Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

168 -

Joined

-

Last visited

Posts posted by smmatrix

-

-

FACT: Switzerland has one of the lowest crime rates in the world of any industrialized country.

FACT: Switzerland has the highest gun ownership per capita in the world with 46 guns per 100 population.

FACT: The Swiss government issues every household a Sig 550 assault rifle.

Switzerland has one of the lowest crime rates in the world with most everyone armed.

Think for yourself. It doesn't take a rocket scientist to reach a conclusion here.

-

Arming citizens "and teachers" is a valid solution.

This is why there is no school shootings in Israel:

-

Very sorry for not contributing in the exact way that you would like me to, SMMatrix.Here, is this better?

- Simple Moving Average

- Donchian Channel

- GRAB Index*

* The GRAB (Goldfish Revolutions Around Bowl) Index was the result of my attempts to incorporate aquatically-backpropogated non-artificial neural networks into my trading. Basically, I generated a Pavlovian response by only feeding the goldfish following a significant price change. Their tank now sits opposite my screens, and every time a big move is about to unfold the fish sense this and increase the rate at which they swim around their bowl. This has worked very well for me, except during the flash-crash, when the fish swam so fast that they churned their water to boiling point. Apparently RenTech were developing a similar idea but with wolf-cubs, but abandoned the experiment because the combined costs of commission, slippage, and wolf-feed were too high . . .

No problem my trading brother. Interesting concept with the goldfish indicator. Do you have backtested results which you can share?

- Simple Moving Average

-

I'm lost here. Can someone please explain how these recent posts are relative, contribute to the discussion of top three indicators, and answer the question of the OP?

Seems like this thread, which could have been evolved well with the discussion of how people view and use indicators, has turned into a private conversation.

:crap:

-

I think a trader becomes a successful trader when he/she can cut the loss and reverse, without any hesitation, to be on the right sideBased on these recent market conditions, you would have done this a couple hundred times this past week.

Markets going up, get long, markets going down, sell short. Back and forth with big swings all week. Price is still at square one.

Both longs and shorts getting stopped out this week. Can't win. Sorry.

-

How about this one:YOU SHOULD TRADE ONLY WITH MONEY THAT YOU CAN AFFORD TO LOSE

I hate this one in particular!

This is so stupid. This implies, that such amount of money is not REALLY important to you. What happens, if you trade with money that is not really important to you, is that you will very probably lose it. If you trade with such mindset it becomes almost a self-fulfilling prophecy.

At least I was there. I've started to trade with money that I can "afford to lose" and I've lost it all. Okay, it doesn't have to happen to everyone, but the likelihood of failure increases from my point of view.

I became profitable in my trading when I could NOT afford to lose my money anymore because I have to earn my living expenses. There might be a coincidence, of course, but I think it is more a matter of motivation.

I don't think you're reading between the lines. What it really is saying is to NOT trade with money you can't afford to lose. If you do, you will surely lose, and I must agree.

If you play with the rent money, you have psychological disadvantage. You won't follow your rules, but you will follow your emotions.

You can win only if you trade with money you don't need.

If you NEED it, you're dead before you get started because scared money NEVER wins!

-

My trading coach uses TS and he said he'll be the last one to switch lol!Cheers,

XS

I know that I will never leave Tradestation. Nothing else comes close IMHO.

-

After 1 week of using MultiCharts and can say that its much easier to use than NT. Everything seems to be in the 'right place' if you know what i mean. I like the charts too, the basic ones by default are simple and clean. The workspaces work really well and seem to use less resources from my PC than NT.Hooking up to my broker is quite easy. Getting data into it for testing is simple too. The quote manager works very well.

One thing i noticed is how relatively quiet their support forum is too, compared to NT's.

So far this has been one of the smartest things I've done over the last 8 months.

Go MultiCharts!

XS

Thanks for reporting back. Based on your review, I'm once again optimistic with Multicharts. I gave up on them about three years ago. Would you mind posting any favorite charts along with your fav indicators?

-

This marketing concept is not new.

Oliver Valez has been doing it for years.

They tell you they may hire you as a full-time trader using their money... only if you buy their course.

here's a link:

-

I just read an article in Novembers Stock and Commodities magazine on this Tradestation Add-on.Very cool....There is a white paper as well that many should read, its on the site.

They will have a NinjaTrader add on in the second half of the year.

This guy is literally a rocket scientist!

XS

Thanks, but the link or white paper did not come through. Please repost. Thanks again.

-

Thanks, smmatrix,Now this is news I can use. Sadly, I was hoping to make the move to Multicharts seamlessly, but now I'll have to investigate Multicharts more carefully. Drat it, but thanks for the heads up.

