Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

20 -

Joined

-

Last visited

Posts posted by TheBigMan

-

-

thanks the big man to share such a great information, i really find it very help full and i hope that you will keep it up and will share more information as like thisthanks

URL Removed by Moderator

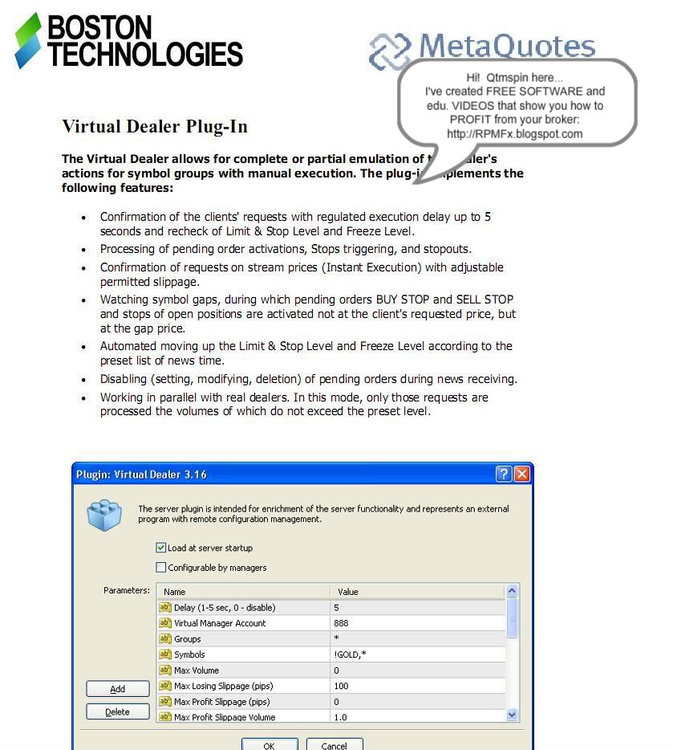

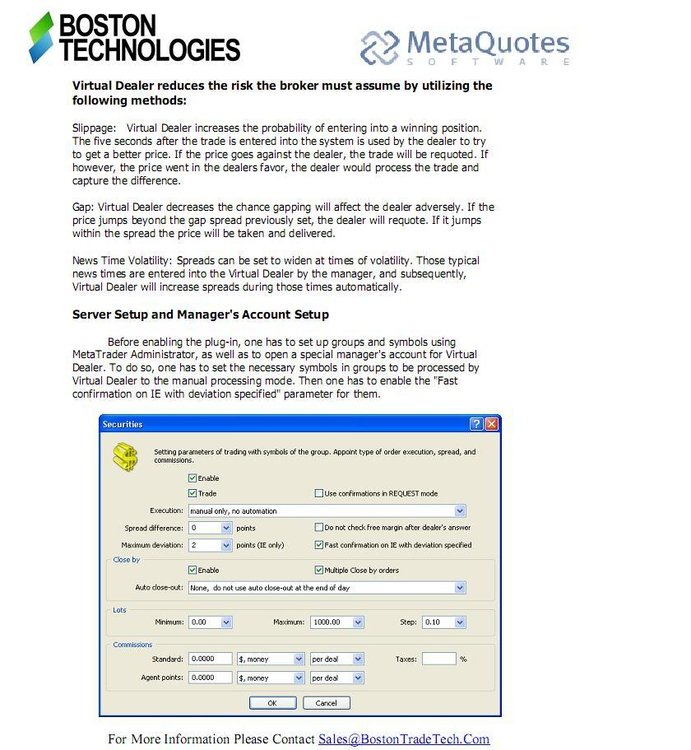

I found more information than I wanted to. There are brokers who were sued for manipulative practices. Take a look at the attachments.

-

I am aware in equities that you are dealing with a computer program (Black box) when you trade stocks. At one time it was a specialist (Human) All order are routed through various exchanges.

Now with forex, there is no centralized location. Therefor you are trading with just the people that go through that clearing house????? In addition, most small forex brokers are not really brokers but just websites. (Middle men)These brokers really just support you and some hold your trade if you loose all the time and keep your money. That is why it is difficult to get paid if you are a winner.

Can someone shed some light on this. I am trying to figure out how the forex chain really works

-

Yeah but it is not web based, so you cant access it from anywhere...plus I dont understand how do they get paid?They get paid by pips. I don't remember exactly how much. I think it was an 1/8 of a pip per 4 or something like that.

-

I got this idea from another forum. Someone suggested that we try to stay on top of and share any new found info on this Wikileaks guy. He claims to have vast information on banking/The markets in the US. After he let that information out they came down on him like a ton of bricks.

Personally I couldn't care less. I am concerned with my account coming down like a ton of bricks.

Please post any new found information or any new websites for this guy so if he does drop a financial bomb, we can all respond quickly and save hopefully all our money before a landslide.:crap:

http://www.guardian.co.uk/world/series/us-embassy-cables-the-documents

-

Does anyone know why SpeedTrader no longer offers automated trading?

-

Indeed, to get the fantastic results they publish the systems are usually hugely curve fitted to historical data. There are lots of 'tricks' that the less scrupulous can use to produce fantastical results on historic data sadly things will unravel going forwards.I don't know. I do think that with Forex, successful automated trading is possible with controlled losses..

-

Someone should tell the hedge funds, investment, and commercial banks that day trading is not dead, so that they stop wasting their time on insider trading, front running, etc.They probably don't day trade because they don't know which is the best time frame to use and which indicators give the best signals. Or, possibly, they are too overwhelmed by fear and greed to trade properly during the day time frame.

Wow this post above was made in 2008. A full two years before these guys got caught with their hands in the cookie jar.

-

If you want to make some money, its generally a good idea to ignore most of what other people say !Does that include you(Just kidding) But that is also true. Actually as a equity trader I have tunnel vision. price & volume is pretty much just it.

-

Yes, I have used these -- quite a few I have tried. I kinda knew better intellectually but had to prove it out myself.I can tell you I've never had success -- and certainly not even close to what is advertised.

With Fap I actually found it worked ok for a while but seems like the brokers sniffed it out once they must have sold thousands of them and they basically "broke" the strategies effectiveness. I'd say in my experience they were the closest to actually working and they just way oversold it. Not sure about newer version.

In general, there is a group of developers/marketers who keep cranking stuff out under different names - always with super slick websites - it's an arms race.

I would suggest you instead look for trading strategies where you know the rules - the "why" it's taking the trade and ones that rely on at least some small portion of subjectivity and trading skill. Those are much more likely to have a chance of working for you.

Then, use automation how it should be intended, to help you manage these type of trades - maybe moving stops or locking in profit, etc...

Just don't expect your computer to turn into a cash machine no matter what the ads say

I did hear that but also some folks said it was the setting which needed readjusting along with the currency pairs you chose. Those two things had a great impact on your outcome.

-

Does anyone use automated software to trade Forex, I have been reading about many automated programs with grandiose performance being promised. I have come across about six. However, very little is being written from objective people about results.

-

Don't feel bad. You have a lot of company in that boat. I have and I am sure many others if not all have done it. Cut your losses. The time you have your capitol tied up could be time spent recouping your losses on new trades. Look at the 28K loss as tuition in the school of (What not to do in day trading 101)

When you get sick, you go to the doctor to get an injection. After you take the injection, you then begin to get better. TAKE THE INJECTION.... The full needle 28k worth. You will feel better a week leater when you have made up most of your losses and trading with a more level head.

-

I think we have all been there... Look at it as an additional tuition in the school of day trading...

-

What are people's thoughts about this article?Here's the Proof Day Trading is DEAD (SPY, QQQQ, IWM, DIA) | Wall St. Cheat Sheet

When I read statement #4 I instant came to the conclusion that his was a bs. article. The movement of the market due to upward or downward pressure is natural and quite common. We see it every day weather stocks go up or down they do it in a zig zag pattern. He said "Yet once again, computers replaced humans in exploiting this edge, thus rendering the strategy ineffective." That is how most traders make their money.....:crap:

-

This post does not make sense.You believe that the markets are random and that there is a 50% probability that it will go either up or down? Flip a coin?

Then you say that "as you hone your skills you will become more proficient....."

Which is exactly the point emg was making. It takes time to learn trading and the failure rate is high.

Markets can go up, down AND sideways. Add commissions and slippage and it is easy to understand how someone who is not "proficient" can quickly become broke, especially trading leveraged instruments like futures.

In that regard, yes you are right.

-

The term programing when it relates to Tradestation is really just logical expressions. It is just like MS Excel when implementing formulas. If this, then do that, if this number is greater or less than , then do...... etc. You will pick it up quite quickly.

-

I'm running Tradestation and have it connected to Ninjatrader/Interactive Brokers.It has been suggested already that I give Multicharts a shot - which I'm planning on.

In the meantime something happens with Tradestation that for me is kinda shocking - given they don't have a solution. They advertise all over about their strategies and how TS can auto-trade your strategy. What they don't tell you is if you lose your internet connection - maybe it goes down, maybe your wireless drops the connection with the router for a bit, or even the router hiccups -- that Tradestation will not automatically reconnect - in fact it will pop up the username/password box again. Which kisses goodbye your automated trading as it sits there waiting for a long -- which means you have to nurse it or you could be in for a shock.

Now, at the time same time, Ninja and IB recognize that it goes down but both have no problem reconnecting as soon as the internet comes back online and it detects it -- haven't seen any issue with that.

Called Tradestation - they say if the problem was on their server causing the disconnect it will retry the login but if it was on my end as described above - out of luck. Seems crazy that this is the answer - how can one auto trade and not be right there monitoring it with this answer?

Anyone have a solution? Something that would alert me if it happens? Something that could log it back in?

Thanks.

If you are doing automated trading and letting it run alone, wouldn't have a battery backup regardless of who you are using?:crap:

-

To become a full time traders, it will take years. Full time trader is smiliar to becoming a lawyer, Doctors, etc. The problem is many people believe day trading es is "get rich quick." If it takes 5 yrs to become a doctor, it will take 5 yrs to become a full time trader. I have no clue why people believe they can become a full time trader less than 1 yr. If that is true, why does it take a long time to become a doctor, lawyer, etc.According to the Gov report, 97% of the people lose trading in the futures market. One of the reason they lose is, they failed to understand trading futures involves substantial risk and only risk capital should be used. All brokerages and few trading school websites have those risk disclaimer. But for some reason, most people FAILED or ignore the risk disclaimer.

For those who are a successful full time traders took them yrs to get there. Plus, they fully understood that trading es is NOT A GET RICH QUICK and trading futures involves SUBSTANTIAL RISK!!!!!!

hope this help

I have to respectfully disagree. With stocks which is all I know about, your chances are 50/50 In all fairness to that, you can throw a dart and you have a fifty percent chance it will go up. There is no other places for it to go. Up, Down... That's it. Now if you incorporate stop losses, when you lose you don't lose much. Sure that is in really simple terms but it is the truth.

Now as you hone your skills you will become more proficient and therefor increase the amount of profitable trades.

-

I traded for a living about nine years ago. I started with Datek which is no longer in existence and then I went to Speedtrader. My success was due more to common sense & luck because my knowledge was minimal at best. I made about 150K in 13 months. I then became a landlord. I plan on returning to Trading come the first of the year as soon as I settle on the sale of my apartment building. Now I will be playing with between 3 & 5 hundred K. I am taking these couple of months to reacquaint myself with the market by learning the routine of the ten stocks I will play with.

I must admit it is very scary and there is so much information out there to interpret. :crap: The benefit I have is that a can stay away from the smaller stocks which tend to have more volatility in them. I don't even plan on using any margin until I feel comfortable with the way things have changed and work now.

If anyone has any help, suggestions it will be appreciated.

-

Yeh. I'm impressed. I very well may go that route. Only problem, I trade with IB. I could open a TS account but I dont want to be paying $100/month just for the market scanner if I don't need to.You know of any other alternatives? thanx for the response btw.

I hope someone can help me understand this. I am just getting back into Day Trading. I have been reviewing this and other sights for general information.

The question is, if you are trading and making money, a $100 or $500 payment to improve or increase your profits should be insignificant. Therefore, what are the average folks around here making from day / Swing trading. Or is it something that most do for a hobby?

Invisible Hand That Limits Your Tradingt

in Trading Psychology

Posted

Sounds to me like you have demons. Try an exorcism. LOL:haha: