Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

jonbig04

-

Content Count

946 -

Joined

-

Last visited

Posts posted by jonbig04

-

-

I hope it doesn't trigger! :rofl:

-

-

it sounds like you have it all figured out.Far from it, but IMO a large account isn't necessary. What's more important is the work done in SIM, how seriously you take it, and how prepared you are before putting money at risk.

-

It sounds like you're plan doesn't include losing.Good luck with that!

The fact is that you really do not know your risk or your accuracy, so err to the side of prudence.

Let me repeat: if I am losing $1,000 PER CONTRACT I probably shouldn't be trading in the first place. In ES thats 20 points. If I know that the biggest drawdown I've ever had is 8 points ( $400 per ES car) than say a $2,000 account should be plenty for 1 car as it allows for a 30 ES point draw down before I can no longer trade. I would say thats plenty of cushion.

I think a lot of you would go nuts if you knew what I started with when I first went live with 1 car. I didn't see the point of idle money just sitting there for no reason. I left myself a cushion and if for some crazy reason that cushion wasn't enough than something was wrong with my trading and I should stop anyway.

Oh and the percentage gained on the acct (bc it was so small) was nuts! :rofl:

-

http://www.cmegroup.com/tools-information/holiday-calendar/files/2010-martin-luther-king.pdfMaybe this will be clearer.

Some will. Some will not open until Tuesday and some will be open later.

Gabe

Thanks, I only had the first page.

-

So doesn't thats say the futures will halt at 10:30CT? Or am I being an idiot (strong possibility)?

-

I was under the impression CME closes at 10:30CT?

-

It's almost as though your mind wants to fill in the rest of a decline that's yet to come, isn't it?Best Wishes,

Thales

Sure looks like it. I don't follow that pair, so I don't know is thats a major R level from before or not. But the double top, followed by a LL and a LH and another LL, to me indicates trend reversal.

Or of course the whole thing could end up being a PB of the larger trend haha

-

Wow, someone said you need 20k to trade. To each their own, but 20k? What the heck do you do with the money that you aren't trading with? I've never understood why people think you need so much money to trade. You need money to live while you LEARN how to trade, but IMO if you have learned you don't need much at all to get started building your account up. Once again this is only after you've put the learning and screentime and have developed a trading plan.

People told me to start with 5k per ES contract, but I couldnt figure out why I would do that when the margin is $500. What do I do with the other $4,500? I know my accuracy and risk and if I could lose $500 or $1000 per contract, I should'nt be trading in the first place, let alone $4,500.

Just my two cents.

-

haha well the 1.3 of course.

-

Is it that you think them not clear, or you think them too insignificant to warrant trading off of them? After all, the very definition of trend and what it means to change trend direction demands the presence of a 123 at the point of the turn. Even a "V" bottom has a pullback that prints the first reall higher low.You said that you did not agree that every trend change does not start with a a 123. I think you must mean, even if you are not aware that this is what you mean, that not every trend change commences with a 123 you would consider tradable. This simply means that you have developed some criteria by which you "filter" your interpretation of price action. That is fine. But you need to recognize that you are doing so, and if you are not aware of what those criteria are, you need to try to figure it out for yourself. But every trend change starts with a 123. And every trend is a cascading of 123's in the same direction (except for a sideways trend, which is either a series of 123's alternating in direction, or a series of alternating HL's and LH's (coil, hinge). What I think you are saying is that there is a size or degree of trend change that you think is optimal, and not every trend change seems to offer a clear opportunity compose of the size swings you prefer to trade. I may be wrong, but I think I am not...

Thales

I don't mean to interrupt what is an interesting exchange, but I think MK is concentrating TOO hard, if that's possible. With respect MK, I think you are over-thinking this. I'm not saying it's easy to master (how would I know), but what I am saying is that what Thales does, and what every single good trader I know does, is simple.

You mentioned that not every trend change starts with the 123, well of course it does! If you can find be an uptrend that doesn't start with a low and a higher low I would be pretty surprised. Of course trading that with a good entry and risk management is obviously the hard part. But IMO using HHs HLs and LHs LLs is pretty fundamental.The respective size of the swings, or waves or whatever you want to call them also differ. Just like a trendline, support and resistance, or a double top.