With all the negative feedback I've heard about Tradestation from my trader friends who are users (and mostly former users), I am extremely surprised by the positive comments that we've seen in this thread. Almost makes me wonder if the glowing reviews aren't being posted by TS employees or moles within Traders Lab. Sorry guys if this sounds offensive, but honestly, in my 13+ years of trading I have never heard so many people praise Tradestation so unequivocally. Just a bit odd, and it makes me scratch my head in wonder.

Tasuki

Seriously, Tradestation is a superior platform. Personally, I have never liked their brokerage and that may be the complaints you're hearing, because I have never heard anyone complain about Tradestation charting. I have seen and used other platforms such as eSignal, ThinkorSwim, Multicharts, Sierra Charts and none of those hold a candle Tradestations abilities. For example, when I write a new indicator, I often write a a script with it and test probabilities over 10 years of 1-min candles. I believe that is about 11 million total candles. What other platform will allow me to write, test my code to this degree? I'm a statistical trader, so these numbers are important for the way I trade.

But, besides backtesting capability, just the look and feel of the Tradestation platform really feels like real trading to me. I'm sorry, but that other stuff, java based charts seems toy'ish to me, but this is probably because I've used the platform since 1989.

Regarding Tradestation moles, I don't think you'll find any here. LOL. Tradestation does not allow any of its sales reps to work the forums.

Best of trading success to you!

-

About three years ago, I considered a move to MultiCharts from Tradestation. Worse experiment I ever made. What a huge gigantic failure. First off, only about 25% of my custom indicators imported. Those with functions had a 100% failure rate, and those without functions was a crap shoot with about 50/50 probability of successful transfer.

I kept on trying to work with MultiCharts, but was sorely disappointed in multiple ways. The screen graphics and GUI totally sucked. Other problems arose, but I finally threw in the towel after trying to make it work for about a month.

I also resisted the move to Tradestion 9, but glad I finally made the move. Like the other posts pointed out, multithreading has greatly improved. It's fast and stable. I'm running several hundred charts at the same time so I notice these things. I've been with Tradestation since the late 80's and we always stayed one or two releases behind the latest for stability.

Anyway, I'm very happy with Tradestation 9. It has a few quarks, but easily over looked or ignored. Tradestation has always had lots of modules, optionstation, radarscreen, etc etc, so I don't understand your beef at this point with all the extras.

IMHO, Tradestation will always be the superior platform... by far!!

-

well....I have a suggestionwhich can be implemented if you are doing interactive trading....

when your position gets opened make sure that your stop loss is 15-20 pips

say you entered in a long trade at 1.3030 with stop loss of 1.3010

the moment the market hits 1.3045 move your stop loss to 1.3030 (which is break even)

take profit at your Profit target....

so simple....You will only incurr a maximum loss of your stop loss which in my recommendation is 15-20 pips.

Of course this method is not good for swing trading...but only for interactive trading...

To all readers....Please comment !!!

It is always interesting to have a nice discussion...All of us will learn from this.

Well, I use to trade like this with tight stops, but found it unreasonable for long term success. And, it's a very stressful way to trade.

My point it, no one can really predict price movement within 20 pips up and down. That is called market noise.

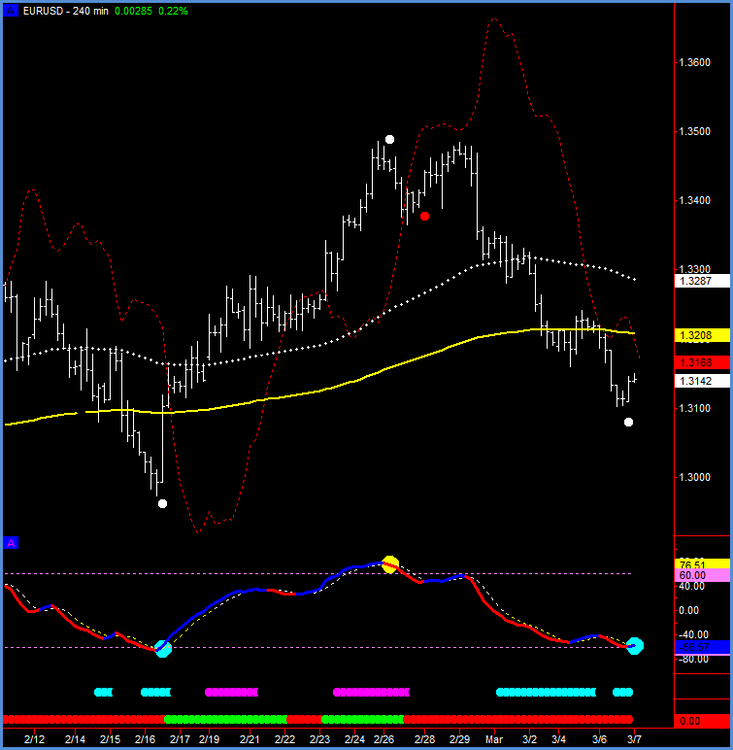

I typically trade with an open target letting my indicators determine the exit, but I aim to see 100+ pips on every trade, however, I will get out if markets are relativity quiet or unstable.

