Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

29 -

Joined

-

Last visited

Posts posted by JMB

-

-

Well.let's be fair and realistic here.There is no method that works 100% of the time.But if we're being realistic we need to go much further and state that every single method being employed by the people on this forum has no intrinsic edge whatsoever..none (naturally i include myself in that category)In trading the most effective method you can employ is to cheat and lie and steal.Unfortunately you need to have the right connections for this to be a viable long term career path.Anyone who tells you different is either deluded or lying.My theory on why so many fail at this is because they spend far too long believing that there are methods out there that have an intrinsic edge,hence the years of frustration and disappointment.

I know almost nothing about Sam's method beyond watching one video on youtube and reading the odd post here.

From what i have picked up it is the usual story.A guy who worked inside the industry has some secrets to tell us about how you might go about predicting the future.

I can't find the relative post and it wasn't from the horses' mouth,but i seem to remember something along the lines of "when the last sell orders came in.only then would price go up".Unless Sam's broker was the only one handling the entire order this leaves me a bit confused.

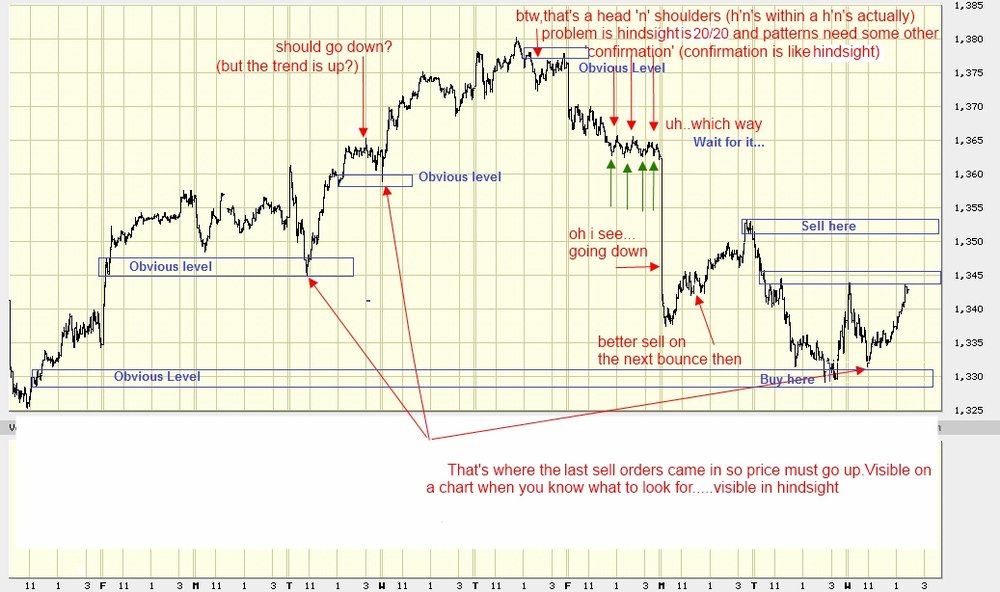

The other thing i picked up was something about "the more times a price level is tested,then the weaker it is"I think i've heard that theory elsewhere also. Well as the chart below shows that is just a lottery and so we need to quantify that a bit more and apply some other criterion,tick a few boxes to improve the odds,check a few different time frames.I'm sure there's a few more nuts and bolts you need to fit in order to make another guys' trading method work for you- and that right there is your biggest problem- it's someone else's method.

I'm also confused about how a market comes to a complete standstill during trading hours because of a 'price agreement'

But i have no agenda against Sam,well,no more than the next guru.And it's not my intention to disrupt the thread.

If Sam's methods gives you a few pointers to help develop your own game,that is all to the good.Don't expect too much more than that.Because for every guy that swears by Sam's method there's another bunch of guys that swear by another method and that alone should tell you something.And very few of any of these guys will be multi-millionaires- no matter how many 'students' the gurus claim to have successfully taught.

Hi Mitsubishi,

I thought i'd borrow your chart example and put some levels on there where you could have taken some nice trades.

