Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

310 -

Joined

-

Last visited

Posts posted by TimRacette

-

-

Do as others do and you'll end up like everyone else. You're better off in doing your own thinking trading your own methods and being different.

-

Certainly! The flexibility and free time that trading for a living provides is why I love it. Great book.

-

Stocks that you hold less than 1 year are taxed at your income bracket level, over 1 year at the capital gains rate, and futures are 60/40 (60% taxed as long term/40% as short term). I'm not a tax expert, but Robert Green's Book, Tax Guide for Traders would be one to checkout.

-

My my, does your website contain more such nuggets of knowledge?Thank you. Derived from years of experience and learning from some of the best traders in the business. Best of luck to you.

-

I think there is a lot of subconscious analysis that goes on aside from the system itself, "Trader Intuition." To be able to fully pass along a system and have it function with someone else behind the wheel is pretty difficult, if not impossible without making at least slight changes.

-

To prevent the dreaded “blow up” of your account you must place a max daily loss limit on your account. Don’t just write it down on a post it. I'd recommend no more than 5% of your total account balance setting a hard loss limit with your broker to ensure this rule will be followed.

-

Hey Johnny, haven't heard from ya in a while, how has the live trading been going? I remember two "light bulb" moments in my trading. This first, was when I let go of my impulse trade (as John Carter would say) and followed my setups exactly, letting them do the work.

The second, was when I got myself to the point where I was fully detached from the emotions of losing money. I was risking such a small % of my total account that each stop out was insignificant and I became able to think objectively and clear from entering,during and exiting the trade. No change in heart rate on a winner, or a loser.

-

Along a specific setups, I prefer to limit myself to certain times of the day (mainly I stay away from the US evening time frames). Over the years I've discovered trading less lead to more efficiency and larger returns.

Rather than limit myself to a # of trades to take, if the market has NOT produced any setups in the morning I will usually close out early. On a day where lots of setups are occurring and hitting my targets I will continue to trade. This ensures I won't over trade on bad days, but also take advantage of profitable markets on good days. Just my two cents.

-

I learned by studying charts both during and after hours, looking for similarities and ways to limit my risk. Attacking the markets from the losing side the winners will take care of themselves.

-

The EminiMind blog is another good one for learning about ES & 6E futures

-

The futures markets are certainly the most liquid, but I think the draw to stocks is actually the less liquidity and slower speed. I think swing trading stocks is a great way to begin trading as apposed to jumping right into day trading. Of course that's just how I began and is entirely my opinion.

-

Great insight Bootstrap, I think that ideology creates a quality foundation and leads to a fulfilling life. Thanks for sharing.

-

Tim,What do you mean by "technical" in the context you used the word?

Just that there are participants at my setups. 7AM to 12PM CST seems to be when my setups work the best.

-

Hi Tim, do you mind to share where can I get audio book for trading especially on trading psychology. So that I can listen while trading.Cheers!

Mastering the Trade, by John Carter is a good one.

-

-

One of the best parts of trading is to be able to work according to your own schedule. Frankly, it’s not even work when you love what you do. Yet a “typical” trading day becomes almost boring over time. I say this because your strategy and rules become so ingrained in your subconscious that you simply act the same way in each situation according to your plan.

“Expect the unexpected, and whenever possible be the unexpected”

No matter what the market throws at you, you must always be prepared. The market throws curve balls at you every day and you must be ready for them. Come along with me as I take you through my typical trading day. You can read my full story here.

(All times are in CST – Chicago Time!)

The trading week begins on Sunday

The trading week really begins on Sunday night. No I’m not trading the Globex market open; I’m doing a bit of prep work for the week ahead. Sunday night is a great time to review the news announcements for the week, read through any weekly forecasts, and go through watch lists.

Most of you know that I trade both the Euro open and the NYSE open using the E-mini S&P and the Eurodollar Futures, this means that I must wake up at 2:00 AM. I have adopted a bi-phase sleep schedule to do so. This means that I sleep for 4.5 hours, wake-up, trade the Euro open, then go back to sleep for another 1.5 – 3.0 hours before waking up again to trade the NYSE open and go about my day.

There is a lot to be said about sleep cycles, more than I care to delve into right now, but from my research (an actual experience) I’ve found that waking up on a 90-min increment such as 4.5, 6, or 7.5 hours results in the most refreshing and satisfying sleep because you are waking up at a completion of a full cycle.

