Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

johnjohn1hew

-

Content Count

119 -

Joined

-

Last visited

Posts posted by johnjohn1hew

-

-

Something I just read and thought it quite relevant to the pursuit of all of us:

"And your doubt can become a good quality if you train it. It must become knowing,

it must become criticism. Ask it, whenever it wants to spoil something for you,

why something is ugly, demand proofs from it, test it, and you will find it

perhaps bewildered and embarrassed, perhaps also protesting. But don't give in,

insist on arguments, and act in this way, attentive and persistent, every single

time, and the day will come when instead of being a destroyer, it will become one

of your best workers - perhaps the most intelligent of all the ones that are

building your life." - Letters to a Young Poet

-

Some trading principles I picked up from an AHG posting:

#1) Discipline at all times. Your most important rule, make no mistake, nothing surpasses this.

#2) The Monster. Never ever average down, ever. Scaling in but not surpassing your original intended size and/or risk is ok. Make sure you know the difference.

#3) Homework. Make sure you do your homework. Before the day begins you should have identified

any major pivots, trendlines on anchor and daily charts. Especially the anchor chart.

#4) Non optimal AHG days. Be extremely careful in days like FOMC, OEX or Holidays where the market is open.

#5) Reversals. Do not call reversals unless a reversal formation forms and confirms around a major pivot or trendline support/resistance. Tattoo this on your forehead.

#6) The trend is your friend and lack of trend your enemy. Do not ever go against the trend unless you have concrete reasons for doing so. ie. Major Pivot, Major Reversal Confirmed Formation. Learn to stay on the sidelines when the trend is not apparent ie. Choppy

#7) Risk vs Reward. When trading you must deal with commissions, slippage, bad luck, bad calls. In order to compensate for this your reward must surpass your risk on all trades in AHG, no exceptions.

#8) Control losses, and allow winners to run, this is imperative for consistent profitable trading.

#9) Under no circumstances must you allow big losses, ever. Take your small losses like a responsible trader. It's not about accuracy. it's not about being right, it's about making money. Do not be afraid of small losses.

#10) React to price, don't predict, let price guide you, don't ever try to guide price.

#11) No bias. Begin the day with absolutely no bias, completely neutral. Ignore news, yesterday news or what your momma told you.

#12) Enter wisely: New trades should be initiated in critical areas of support or resistance, this prevents noise from interfering with your price action analysis. It also eliminates, somewhat, the possibility of questioning the play - it should work or it wont, no second guessing.

#13) Overleverage. This is completely unacceptable. Trade a size that is adequate to your trading capital. You must survive to trade another day to make it. No setup is worthy of overleverage, not even one. We fill our glasses with drops not splashes. You want to grow, do it slowly, preservation of capital above all.

#14) Patience. It really is a virtue in trading. Patience for waiting for your best setups and patience for letting them reach your well planned targets. This is the cure for overtrading., If you could wait 8 hours a day to get paid little money at your past or present job you can surely do so in daytrading.

#15) Winning attitude. A positive mental attitude is essential to succeeding over the long haul, and my definition of a winning attitude is a positive expectancy from our efforts. Take a moment before the trading day begins to see yourself making all the right decisions, waiting for the market to come to you, striking at the correct moment, etc. It's a good way to increase your focus and get into the 'zone'.

#16) Determination: Pick a strategy, study it, analyze it, and apply it. Don't go switching your trading plan every week in hopes of reaching perfection, you'll become a master of none and end up nowhere and frustrated.

-

Thanks for the reference. Now that I know what you are talking about, I'd like to ask if you think that applies to trading?In life, what there is to know is easily learnt if we use reasoning.

-

Theory of recollection?Read Plato's Dialogue Meno, or do a Google search.

-

Backstory is pretty simple – they come and they go in the threads. Noticed it and I’m curious what happens. Introduced a few snide possibilities in the o.p., but was seriously asking if any others had insights into what happens to ‘them’ ( ‘them’ being the serial professionals (MD, PHd, licensed etcs. ) that come and go on TL ).Across the years, I continue to evolve my own (currently somewhat ambivalent but mostly neutral) opinions about trading therapists and coaches – but that is not really germane to this specific topic / question.

If you have insights, please share. If not, no problem. Most of the question threads I start go with some reactivity and few or no answers. nbd…

Why would anyone put more emphasis on what a scholarly trader has to say than on a trader without any education? This is kind of sad and elitist.

-

Thanks DugDug, my comment was not directed at any one in particular, i was just expressing my feeling after having read what the original post stated.To me, people should only seek help and not answers from others. Maybe i believe too much in the theory of recollection.

-

Why not figure things out on your own and stop blaming others for not giving you what you are too lazy to find?? A question that should be added. I hate to see people lying to themselves.

-

Try Tools > Options > Misc. > Reset instruments or database. I had a problem connecting to zen-fire two days ago and i fixed it by resetting the database. Could work for you.

