Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

62 -

Joined

-

Last visited

Posts posted by Grey1

-

-

Yep,That said, a lot of traders do use 30m & 60m to daytrade.

Agree,,,the main time frame for tweezers formation or exhaustion is 1 minute,, the 30 and 60 time frames are only to meausre the OB/OS levels using any available oscillator such as RSI or CCI ..

if you was position trading trading then the best time frame to meausre OB/OS would be daily /weekly /monthly or any proven S/R

Grey1

-

Tweezers at any significant support or resistance level are usually pretty reliable.note: in the image i mistakenly labeled S as R. The tweezers formed at support.

The tweezers formation ( double exhaustion ) is best when it either hits 3 Over bought levels/Oversold levels or hits S/R...

10 , 30 , and 60 min are the time frames for intra day trading. As soon as these levels are reached look either for tweezers or shooting star . These are high probabality reversal pattern.

Now,, in extreme trending market the retest of exhaustion levels( tweezers levels) is very possible ,, so if your entry is not spot on then the price might go your way first to come back to haunt you before eventually going your way ,,

one Further point :-

if tweezers are formed against the strong trend ( this is what most traders do and is in correct ) then this is counter trend trading and over a long period the reward does not justify the risk as statistically not more than Reward/Risk= 1 is attain able. How ever if the tweezers are formed in the direction of trend then this is where the major wins are and trader should take a Full postion ( against 1/2 position if anti trade trending )

Grey1

-

How do you define when to take reversals vs. trend trades?A new trend is born when the reward to previous trend diminishes..

If you use Multi time frame analysis the use of multi time frame analysis can shed light to the end of the previous trend and birth of the new one ,,

For example if Index ( any index is good enough as they are all as efficient of each other) in 10 min and 30 min and 60 min time frame is OB then the risk is to up side Hence the chances are that a new trend should born ,,

In pro environment where i used to trade we did not trade any particular trend but only pull the trigger based on the correlation between Risk /Reward at any given time and that is basically using Multi time frame ,, ( We how ever do not use oscillators we use Neural net work to identify the R/R in various time frames)

Any way for traders who are after simple trend reversal R/R system the use of MLT is a stepping stone ,,

The basic strategy for reversal detection is as follow

short if

1) INDEX IS OB in 3 time frames and

2) Price exhausts in the form of either shooting star or spike and immediate sell in the next bar

Grey1

-

I would add it is maybe not so much about trend identification, but trend CONTINUATION. I call it this as often (and i fell into this trap before) its not so much the entry that is hard, its the hanging on to a position that causes the issue. So identifying why/how a trend continues is better.Excellent,,,,,,,,,,,,,,,,,,,

-

This thread is ideally about discussing good/interesting/profitable ways of being able to manage and combine strategies.This is both in the respect of asking the questions

- how to manage and combine various strategies

- how to manage and combine long term trades and short term trades

- how to manage taking profits v letting them run.

While I dont wish to get into arguments about what works, whats best, etc; etc;

So ....I would like to start off with a few assumptions with which to begin a discussion.

Assumptions.

1...Trading with the trend works - is easier, less stressful, less timing is involved.

2...The big money is made in the big moves with fewer trades.

3...Psychologically tricking ourselves is actually very important - more so than discipline

4...Discipline is important in that you have to follow what ever plan you devise

5...While a lot of ideas can be backtested, context is important, as is flexibility, hence a lot of discretionary trades, whilst having a basis that can be somewhat tested, are not binary, and hence very flexible as to what works and when to apply it - in other words dont take anything too literally if you cant profitably test it as human input is vital in trading.

.........................

It has dogged me for all the years I have been trading that there is always a conflict between letting trades run, and taking profits. Mainly because, we are all told to let things run. That is were the money is made.... however its really difficult, as we always prefer to capture short term gratification

We think that - by taking lots of little profits that the market offers, we can capture more PL.

Example: a currency may move 15-20% over the course of the year, yet it move 1% a day (possible 255% a year). We extrapolate to think well if we can capture even only 1/3 of that we will still make 80%

- We also think that the less time you spend actually exposed to the market the less risk that you have. Hence the desire to get the timing right so we make quick money and then exit waiting for the next opportunity.

Problem is with this the maths. Let’s say your chances of being right are 50% (50:50) if you buy something and get it right, then sell it taking profits, looking to buy it again on a pullback etc; Are you not actually increasing your risk?

I always thought the probability was that getting it right, AND getting it right AND getting it right was along the lines of 50%*50%*50%.... etc; which means that ultimately you actually made it harder foryour self to get it right over the long term.

(now I know this varies, and this is possibly nonsensical …. Just go with the flow for now)

Yet buy and hold also does not necessarily work either – that’s why we want to try and beat the market with ideas etc and develop trading styles, strategies and plans to better the odds in our favour.

We also know that doing the same thing over and over again is boring – even if it works, and that psychologically trading is difficult. Basically our brains are not really built for it (read Your money and your brain by Zweig plus other books)

So how do we combine – trading less, trading with the trend to capture the big moves, and yet still manage to satisfy our needs? One of the ways seems to be in combining systems and strategies, and being able to take profits, as well as running trades.

This becomes then a question of …. Is it not then one big system?

Eg; you short 3 contracts, buy one at a level that allows you to cover your costs, buy one at a level that allows you to move the stop for the remaining contract to Break even and then run the last contract.

The argument is that its one system – why not just sell three contracts and let them ride. OR

Is it three different systems – one for each contract.

Lets just assume for simplicity sake that they are just one system, and that this system is designed to help make it psychologically easier for the trader to follow, by satisfying their base desires, and also allowing them to run it.

So to the crux of the discussion.

Do other traders have thoughts on how best to do this?

What do they do in practice?

What do they find hard and or easy about each aspect of it?

How can they trick themselves if need be?

Market is a counter initiative mechanism and human use their initiative to trade it,, Through out your life you have been told to use your intuitive to do things right way and suddenly you are facing a mechanism that punishes you for using your initiative,,, strange hey ,,

what is the solution ?

open a position lets say with 3 contracts close 2 contracts as soon as you have moved 0.5 unit of volatility in your favour with stop to break even point and walk away and I mean away from the PC for the rest of the day ,,, your position does not need your round a clock analysis and all it needs is to walk away and let your position run and run ,,

I totally understand this is not a very clever strategy but it works best with those who are loaded with millions of confused strategies and their initiative works against them by finding an excuse to close a perfectly sound trade instead of letting it to run and run ,,

I also like to add a note on stop loss.. instead of continuously thinking where to stop loss I think you must spend more time on TREND identification and not where to put that stop,, The trick in stop loss is not to stop at this or that level,, the trick is to reduce your position size and have a wider stop based on the instruments volatility and instead let the profit run ,, this is the back bone of risk analysis and traders should concentrate on putting less pressure on their CAPITAL than having a larger pos size and tighter stop loss.

Grey1

-

Indeed it is. Comes from flawed logic, the old 'I have a black cat therefore all cats are black' syndrome. Or more common I don't have a black cat there for black cats don't exist. If I had a cat I would call it Schrödinger then it could be black and not black at the same time (as well as being both alive and dead) .

.Of course high priests of various trading cults prefer dogma to cats though are humbled when they met (black) swans.

One object( particle) can be in two different places ( on moon and on earth ) at the exact same time ... sounds flawed logic but it is not,, it just looks and sounds flawed to ignorant

Millions of ways of pulling the trigger to buy or sell but only very few ways of having risk adjusted returns and most trader here do not understand or have the knowledge of risk based trading models.. This is why 90% of traders lose ,, this is why they deserve to lose ...

Grey1

-

The main reason for supports/ resistance not holding is the pattern recognition algo's used by block traders... These algo's once confirm a trending down / up in a major index then no longer use their oscillator based module to trade and hence support or resistance becomes far far less effective in their exit strategy . ( hence going through support )

There was a very strong support on GS @ 160 but there was over 12 block trades ranging from 1.2mil to 5 mil last past two trading days to cut through the 160 level like hot knife through the butter,,,

hope this makes sense

Grey1

-

I trade stocks, and I do pretty well at it. Apparently I am among the few lucky souls who manage to do so without even knowing what a V W A P is. And I'm not asking what it is, for I really do not care. And I'm not saying that for some folks, a V W A P, whatever it is, may in fact be useful. I am just saying that you are wildly overstating the importance of whatever it is you are talking about, and a bit less hyperbole would be appreciated.Best Wishes,

Thales

Institutions use VWAP as bench market to enter or exit . They have their own algo to execute @ VWAP how ever some large block traders ( non institution) use Brokers such as IB to execute their order.. It is important not to trade against block orders hence the importance of this vital bench marke..

