Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

4271 -

Joined

-

Last visited

Posts posted by brownsfan019

-

-

I liked the title did you read it?

did you read it?Not yet Obsidian, but on the to-do list.

-

Market Sense and Nonsense: How the Markets Really Work (and How They Don't)

New book from Jack Schwager out soon. His books are usually a good read.

-

-

would anyone know if the acquisition of oec by gain capital is good or bad for our accounts?Good question and only time will tell IMO.

So far everything ok, but not sure if everything has been transferred yet.

-

Yeah that outage was not fun at all. That was a bad one for sure.

I saw that mess today. I just use them for data. Would never put my cash at risk here. Someone in the technology ranks at this place needs their cage rattled. There has been quite a few major probs over the last several months that presumably has cost them dearly. Hope you all could get out of your positions safely. Doesn't Schwab own them now??What major probs over the last several months are you referring to? I have not had an issue prior to the outage this week. As a matter of fact on ET we were talking about how long it has been since an issue.

Guess this was a bad week as Think or Swim / TD Ameritrade was down today.

-

anything but OEC is ok.Lol Tams. You have an actual reason for that?

Too funny, some people around this place.

Go ahead an EXPLAIN why OEC is not good. I'd love to see you actually explain this w/ facts. Or we can just pretend like I didn't ask this question and you can keep just following me around.

-

Pretty interesting. Definitely no shortage of opportunities there.Oil is really moving today. Nice short entry opportunity in CL this morning at 8:11am EST. Entering at the EMA took little to no heat and moved from 82.35 to an intraday low (so far) of 80.25 in about an hour.

That is a serious, money-making trade JMC. Obviously not going to catch it all, but wow, nice trade. That's part of the risk-reward that your setup seems to provide. You can enter w/ a 10-20 tick stop roughly, and turn that into as much as 200 ticks.

Very nice.

-

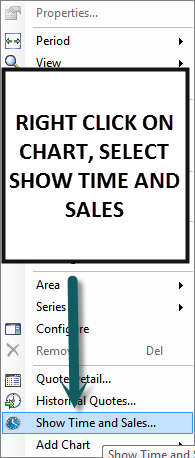

There are plenty of futures brokers that's for sure. Make sure you get a demo of any software you are considering. I personally use Open Ecry and we have a little support area right here on TL for them. With OEC you will get free data to just about any market you might want to look at and a free platform, which is very nice IMO. The platform comes with charts and DOM to enter orders. If you need more than the standard OEC charts, you can take that data and plug into other platforms too, so at least save the cost of data.

Just make sure you demo a few platforms and whatever you settle on, get to know the order entry methods so there's no questions when real $ is on the line.

-

Step 1: Talk to a qualified attorney to plan for your demise -- including your trading/investment accounts.

Step 2: Follow their advice.

Seriously, this is something that you need to pay for top quality advice for - not an internet forum.

This is one advantage of day-trading, by 4:15pm EST, my positions are closed. As long as I don't kick the bucket in the middle of a trade, my trading accounts should be sitting in cash and if I do, that's what stops are for.

As for the investment accounts, they are considering investments so by the time my accounts are passed on, no big deal.

As for the investment accounts, they are considering investments so by the time my accounts are passed on, no big deal. -

Full Tilt Poker Accused Of Stealing $440 Million Of Players' Winnings In Giant "Ponzi Scheme"Read more: POKER: Full Tilt Poker Accused Of Stealing Winnings In "Ponzi Scheme"

Wow who say this coming? I wonder if the other sites are as well?

MMS

That is crazy MMS. Should be interesting to see if it sticks and is true. If it's true, some well-known names being accused in that.

As a side note, Cleveland finally getting a casino so I may be playing poker more than ever before!

-

Thanks for this. The picture below shows where I place the stop initially and how I tighten it up until it gets to break even.Back testing appears to support the view that leaving the stop a tick below the low of the hammer, untouched, results is more profitable trades and less break even ones.

What's your view on this? Thanks!

My view is -- very nice trade entry and stop. And stop does not move.

I've never found trailing a stop to be a good idea, but that doesn't mean it can't work. I know moving the stop 'feels good' but that feeling usually cost me money so I just stopped doing it.

Nice charts though, feel free to post those in this thread! Can't tell what market, timeframe or anything on your chart.

-

Its slightly off topic but what do most traders here do when there waiting for a setup. Especially those who trade 5 minute and upwards. I find it extremely difficult to maintain concentration when the first setup on a 15/30 minute may not be for hours into the day.I've also found that because i have waited so long for that touch of the ema, it is difficult to say no to a candlestick that is weak, a market that is losing its momentum, etc. The trade you just look at after and know that was a crap setup.

Any advice or is this something i'll learn the hard way

When trading off 5 minute or longer charts, it can get a bit tedious especially if you are staring at one market. A good suggestion was to set an alert on your platform and then either do something else or watch multiple markets. If you watch 4+ markets that are not correlated, then that boring 5 minute chart can get more active.