My Daily Trading Schedule

2:00 AM Begin trading at the Euro Open

The first thing I do when I wake up (after grabbing some juice and toast) is to see what Germany did in the hour leading up to the European open. Typically the European session will do the opposite of what Germany did. I’ve found this holds true on Tuesday, Wednesday, and Thursday mornings (the meat of the week). Monday and Friday are typically less participation days.

Since it is slow and quiet during the wee hours of the morning I will throw on an audio book or some podcasts to listen to. I find that I am the most productive during this time so I will occasionally work on a blog post or other project if I am waiting for a level to set up it is especially slow (such as right now!)

(I begin Euro open trading on Tuesday morning as Monday is usually uneventful and slow).

5:15 AM Back to sleep for 90-mins

If the Euro session is really slow and I haven’t had any trades by 3:30 I will go back to sleep at 3:45. I try and get to sleep by these two times because it allows me to complete a full one or two sleep cycles by the time I wake up next for NYSE open trading

6:45 AM NYSE open trading begins

I call this NYSE open even though the cash session doesn’t open until 8:30. This starts the main part of my day. I usually feel refreshed and away both times I wake up. After taking my resting heart rate I throw on some clothes, grab a yogurt and some orange juice and hit the office. (Oh yeah, forgot to mention that my office is down the hall from my sleeping quarters, a nice feature to say the least).

I review what has happened since the Euro open and take a quick glance at Reuter’s news headlines. Then I pull up my daily notes and fill out the day’s numbers. I read over my trading rules (again to engrain them into my subconscious), by now this has just become habit, and the trading beings, (or resumes).

(I don’t trade the ES during the first 30-mins because it is erratic as market orders hit the tape).

10:30 AM Lunch Time

This is more of brunch as I will make eggs or some sort of sandwich. I always eat at this time because I found that over the years I almost never had a winning trade on the ES from 10:30-11:00. This is also the Euro close so I like to let things settle out. It’s not worth my time to trade this time frame. If everyone else is at lunch, I should be to.

11:00 AM The home stretch

If Euro has been technical all day I continue trading it until 12:30. I also look for a full trading hour’s only halfway back setup on the ES around 11:45-12:30. This is usually the only setup I will take after 10:30 on the ES, else another larger 15-min setup. I stay away from the micro time frames as most of the time this the slowest and choppiest time of the day.

12:30 End Trading for the day

The first thing to do is congratulate myself for following my rules, regardless of P/L. From there I fill out my trading journal and review all my trades from the day. I rarely trade past 12:30, only if it is a super technical market on the ES in which case I will trade until 2:15 as the last hour again becomes choppy and erratic.

I am constantly reviewing my rules and trade setups.

Between now and 2:00 I work on other projects or tasks that I need to take care of, sometimes it’s running to the post office or bike shop, watching some YouTube videos, or catching up on some podcasts or an audio book.

2:00 PM Workout/Ride Time

I race mountain bikes competitively so 2:00 is my time to ride and train. I’m usually on the bike for 2-3 hours T-TH. This not only acts as a huge health benefit, it breaks up my day and allows me to regroup and reset my systems. Plus I’ve come up with some of my best ideas while on the bike!

5:00 PM Dinner, time to relax

Making a delicious dinner is one of my favorite parts of the day. I’ll usually fire up the grill and put on some chicken, or steaks, or throw some sausage and peppers in the oven (among other sides).

6:00 Market Recap

Now is the time of day where I review the broader market data. I use my excel docs for this. I then review ALL the setups for the day and see if there is anything I missed or trades that I took that weren’t valid. If I find that I took all the valid setups for the day it’s been a great day. Once and a while I will miss a setup or over look something that invalidates a trade, but with taking 6-12 trades a day and specific time frames to be looking for setups that doesn’t happen much. or the day.

6:30-8:30 Project Time

This is time I use for working on projects or chatting with traders. Wednesdays I meet with a mastermind group with some local small business owners to discuss our businesses and work to expand them. During the summer this time is filled with sports leagues and some group rides on the bike.

8:30-9:15 PM Time to wind down

I try to get in bed by 8:30 and read some Forbes magazine or a good book so that I can fall asleep by 9:15. Getting to bed by this time, again, lets me get in three full sleep cycles (4.5 hours) before doing it all over again.

I use this exact schedule 3x a week Tues-Thurs. Monday I wake up at 6:45 AM skipping the Euro open session, and Friday I’m done trading at 10:30 and will hit the golf course (in the summer) and gym instead of riding the bike. Friday night it’s time to meet friends for dinner and drinks. My weekend is then filled with riding, races, trips, and other fun activities.

I spend a lot of my time away from trading listening to audio books, talking to other business owners (both trading and other disciplines), and riding my bike. It makes for a great balance and is a lifestyle I love!

If you have a routine, schedule, or I’d love to hear it. Share your trading story in the comments section below.

-

We’ve all experienced the effect of a mentor, whether it is a teacher, coach, or colleague. These are the 10 top traders that have played the biggest role in my trading, both as an inspiration and through their teachings.

10. Eric Utley – TradingAddicts

I began following Eric back in early 2007 from a podcast that he produced with Jeff Kohler. Eric has been around the markets a long time and understands the important of larger time frames and remaining patient, allowing the trade to pan out. I have learned a lot about market profile and macroeconomics from his teachings over the years. He has a lot of insight in regards to larger time frame trading as well. You can find out more about Jeff at TradingAddicts.com.

Primarily Trades – Futures, Bonds

Specialty - Market Profile, Macroeconomics

9. Ben Lichtenstein – TradersAudio

Ben is not like any other trader on this list. Ben stands at computer station outside the S&P500 open outcry pit at the CBOT. Here he watches the traders and calls out what is taking place on a daily basis through his squawk box. I have had the privilege to spend a day at his side watching the live trading action and I can say it is a blast. It's amazing at how fast he can process the information and spit out quotes, bids, offers, and from who those orders are coming from. I listen to his comments during the trading day using the Thinkorswim platform.

Primarily Traders – Futures

Specialty – Pit Trading, Market Profile

8. Tim Bourquin – TraderInterviews

If you’ve heard of or been to the Traders Expo then you will be familiar with the work of Tim Bourquin. Tim is Co-Founder of the Traders Expo and interviews some of the industry’s best traders at TraderInterviews.com. I have had the privilege to meet and be interviewed by Tim back in 2008 (the interview can be found in the archiveson his site).

I have gained a lot of valuable information from the interviews Tim he has put together. As a presenter myself at the Las Vegas Trader's Expo in 2009, I can also say that he has build a great learning environment for trader's to meet and test out the latest software and strategies.

7. Jack D. Schwager – Author, Market Wizards

You would be hard pressed to find an author that has spent more time gathering content for his books than Mr. Schwager. In preparing Market Wizards, Stock Market Wizards, and New Market Wizards, Schwager traveled the country to interview America's top traders.

These books provide extensive knowledge about the intricacies of various markets, trading strategies, and trading OPM (other people's money). Some of the people interviewed include Paul Tudor Jones, William O'Neil, Dr. Van K. Tharp, Mark Weinstein, Ari Kiev, Linda Bradford Raschke, and Mark Cook to name a few.

6. Jeff Kohler - OptionAddict

Jeff has had a huge impact on my trading. I learned more about price patterns and options trading from Jeff than any book I have read on the subject. From Jeff I also learned the skill of creating and filtering watch lists.

Always keeping it laid back, Jeff produces a weekly watch list and is a partner with Eric Utley over at Trading Addicts, along with keeping up his OptionAddict blog.

Primarily Traders - Options

Specialty - Price Patterns

5. Martin “Buzzy” Schwartz - Day Trader

I came across this champion day trader in reading the book Pit Bull. This biographical account of Mr. Schwartz tells the story of how he became an expert at trading S&P futures. The year was 1979 and his first full year as an independent trader, Mr. Schwartz made $600,000 and a year later earned $1.2 million.

While I have not met him personally, the book is written in such compelling form that you get a sense of what it takes to become a truly great trader. If you trade futures, you must read his story.

Primarily Traders - Futures

Specialty – Open Outcry Trading

4. Jesse Livermore - Speculator

My list wouldn’t be complete without mentioning the famed Jesse Livermore. Similar to Mr. Schwartz, Livermore’s trading journey is told in compelling fashion in the book, Reminiscences of a Stock Operator.

As a young boy, Livermore began his career in the early 1900's in the New England bucket shops, later given the name “boy plunger” making (and losing) a fortune multiple times. There is a plethora of knowledge in this book. A must read!

Primarily Traders - Stocks

Specialty – Speculation

3. David Halsey – EminiAddict

There really is no one I can compare to David Halsey. He blogs over at EminiAddict.com and as the as name implies he primarily trades the E-mini S&P and Eurodollar. DH provides an incredibly useful trading room where he talks about trade setups, management of trades, and answers questions all day long. Before I met DH, my trading strategy was good, it had come a long way, but it was missing something. I found that key ingredient with DH. He’s a great trader, with great character, and an all around outstanding guy.

Primarily Traders - Futures (S&P, EUR, GBP)

Specialty - Fibonacci and NYSE tick

2. John Carter - Mastering The Trade

As I close in on my number one trader, I knew who contributed to the most “light bulb” moments, John Carter. Those moments when we take things to the next level only happen every so often, yet I found them happening many times when listening to John Carter’s audio book Mastering the Trade. It is a terrific guide to get over the “hump,” and break free of your impulse trade that is costing you money. JC is a great speaker and very friendly guy always willing to help. I owe a lot to him.

Primarily Traders - Futures, Stocks, Forex

Specialty – Pivot Points, Market Internals

1. Peter Reznicek - ShadowTrader

At last we come to the trader who has influenced me the most, his name is Peter Reznicek. I chose Peter as #1 because he introduced me to market internals what really is going on “under the hood” of the market.

Peter puts out a weekly video and comments daily on a Squawk box on the Thinkorswim platform. There is also a phenomenal audio series he put together that I have listened to over and over again, ingraining the concepts into my subconscious.

Primarily Traders – Futures, Stocks, Options

Specialty - Market Internals

I have followed Peter from day 1 of my trading and it is for this reason that I chose him as the top trader who has influenced me the most.

I hope you have enjoyed reading through my list of most influential top traders. Any one of these traders could be placed into the “traders hall of fame” if such a place existed. The knowledge I have gained through the years following their blogs, podcasts, squawk boxes, and trading rooms has truly shaped the trader I am today.

Every one of these traders are extraordinary mentors and have helped change the lives of countless individuals. If you are dedicated to learning the art of trading these 10 top traders can help catapult you, as they have done for me, to success as a consistently profitable trader.

I cannot express my gratitude enough. You have all played a huge role in my trading.

Thank you!

-

The main reason people fail at a new venture is a lack of experience. Entering the world of trading, you are up against the best and brightest minds in the world that have years and year of experience on top of you. The #1 tool that can help speed up the learning curve is the implementation and use of a trading journal.

"Trade to trade well, and the money will follow."

Whether you journal by hand, on the computer, by audio recording, or through video, there is no right or wrong way. The ideas discussed here are simply a template to get you started. Be creative and adapt them to your own style that what works for you.

Establish the End Goal

The first thing to do before creating a journal, before placing a trade, even before picking a market to trade is to pull out a piece of paper and write down your answers to the following three questions.

* If you had an unlimited supply of money, what would you spend your time doing, and who would you spend it with?

* What will happen to you 20 years from now if you do not learn the skills necessary to become a successful trader or investor today?

* Why trading? Given the four basic ways to make money (employee, self-employed, business owner, and investor) why do you want to be a trader?

Take some time to think about your answers and reasons behind them. Once you’ve done this you are then ready to create a goal. This trading goal might be something like, “I will make an income of $10,000/mo.” or “I am a consistently profitable trader month over month.”

Most people and goal setting workshops will tell you to attach a date to your goals and for most goals that is the case, however with major life goals attaching a date will only set you up for disappointment. Not reaching your goal by that date may deter you from moving forward and many will give up. You must commit to doing whatever it takes no matter what or how long it will take. Don’t let anyone discourage you. This concept applies for any major life goal.

Purpose

The purpose of a trading journal is to build confidence in your trading system. When you trade with confidence you are able to trade objectively. By taking detailed notes about your trade setups, emotions as you enter, manage, and exit the trade, accompanying market activity, and profit/loss (to name a few), you are able to break down which things are working and which are not.

My Trading Journal

Now that you have some ideas on how to begin I’d like to share how I organize my trading journal(s). I use handwritten notebooks for my emotional and daily market summaries and excel for the analytics and market analysis. I have attached the excel templates with examples below, feel free to tweak them and make changes as you like, if you have questions go ahead and leave them in the comments section below as often times many share the same question.

I have attached my...

* Trading Log

* P/L Report

* Daily Notes

* Market Analysis

Trading Log:

How I use it

I use this spreadsheet for recording and tracking the effectiveness of my individual setups. I break out the setup and the win percentage to see what setups are working the best.

Things I learned

After a few weeks of inputting trades it was really clear that the micro timeframes I was trading were not as profitable and in some cases the only negative trades I was having for the week. The result, I went back and tweaked my entry for these setups and then reduced the number of contracts I was trading for the setup resulting in decreased losses and increased profits.

P/L Report:

How I use it

Have you made money at the end of the day? This is the bottom line report.

Things I learned

This report keeps the commission expense in check and helped me see that my biggest days were sometimes the days with the fewest number of trades. It also makes it clear that the month is made up of a few big days and a number of average days. On days when the market is providing quality setup after quality setup I continue to trade, days where the market is slow and I have a couple scratch trades I usually lock in gains that I may have and stop trading by 10:30 CST.

Daily Notes:

How I use it

This is my go to spreadsheet that I use every day. I began this in a handwritten notebook, but after drawing the same boxes and diagrams day after day I moved it to excel. I have condensed it down over time.

In the beginning I would record the market internals every 30-minutes and this was the sheet that kept track of this. I have since added an indicator in my Thinkorswim platform (my charting package) that tracks this for me.

Things I learned

This spreadsheet acts as a checklist as I fill it out each night for the following day. During the trading day I record my trades on this sheet as well.

Market Analysis:

How I use it

I record all my market data on this spreadsheet. It may be a little overwhelming at first, but after years of recording this data each night it becomes pretty easy to spot patterns and trend changes.

Things I learned

I look to the internals each day to really gauge the strength or weakness of the market. This spreadsheet has helped me uncover very interesting patterns and occurrences that may only happen every few months, but result in big trend changes in the markets. These indicators are talked about in the book Mastering the Trade by John Carter.

End of Day Questions:

At the end of the day assess your trading by asking yourself these questions.

* Did I follow my rules?

* Did I take all the valid setups?

* Did I hold to my targets?

Review the setups for the day and congratulate yourself if you followed your rules, took all the valid setups, and held to your targets. If you do this the money will follow, as I can personally attest to. Since incorporating these journals into my routine back in 2007 I have been able to increase the efficiency of my strategy and continue to become more profitable each year.

Being disciplined and keeping a methodical approach has really helped me trade consistently over the years. If you’re interested in more reading on the subject of trading for a living check out Trade Your Way to Financial Freedom by Van Tharp.

If you’re not into keeping hand written journals and don’t quite get the whole excel coding thing, Trading Spreadsheets has some great tools for you to setup a journal.

I hope by sharing my trading journal you have uncovered a number of ideas to create and build your own. If you have more ideas (as I’m sure I haven’t touched on them all) please share them in the comments section for everyone to enjoy.

Thank You!

-

I liken it to hunting... know your prey, know it's habits. Stalk it patiently, and with a plan. Take your prize and get on with your life.Well said mmustoe. Great analogy.

-

Striving for consistency is the goal. It's always possible to get access to more capital if you have a consistent trading strategy. IMO it was harder trading smaller, trading larger became easier, ironically.

-

Great group of people here Legba, one of the best trading communities around.

-

Starting with stocks is a must to fully understand the game. Then I think the E-mini Dow /YM is the easiest futures instrument to begin on due to the $5 per point increments. This allows for the most exit points as apposed to the E-mini S&P which is in 0.25 increments @ $12.50.

Biko- Ya the more "liquidity" the more efficiency, therefore harder to trade. The Ag markets are a great place to learn and take advantage of some great moves.

-

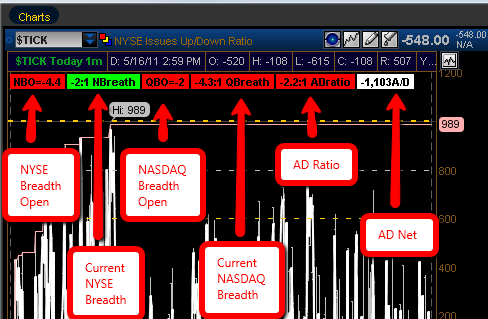

Here is my Thinkorswim code for Market Internals and NYSE Tick (props to thinkscripter and a few other traders for the idea and original code).