How ever if you donot know and donot want to know and happy with what you doing and making loads of $$$$$ then Good on you,,

http://www.interactivebrokers.com/en/trading/orders/vwap.php

grey1

-

.....................

-

[/color]i agree that no indicators needed at all .

Some indicators such as VWAP line is bench market for block trading .. This indicator is a must for stock traders ,,,,

Other indicators which are close to price action and designed to eliminate noise are very good too ... Most commercial indicators are of no or very little value though ..

Grey1

-

To become a profitable trader you must realise

1) Classical TA on its own is power less in market forecast,

2) Understand the concept of risk and how to diversify risk

3) learn modern TA and not stick to classical TA specially how Block trades are moved intra day ( vwap execution )

A profitable Trader is not blind to news even though most news are priced in ,

A profitable Trader understands risk .. Hence he concentrates on entry than exit..

A profitable Trader understand volatility and exhaustion theories in modern TA,,,

I used to trade for a bank for years and in 5 years did not see a single soul trading charts and classical TA to make a dime over the long period,, ( I have seen traders to have a lucky run though for few days )

ALL above IMHO ofcourse

Grey1

-

Wishing all traders an awesome holiday ... Hopefully This time next year you all be millionaires

Grey1

-

I have now read many of the internal over night reports from ( JPM .Goldman .MLynch ) and the problem is not as big as an average trader thinks , of course the spill over effect within UAE is not some thing one could over look but I doubt if this is going to be a next leg down ,, I feel fear element is un warranted and the market should soon continue the move to upside, ( as early as mid next week ) ...I am thinking of going LONG few top quality stocks such as AAPL ,AMZN ,BUCY mid week and hold them till End of DEC..Program Trading :--

Most program trading use neural net ( dynamic pattern recognition ) and they are dumb in a way, they don't understand the reason for the move but still the move is seen as a down ward sell off and a sell off from highs, is very bearish ( even if we assume the sell off from high is bearish the market has to come back to near the previous high for Double top formation before major correction ) , As a result most intra day activity for the next few days will be on the short side but the fundamental reason for continuation of the previous trend should prevail and we should be above 10500 by xmas,, ( all in my opinion ) ,.

FA explains the reason behind a move TA is blind to the reason and only sees the move,,, don't bet your farm on TA only because if you do then you are setting your farm on fire ,, ( IMHO ) of course

Grey1

IMHO this will not be any where near the subprime bust

The market seems to have now discounted the DUBAI's problem and getting ready to continue its previous up trend ,, I feel the up trend move should exhaust in around 4 weeks time with a spike in DOW to above and a sell off from high . The market will then look for a catalyst to retrace to below 10000...( IMHO ) ..

The equity market is trading well above its VWAP and most institutional traders know this ,, as a result they will be selling / reducing their long position by selling into the spike...

Grey1

-

Dubai shock after debt standstill callFT.com / Companies / Financial Services - Dubai shock after debt standstill call

this can be worse than the subprime bust.

I have now read many of the internal over night reports from ( JPM .Goldman .MLynch ) and the problem is not as big as an average trader thinks , of course the spill over effect within UAE is not some thing one could over look but I doubt if this is going to be a next leg down ,, I feel fear element is un warranted and the market should soon continue the move to upside, ( as early as mid next week ) ...I am thinking of going LONG few top quality stocks such as AAPL ,AMZN ,BUCY mid week and hold them till End of DEC..

Program Trading :--

Most program trading use neural net ( dynamic pattern recognition ) and they are dumb in a way, they don't understand the reason for the move but still the move is seen as a down ward sell off and a sell off from highs, is very bearish ( even if we assume the sell off from high is bearish the market has to come back to near the previous high for Double top formation before major correction ) , As a result most intra day activity for the next few days will be on the short side but the fundamental reason for continuation of the previous trend should prevail and we should be above 10500 by xmas,, ( all in my opinion ) ,.

FA explains the reason behind a move TA is blind to the reason and only sees the move,,, don't bet your farm on TA only because if you do then you are setting your farm on fire ,, ( IMHO ) of course

Grey1

IMHO this will not be any where near the subprime bust

-

I wasn't trying to come across as a smartass. What I am trying to tell you is this:A. Trading is part of a package, the package being the individual. One part of the package cannot suddenly excel, that too in probably the most difficult endeavour known to man, if the package overall is of poor quality.

B. Once you have experienced this realisation and have acted on it and seen the results, it doesn't matter what others may or may not say, or whether they agree or disagree.

well said such a word of wisdom my man

-

I stopped using indicators about 3 weeks ago, I like the idea of just using price action.Bruce

Market goes through cycle ( foundation of TA ) and an adaptive indicator ( not an static one ) can be extremely useful ,, in fact the heart of automation and program trading is the use of indicators very close to the price action using noise reduction analysis ,,

There are many advantages in using adaptive indicators

1) noise elimination ( only a very trained eye can see the difference between a trend and the noise)

2) Analytical models are easier to construct..

3) Risk can be defined in terms of dynamic settings of the indicator Hence better RIsk management

Disadvantages

1) most trader use indicators with the same settings every time under all market conditions at all times.. This is dangerous and misleading and most traders spend majority of their fund and trading life to realise that their indicator is not working not knowing why it does not work .

2) Trend following indicators such as MACD , SMA or EMA ( not noise controlled MA's) are laggers ( the correct use of these indicators need an emotionless human to let the profit run after realising many losses )

3) oscillator based indicators ( RSI ,CCI) don't lead the market but they can be a window or an INDICATION to future price projection ..These tools are often used in correctly for Anti Trend trading ,, ( very dangerous game to play ) ,,,

Price action Advantages

1) A trained eye is all what is needed

2) Most of advanced TA theories such as exhaustion theories only use Price action

Price action Disadvantages

Difficult to Model for automation ( Best tool would be Genetic Neural pattern recognition technology )

IMHO no matter what strategy or tools you use for intra day trading the RISKS are extremely high and majority of successful traders use a combination of FA and TA ( avoiding high frequency scalping ) on a longer time frame using RISK ANALYSIS AS THE CORE ENGINE of their analysis .. IMHO a trader with little understanding of risk analysis will eventually get wiped . Only those who understand the RISK survive the market..

Grey1

-

It's coming along slowly thanks. I took some time out, but am trying to make up ground again. It was quite some session with Lote_tree by the sound of it !Thank you for your most generous offer about any problems I may have and the possibility of a meet up. It would be something I would like to do very much and I think sometime post-Christmas would be great so that I can get a little more development work done so that I might be able to also show you what I have done.

Fly me to the Moon :rofl:

Charlton

please email me to arrange a date as it says you donot accept private message on this site

thanks

-

Although I can see the point of posting P/L because it demonstrates that it is possible to make money from trading, I am sure (from knowing Grey1's material on another site) that readers will find what he has to say extremely interesting and useful. I am sure that he will show very clearly how successful traders manage trades, because trade management and especially risk management forms a major part of his strategy.Many people followed his technical trader's thread over on T2W and found it beneficial. A number of people including myself have incorporated these ideas into automated or semi-automated trading engines.

Charlton

Hi

I hope you have developed your risk based engine and happy with it,,, LOTE_TREE was here in my house and he is on his way to develope his own code..We spent 9 hours to gether and it was mostly about risk management... Let me know if you have any problem then perhaps we can meet here for a full day of live trading..

grey1

-

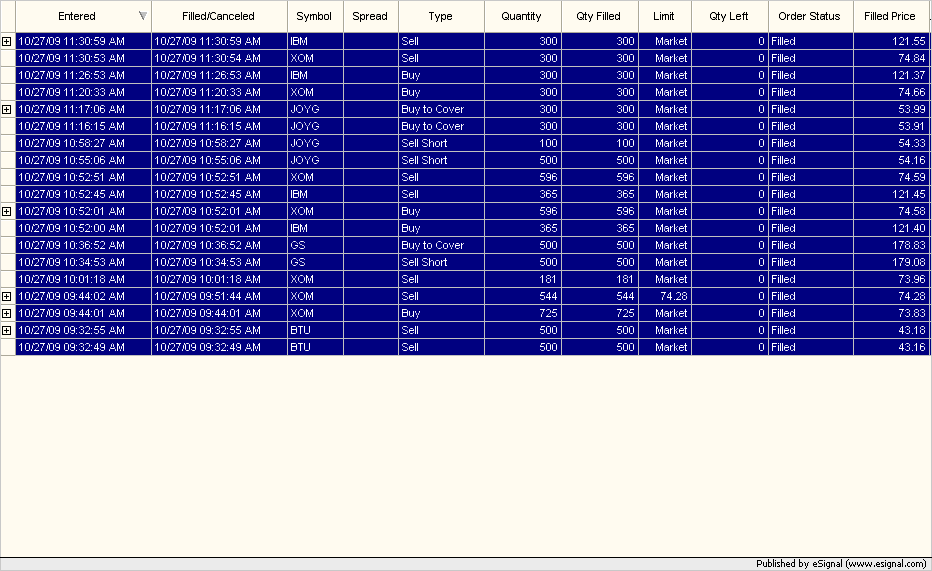

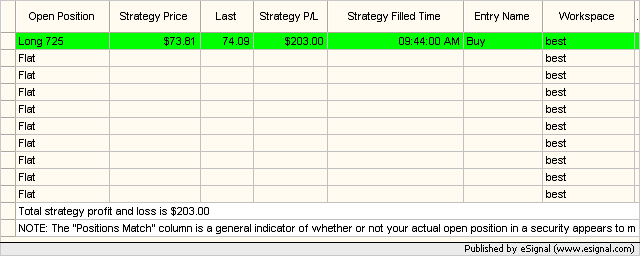

Grey1 will not be trading any more to day ,,hence this the final P/L

Final P/L + $1430

I am including all trades and the price filled .. I doubt posting P/L will help any 1 to learn trading hence I wont post any more and instead will be posting on various advanced Risk analysis,statistical arb , pair trading , program trading ,modern chart analysis ( pattern recognition using gentic NN, fuzzy analysis, expert systems and various AI techniques ) as we go along ,, this way I am sure my expertise will benefit some soul .

Muachs Gracias

-

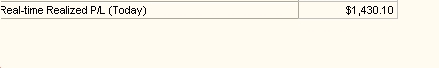

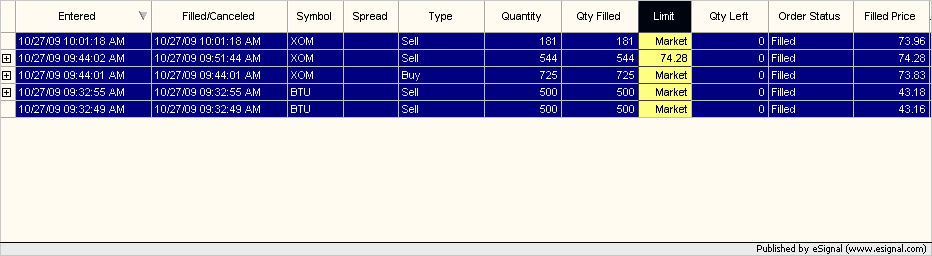

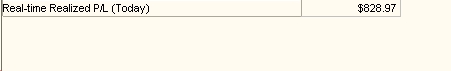

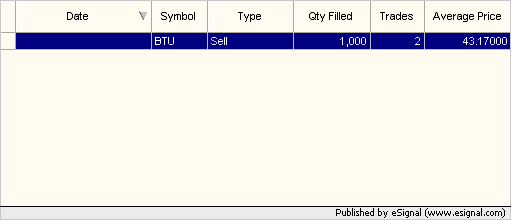

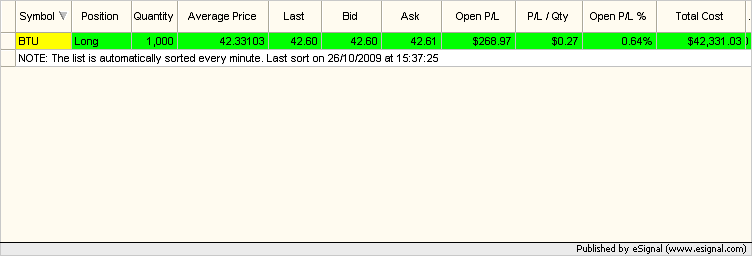

GREY1 closed his over night BTU long Trade with $828 profit as seen ,,Round1 Grey1 wins Mr Market lose,,

Grey1

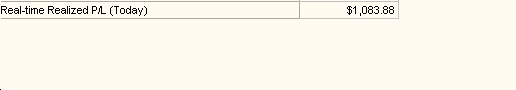

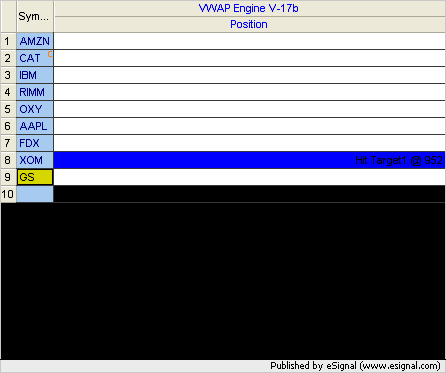

Round 2 LONG XOM the entry for the stock was perfect ( automated entry ) .. LONG 725 which profit was taken on 544 when it hit its first target with 181 to run ,,, the last lot was closed resulting in a total of $1083 profit for the day.

Grey1

-

GREY1 took an over night LONG TRADE on BTU as seen,, The shown P/L does not mean any thing as the market could Gap down and I am toast,,BTU is an energy stock and could defy the gravity ..

I be happy with $1000 profit and a loss of $500

We will see tomorrow

Grey1

GREY1 closed his over night BTU long Trade with $828 profit as seen ,,

Round1 Grey1 wins Mr Market lose,,

Grey1

-

Grey1 - while offering your opinion is welcome here, your declarations of 'I know all' is rather old (and you haven't been here long).If you want to offer your opinions, have at it. But telling someone if you don't know the answer to some of your questions you won't make it is ridiculous. I don't know the answers to all of them & here I am doing it day-in and day-out.

Here's what we know - there's many, many ways to trade the market. Just b/c someone doesn't agree w/ your methods does not mean that person is wrong. We did this song and dance in another thread but apparently it's not sinking in.

Only GOD knows it all ,, I have expressed an opnion about the foundation of education in financial engneering which is risk analysis which you hate it,,, fair enough .. I have expressed my view on RISK first Reward Last ,,I have also expressed to encourage traders to concentrate on money flow based on FA than PURE TA.. This is some thing you are thought if you worked for a BANK , now if you donot like it then I understandand ... People say there are many ways to make $$$ from market but you forget to recognise those methodologies that are not risk based will lose in long term even though could work in short term ,,

Grey1

-

I recently became aware of this site after coming across it during an interview with Mr. Lee. I have just decided that my career of choice would be day trading, and plan to treat it as such, not just something to do to make money. I strive to learn all that there is to know before I take the plunge of losing my first trade. I'm 19 and have the financial stability to start, but the question is where. Starting fresh is an understatement...I'm not sure what to accomplish by asking the very same people I would be taking advantage of ( by that I mean of their mistakes) in the all-to-real market, but I don't know any traders personally so my options are limited. A first step would be great advice. Please understand that my proficiency is far from complete in the lingo of tradespeak.

Thank you,

Kyle

I suggest you paper trade for 2 years..

Get yourself a piece of paper and check the following ( if you donot know the answer then you are not going to make it )

1) How do I reduce systematic risk intra day

2) How can I adjust pos size to reduce risk to capital

3) How can I diversify over different instruments

4) Is it enough if i Use TA ONLY to become profitable( This is a very important question and you should speak to winners of stock market to tell you the truth )

5) what style of trading is less riskier( intra day ( avoid it if you can ) , swing few days using TA or swing using FA ( I encourage you to do the last)

6) DO I need to Watch CNBC

7) what is the first step and where should I start( I give you a hint start with NO1 if you insist on day trading )

Think of the risk ,,, you will be eventually rewarded for excellence

Grey1

-

Tweezers & Shooting Stars

in The Candlestick Corner

Posted

I once told an ignorent that the probability of throwing a coin is 50/50 and he told me look

FACT ,, I just threw the coin 3 times and i got 3 heads so it cannot be 50/50

I did not continue the argument

Grey1