I move SL to breakeven+1 pip after price has moved to our favor by 50+ pips. This makes the trade risk free trade and I move on. I don't have any other trailing stop strategies, though I wish I had. I'm not interested in doing a 25pip trailing stop or anything like that.

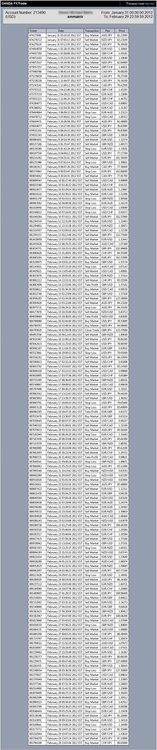

With my trading, I believe I am fairly successful. I trade 1:1 leverage and I am up +2037 pips Year-to-date and +23.74%. My goal is 100 pips per week, but I have been exceeding that as of late.

For instance, this week, with Forex, I had 13 trades (6 winners/7 losses), broker confirmation statement attached. I netted a total+248pips this week. Wish I can do that every week. In Jan, I hit +721pips, and Feb +946pips (broker confirmation screenshot attached).

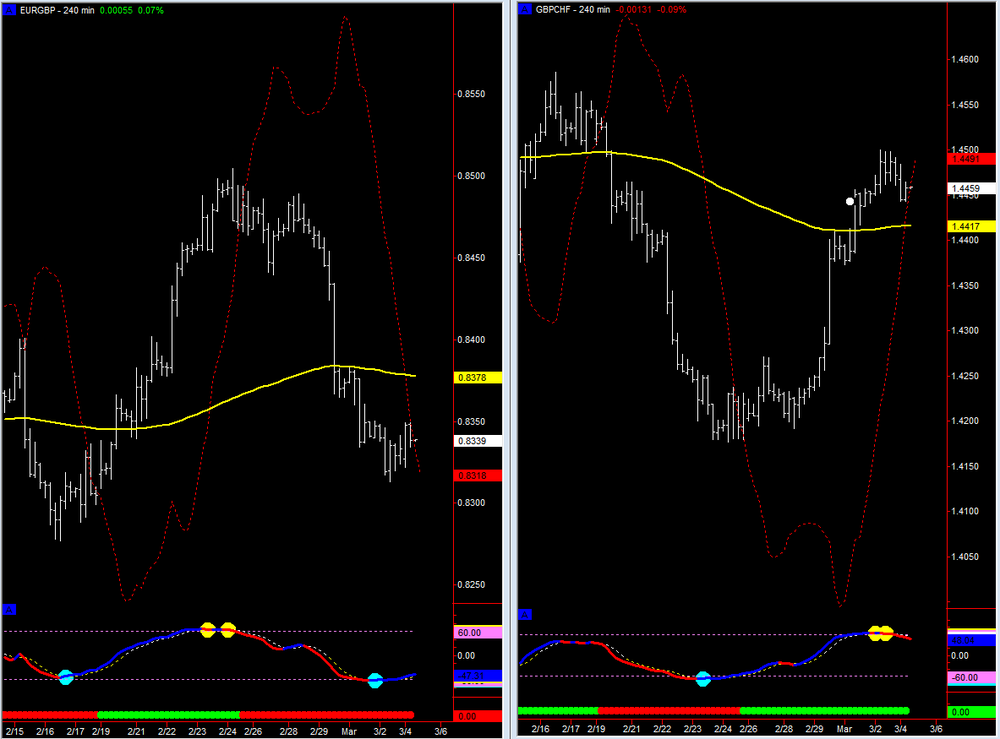

I prefer to trade off of 4-hr charts as it provides the best lifestyle for an active trader, but I often find myself taking trades off the 30min and 60min chart. I am still trying to ween myself off the faster time frames.

Hope this helps.

-

I'm almost tempted to try Tradestation. Easylanguage looks so much easier than NinjaTraders language. I love NinjaTrader, its just that i have to outsource my coding and it gets expensive for long extensive coding....another reason to keep it simple.I have a lifetime license to NT, so thats enough encouragement to persevere i guess. Whats Tradestation cost to use?

