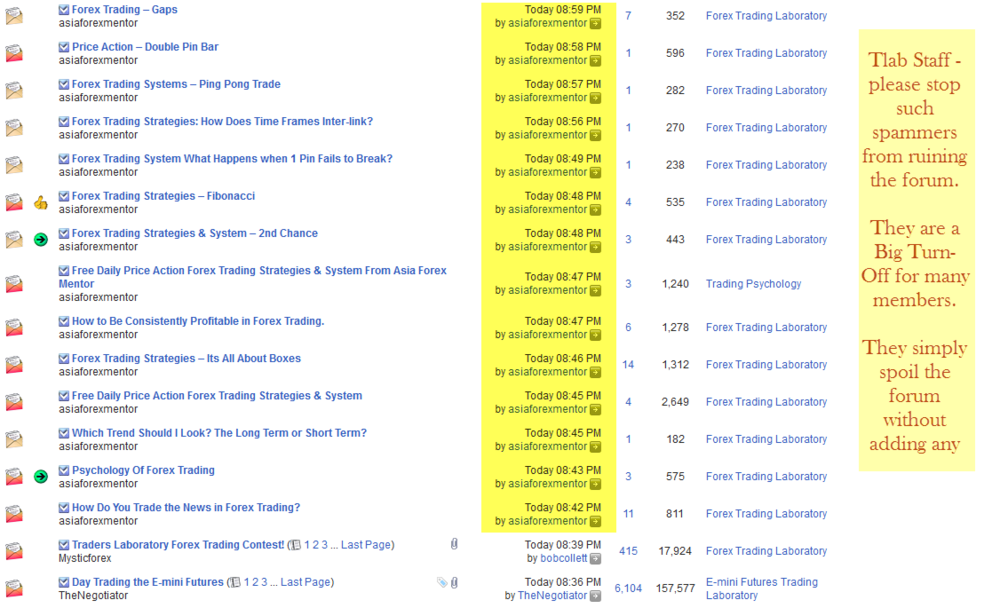

I request Tlab Staff to please do something about stopping such spammers -

http://www.traderslaboratory.com/forums/forex-trading-laboratory/13572-can-u-please-tell-me-how.html#post166574

They will literally ruin the forum in left unchecked.

Thanks