-

I think I have everything set up and ready to be back 100%. Of course it's a 3 day weekend haha. I'm glad I have it sometime after rollover for some PA to develop on the larger charts. We have some good stuff in the charts. I'm going to try to be more diligent with the journal. Sometimes, win or loss, I just get lazy and don't update. I'm going to try to do better.

BTW as far as I understand it, globex is going to open at regular time tomorrow evening and the hours will be normal until 10:30CT at which time the trading is halted. I hope I have that right.

Click for full size - Uploaded with plasq's Skitch

Click for full size - Uploaded with plasq's Skitch

6E is still looking a little funky to me, though we are approaching a major S level. Looking for a nice reaction there.

-

I have to be honest kiwi, that's all a bit too confusing for me.

-

Excellent post, Sevensa. Nothing helped me along more than when I came to appreciate the concepts you so clearly set out here.Too many focus on winning. What they need to focus upon is making sure that when they win, they win at large enough multiple of their losses so that over the long haul, profits outstrip losses. If I had to lose $1000 50 times to win 100K once, I'd be quite happy with that winning percentage. Of course, I may not have the stomach to sit through that draw down. But th epoint is the point.

Best Wishes,

Thales

Couldn't agree more. Accuracy should only be discussed in the context of risk/reward. My accuracy goal is 33%.

all just my opinion of course.

-

Haha yea, it was all at once. It happened in a single second.

-

-

So I know I said I was going to start back trading, but I haven't yet. The reasons are two-fold: 1. The low vol holiday action combined with rollover made a lot of my S/R areas obsolete, I needed time to mark off some new, more relevant ones. 2. I'm in the process of moving. I have my s/r levels down and the move will be over this week. Hopefully I will be back 100% next week.

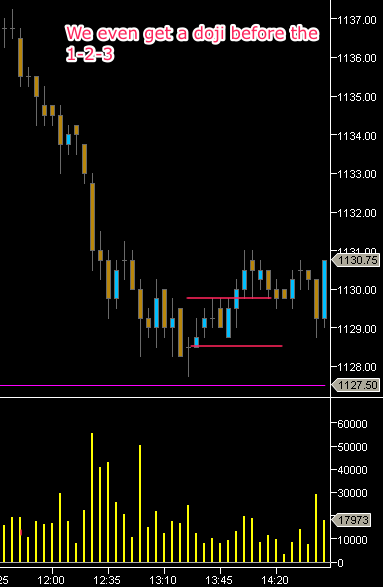

I was watching ES today and saw what is very close to my standard S/R play. I wouldn't have gotten in because the retracement (on the 5 min chart in the 1-2-3) wasn't very full. I would have liked to retrace another couple ticks. But it does give me a chance to show in the charts what I'm looking for in this setup. It's not a would-coulda thing, just an illustration. So here goes:

The double bottom is what cemented the 1127.5 area as an important area in my mind. The hump retest is just one way to enter off a double bottom. I used to do it a lot. Just pointed it out for fun there.

I should mention that this is my "tape", 5 sec chart.It should say switch to the 5 minute.

-

You know that feeling you get when your just know your stop is about to get hit, but instead of cutting the loss you just sit there and watch it take you out full stop ... that's a bit like I feel right now ...I'm all in/all out on this one, and now I'm just waiting for my stop loss to take me out ...

Best Wishes,

Thales

lol, that feeling is the worst. I managed to catch the cowboy breakout.

-

Jets hit profit target.Still long Eagles.

Best Wishes,

Thales

Nice thales. Perfect setup.

Totally stopped on the Bengals trade. Currently long the Cowboys based on initial point-action.

-

Hmm I'm not sure I understand the question, but my stop changes with the PA of the trade of course, but often a trade requires a stop that I'm not comfortable with, usually anything over 2.5ES and I'll just skip it.

I try to look for a semi-strategic place to exit within my R/R parameters, i.e. previous day's high/low etc.

I never really thought about it, but no I'm not risking the same amount on each trade in terms of the initial stop, but it doesn't vary that much. Usually the stop is 1-2 ES points.

Sorry if I misunderstood the question.

-

I couldn't agree more, Thales. Over the holidays I conducted a pretty solid review of my FX trade ideas (trade idea to me, means having the general context right) since coming back to FX land a couple months prior. To my astonishment it is my micro managing that is massively affecting the bottom line. My overbearing desire to book profits early because it looks like it might start moving against me soon and/or moving to BE before a test of my entry has happened.I need to simplify more rather than make things more complex with excessive micro managing.

With kind regards,

MK

Exactly! This is what I discovered in my trading and is why when I place a trade I set my targets, move to BE if I can, and leave. I literally leave. I go walk my dog usually. During that time I make peace with the potential outcomes and come back to check on it a little later. If it's still sitting there (usually is) I recheck everything and leave again. Cook food, vaccum, etc. It's what works for me anyway.

-

It may take me a few days to get back to 100% trading. The low vol holiday mess chopped up a lot of my levels and patterns. Right now the cleanest instrument for me is ZN. Funny, I don't even know how ZN really works. I know that its a future of the 10 year T-bill, but thats it. It's quoting doesn't really make sense to me. But really...who cares? All I need is it's PA.

-

Holidays are over, and I'm glad. I was having market withdrawals. It's time to take my trading to the next level. Though, that is mostly a matter of increasing size which isn't really a focus in this journal. In real life trading though, it's what I'm working towards so I figure its worth mentioning.

I thought it would be a good idea too write out my trading plan as it has been tweaked a bit since I last did it. I don't want to go into too much detail though, only because I have done it so much in the past. Explaining why I'm doing what I'm doing might be like beating a dead horse in this journal. Of course if anyone has any specific questions I'll be glad to answer.

Side note: For whatever reason, volume based charts seem to me to ridiculously superior to time based ones when it comes to identifying S/R levels.

Trading Plan

ES is still my bread and butter instrument, and my favorite. But I foresee that in the future I will favor other instruments more and more. It is also the only instrument on which I am employing the strategy below. I haven't perfected this setup yet and don't want to move it over to other instruments until I do so. I will also be trading 6E and ZN (which which I recently fell in love with at first sight), but I will only be taking the brea out set up on these for now.

Standard S/R fades and major levels.