-

Apologies for not reading the whole thread and perhaps asking a dumb question, Bathrobe, but are your posted trades on a live account, or is this all sim? I note the 0 commissions, so I assume it's not real money, but would your methods translate to a relatively small account, when presumably you'd have to trade fewer contracts?You have to type in the commission per broker manually... Tools > Options > Commission

-

Made my second live trade with this approach! Another winner!

(My first was last night, which I posted on here.)

I got short for a small move on the GU.

Price had broken through my drawn support and came back up, so I set my sell stop one tick below the low that had broken through my support...

Sorry not real time...I'll try to do better...I'm just starting live so I'm just really focused on the price and don't want to worry about posting it...

(I made the previous post so it was semi-real time.

)

)Funny, cause that is exactly what i am trading, but i'm riding it.

-

I'm still new at this...and I have to say I honestly don't see any particaular pattern, other than the H, L, LH pattern that everyone's always looking for...but for some reason I get the impression you might be alluding to something else...something I may not even be familiar with...But if it isn't, and you're just talking about H, L, LH, then that is obviously there...but I feel like that's just too obvious...

I haven't taken any trades. I actually just got on here...overslept a bit... :embarassed:[

Here you go Cory...some patterns.

-

Would anyone have taken a short at the blue line?Gabe

Using price action, it is kind of hard to say if one would or wouldn't, but using volume in conjunction with price action i would say no, because declining volume generally means no participation even though price is falling - you would want to see high participation in a move away from a magnet, such as s/r pivots.

Edit: Actually, just using price action you would want to see strong trending away from a s/r pivot.

-

Coincidentally, I just started a political philosophy online class offered by Yale.Granted, you don't get "credit" for taking it, but having read the Platonic dialogues many times and I thought I understood them well...until I started listening to the lectures on them. The professor does a great job pointing you in the direction Plato is going, without forcing his opinions down your throat.

After reading this, then looking back at my copy of Plato, i instantly read:

"But then, if i am right, certain professors of education must be wrong when they say that they can put a knowledge into the soul which was not there before, like sight into blind eyes."

-

"...But, whether true or false, my opinion is that in the world of knowledge the idea of good appears last of all, and is seen only with an effort; and, when seen, is also inferred to be the universal author of all things beautiful and right, parent of light and of the lord of light in this visible world, and the immediate source of reason and truth in the intellectual; and that this is the power upon which he who would act rationally, either in public or private life must have his eye fixed."

-

"[socrates] The process, I said, is not the turning over of an oyster-shell, but the turning round of a soul passing from a day which is little better than night to the true day of being, that is, the ascent from below, which we affirm to be true philosophy?"

The most powerful thing i have ever read.

-

Thales, I was wondering what you thought about this potential short. The biggest problem I have with it is R/R, but leaving that aside for now.I drew some purple bars in there to show what I'm looking for price to do before entry.

I'm not Thales, but i think it looks ideal. Strong movement down, breaking out of the double top midpoint. You should then expect a decent pullback, but barely anything comes in = giving strength to the pattern's meaning, suggesting further to go. Also, the swing high (just above the green line) before the move upwards could be the top of a zone of support IMO, thus a PT1. Support and resistance aren't exact (for those who want to know).

-

A breakout is a breakout regardless of the method or chart used to display it. A breakout has several atributes, but none of them depends on the method or interval you choose to display the tape data. First, there must be something important to break. You can anticipate the importance because of historical action. Then the importance must be confirmed by the current action, that means traders must work hard to break the level, i.e. there must be volume suggesting that there was somthing to break. Then, the difference between a breakout and a thrust (i.e. rejection above R or below S) lies in what happens after the level is broken. Either price is rejected from the new ground or it is not. And if it is not immediatelly rejected, then the breakout either attracts a follow-through or it does not.Whatever chart you use to watch the potential breakout, you can see the level getting broken. But if you want to observe what happens immediatelly after the break, to watch the immediate response, you need a very high level of detail, even the highest one.

That's the simple logic behind breakouts of past support and resistance used as present indicators. As Blowfish put it: the bar intervals we use to display price are samplings. We could use line charts, but bars are easier to interpret - everyone who posts in the forums so far has been using bars charts (including you, head), so obviously there is something of value in them. All you really need is a sampling of what is happening and then base your opinion on that information.

Sorry Jon for posting in your journal - this is the last one. I hope next time that a comment to one of my statements is either messaged to me or posted in my own journal.

-

Say if price breaks out on a 10,000 vol chart and then pauses a little, this may be just a single 10,000 vol. bar above the s/r level, but in, say, a 30 second chart, this could be a consolidation (digestion) of the BO and following this congestion a possible continuation. Also, maybe the 5 second is too fast. I read that Anek advised traders to master the 1 min. before trying to read the 5 second (his idea of the tape).

Here is a quote i got from a market profile thread on TL:

"Pull backs in an uptrend are healthy just like rallies in a downtrend are healthy. Why? Because that's the markets way of digesting big moves, allows profit taking, and also allows weak holders of stocks/contracts to exit the market and turn it over to traders/investors with more conviction that aren't going to be shaken out easily.*"

So, if a pullback is on lower volume, there is not much interest in the downside and very few traders are putting supply onto the market (but this has to be observed in terms of effort and result - ie. vol.'s effect on price).