Entering long with a stop, I've been placing my initial stop a tick below the low of the signal (candlestick pattern) candle, then, upon the close of the entry candle (which drags me into the market), I tightened the stop to a tick below the entry candle.So far my impression is that this is unnecessary and would be easier, faster and less error-prone in a one minute timeframe to put the stop directly a tick below the low of the entry bar.

What's your experience? Any advice on this? Thanks in advance!

Actual examples would really help as I don't quite get where your stop is initially and then where it goes to. For me, if I enter on a hammer, the stop is tick(s) below the low of the hammer. And that's where it stays.

For those of you who want more scalping action, put a 34 ema on a volume-based chart. They're smoother for this kind of thing and you'll get more signals than minute-based charts.I agree - tick charts or volume based charts will provide more setups for sure. I had mentioned to JMC previously that I put his design on a 800 tick ES chart and did not look bad at all. I admit, I have not been tracking it daily so please make sure you do before jumping in.

So the options to get more action during the day could be:

1) Watch more than 1 market

2) Watch 1-2 markets but use 'faster' chart settings - 1 minute, tick or volume charts. You could also use a combo of these as well. Say you really like the CL or ES moves, or for margin purposes you want to focus on 1 market, you could have a 1 minute chart up, a tick chart and/or a volume chart of that market.

Currently iam trading the 15 minute charts and am just struggling to get a decent risk to reward ratio and more than 1-2 trades in a day. I don't really want to be stuck infront of a computer screen all day waiting either. However i find the 1 minute chart slightly daunting due the large amount setups off the ema.15 minute charts would be difficult to 'trade' from IMO. If you get 1-2 setups in a day, I would call that a victory. You are getting 4 bars per HOUR. If the 1 minute is too fast, try the 5 minute out as Josh suggested. That could be a happy medium to speed the charts up a bit and also find good risk-reward setups. If you focus only on risk-reward, the 1 minute will be hard to beat. Look at some of JMC's screenshots - he's risking maybe 20 ticks on the CL and seeing moves of 50 ticks+ on his trades. Risk $200 to make $500 or more is not bad at all IMO.

-

so is oec any good or not? i know browns fan should change his name to oec fan, but anyone else.....?i had a look at their web site and i must say they do offer a lot for the money. its almost too good to be true IF they data and software is reliable and fast.

and we all know what they say about too good to be true.....

Maybe I'll ask MMS to change my name. LOL

Not sure why OEC seems to good to be true. They are good at what they do and you don't have to take anyone's word for it - - demo it for yourself! Demo is free for 2 weeks I think and I'm sure you can ask for an extension if needed. Get the demo and look for yourself. Don't trust anyone on this forum till your own eyes see it.

Here's what I know - if OEC had problems, this forum and ET would light up with complaints. Anytime there's an issue, both forums (esp ET) light up with complaints. There hasn't been any issues for quite awhile. If there were, I have plenty of vultures on this forum just waiting to pounce on OEC and me. You'll note that those vultures have not been around for a long time. For some reason they disappear when things are running smoothly. They are only there to jump all over OEC and me when there's an issue, but never to be heard from when everything is running perfectly.

OEC is not TT or CQG but it gets the job done. I use the money I save to buy Sierra Chart/IQ Feed and use OEC to execute. There were problems in 2009, but things have been pretty stable for me since then.dVL

PS:

I also have a good relationship with my IB that predates OEC. You will probably get better customer service if you go through an IB.

OEC is not TT or CQG or T4 for that matter. The only way you can see if OEC can work for you is to demo it. And even if their platform is not capable of what you need, you can still take that free data and plug into MultiCharts and other platforms!

I was paying $500/mo for T4 before moving to OEC and have not looked back. You can see on this forum that was years ago, so that has to say something. If OEC was crap, I would have left a long time ago and just went back to T4.

As for best service, I guess it depends what IB you use. I go direct to OEC and never have any problems, but at this point I really don't need much direct customer service.

IN THE END demo it for yourself and see what you think. You can use the entire suite from OEC - platform, data and DOM - or you can take that data (save the expense of buying data) and plug into another platform and just use their DOM.

-

Nice charts JMC.

One thing I've noticed when you post charts is that the morning appears to provide some very nice, risk/reward setups. And that does not surprise me seeing that the morning usually provides some great moves.

-

There is a very good, very inexpensive, very friendly room that trades the ES using trade decision support technologies that denote precise order flow in several time frames. They trade currencies, ES and crude.The room is inexpensive and they offer a $5 5 day trial. Trading Addicts shows real time charts and the moderator shares his trades with members.

UrmaBlume

Is this chatroom affiliated w/ you Pat? Very curious use of wording that a google search comes right back to your linkedin profile.

You wouldn't post a link to a site where you are going to benefit from and not tell the TL community, would you?

-

Take this with a grain of salt, but the outcome of their research is that, in sample, the optimal entry is with a stop. Out-of-sample, the limit order performed best.There is a considerable amount of detail in this book, which lends credence to the author's research. As an explanation of why a stop entry performs better in their tests, they speculate that optimal entries appear to have both a counter-trend element (entering against the pullback) and a with-trend element (entering with a stop).

I've always entered on a stop - reasons being:

1) You guarantee to fill all your winners

2) You guarantee to not fill some losers (no fills)

In contrast, a limit order works as follows:

1) You guarantee to fill all your losers

2) You guarantee to fill some of your winners

And when you break it down like JMC does on a 1 minute chart, you aren't 'sacrificing' much for that extra confirmation. On a daily those no-fills can be huge. The catch being you are paying for that extra confirmation and you will get tick-in's that will frustrate you.

-

Traders,Still no comments.

Do you find any benefit in knowing when a price has remained stagnant for a period of time, say 5 seconds? Is there a message in a price that has remained stationary for seconds that you guys use for your trading?

Give me something :-)

Didn't we just discuss this in your other thread?

-

I would suggest testing out a few to see if there's something you like better than others. Some on this forum use Open ECry and they have a nice demo there. You can pick up some pointers on the software here on TL as well.

-

Hi XS, thanks for responding.The main reason for the post was to get opinions on approaches when these situations occur. So putting this trade to one side for a moment, I would like to hear thoughts on what may be occuring when I price holds steady for say 5 seconds? Are the big players buying at that price? Something must be occuring while a price remains stagnant for 3 to 5 seconds. What are traders typically doing during this period of stagnation

Cheers

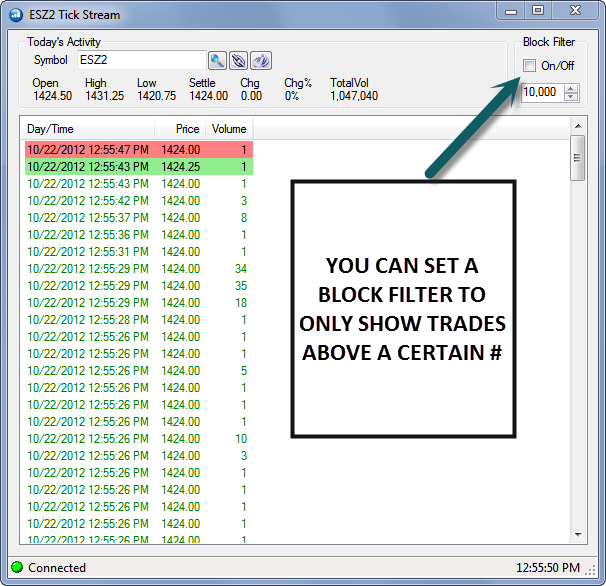

I would think time & sales would help here.

1) find price not moving

2) reference your t&s window to see who is buying and selling at that price level

The difficult part of this is back testing as you'll need a data stream since charts will be of no help here.

You may just find out that there really is no one interested at that price at that moment in time for whatever reason(s). This does not surprise me on the YM at all. Try the same exercise on the ES.

-

cheap enough eh? why don't you get it and let us know how it goes??how much is it? no prices are posted there for the webinar??? i just know he deals with the issues this thread raises. might be a decent site. might want to google his name and see what you find out????Ok after one month let us know how it went. Seems like I read somewhere that you should buy the basic course first before doing the webinar???? You might want to look into that.Do you own the manual of the site you are promoting????

Have you posted your review of the site and process??????

At what point are question marks too many???????

-

John at deals with these issuesWell, there we go - for 40 bucks you can master the DOM from a guy that claims he's selling the same system that pro's use.

-

Browns fan,Thanks for responding.

In answer to your question, the bid/ask was moving and it so happens that I did record it.

I really dont believe it was my Internet connection.

I recorded the trading using Camtasia

If you got it recorded, then get that to your broker's support ASAP to see if there was an issue or just normal DOM activity. If the bid/ask was moving, then I would think everything was fine and you were just watching a time where there was a spread. Does your DOM have a way to show when there is a spread? If so, turn that on.

-

Do you mean your DOM was literally not moving? Were the bids/asks on the ladder at least changing? Or was everything static, including all bids/asks?

If your DOM was not moving at all - current price and bids/asks, I would check with your broker. Try to record it so you can send them a video of it.

If it was just current price not moving, that can happen, esp on the YM where there can be a 1-2 tick spread at times. You'll also see this happen around news announcements. As long as something is moving on the dom - mainly the bids/asks - then you should be connected. Also check if your broker has a way to check your connection, maybe your internet had a hiccup.

-

How have you created that fixed target? Is it just from experience from watching the markets or using an indicator. How soon did you adapt to say the recent vast increase in volatility. It completely threw me, I was so set in my ways of expecting this much profit per trade on average, having tight stops and moving to breakeven quiet soon.It's just based on each market. On the ES for example, my risk is typically 1.5 or lower. As long as I make 2.0 on winners and have enough of them, the #s work. On the CL the risk is usually 10-15 ticks, so I like to keep my winners at 20 or more.

Intraday trading, esp in this volatility, can lead to very quick retraces or some extended runs. No matter what your exit method is, you just have to capitalize on that - either get your profit and out or make sure your winners can run.

Forex Price Action Scalping

in Books

Posted

Forex Price Action Scalping

Has anyone read this? Few on ET talking about it and first I've seen it.