-

Benny- I use a 512t chart on the ES and around news announcements even THAT time frame can become erratic. The problem with executing orders on any time frame smaller is that you're entering the realm of high frequency and program traders who have computer systems to react to those moves way faster than a screen trader can manually enter orders.

The big money is made in the larger move. Trade the trend until it fails.

Breadth, AD Line, Tick, Trin -- How They Can Improve Your Trading?

in Tech Analysis

Posted

The Market Internals are similar to the instrument cluster on your car, without them you really don’t know which direction you are headed or how fast you’re moving.

There are four indicators that make up the core market internals:

Each indicator has a separate reading for the NYSE and NASDAQ, but our primary focus will be on the NYSE.

You can setup your trading screen to neatly display all four market internals in both chart form and numeric form. I have mine setup in grid chart format using the Thinkorswim platform.

Specific instructions for setting up your own market internals charts using Thinkorswim can be found at the end of this article.

Breadth

The ‘Market Breadth’ or ‘Breadth Ratio’ is a volume ratio composed of volume flowing into up stocks versus volume flowing into down stocks.

The breadth ratio is expressed: Up Volume / Down Volume.

This reading is important in relation to where it has been, especially where we are now compared to where we opened on the day.

For example:

If at 10:00 AM we have 10M shares moving up and 5M shares moving down, the resulting breadth ratio is 2:1 positive (10M/5M), twice as much volume is flowing into up stocks as down stocks.

If at 10:30 AM the market has sold off but we now have a breadth ratio of 3:1 positive, this is a signal that the markets are actually becoming stronger and it’s time buy the pullback, so look for a long setup.

Out of all four internals, the breadth ratio is the most important.

Advance/Decline Line

The ‘Advance/Decline Line’ or ‘A/D Line’ for short, is the second most important of the internals. This indicator tells us the net sum of advancing stocks minus declining stocks.

The A/D Line is expressed: # of Advancing Stocks – # of Declining Stocks

There are roughly 3000 stocks listed on the NYSE and 3000 on the NASDAQ. An A/D Line reading of 1,500+ is very bullish and a reading of over 2,000 is extremely bullish. On the flipside readings of -1500 and below are very bearish and readings below -2,000 are extremely bearish.

These extreme readings are indicative of trending days where once the market continues to trend all the way into the close. We look to the A/D Line in conjunction with the Breadth Ratio to confirm these trend days.

For example:

A day with 2,500 advancing stocks and only 500 declining stocks would yield a net of +2,000 (an extremely bullish reading). It would take a large catalyst to shift the market direction with a reading this bullish.

If on the open you continue to see the A/D Line moving +500, +700, +900, this is a sign of market strength. If however, the market is moving higher, but the A/D Line is moving lower, a divergence has occurred and could be a sign of a market turn.

It’s important to look to the other market internals for confirmation as one indicator alone is not sufficient to confirm a move.

Trin

TRIN stands for TRaders’ INdex and was developed by Richard Arms in 1989 (it’s also referred to as the Arms Index). Its main purpose is for detecting overbought and oversold levels in the markets

The Trin is expressed: # of advancing stocks / # of declining stocks divided by

volume of advancing stocks / volume of declining stocks

The resulting Trin # is inverse to the market (a + reading is bearish, a – reading is bullish). A ratio of 1.0 means the market is at parity. A reading of 2.0 means much more volume is flowing into declining stocks. A reading of below 0.6 means much more volume is flowing into advancing stocks.

With the introduction of inverse ETFs the Trin has lost some of its appeal to intraday traders.

John Carter talks about the Trin in his book Mastering the Trade and has this to say…

If after closing above 2.0 the markets can’t rally the next day, a major selloff could be in store.

Tick

The NYSE Tick Index gives us the relationship of stocks up ticking versus down ticking at their last traded price. The Tick is an extremely useful tool for intraday traders.

For Example:

If there are 3000 stocks trading on the NYSE and 1500 trade higher from their previous price and 500 trade lower than their last price the Tick will read +1000. But wait what about the other 1000 stocks? They could be unchanged from their last price.

When using the Tick we are looking for extremes to enter or exit a trade. Tick readings of +1000 or -1000 are considered very strong as we typically trade between 1000 most of the time on the NYSE.

Tips for Using the Tick:

Note the extreme tick readings for the day:

Here are some live trading videos using the tick.

Market Internals Setup Instructions