Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

3239 -

Joined

-

Last visited

-

Days Won

2

Posts posted by TheNegotiator

-

-

Just an observation, but if the mid/open/VAL/VWAP area 12.75-13.50 cannot be retaken the current low at 1407.00 is in danger of being broken imho. But trade what you see and what does happen. :missy:

-

-

-

democrats comfortable going over the fiscal cliff - boehner

-

Just a quick clarification on how I view gaps:-

Two ways

1) Session gap - this is RTH close to RTH open. I generally prefer it as the gap is artificial anyway. The "unauctioned" prices are point to point and it's my view that it's best to take it from the last price.

2) Range/Profile gap - this is a gap between the extreme of the prior RTH session and the open of the new RTH session. The gap is the "unauctioned" prices where the market has yet to trade at all.

I prefer 1 but I always look at both - especially when the close and high/low are not close together. I believe it also depends on the market mode we're in as to which is more likely to act as a level (and if it coincides with an important level as well).

-

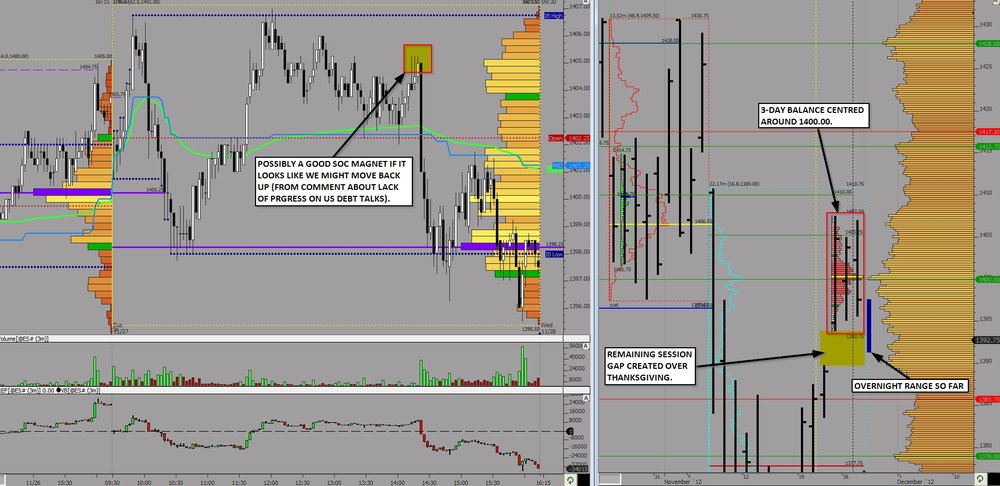

Quick thought. If we opened here ~14, the half gap(to close) would come in around the high from 11/7 which is the high of the cyan balance profile I have drawn.

-

-

So zh is claiming the spike overnight was a ff. Whether it was or it wasn't, the market has extended higher and is setting up to be potentially quite bullish. I guess that depends though on any more comments coming out from various sources about the fiscal cliff and greece/spain/europe situation.

-

-

On the auction: if the market really is strong and bullish about news today, prior VPOC shouldn't be rejected. i.e. the test of 1400.25 is crucial. It could still reverse from there initially, but if I was a bull I would not like to see a quick rejection of that price area.If that were followed by the market falling back out of the prior 3-day balance, I believe there would be some toasted longs.

I'm not saying I believe this is what will happen, just thinking about what might be the consequences if it does happen.

-

On the auction: if the market really is strong and bullish about news today, prior VPOC shouldn't be rejected. i.e. the test of 1400.25 is crucial. It could still reverse from there initially, but if I was a bull I would not like to see a quick rejection of that price area.

-

El Presidente in 20 minutes. Market taking a break and maybe needs more fuel one way or the other, and Obama will likely deliver.Yeah the Big O could certainly move us like crazy if he's chatting about the fiscal cliff.

-

-

I am looking at this thinking what could happen.

- We fail to hold the 3-day balance = not very good and move lower possibly down to that 77.75 level becomes more probable.

- We build in the balance = overnight and early rth shorts are stuck. Take out 1397.50,98.25& 1400.25 and look to that SOC at 1405.00 then balance highs etc.

- We do nothing. Fill the gap, literally.= LAME

- We fail to hold the 3-day balance = not very good and move lower possibly down to that 77.75 level becomes more probable.

-

That's the session gap closed now. Bear in mind if we do take 97.50 out, there could well be some stops aka liquidation of overnight positions. Not definitely, but be aware. I wouldn't automatically be sitting with my sell limit at 1399.75 put it that way.

-

What do others think about this 2PM report?I think we're news driven

-

Rehn and Boehner double teaming the market there.

-

Sellers being exhausted at 87.50 is a good example of what I was referring too. We had huge sell orders going off there but the order book imbalance and limit order demand exhausted sell orders. We subsequently developed an order flow reversal from this book imbalance.Always about context and what happens next though. If sellers are exhausted at a level it's gotta be about what happens next. If a big seller is there but doesn't know if a big responsive buyer is going to step in at an important level, selling is bound to ease off. If then there's no responsive buying (at least by otf), you know that level is in danger of being run. But then it could build a base too like it did yesterday.

Just wanted to point out that it's important to view the trading action in technical and auction context and then see what the next data point is after that...

-

NHS -0.3% vs exp +0.3%

-

I agree -- but even the remarks that sparked the initial move off the 40s was pretty much "non news" -- "we are making progress" means jack in politics (as evidenced by where things are now). The market is really paying attention to this fiscal cliff bologna, and is quite volatile about it. But the important thing is that the 42 area was a very key technical area that the market needed to hold. And, the 06s were also technically good for a short. So, whether it's nonsense news or whatever, the technicals provide the road map.This is my initial downside target.

Absolutely .

-

One thing about that comment yesterday I am thinking is what does that really change? We know that negotiations are ongoing and currently tough to conclude so it will likely go to the 11th hour. Also, it's a purely qualitative remark. Someone thinking it they aren't going well and stating what the level of disagreement is on specific points are two different things. My feeling is there could be a move back at some point but giving the technical context I'd like to see a rejection of lower prices before jumping in front of the train. This is just one possibility. It could of course tip over an test at the very least the 'balance' area vpoc at 77.75 again and it could sell off even harder.

We have to plan and watch and see whether what the market is doing is aligning with our ideas. :missy:

-

Today we have New Home Sales, Crude Inventories and Beige Book due out. EU's Rehn and Fed's Tarullo are due to speak but the focus is likely to be on the ongoing talks on the US fiscal cliff. The comment last night that the talks weren't progressing and the subsequent reaction was a clear indication that this is a big focal point for the market right now. The 3-day balance could well provide enough propulsion on a break to extend to test targets further below (or even above if we were to get some strong responsive buying on open) with the gap fill first on the hit list.

Some thoughts on a chart:-

-

It's interesting when people say they don't like scaling out of positions. By scaling, you control your risk and also your upside potential. However, let me ask you (as in anyone who doesn't like scaling) how many trades you take where you are shown at least some profit only for it to move against you for a loss? Scaling out therefore helps turn(if done well) many losers into small losers, scratches or small winners. I think (and hope) it's quite clear why someone would want to achieve this.

Plus, two of the most psychologically painful scenarios with all-in all-out can be avoided by scaling out:-

1) Decent winner doesn't get to target. Say the ES shows you 4 points but you (in your almighty wisdom) believe it's going to get to 6 or 7 easily. It turns and hands you either a scratch or even a loser. Sickening.

2) Winner gets to within 1-3 ticks of your target. Let's call that target as above at +7 points. You don't scale or trail. You are fully loaded and maybe your original stop was something in the region of 2 points. So at market you can take 6.25 points. But you don't because you have a plan and you must stick to it. For 3 ticks, you are now risking 25 ticks. Madness right?

IMHO you need to have a plan to take something off at the very least when the risk is far greater than the potential reward.

I think the trouble is that people will argue about this one until they are blue in the face. The trick is to do what truly works for you. Back to the thread though...

-

First, let me start of by thanking the admins here who have recognized the value of my contributions, and what I have to offer as a trader and a vendor, and have expressed an interest in my sharing more here. Over the past year, I've been both developing and trading with specialized software that I designed for reading the tape, order flow, and order book imbalances.We are now nearing completion of the software and have developed it to a commercially ready state. We are running some last minute tests and plan to have it available for subscription in the next 1-2 weeks. The pricing isn't finalized but it will be available for a monthly subscription fee (likely around $120-$160/month). The first version will be fed by the Ninjatrader platform and we are authorized Multicharts developers, as well. We plan to have a MultiCharts version ready in about 6-8 weeks. There is no way to purchase the software yet but if you sign up under the "Contact Us" tab on our website then you'll be added to our maillist and will get first notice.

In this thread, in my first posts I plan to start by explaining how the software works and what it offers because it works differently then most other software. In later posts, I plan to share more of my own trades, calls, and trade setups in more detail.

Looks quite good. Firstly, how resource hungry is it? If you are trading based on order flow you want a responsive execution platform. Two, it seems a little pricey to me considering you can get an iqfeed/sierra combo and run it as a standalone solution for a similar price to what you've quoted above (and much less if you are trading cme products and have the data waiver). Any thoughts?

Day Trading the E-mini Futures

in E-mini Futures

Posted

I love it! You just have to be nimble and disciplined. Plus, even if you don't actually like this type of movement, it's exactly the kind of shake up the markets need to get them trading nicely again (not that they haven't been).