1. Wait for price to approach major S/R (taken from larger time frame chart)

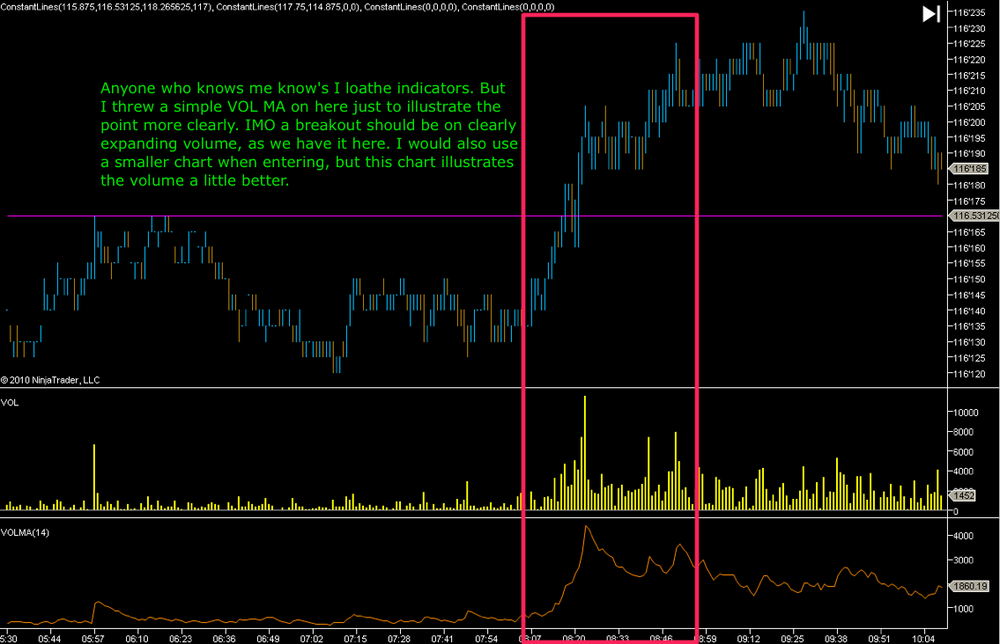

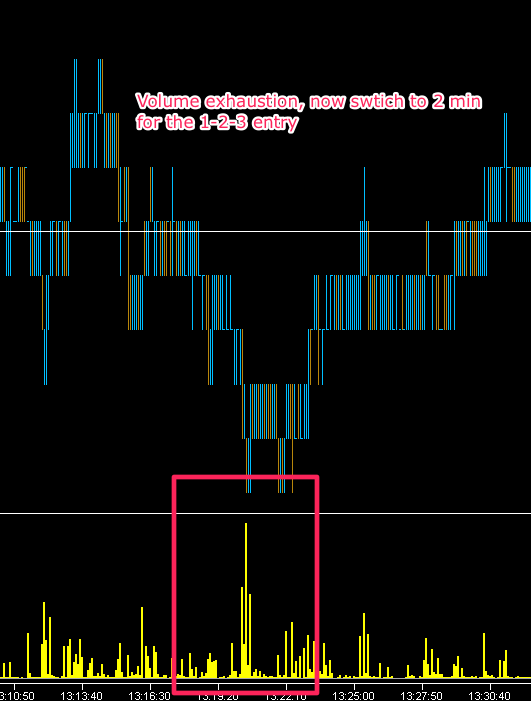

2. Wait for strong climactic volume. The ONLY purpose this serves for me is to show me that other people are watching this level.

3. Then move to a 2 min chart (after-hours I use 5 min) and wait for the 1-2-3 setup for further confirmation, and stop placement accordingly.

4. Stop can be moved to BE when I deem necessary. Otherwise, all in/all out*. Minimum Risk/Reward of 1:6.5

Break Out Setup

Is 'breakout' one word? Ha, I have always wondered. Any who, I love this setup. I've droned on enough about why I love it an how it works enough though. I really use only 2 charts here, a large one (30kCVB on ES or 10kCVB on ZN) and a very fast one with volume, usually 5 sec.

1. Look for clearly defined patterns or ranges. Usually DT or DB or a very defined range. I should make it clear that I'm not looking for formations that might look like a pattern. I want it to be clean and defined. We're talking a chart that may span a few days with tops that are equal to within a a tick or two.

2. I then wait for price to break out of that pattern or range resulting in a confirmed DT/DB or a failed DT/DB.

3. I move to the 5 sec chart and expect to see large volume expansion. In other words, I expect to see a breakout.

4. I have 2 separate methods for entering. The first is immediate entry at market upon seeing price breakout. If price stalls, stops, or retraces to my entry I exit. Usually for a 203 tick loss. I do this because 70% of the time, the momentum of the break out is significant enough to A. make the fact that I entered at market irrelevant and B. send price going a long ways before it ever pulls back.

The second method of entry (assuming I took a few tick loss on the first try and price is pulling back) place a stop entry a tick below the low of the previous move. So if it's a breakout to the downside, I entry as soon is at makes a lower low.

5. 6.5 minimum R/R all in/ all out*

Those are my two setups!

*I will continue to use all in/ all out until I hit a certain size in contracts I'm trading. As of now my size is small enough for me to stomach a +10ES coming back to BE, but once I increase my size beyond a certain point I'm not going to be able to stomach that. Yes, its a weakness haha,

-

Thanks Thales!

Reading Charts in Real Time

in General Trading

Posted

Hit the the target for +8 ES. I didn't realize that S was so close at only 8ES points. Oops. We are now bouncing off the S at 27.50 pretty hard. Anyway, good way to start off 2010.