Cheers,

XS

Tradestation is about $250-300/mth depending on your data feeds.

However, if you fund an account (min $5k), you can get TS for a discounted price of about $150/mth.

If you trade with them, and have so many transactions per month, you can get $100 of that waived (almost free then), but still have to pay data fees.

If you only trade forex, I believe you can get Forex for free entirely if you fund an account. No monthly or data fees, but you are only limited to forex data.

The thing I do if have a funded account there, (no trading required). I get the discounted rate, and my monthly fees are debited from my balance.

Like I previously said, I love Tradestation and would not consider anything else as a professional trader. You can contact my rep at Tradestation if you have more questions. He's happy to help:

Peter Albino

Direct: (888) 735-1222

Email palbino@tradestation.com

-

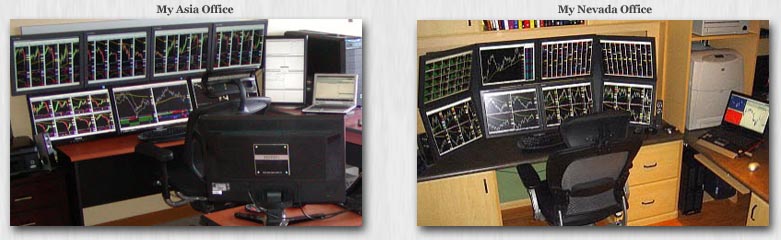

I have two offices, one in Asia and the other in the U.S. I spend an equal amount of time at each place, and my trading desk are almost identical along with my trading assistants.

desk picture attached.

My charts are in front of me, and my trade execution platform is always on my side on a laptop. Redundancy is key. If power or internet go out, have immediate backups in place.

Yes, chair is very important. Spend a fortune on it. That's where you'll spend half your life, so make it comfortable. Just like your mattress, don't skimp on it.

Most of the time, the television is distracting, so lose it.

Tip for newbies: If you're not profitable now, spending lots of money on a revamped work area is not going to make you profitable. Get profitable first, then expand as you grow.

-

Hi there! I'm a newbie here. I'm a article author of life, love, goals, politics, news, health, and other interesting things. I find this site interesting and informative and I know I'll enjoy it here as well as learn more to widen my views.Welcome aboard. We look forward to your posts.

-

Respect mate, you seem like a knowledgeable guy!!Can you elaborate more on the differences (advantages) of what you are using? are they easy platforms to operate with or smth I will get lost? seriously first time I hear about then. Oanda i've read somewhere it is a broker right?

I like Tradestation for charting because I write my own code (indicators), which I can write scripts to back test over many years of data. I also stick with Tradestation because I am most comfortable with them, and their charts. When I see other charts, it seems like I'm looking at toys or wannabe charting services. By the way, I still use bar charts, never took a liking to candles because I feel they take up too much chart real estate. Just like Tradestation, I like bars better than candles because that is what I am used to. Chart image attached. As you can see, my charts are simple, no flashy indicators or anything like that. Price action is always the primary indicator and I often wait for markets to prove its intentions before jumping in based on indicators.

Next, I like Oanda for trade execution. Excellent customer service, very tight spreads, excellent platform, etc etc. Oanda is one of the biggest, but also it is interesting to note that Oanda is the number #1 broker with highest percentage of profitable accounts. Source: US Forex brokers profitability report for Q3 2011 - OANDA back on top, profitability up | Forex Magnates

Oanda has held #1 position of most profitable accounts than any other broker for the all the quarters leading up to this report.

However, Oanda recently started offering Metatrader and guess what? Profitable accounts have dropped? Coincidence? I think not.

Now, Interactive Brokers is #1 (they have large percentage of professional traders and they do not offer Metatrader), so they should keep this #1 spot forever.

My best advice, trade using the tools of the professionals. Don't be afraid to spend a few dollars on a real charting service. Get very accustom to it and trade confidently.

-

huhhh, so how exactly are you trading forex then? :crap:Believe me, zulutrade or Metatrader do not have an exclusive on Forex. Not even close. They probably get less than 1/10th of 1% of the forex transactions worldwide. I was trading forex long before these guys and will continue trading forex long after them.

I use Tradestation for charting as I have done since the 80s. My first copy was sold to me by Bill Cruz himself (Tradestation called SystemWriter in those days).

For trade execution, I use currently Oanda for my personal/family trading account. And, I use HotSpotFxi for the institutional account I manage. Not my choice, but it's an excellent platform anyway and I am use to it.

It is only my opinion, but I feel the Metatrader platform is setup to help the trader lose money the quickest. It is made for the broker, you know! And, by the Russians! And, it's hack-city within that community. What do your really expect? It's setup to help you lose money the quickest with the way it positions leverage, and its use of colors (reds specifically). My two centavos.

-

-

The two names in Forex I dislike the most:

Zulutrade & Metatrader

Uck!

-

-

-

When I read on forums discussions about automated trading systems, the first thing that comes to mind are those high-frequency robots so commonly marketed via Clickbank which are good for nothing except emptying your wallet in more ways than one.

However, with credit to Bluehorseshoe saying that these funds do use automated systems to execute 100% of their trades. Then I think of those profitable systems which I have seen in the past which trade once every couple/few months or very seldom. Yeah, they're profitable, but the rate of too slow for me and did I mention a little too boring? Are their any HF trading systems that are profitable for anyone else except the broker? That remains to be seen.

I see Dunn accomplished a 1% return for January. Still, not great for the type of returns I'm seeking. I would rather continue manual trading. By the way, my results for Jan was +7.78%, and February at +11.82%. But again, I'm not moving battleships with my trading, as he probably is with his trading. I've had a couple good months, and maybe he's had a bad month. So what.

Bottom line: I am sure there is merit in some automated trading systems, but just not those ones that come to mind and commonly seen on the internet. I would be interested in testing/using systems that had low drawdowns under 15%.

-

Most of those mentioned - Dunn, JW Henry, Winton are LONG TERM trend followers, and some of them are very systemised.There is a lot of controversy about their systems in terms or are they broken, how systematic are they, how diversified they are, how long/short term they are, if they actually produce alpha.etc, etc;

This is very, very different from what most would consider robots for day trading.....

Others of note can be found here - a very good site to further investigate

Trend Following Wizards Performance | Au.Tra.Sy blog - Automated trading System

Makes sense. Thank you.

-

What utter rubbish! Go and look at the track record of a fund like Dunn, Winton, or John W Henry. Totally mechanical trading, and some of them have been doing it for over thirty years.Yes, there are probably a lot of crap, over-optimised trading systems out there, but the idea that trading systems as a whole don't work is complete nonsense.

Your source please?:

We would appreciate your source that the likes of fund managers like Dunn, Winton and John Henry are using mechanical automated trading systems.

Also, 30 years ago is a little stretch methinks. I started trading 26 years ago, we had little RadioShak TRS-80's with tiny numerical screens, but we received our charts via US Mail every Saturday morning on newsprint. We would hand draw our indicators on those charts and call our brokers to place trades. Mechanical trading was unthinkable then... at least for us mere mortals.

-

For every person who sells the high tick or buys the low tick, there are 100 others who try and fail. And the one who succeeds is probably just another losing guesser the next day.Sell the "smart money" crap to the gullibles who think that the future can so easily be predicted.

Profitable heh?

First you say "impossible", then you say 1 out of a 100. Which one is it?

Chill a little. Trading doesn't have to be that difficult. Its not impossible.

To Arm or to Disarm.

in General Discussion

Posted

A LITTLE GUN HISTORY

In 1929, the Soviet Union established gun control. From 1929 to 1953, about 20 million dissidents, unable to defend themselves, were rounded up and exterminated.

In 1911, Turkey established gun control. From 1915 to 1917, 1.5 million Armenians, unable to defend themselves, were rounded up and exterminated.

Germany established gun control in 1938 and from 1939 to 1945, a total of 13 million Jews and others who were unable to defend themselves were rounded up and exterminated.

China established gun control in 1935. From 1948 to 1952, 20 million political dissidents, unable to defend themselves were rounded up and exterminated.

Guatemala established gun control in 1964. From 1964 to 1981, 100,000 Mayan Indians, unable to defend themselves, were rounded up and exterminated.

Uganda established gun control in 1970. From 1971 to 1979, 300,000 Christians, unable to defend themselves, were rounded up and exterminated.

Cambodia established gun control in 1956. From 1975 to 1977, one million educated people, unable to defend themselves, were rounded up and exterminated.

Defenseless people rounded up and exterminated in the 20th Century because of gun control: 56 million!!!

You won't see this data from the left wing lib-nuts, US evening news, or hear politicians disseminating this information.

Guns in the hands of honest citizens save lives and property and, yes, gun-control laws adversely affect only the law-abiding citizens.

With guns, we are 'citizens'. Without them, we are 'subjects'.

During WWII the Japanese decided not to invade America because they knew most Americans were ARMED!