People take the charts at face value, for that they look at the candles, for that they look at the orders that have already been filled, for that they take trades in the direction where price has already been filling orders, and what do most traders do? they put indicators on price candles that give an opposite view of what you should be looking for.

-

Hi JMB,As a general rule, all else being equal, you'll find that the larger your stop-loss the higher your win-rate. A risk/reward ratio of 10:1 where the stop is ten times the size of the target can push a win rate well above 80%.

Well,... All else being equal, a Risk/Reward where the stop is 10 times bigger than the target has probably caused for more margin calls than anything else. 80% win rate still means that you win 8 times and lose it all with 2 losses.

my

-

I traded binary options with Banc De Binary last year.....Banc de Binary is registered in Cypress. Most of them are b.t.w. I wonder why.

-

Let’s take this a bit further.

Let’s say that you see a nice trade in the EUR/USD and you take a short (sell) for example. You put your stop 20 pips above your entry and your target (in case you only work with one target) is 60 pips below your entry price. That is a positive Risk/Reward of 3:1. If you lose you lose 20 , if you win you win 60 pips,......Simple. You can actually lose 2 times this trade and win only one time and still come out ahead, but that’s not all. You can choose to close your trade whenever you feel, you can also close a part of the trade when you get to your target and look for a 2nd target and so on.

When you open a Binary option "trade" with let’s say $100usd and the payout is 81% they take your $100usd when you open this trade and pay it back to you when you win + the 81% on that $100usd. Many beginners at this will think that they actually won $181usd but we all know it’s just $81usd. Also when you open a binary option trade you have to wait it out until the hour (or whatever amount of time you choose) is over and get paid or loose. You have no saying over that trade once you are in. When you lose one trade you now have to win the other one to come out ahead, not to speak about a losing streak.

And then another thing. As you have probably noticed on all these sites this Binary Options trading is largely promoted to Forex traders as this is a very big retail group where 95% (if not more) of them are losing all their money, ....why would you think that is?

I know it all looks easier as you just have to bet (yes this is a wager on a derivative) on an up or down move but don't fall for it. Never take a trade where you can lose more than you can win, the only time in life when you would do that is when you buy a new car that drops in value when you drive it out of the showroom and where you will never get the same money back for it when you want to sell it

-

Hello Kent,

Binary options look good (as its promoted to be and look simple) but it goes directly against every form of effective investing/trading.

The payout on these Binary Options are 70% to 81% ON YOUR INITIAL "INVESTMENT".

This literally means that you will win $70usd to $81usd for every $100usd you put in, If you lose you lose your $100bucks, which in turn means a horrible negative Risk/Reward ratio.

Imagine taking a regular Forex trade where you put your stop at 100 pips away to make only 70 pips on your target. Some traders on these forums don't want to know anything about Risk/Reward ratios and that's ok but i have yet to see anybody making money with a strategy where you can loose more money when you lose then when you can win money when you win.

-

I just took a look at the website of the number 1 AsiaForex mentor. At first i thought that the price was $877usd and thought it was a lot but then i looked at it a bit closer and it actually states "All these for just $8777usd" .........????? Did i miss something here??

So i get to learn how and where to draw a box around already excisting price candles that consolidaded and where price could break out on any side at any time. I must have missed something here.

-

What we can notice from the chart is that price consolidates in the boxes and to eventually break out from the box to form another box.So price move in boxes when its not trending.

Well, its not that price moves in boxes, its that you drew the box around price.

-

Most traders in the beginning (myself included) jump at strategy first and believe that thats the only way as thats what's being told and sold everywhere. I believe one realy starts to learn to trade once you take a step back and look at the market for what it really is.

Trading is a plan in its whole and therefore has to be planned out from minute to minute from the moment you wake up untill the market (that you trade) closes. For example, a daytrading scalping strategy might work well for someone in the morning hours of that particular market traded You would not take a scalping strategy and trade it in the afternoon when certain markets are closed.

One question that i ask myself before i enter a trade is "would a big wallstreet firm, bank, hedge fund or institution get in here?" As i firmly believe they are the ones that have the actual account size to make price move from one level to another level and we "the small retail dudes" facilitate those moves, i think that that is the first place to start. No need for indicators here.