-

I'm done with the forums. ^^ Explains everything.

-

AHG 1.0 is what i think they call it.

-

It doesn't really matter what Anek is doing right now. I read over the method and i think it makes sense. In my interpretation of it and in my submissions to this thread i will only be using volume as an indicator in conjunction with price movements. But you are free to post what you'd like and how you use "indicators" to confirm your trades based on price action.

-

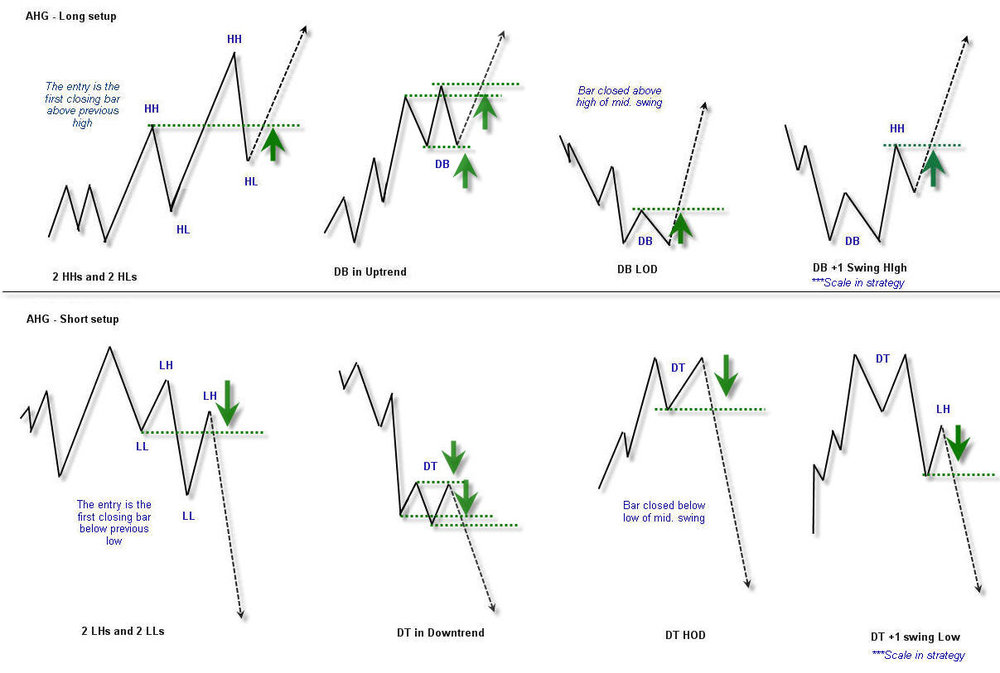

Lately i have been looking at the AHG method and have noticed similarities between that method and all other price action methods. AHG trades only price, using support and resistance, trend lines, price patterns, volume, market internals, market profile, etc. as confirmation. If you're not familiar with the AHG i have included a pdf of the original AHG method that contains snippets from the enormous journal on Elitetrader.

In this thread post your analysis of charts using your method in conjunction with the AHG method. Lets see what we can learn from this.

-

Could be or the poke below the lower line of the frlag could be a fake and it will just continue up.Gabe

PS SL hit.

I would not do anything now because there is no market until 8PM EST.

So 2 trades 2 losses.

Could this be avoided?

Hey Gabe, right after you posted that long setup i posted the exact same chart in a 5 min. interval, but i had a bearish outlook. A double top was forming and the 15 minute did not show this. You should watch more than one interval for confirmation.

-

.thumb.jpg.74d4208fafa3843f2f805f9fb10724e5.jpg)

Reading Charts in Real Time

in General Trading

Posted

The Effective Trader

"To be of no-mind” (mushin) means the “everyday mind” (heiji-shin), and when

this is attained, everything goes on well. In the beginning, one naturally endeavors

to do his best in handling the sword, as in learning any other art. The technique has

to be mastered. But as soon as his mind is fixed on anything, for instance if he

desires to do well, or to display his skill, or to excel others, or if he is too anxiously

bent on mastering his art, he is sure to commit more mistakes than are actually

necessary. Why? Because his self-consciousness or ego-consciousness is too con-

spicuously present over the entire range of his attention which fact interferes with a

free display of whatever proficiency he has so far acquired or is going to acquire. He

must get rid of this obtruding self- or ego-consciousness and apply himself to the

work to be done as if nothing particular were taking place at the moment. When

things are performed in a state of “no-mind” (mushin) or “nothought” (munen),

which means the absence of all modes of self- or ego-consciousness, the actor is

perfectly free from inhibitions and feels nothing thwarting his line of behavior. If he

is shooting, he just takes out his bow, puts an arrow to it, stretches the string, fixes

his eyes on the target, and when he judges the adjustment to be right he lets the

arrow go. He has no feeling of doing anything specifically good or bad, important

or trivial; it is as if he hears a sound, turns around, and finds a bird in the court. This

is one’s “everyday mind.”"