Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

81 -

Joined

-

Last visited

Posts posted by zapisy

-

-

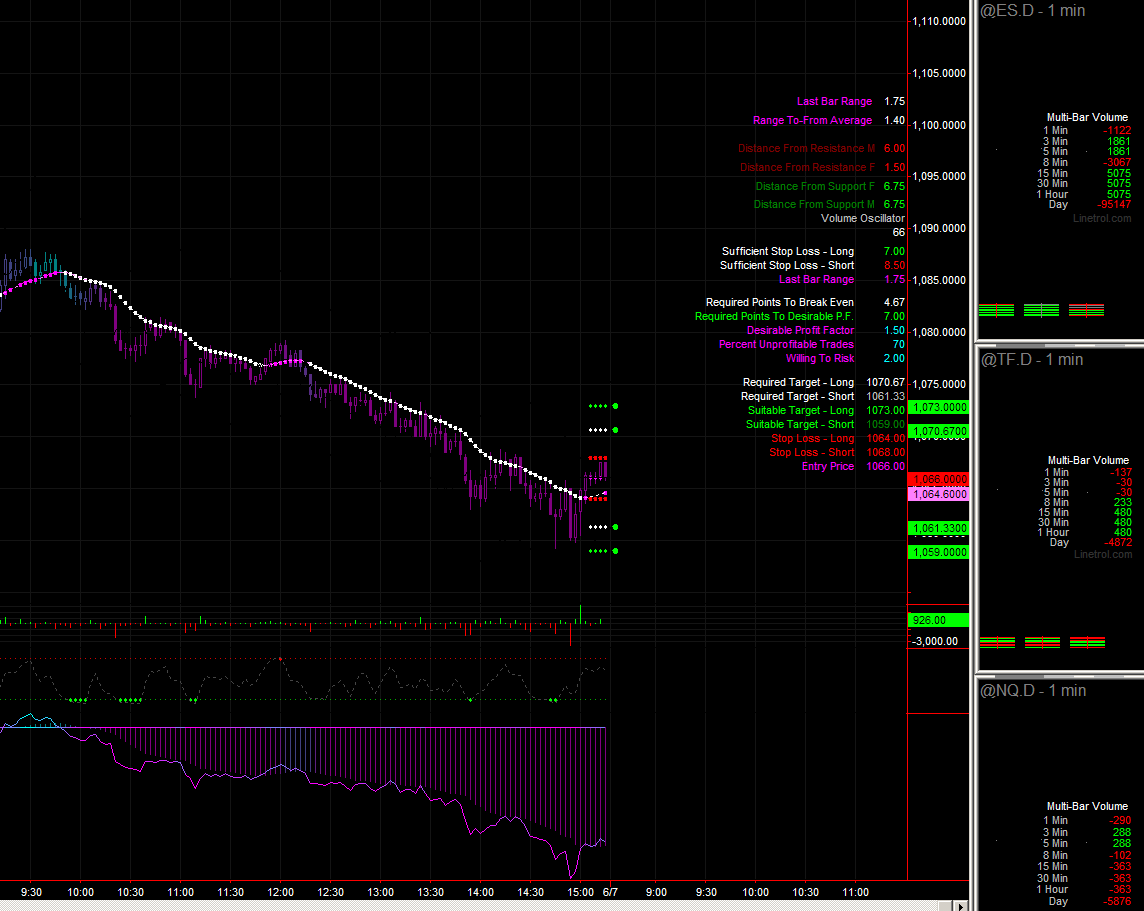

Few changes added.

Easy to use and very helpful in seeing where should be our stop and profit target - if it's real - by looking at the chart.

You can also setup you past trading effectiveness to calculate the Profit Factor you would like to achieve.

Works with TradeStation 9.0+.

Download Here

linetrol.com/files.htm

-

-

I do not have,

Linetrol

-

Only strong volume, does not mean the market will move in any direction, and in which one?...

All the best,

Linetrol Development

-

to backtest "More less you can use something like this" with intrabarordergeneration

-

Easy to use and very helpful in seeing where should be our stop and profit target - if it's real - by looking at the chart. You can also setup you past trading effectiveness to calculate the Profit Factor you would like to achieve.

Your comments and questions are very welcome!

Works with Tradestation 9.0+. If you need for an earlier version, please contact us.

-

Hi,How do I set a profit target and stop loss for long, and different target and stop loss for short? Right now, I call setProfitTarget and setStopLoss, and they set a global target and stop loss.

Thanks

More less you can use something like this:

If marketposition>0 then begin Setstopcontract; setprofittarget(100); setstoploss(100); end; If marketposition<0 then begin Setstopcontract; setprofittarget(400); setstoploss(400); end;

All the best,

Linetrol Development

-

Yes, it does work, but like others said; it is long time to create one, then test it.

One advice. Do not optimize systems in the hard way, just to find good equity curve - it is called curve fitting, and it never works the next day.

The best it to find strategy/create one, that does not need any optimization, and adopts itself to the market. If you have to optimize, then always take at lease few months from the chart (latest few month), then optimize, and then apply the new data to see if it works.

-

-

Why we have 100?, because we have no regulations and too many big companies that hold the price. If the gov would say tomorrow that all contracts have to have 100% security (money on account that the contract is worth) then you would see the price 50, no more. We do not have problems with oil, and have it even more than we thought ( do not tell about cost of deeping)... This price is a fake that would change once we put real regulations in place: like real delivery of oil (this is where from the futures contracts came from - right)? So why we try to regulate market with money that we do not have - fake money = leverage). We all agree that the market regulate itself - yes, that is true, but not betting using fake money - laverage again.

Take care,

-

They should ban it - naked.

I do not know if you ever thought why the crisis even started...

First to blame is USA's banks greediness and Alan Greenspan in my opinion...

Second "man", and crucial, that put the plug in, are the OIL speculators...

This is very long theory (just my opinion), but I will explain it shortly.

1. Everything was ok. People bought houses for profit or they liked it.

-

2. Second, people started buying additional houses for profit ("they got loan for nothing")

-

3. During that time, Alan kept the interest rates very low!

-

4. Once the FED realized that the bubble is present, he/they made the biggest mistake they could ever make to stop the bubble and not that big inflation. Rising interest rates!

-

5. People instead of paying $1500 loan every month (making $4000/per family), they saw an invoice from the bank for $2000 and more! If someone bought house thinking that "will be ok with the payments", "somehow we will make it", then the extra $500+ is crucial.

-

6. Oil went up from $40 to $140+, and instead of paying on gas station $100/month, they started seeing check for $300+.

-

7. Inflation went up again because of the OIL. FED increased the interest rates to the critical point, and everything got f.....

-

8. Crisis Done

-

FED/ALAN was the worst, and Speculators of the oil just increased the whole problem (inflation and interest rates), that could be easily straighten out by the market.

Where are the regulations for crucial products that the entire world needs - necessity?

Do you trade oil - ok - then please order future contracts - please pay half now, the rest later, and the oil will be delivered on the expiration date.

Or Make the margins high enough, to stop moving the market the way the BIG companies want.

Speculators are not good, if they have no interest in the product that they bet on; because for big companies it is very easy to set prices they want.

Do not agree? Isn't selling 1 mil of shares by specialist from wall street for the best price (they are getting commission if they sell higher) - not to driving the price lower?

If the free market/speculators very really moving the prices as it should be not keeping

others - small players thinking that everything is ok - a sick speculation?

Only when very bad news are coming, they have no chance to keep the price (almost),

otherwise they can sell 1 mil share in one day, and nobody will even know that - still

holding or buying that security. This is not a healthy speculation - this is fake,

that does nothing good to the economy, but makes the "people - economy" poor.

Because we pay for it later. In taxes or the stores - not the government or citi group that

took money from gov at 0% interest, and f... the whole business.

The top management still have millions in the pocket anyway...

Take care.

-

In my opinion, SIM trading is good just for finding the way we want to trade (the system).

It is also good to learn the greed, since sometimes it is very easy to bet double on the trade trading fake money. If you learn to avoid it on SIM, then you'r 1+.

But sim account should not be used too long, since it does not include the real risk and the greediness. It is better to start trading micro lots, because you will make and lose real money but it does not cost that much.

-

I would take care of the Crude Oil speculators. More margins and real delivery of the OIL would change the price to $10 again.

-

Why is so fantastic? Any pros?

-

I enjoyed your Tick article. Thanks. I'm wondering if you know how to apply a tick chart directly onto the price chart. I'm using Tradestation.I noticed you were using an 800 tick chart with the ER2 and a 1 minute tick chart. I'm curious as to why you chose those time frames.

I read about a strategy where you look for a new high to be put in on a price chart but the tick fails to make a new high which would be a short signal. A long set up would be the opposite. The trader traded the es and had made a custom tick chart comprised of the s&p 500 stocks only. I'd love to know how to set this up but after reading your article I wondered if it would be just as effective a strategy and easier to set up with the regular tick and the er2.

One other strategy that has always facinated me is to watch for the dow to hit it's major resistance or support on a day or hourly chart usually at a big round number. When the tick fails, and hopefully the es gives some leading indication that a reversal is taking place, then you would load up on OEX at the money put options (or calls if dow is failing at support). The strategy calls for $20,000 in options and you would adjust the quantity of options accordingly on every trade. Option expiration week, when the options are priced low, you could wind up with 100 options on a trade for example. Naturally, one might need to build up to a $20,000 per trade level, but if one is good at reading the tick, I can see this as a way to hit consistant home runs.

Any thoughts on those ideas?

TJ

You can not combine tick and minute charts in one window. You can just place them close

-

Basically, your Profit Factor Should be more than 1.5, even if only half of your trades are profitable. Use slower time frame, and do a back testing for at lease few years, and forward tests if you optimize the strategy in any way.

If you optimize the strategy, the easiest forward test for any strategy is to apply the strategy to all the data possible without recent X months. Then do the the rest of coding, optimization, and add the data you were missing. This way you will see if the strategy will even work for the X months.

All the best,

Lukas

-

can you post pictures of how the indicator looks?

-

Volume is the total volume traded, ticks are only when the price changed from let say 1 to 1.1. - one tick, from 1.1 to 1 again, second tick; but this tick does not show how many contracts/shares were exchanged during that price change.

-

Lina, where do you see the volume?

-

Exactly... Instead of complaining and criticizing, I would rather see some suggestions about the volume. Have something better? something really good? please share!

Take care.

-

Yeah.Another half witted spammer playing the same old stuff. I wonder if anyone was stupid enough to get suckered by they/them/it?

Kiwi, I replayed to what Lina shown us. If you think that this is spam, I would delete the post - but can not edit anymore.

I can not compare myself to your number of posts, but I posted on this forum many times already, many times people thanked me, and have never posted any marketing before and never will. Line shows what she/he uses, and I show what I use. That is it. You do not have to be unpleasant.

-

Yes, this is our research and code.

-

I use something like this:

-

Yes

yes

yes  yes

yes

Money Management - Simple To Use And To See - Tradestation

in TradeStation

Posted

Hi,

I have provided working software. That the code is closed, does not mean that the tool is not working. If you want to see the code, just write it yourselve... Otherwise do not criticize something only because the file is closed.

Thanks,

Luk