"the not-so-magic-trading formula, i like that title , thats exactly how trading should be. I wish i thought this way 7 years ago :doh:

-

Some traders have families to support and are the primary wage earner let alone tax issues. Simply, a young trader with no debt while still living at home with mom & pop is more likely to be compounding in comparison to someone with debt and sending the kids to private school.Thus, the young single trader in comparison has a much better chance of compounding in comparison to someone that has a family to support. In addition, throw in some realities like a divorce, serious family health issues at some point in a trader's career and the revenue service wanting their share...

I think you get my point.

You must be single and/or with no family and/or not the primary wage earner ?

Hi, wrbtrader,

Man, hahaha so true. To become a succesful trader my biggest challenge was not to find a winning strategy and developing a trading plan (seriously, thats the easy part). For me it was figuring out a strategy AROUND my family life. Got 3 kids , two go to private school and one little one (11 months) demanding attention 24/7 . The wife also works so half the time i'm changing diapers and looking at the charts at the same time. The single dude living at his parents house has such a huge advantage (only a shame you realize that when its too late and paying bills like there is no tomorrow hahah).

Sorry, didn't want to get off topic here but i guess there are traders out there that know exactly what i'm talking about. "How to be a trader and having a family life" could be a good title for a whole new thread.

-

IMHO as its too often misunderstood, glossed over or just thrown out there - all the constant talk about RR is probably the greatest load of bollocks ever dumped on the trading community.

I personally think we all trade with a R/R ratio wether we conciously trade with it or not.

For example: If you take a trade entry (lets say short) and lets say that for that trade your stop above your entry turns out to be 15 pips, when do you decide to move your stop to break even? I mean , there is an amount of pips where you already know beforehand where if price hits that level you would move your stop, after that there is an even lower level where if price hits that level you would move your stop again. Off course at this point you're now in a win/win situation but the moment you enter a trade and have a stop loss on i certainly may hope you are looking to gain more then you initial stop loss.

Here i would like to ask you a question. If you are not trading with a R/R ratio, how do you define a High probability/low risk trade? Not attacking you here by the way

-

"Low" or "high" relative to what? In your case, you're defining low and high in relation to where the market has been. But that doesn't matter--it only matters where the market is going. It's pretty simple (but not necessarily easy): don't fade a trend day because the price is "high" or vice versa. Buy high, sell higher, if that's where it's heading.I do have a bit of a contrarian view on the market i confess. I define High or Low based on a higher timeframe and its trend.

I do work with R/R ratios because thats a way for me to define a target, this does not mean that i take my trades of the table once that target is hit, i move my stop to break even when it gets to target 1 , then move my stop to target 1 when price gets to target 2 and so on, i'm more of an All in All out trader. Stops/amount risk and targets are always different as in amount pips. I would never have a set amount of pips or points for my stop.

Joshdance, in your comment you say that it matters where the market is going, thats correct, but i'll be the first to take the opposite trade (fade that trend) where the market should be.

I guess everybody has its way of going about it.

-

That great guys, many thanks for your comments and ideas. I have read all of them and i can say that all of you have different style of trading Forex. However, i have share these tips as it is helpful to me and i usually use this style to trade on daily basis. I wanted to see whether we have some similarities in trading forex and also i wanted to share it as maybe it can help some of you. Some of you did not agree with it and i can understand as you might trade differently. I just wish that we can share other thing as many here have the potential in Forex.Hi Samuel.

One thing that was very helpful to me was to throw away my trading books all together (or at least put them in a box). If you are trading with indicators then read Constance Brown book/ or books) . I once downloaded a zip folder with 250 trading books, all with their own vision on what the market should be or how the market should act and react and i got totally dazzled and confused.

Another thing,.....take of all indicators and oscillators and MA's fom your chart, sit back , look at it,............what do you really see? candles or bars wich represents peoples percieved value of the market. Talking about values, If you see that price is high up on your chart then the price (for me ) is high, nobody wants to pay a high price for anything so start thinking of selling. I'm not saying you should sell right away but you should not think about buying. all in the right context off course which is always a higher timeframe trend.

Another way i can put this: If i take a short entry, there's no way price has a chance of moving higher. When i take a Long entry , there's no way price has a chance of moving lower. Sounds all simple but i would never make that decision based on an indicator or a line i drew or because an MA is telling me that price moves lower in comparison of the last 10, 20 30 bars. Buy low , Sell high, most traders have heard it before and are sold the idea that it's not possible to pick tops or bottoms but its the only way for me.

-

Hi Samuel,

I personally do not trade with any indicator. I might on smaller timeframes look at a Bollinger Band as it moves faster to see if it has confluence at the level i'm looking to take.

Many traders are not very succesful at this game and yet many traders are using the same indicators. If you want to have a real look at how to use indicators in a better way (so you can have an edge,...or bigger edge over other traders) you might want to consider Constance Brown's book "Technical analysis for the trading proffesional" . It will give you a better understanding on the WHY you should use but more so HOW to use them. Oscillators do not always move between 0 to 100. You'll be surprised.

Good trading to all.

-

Trading in the forex market tends to be a little confusing when you're first starting, which is why it's vital to your success as a trader to understand technical indicators and use them within the framework of your forex trading strategy. Forex indicators assist traders in predicting the direction in which the currency market will travel. Following the indicators will give any forex trader the information they need to work their forex trading strategy.You see technical analysis is just the study of the short term price action in the market. Now, this short term price action is determined by the buyers and sellers in the market. Markets are just buyers and sellers trying to buy or sell. Their emotions rule the markets. When these buyers and sellers all start behaving in the same manner, you can well imagine market can become highly predictable. When things become predictable, they lose their value. This is the exact reason why when majority of the traders use the same indicators they become useless.

The different types of Forex trading indicators depend upon the need of an individual. For just a technical support, a trader needs to set up the whole scenario of deriving the very least of information from the indicators. This can be a set up of two or more kinds of indicators which are combined in order to obtain very helpful results.

In a layman language, indicators are something which alarms you to trade. It sets up informative surrounding and makes work much easier. It is supported by trend, cycle, volume and momentum in trading. The indicator uses trend to show the ongoing setup of the market. It makes the trader aware of the uprising or downfall in the market which can be used as a piece of information.

The Bollinger Bands

They give very good signals and can be used as support\resistance indicators, telling us - before the move occurs - that a reversal is prone to happen. When price touches the lower band it is oversold, and when price touches the upper band it is overbought.

The trading method for the Bollinger Bands is basically to look for price-action support and resistance levels, and confirm them with bounces on the Bollinger Bands themselves. This results in very high win rate and consistent profits.

The Simple Moving Average, or the SMA, is an interesting indicator that most traders do not use in the right way. Most traders use it as a trend-following indicator to enter trades after a trend has been established, however we use it in an entirely different way.

For example:

The last five closing prices for MSFT are:

28.93+28.48+28.44+28.91+28.48 = 143.24

To calculate the simple moving average formula you divide the total of the closing prices and divide it by the number of periods.

5-day SMA = 143.24/5 = 28.65

The most accurate and predictive way to use the SMA is in the bounce method: we wait for trend to establish, but instead of randomly entering, we wait for price to retrace to the moving average and bounce off it.

Relative Strength Index

The RSI is the abbreviation of the Relative Strength Index, which is introduced by Mr. Welles Wilder in 1978. The RSI method is one of the Oscillator analysis, which indicates the gapping in the forex market using figures, 0 to 100.

RSI = 100 - ( 100 / ( 1 + RS ) )

RS = Average of inclining prices for X days / average of declining prices for X days

Now you have to choose which one is best for your trading

Hi AndySteven,

Personally don't use any indicators but if i did then i would apply the methods and indicator use/settings from Constance Brown's book "Technical Analysis for the Trading Professional". A must to have an edge if you trade with indicators.

-

I actually went back to watch the Boris Schlossberg last webinar. I still couldn't watch the whole 44 minute webinar but i wanted to see if there is anything i missed from that webinar as some traders see a good way of trading in this method.

Now, for the sake of this thread which started out as the "tip for better trading" thread i would like to point out to newer traders that:

-Its not very wise to start out trading as a scalper (especially not in the spot fx).

-Its not very wise to have a negative R/R ratio (i.e. bigger stop loss than target point)

-Its not very wise to take trades without knowing your R/R ratio at all. (If you have a reason or criterea for your entry , the opposite of that criterea might be your exit,....or at least a reason to move your stop/ trail your stop).

And its certainly not wise (and this is a big one) to buy higher when price is already high or sell lower when price is already low. This was another thing that Boris Schlossberg was preaching about.

Off course, looking at Boris Schlossberg's last webinar it very apparent that he is a momentum trader. He say's that he is succesful with it , maybe he is but i think its very dangerous to trade that way, especially for newer traders.

Not trying to be the expert here, just thinking the logic through.

Good trading to all.

-

When I went to school 70 was a passing grade. A high grade didn't start till 80 up into the 90's. 100 naturally was excellent.High probability is not 70.

So guess why he uses 50 and 20. He doesn't add them together. :doh:

He has a win expextancy of 80% or higher.

Is it true? I don't know and I don't care.

All I have been doing is explaining, obviously not to your satisfaction, why he trades the way he does.

It makes perfect sense to me, even if it is not my style.

But you on the other hand won't accept it because it doesn't make sense to you how someone can win, in the end, by risking more.

You'll get it, someday.

Its all OK mate, no worries.

The title of this thread is "Tip for better trading". I just did not see much merrit in B.S.'s system. Risking 50 points to gain 20 points is in my eyes not a very good example of a "tip for better trading" , i don't care if your win EXPECTANCY is 100%.

:missy:

-

He is willing to risk 50 to make 20 on high probablility trades - only.Do you understand the written word.

If you know anything about horse racing where there is a favorite at 2 to 1 and a bunch of long shots at 50 to 1. Which horse would you be more comfortable wagering a greater sum on?

Of course the long shots pay off bigger but only on the rare times they actually win.

If you have strat A at high probability and strat B with low probability which would you go big on?

Simple math: risk 50 / make 20, winning 8 out 10 times equals 160 - 100 = net 60

This is for a scalper type scenario. Something most traders lose at. As I said I don't trade this way but for those who have a short attention span and have a need to have a high win rate it can work if done right.

BTW myself I don't use R/R ratios at all. Price doesn't care.

Hi Suntrader,

Thanks for the math class. I just realize i am not as good at math as you are.

Could you explain me and maybe all the other traders out here what happens if you risk 50 to make 20 and win 7 out of 10 times? even if you would take trades ONLY on High Probability entry.

-

. But you left out the part where he is willing to lose 50 to gain 20 .... on high probability trades only.Ehhh, did you take a good look at what you just wrote there?

1) He is willing to lose 50 to gain 20. Thats not a very High Probability set up now is it?

2) On High Probability trades only. What???? does he also trade LOW probability trades??

You are right , i real real do not understand this guys way of trading ,...thank god for that!!

-

Knowing "where" NOT to trade is a rule that will keep you out of bad trades.

Most "Trading educators" out there "teach" you a trading strategy that looks good, yet most traders still lose money.

Having that said , only context can tell you where you should enter a short or a long trade.

This is something that i have not seen many "if any" teacher teach.

You can take a startegy that sucks but if you enter that strategy in the right context it can still make you money.

Talking about scalping,...well, its Ok to do , just not in the spot market. Way too many comissions or high spreads to pay and that is if your broker is working in your favor :haha::rofl:

Futures would be better for that.

Another thing. This thread just started but it will likely grow out of proportions due to the catchy word "secret". Everybody wants that secret to make money in FX. Whats the secret?? Think the Logic. If you buy bananas at the store , buy the most green ones (they last longer) If you sell bananas sell the most yellow ones (they do not serve you anymore) get the point. BUY LOW , SELL HIGH.

My

-

karoshiman,I know this isn't your idea since I have heard it before, but it is purely delusional.

You make a hedge fund sound like a lumbering whale. You have zero advantage over a hedge fund assuming that both of you know how to trade, in fact, you are at a monstrous disadvantage because of your size. They can employ tactics and strategies which are simply not economically feasible for you because of your size. This really needs to be thought through.

There are plenty of people on these threads who desire to be viewed as being enigmatic. I understand that anybody can be anything they want to be online and this is fun venue to be something they are not. I suppose the practice fills a gap or something like that.

MM

I would say that we do not need an advantage over a hedge fund/institution/bank. You can see them on a price chart and its our job to get in at a better price before their limit orders get hit. Damn , is it me or did that just sound super cool?? :rofl:

-

this is an example of how many traders' mind workHahaha thats a good one :thumbs up:

-

The cult of technical analysis and day trading seems to grow and grow. The Web is crawling with technical analysis (TA). Tax changes have created a boom in spread betting, and hundreds of courses have sprung up to teach traders to read short term 'technical' chart set ups. All of this - coupled with the ongoing use of the terminology by market commentators and practitioners - may make you wonder whether technical trading rules are profitable and worth using in your own investing? Given its popularity, is there something to all this TA, basically?Rest at:

Technical Analysis Debunked: 5 Reasons Why We Don't Believe In Charting | Stockopedia Features

--------------------------------------------------------------------------------

TA is IMHO the only way to objectively take action from and enter into a trade with a real plan that you follow consistently. This is also the only way you can realize if your plan works or not. At leat you can put some numbers to your trades (even proffesional BlackJack players have an objective system with technical rules, they can't take the dealers word for it). Everything that happend in the market (fundamentals included), is happening in the market (fundamentals included) and will happen in the market (fundamentals included) is already considered and taken into account on a price chart. For this reason you can put a plan towards the future with Technical/Objective analysis. How can anyone make a consistently profitable trading plan/system by looking at the news on CNBC?? You cannot just say: Ok of Bernanke says the buzzword "Interest rate" i will short. The experts you see on TV who are giving you their view on the markets are probably working for an institution/bank/fund that looses when you win.

Just giving my opinion and i'm definately not an expert here.

Is it not funny when the experts say that a certain market is very strong and bullish that always two things happen: Your spread widens for about the double or triple and after that the market drops like a brick in mid air.

Well,....my

-

Many traders can't (or don't) take the small losses. They often stick with a loser until it really hurts, then take the loss. This is an undisciplined approach...a trader needs to develop and stick with a system.You'd be amazed by the amount of traders without a system and trading plan. Some even teach and preech on it to not have a stop at al.

When people go to a casino with a 100 bucks they usually loose it because they are ok with that because in the end "the house always wins, right?" They are the players without a plan. But there are players out there that bring home a good living from the BlackJack table, these are the players with a good plan and system and stick to it and modify it when there is a flaw.

The other day i saw a webinar on very well know website. The guy who led the webinar is actually a very well known FX trader but i couldn't believe what this guy was "Teaching". At first he started off saying that his system Buys high and Sells low (????). Then he say's that he is perfectly fine by having a 50 pip stop to take a 20 or 30 pip gain (????) , whatttt?? a negative R/R ratio???? Then this guy is selling his service or system online.

Actually his real initials are B.S. believe it or not , i'm not joking :haha: thats exactly what i thought of his system

-

and maybe markets based on human traits have similar ratios.

I just need to remember Keep it simple, keep it simple keep it simple.

I'd personally say that there are no ratios at al. I lean to Suply/Demand and business cycles. Well some might see that as ratios.

I also think traders need to keep it as real as possible and think logic about things. To give you an example. Almost alway's when you go to any brokers website they offer you FREE trading courses or even worse a complimentary signal service for a month or two, but what is the logic behind that?? Why would a company teach you how to REALLY trade and win and make money if that's exactly what would make them loose, right? If you win, the broker needs to pay up. Having that said and going back to keeping it simple,......can we keep trading simple? I'm not so sure about that but we can cross out what's bogus and look at what is real and keep a logic view of things.

Sam Seiden-Understanding The Exact Process Behind The Movement In Price

in Trading Videos

Posted

Hi Patuca,

I wish i did. Trading is going all good and all but ehhhhh the thing is in Mexico you'll be happy trading on a "so so OK internet connection" in your own home let alone trying to do this on the beach stealing internet from some hotel hotspot hahaha. 2014 and they still look at you if they see water burning when you ask for a connection which is a bit faster then 10megs :crap: