Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

indextrader7

-

Content Count

60 -

Joined

-

Last visited

Posts posted by indextrader7

-

-

Trading with indextrader7: Help me find the pattern?

Latest article points out a time of day pattern over the past six sessions in crude oil.

Does anyone follow this thread???

-

-

The seven phases of my trading:

1. (Day 1) I've got a great method of trading, let's be patient, focus on having a probabilities mindset, take these setups, and manage risk.

2. (Two days later) I am having good success with this.

3. (7 days later) I am really on fire, I have been profitable for 9 sessions in a row.

4. (Next day) A breakeven day or two, I'll do better next session. Risk management is getting a bit inconsistent.

5. (Two days later) Daily loss limit hit, man, that sucked, I'll do better tomorrow. This is only a temporary setback.

6. (Next day) Daily loss limit hit again, wow, what am I doing? I've got to re-think this thing. I've got to question my setups, question my analysis, question my exits, question the market I am trading, question the timeframe I am trading, etc.

7. (A day or two) Spend hours and hours and hours pouring through charts, trying to find the answers to prevent the losing sessions I have. Find "the answer".

1. (Start at day 1) I've found it, I now have a great method of trading, let's be patient and take these setups, and manage risk properly.

------------

The truth is...the bottom line is that.... all of this is too emotional.

I need to focus more on simply executing my edge, which is in fact an edge... IF I execute the risk management methods that go along with it. You see... even as I say that, I am admitting that there is a difference in my mind between my "edge" (hear setups) and "risk management" (hear exits). There is no edge without both in place.

I must continually focus on keeping a probabilities mindset and executing my plan and processes.

I will admit that I am growing awfully tired of going through the 7 phases. I'm still net profitable over the full cycle, but it's taking a toll on my emotionally.

-

-

Here's today's article. It's about an interesting observation I made in CL lately Trading with indextrader7: Bull-Bear Cycles in Crude Oil

-

Trading with indextrader7: Live Trading Webcast 2-28-13

Here's today's recorded trade session. A losing session today, full daily loss limit hit. This may be more important for new traders to watch than to watch a winning session!

-

-

Trading with indextrader7: Psychological Journal

An article I wrote on the idea and application (in my own journal today) of a psychological journal entry to enhance trading. I think y'all will like this one!

-

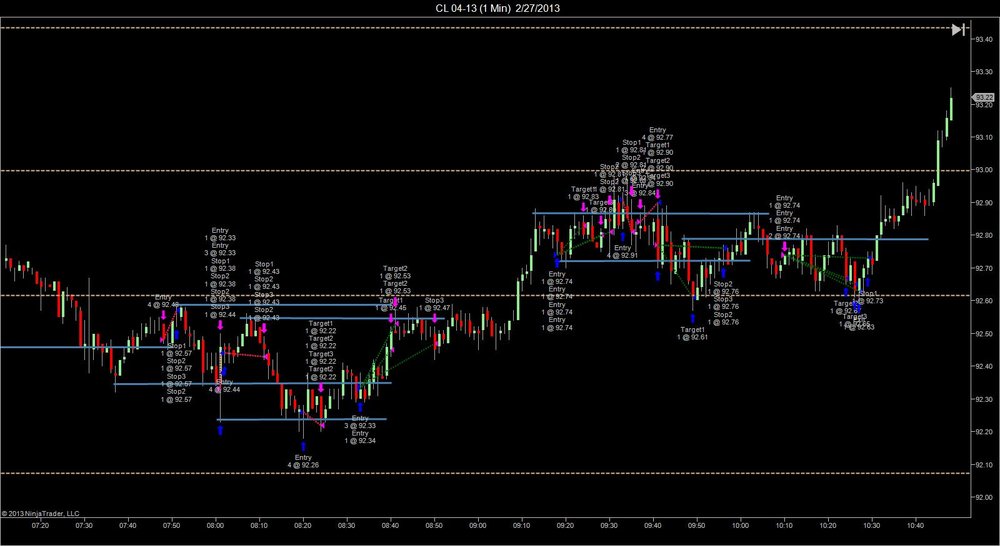

Today's recorded session now available Trading with indextrader7: Live Trading Webcast 2-27-13

It was a challenging day in CL for me, and the first losing day in 7 sessions. I feel like -1 tick today was a success though, given the PA.

Here's the picture summary

-

-

Hope everyone had a good trading session today. I was +32 ticks on the day (average ticks per contract traded). Could have been a better day, but I had a few trade management issues.

If you missed the real-time trading session this morning you can find the recording on my blog. Trading with indextrader7: Live Trading Webcast 2-26-13

I also recently posted an article on a great tool for measuring profitability, and gauging drift in trading performance. Trading with indextrader7: How good do you have to be exactly?

-

Real time trading webcast starting in a few minutes

If you have google+ (recommended) join here: https://plus.google.com/hangouts/_/a2872c7980b35ac224ce7cb8ce45bb35da6b85f6?gid=893851448980

Don't worry, I can't see you or hear you, I have everyone auto muted/blocked with a program. You are encouraged to chat if you have comments questions.

If you don't have google+ and/or refuse to get it, you can watch on my youtube channel, as it will be streamed live there. You wont' be able to participate if you want to comment/question. Here:

Let's get it!

-

First blog article about using MAE and MFE in a creative way to enhance trading.

-

I'm not sure if any of you were able to make it out to the webcast today, but it was a great session to have up. No, it wasn't a destroy the market hundreds of ticks session, it was a real grind. A real picture of what it is like to have 5 trades go against you, but manage risk properly and be in position to bank when the big setup comes to you.

If you're a newbie, watch the whole thing. If you're just wanting to see the trades, press the next button at the bottom to fast forward to the start of each trade.

Enjoy!

-

I'm testing out a different format today, Google+ hangout.

You must have a google+ account (quite easy to sign up for) to log directly into the webcast and interact with me. You can go to that here: https://plus.google.com/hangouts/_/c65534d440674133dfdade61820c59d9f49e74e5?gid=893851448980

I will have you auto-muted, with sharing and voice also off on your end. I want this to be a clean, mainly one-way presentation. Chat is enabled, and encouraged. Please direct most any chat you can to the whole room, as last time people heard me answering questions that they couldn't see.

If you don't have a google+ account, and refuse to get one, then you have another option. The webcast will be streamed live on my youtube channel. So you can watch here: indextrader7 - YouTube

Starting now, let's have fun.

-

I'm broadcasting my trading live tomorrow.

I was having a conversation with a non-trading friend, and explaining them things about my journals on BMT and such, and they got me thinking about how helpful it could be for someone to see me trade, and hear me talk out my thought process live.

Join me as I continue to sim trade CL and prep for the TST combine. I'll be starting at 7am CST.

I think you may have to click on the audio button once logged in in order to hear me. I'll have your end muted, but feel free to chat if you like.

Here's the link! https://join.me/572-521-271

Could be fun!

-

This thread is no longer active. Please ask questions on my journal at big mike's. Thanks.

-

Index Trader,I looked around for Big Mike's Traders forum and could not find it. Is that within the E-mini futures trading section?

Thanks, CMA

You'll find it in:

FORUMS > TRADING JOURNALS

-

MAE is what I saw on one of the charts: Maximum average excursion?Did all these stats come with your trading platform for your to fill in; or did you create the stats from scratch?

I made my own excel spreadsheet from scratch. I haven't found a platform that can realize that I'm still in the same trade when I scale in/out of a position. They all treat them as separate trades which throws off my true stats.

-

With such favorable stats, and very reasonable drawdowns, aren't you inclined to increase trade size?I'm building a track record, so no.

-

I love your flexibility and willingness to stay with your main theme for the day (upside breakout).What are the two time frames in the two trading windows and and what the trading platform?

I change around from time to time, but mainly watch the 50 tick and 250 tick charts.

-

Great hands-on video, showing how a practical working trader makes money even when things don't go right.Do you always go home flat?

Yes, always flat at the end of the day.

-

Indextrader7, it is great that you started this TF thread.The ICE site shows 0.964 correlation of $RUT and $SPX for period 1/1-9/8/2011.

I'm a long time stock trader and former ASE options market maker. I'm interested in getting started in TF.

I wonder if you (or other TF traders) could touch on practical issues for newbies:

FCM recommendations (pluses and minuses) and trading platforms used.

Thanks, CMA

I've used Tradestation and OEC. I feel like the majority use Ninjatrader. I think you can't go wrong with any of those platforms.

-

I've been carrying this thread on at multiple forums. I am consolidating my trading journal to one place because it's too much work keeping multiples.

I'll be over at Big Mike's Trading Forum. Journals section - "short term TF trading".

See you around.

Short Term TF & ES Trading

in E-mini Futures

Posted