Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

winnie

-

Content Count

141 -

Joined

-

Last visited

Posts posted by winnie

-

-

Hi jthetrader ,

Thank you for your clear explains and help. I am trading the Hong Kong Stock Index futures.

My problem in using VSA is I always focus on the recent bars. When I see an upthrust, I always wait for short trade and ignore the whole bull trend.

:\

-

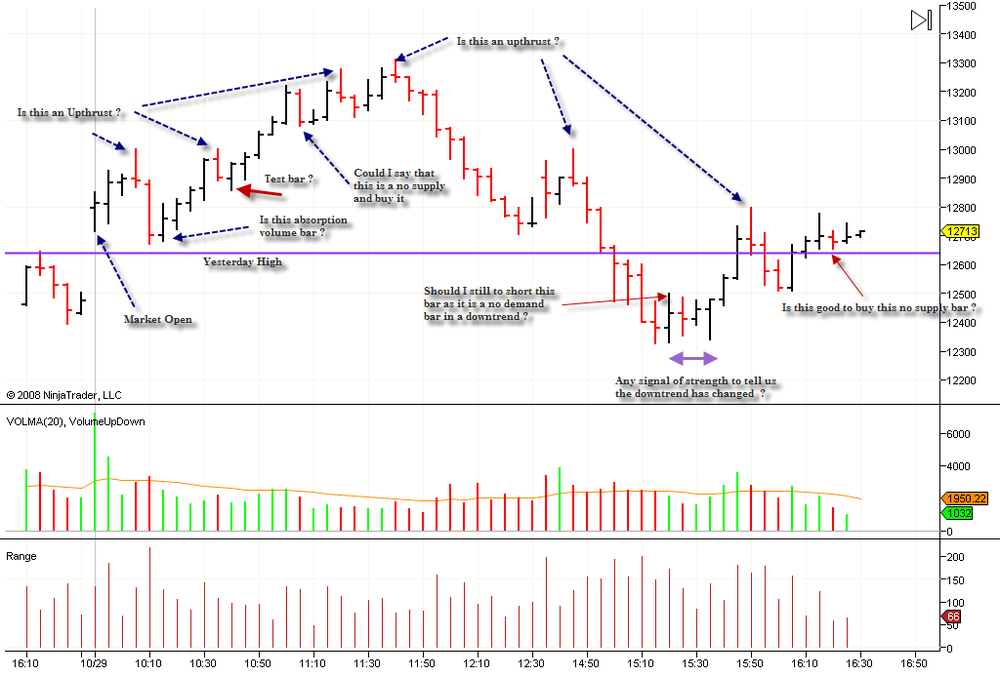

I have attached a chart with some question in it. Would anyone help me to answer ?

I see many upthrust on the charts and also do not know how to determine the change of trend in this chart ? In TradeGuider, they like to use a trendline channel. Is this a good method ? Eiger teach me to watch the shortage of Thrust is very useful.

Thanks for all your kind help

-

Dear all of you,

thanks for all your kind help in answering my questions. I have print all your charts and comments and read a lot of times to study. I have a problem in identify UpThrust. What is the definition of UpThrust ? Do we need the volume be ultra-high ?

Thanks

winnie

-

Dear Eiger,

You are right, I should have more patient and wait for the top or bottom to forms before entry and let the story begin start. Thanks for your kind help, your chart is really helpful and I study it many times.

Just a question : do we need a down close for a test bar in an uptrend ?

Winnie

-

Dear all,

Is wycoff has any method to determine the trend which could be used in intraday trading ?

Thanks

-

Dear Eiger,

thanks for your time, it is very clear and helpful. Would you tell me what is mean by downthrusts shorten ? How to measure down thrusts ?

Thanks

Winnie

-

Dear Eiger ,

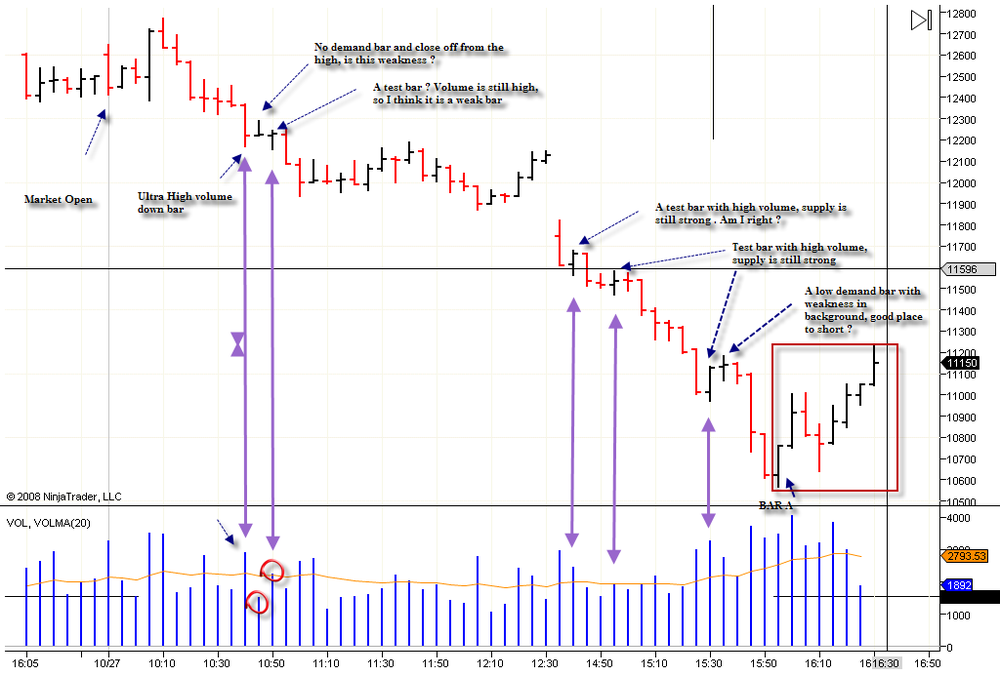

thanks for your support. I am practicing VSA everyday in both real time and after market. The hardest part for me is that the VSA concept is different than the traditional one. The hardest part for me is the testing bar. When I first learn technical analysis, it states that when volume is high and there is key reversal in testing the low, it should be bullish. However in VSA, it states that it is a weak bar instead of bull bar. Why does this happen ? Would you explain to me why a test bar with high volume is bearish ?

I have attached a chart for your reference. Would you point out my mistake if you have time. Today, I learn from you and focus more on the test bar volume. It works better.

Would you tell me could you see any strength starting from bar A of my chart ?

Winnie

-

Eigaroutstanding reading thank a lot

just a small question (maybe off topic--sorry)

I thought about Vspike-reversal and please how do you think about it ??. How is possible then sometimes start raly up without some litlle sideways(base) or test of bottom.??? As you wrote on the lows of yesterday. In this case I always wait for some small acumulation but sometime didnt.

When I read your post everything seems very simply and I dont understand why I didnt see this situation in real time in market

maybe experiences

maybe experiences Thank

I have the same feeling, cannot find such good setup in real time. I just take all the signal and use strict money management stop to trade only. Hope one day I could smart as Eiger. In real time, I always focus on catching the top and bottom. When I use multi time frame, I always find conflict signal. Hihger time frame down trend, but 5 minutes seems to form bottom. This make me do not know which side to trade, buy or short ???

Anyway still learning

Thanks

-

Dear Eiger,

Do you think we need to evaluate bar by bar (5 minutes) ? That means to drop down what the market is going to do in every bar . In addition, in your chart , at point E and H, both are no demand bar. In actual trading, would you sell the no demand bar at close or wait the low of the no demand bar be broken ? In this example, wait for the low be broken can save us from the losing trade at E as its low never be broken.

Thanks

Winnie

-

Dear Eiger,

Very very useful for me. I will continue to work hard:thumbs up:er and ask questions. Trading is not easy but very interesting.

Thanks:thumbs up::thumbs up:

Wnnie

-

Dear Eiger,

Thanks for pointing my mistakes. It is very useful. I think I need more experience in learning to determine the background. I always focus on the definition on no supply and no demand by just watch the volume is lower than previous two without consider the background. It is really useful, thanks for your time.

Winnie

-

-

Dear CandleWhisperer,

Firstly, thank for your time to answer my question. It is very helpful.

However, I still have some question in your answer.

As i said if the bar after the ultra high volume down bar is a no demand bar, should we still take a short position. The question is, if we combine the ultra high volume bar and the next no demand bar together, we would think this two bar will be strength. However , if we only consider the no demand bar, we will think it is a bearish signal. This really make me confused.

:doh:

Another question is in my chart which I have attached.

In the test bar, how do we define the volume is high or low. Do we use the same standard as no demand/no supply bar, volume less than previous two bars ?

Thank for your kind help and concern.

Winnie

-

Dear all,

I still have problem in identify the strength and weakness background. I have attached a chart for all your attention. I really do not know that if I see an ultra high volume bar follow by a low demand bar, in a downtrend, should I take the sell signal in the no demand bar. I feel confused is that :

1) Ultra high volume bar with wide spread , follow by an up bar should indicates there is professional demand in the ultra high volume bar , am I right ?

2) an no demand bar in a downtrend , show it is a bearish signal

When (1) and (2) combine, it become very confused. Hope you can help me crap:

I have find that in VSA club, there is a lot video which are very useful. I am not a member but just want to share with all you .

Thanks

Winnie:

-

Dear all,

If we find an wide spread dn bar with ultra high volume and next bar is an up bar with lower volume. We will suspect the dn bar has some demand in it, otherwise the next bar shold l be dn , am I correct ? If the trend is dn, should we buy or sell ? Usually , I find the next up bar after the ultra high volume dn bar is a no demand bar, this make me very confused . IF we combine this two bar(the ultra high volume dn bar and its next bar: a lower volume up bar) , it should has strength. However if we only take consider the lower volume up bar only , it is a no demand bar(should be a sell signal). What should I do ?

Thanks

-

-

Dear All,

I have one problem using VSA. When I see an uptrend and then I wait for no supply bar to enter. However, during the uptrend , it sometimes has some up bar with low volume(like a no demand bar) or ultra high volume , this usually a weakness signal, should I still wait for the no supply bar to enter long ? I find that even there is weakness in background, the market can continue to go up a while before actually reverse.

Thanks for sharing your opinions

Winnie

-

Dear All,

In VSA, we know when market move up with ultra high volume and spread, it is a bearish signal and no volume up bar is also no good . Then, how to define a healthy up bar ? What kind of volume and spread do we need ?

Thanks

-

Very clear and detail ! thanks for your kind help:thumbs up:

-

Dear all experts,

If we see narrow spread and high volume bar in an up trend with an up close, thus this mean it is a weakness signal in the background ?

Thanks

-

Dear All experts,

I have one simple question to ask. In no demand and no supply bar, we need the volume less than previous two. For testing bar, do we also need the volume lower than previous two and range are narrow ?

Thanks for your advise

Winnie:helloooo:

-

Very clear and very useful . Thanks for your kind help.

Winnie:thumbs up:

-

It is a good way to enter market at low volume bar. However, is any suggestion how to put stop loss ? It is reasonable to place stop a few ticks above the low volume bar high or low ?

Thanks for all experts

-

After using VSA, I know more about the market and feel it is not random move. However, I would like to ask all your expert, do you really sit all the day in the chair and focus 100% ? How to keep your focus ?

I am living in Asia, it is mid-night during the afternoon of the US market, sometime I feel tired and lost focus,this is a hard problem. any suggestion to solve ?

thanks

[VSA] Volume Spread Analysis Part II

in Volume Spread Analysis

Posted

Also I have problem in identify the trend. I really don't know how to define the trend. How would you define the trend. Am I too stupid ? :doh: