Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

Tess

-

Content Count

22 -

Joined

-

Last visited

Posts posted by Tess

-

-

I think the reduced summer-months activity is simply a coincidence this time around Aaron. Sure, there’s definitely less participation at this time of the year, but there’s also a whole pile of other major issues playing out around the world. When you got uncertainty & nervous psychology causing ripples out there, then it’ll get reflected in the price bars.

i’m not saying Tokyo is unplayable. It’s just we prefer to roll our sleeves up & start slugging when the playground fills up with kids, & that generally kicks off as the Frankfurt & London children arrive at school.

if you study your technical charts, you’ll often see the Yens & their Australasian counterparts doing a little business during the Tokyo shift. The majors might be in snooze mode, but occasionally you’ll get movement, especially if the equity markets are in overdrive.

but I guess it would be prudent to transact your business when the liquidity is likely to be at it’s highest? & that definitely pans out during European hours & the NY overlap.

our normal daily open to close business hours are Frankfurt open thru to the London close, with half an eye on NY for another couple hrs if it’s been a busy day.

-

any positions that are active in a pair (whether they be opm or personal accounts) for any longer than a day or two would be usually be drip fed or averaged in, regardless of the aggregate size.

it would have to be an awful lot of selling (buying) taking place during Tokyo to raise more than a eyebrow, & would normally signal some kind of unique event unfolding out there which wouldn’t necessarily be directly related to trading.

if that was the case, then there are certainly viable alternatives, including phased encashment & options to name but 2.

that’s a pretty much open question you pose though. A whole lot depends on which kind of strategy is being employed, over what timeframe, across which pair(s).

not every trade or account justifies a mid to long range view. Like everyone else out there, we’re at the mercy of what cards the market deals us. We trip up, we also occasionally get the timing wrong even though we nailed the directional flow. It’s horses & courses.

main concern is the risk management. You get that all disjointed & you’ll get your ass handed to you on a golden platter.

when we get a trade out of step or it begins to wash out – it’s time to cash your hand in, step back & re-assess.

when we get it right & the timings in tune – then it’s time to pile on & ride the waves.

You got yourself 2 main game plays out there mister: Damage limitation & profit exposure maximization.

Know when to hold em (& compound em) & know when to fold em

-

Today the market is very flat.. Some wonderous news on Monday coming? Some holiday today that I'm not getting a paid day off for hmm hmm hmm?Aaron

they can get a little tired & grouchy & put in an off day when things are quiet every now & again, but quite a few of the popular pairings have vibrated on & around busy activity levels the past week or so.

euro has been a little subdued printing only 73% of it’s avg weekly move. But depending on your appetite, still offered a decent risk short off the big figure back to it’s recent demand zone?

I thought Pound/Jap was the most interesting pair of late though. Look at all that hustle & bustle back & forth thru it’s major range barriers. Man, those were real neat ‘pullback & go’ moves (both north & south) off the 210.25-55 zone. Not a bad little shake off 212.0 on the continuation higher low shuffle either.

that one printing 1.5 times it’s most recent avg weekly performance return.

it's now knocking on a pretty heavy door up here @ 213.80, a keen s&r zone from back toward 4th quarter 07 – 1st quarter 08.

those lower levels might just be of interest should prices decide to revisit (profit targets shorts etc), but we now got a fresh zone of interest to focus in on.

pound/swiss also hustling a key range barrier up at 2.0410-30. I think that was mentioned on here recently? Might be worth noting that one in your jotter pad.

-

I do hope you are able to understand my writing because my english not really good.don't you worry bout a thing Mr arifwise sir. I'll handle all the in-depth agent negotiations. we'll have you all slickered up in no time at all.

you'll be taking a bath in Moet before the weeks out, I kid you not!!

stay the hell away from Anna-Maria & Krantzy & any other muscle hog. they're only after your $$'s. i'll look after you, yes sireeee.

-

Krantz know you're running around bullying the nice guy's?awwww, you two are far too goddamned sensitive for your own good

hell, I might just get into a huddle with ole arifwise & his boys, see if I can’t get a piece of this action whilst it's still hot (& before the forum cops close him down).

i'll trump his phone call to those fella’s agent & broker the deal myself.

ought to be worth a six figure sweetner?

Jocelyn can ride shotgun if the heat gets turned up :o

-

you’re several steps behind the curve arifwise

go get on the phone & see if you can get hold of Nison, Bain & Person’s agent. He’s hustling & schmoozing deals for those slickers all over the w.w.w

bound to get in you in front of a whole truckload of easy $ greenhorns only too willing to slap their dough down onto your tip-sheet table. You’ll be beating them off with a stick.

-

re: fees chargewhat quality do we get for usd49.99 lesson ? if you pay peanuts, you will get monkeys !

if too expensive it will keep people away.

Life being wonderful and beautiful as always so let make it simple. will share my trade decisions and any profit above 10% nett per month, those benefit from it honestly bank in my portion as you feel worth it distributing it. anything less than 10% nett profit, you keep it. or lets raise it a bit higher say 20% nett profit a month. I dont know im just toying the ideas here so that everybody will be happy and hopefully the happy vibes transmit and transfer and touch many others.

LIFE IS SO BEAUTIFUL...........

be bless always

oh maaan, can't wait to witness the fall-out from this when the forum cops & soothsayers get a hold of it :o

you some kind of whack job??

-

Fundamentals just get in the way of trading.

I think the secret of this business is risk management and to ignore all news flow.

Oh boy, I've heard it all now :o :o

What ship did you sail in on??

You got the risk management part down ok, but it appears you're getting your legs all tangled up with your generic fundamentals & specific news flow releases?!?

As for being rude?? I thought it was a perfectly polite straight up & down comment. I'd grow another skin if I were you buster

-

I guess you don't pay very close att'n to your fundamental sheets or stay abreast of what actually is going on out there, otherwise you'd know why it was biased heavily to the short side regardless of whether they hiked or remained in neutral.

Go get yourself up to speed on the background to these pairs & the real drivers of the currency market. Then you can maybe stand an evens chance of playing ball with both hands instead of one

-

I'll be sure to check my S&R's and be sure they match up with the levels you have posted.I guess your wages are tucked safely in the satchel off those levels this week for sure

Probing that lower floor zone again into late NY traffic. Like Krantzy said, should shake a little dust off the early June sub 2.0000 number if they shout loud enough.

-

I know of a 3 part professional NLP recording that was specifically for trading of forex.sweet jesus, you gotta be kidding me right? :o

do they do one for the 1st 30 minutes of european play?

-

:o you bored Arty?

don't let him entice you into dropping your discipline lote_tree.

not a good sign letting go of the discipline.

-

Yes, wasp is correct.

Sorry for the jargon, old habits blah blah - annoying all the same.

Don't look too deep or over complicate the price action on those charts. Strip it right back & look for area's where price is out of whack or imbalanced.

Supply = resistance

Demand = support

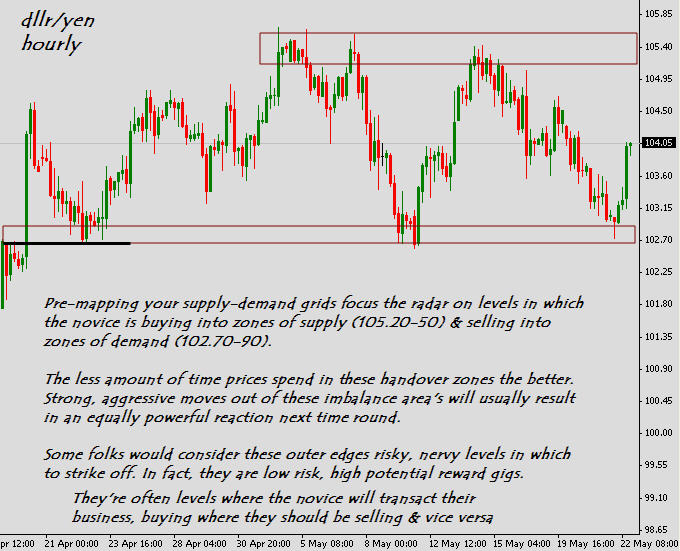

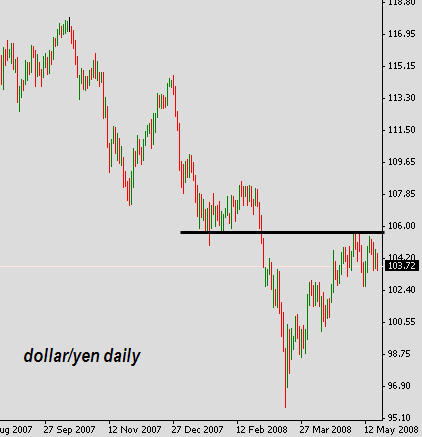

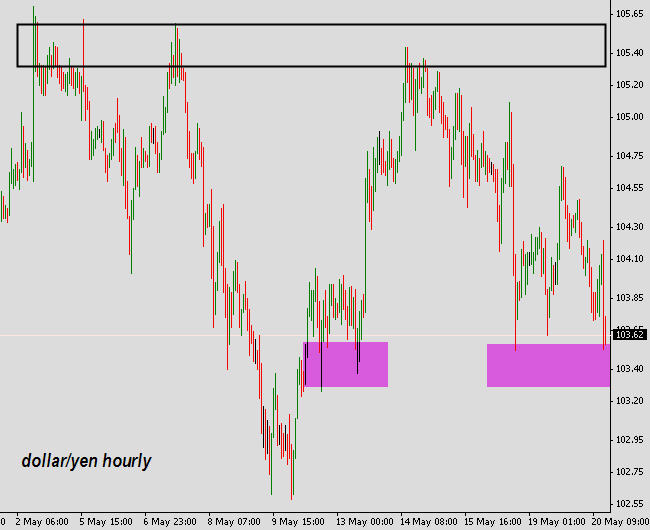

That can unfold in range mode where prices ping back & forth off structured or quite visible high-low extremes, (as per the Yen graph) or as prices shoot out of a hole & attempt to cut out a trend.

A pullback to test the momentum will usually follow that type of activity. Buyers/sellers remorse or simply queue jumpers who then panic & fold at the 1st sign of a fade will get unseated at this juncture as the smart crowd climb aboard on the ticket out of a breakout zone.

-

Lets take a snook at yet another example. There are plenty out there every week.

As always, the Daily-240 will give you a little outer edge structure as far as the major grid zones are stacking up...

Inexperienced or novice punters will usually attempt to execute way too late or jump on a fast moving train (generally as prices are approaching supply-demand camps). Those are the sweethearts you want to be transacting business with, & by structuring your trades where previous area’s of imbalance have changed hands, you’re increasing your chances of obtaining value whilst minimizing risk.

Yeah sometimes they jump out atcha, other times you got to sit awhile & wait for them to come knocking.

But knock they will

There was a cool handover Monday on the Cable. Aussie has played ball too all the way through April off 9300.

-

He's living on the big island right now, so his hours are a bit off from ours, but it lets him trade the asian and european sessions nicely.

aloha hooola huh?

sea sand sex & surf & not necessarily in that order - good for him!

good to hear you're gunning your engines too

yeah that old discipline stick will beat you good if you let it :o

keep it in eye shot & you ought to be clear of it's barbed warnings

you been playing your own currency lately? peach of a stair step journey on the CAD since early May. Those fella's who got their close quarter stops snatched yesterday (Andre's post) will be puking into their beer today I don't doubt :o

just lost their value ticket on that baby good & proper.

-

hello Cary

i trust you're keeping well?

i can't take credit for that one unfortunately, it belongs to one of the fella's here. But it's a common area of activity, based around repetative generic analysis that the guy's have posted up here, hence the inclusion.

it might yet follow the other 50 odd % of triggers which get dumped into the scratch/loss bucket, but it's a nothing entry which pushes the value to risk ratio we like to try maintain.

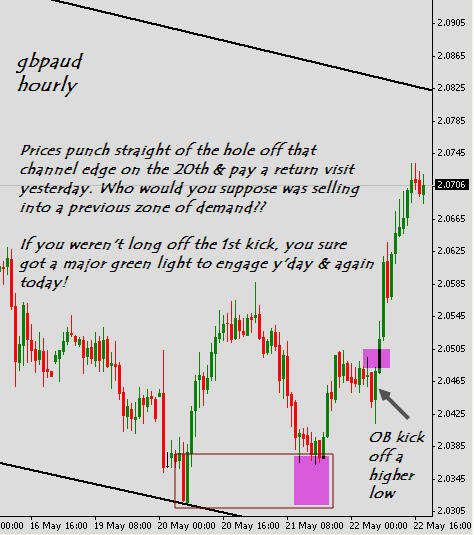

the main focus on that pair (for longs) will be radared into the developments on & around 2.0560-80, depending on how price tackles all the flak at that s&r level. But on this occasion Jim considered it worthy of a feeder stake off that channel edge.

We'll see.

How's your buddy Jack?? He still studying his trading books?

-

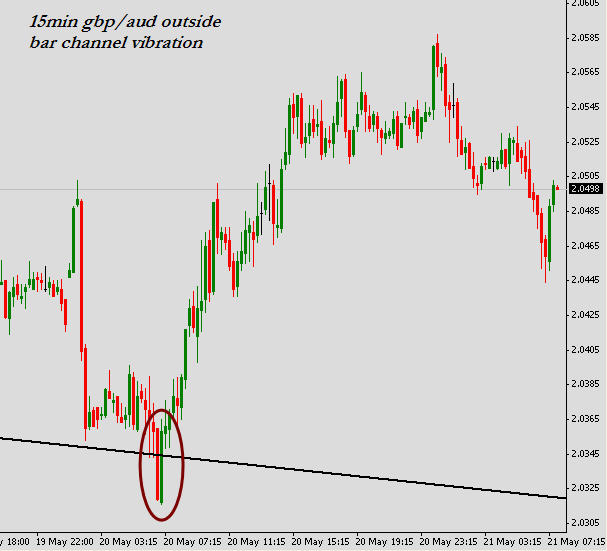

this pair is throwing up an interesting risk play off the channel edge. Not sure how many folks look outside of the main culprits, but these cross instruments offer up some real cute opportunities.

these outside days, outside & inside bar prints & the like, occur for very obvious reasons & yesterday’s bar shift off the channel edge afforded a positive risk shot on Sterling momentum which resulted in an outside day on the approach to 1st line resistance at this 2.0580 line.

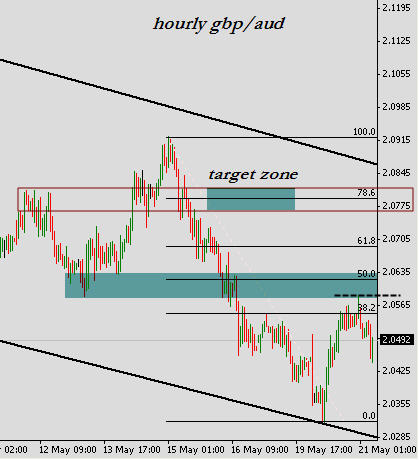

A bust & hold of that lower fib exposes a run for the upper supply loop @ the 78.6, underneath that upper channel edge.

It may well get clouted back to these 10yr lows, but if you’re seeking to step out & get ahead of the crowd, these kind of set-ups can sometimes give you an edge on the herd.

-

Cable punching through some weak stops today huh? That's a mighty impressive plod off that 94 support base. Must just be a short squeeze exercise.

You can almost hear those old stops hitting the floor as it tanks on :o

-

you bounce those asian jumping jacks around via the shorter frame view Wasp? How do you get along with them?

apologies if you've covered it in your blog, I haven't gotten around to perusing everywhere yet. It's a busy little shop & that's a fact.

I like to try get aboard at the wider edges (chart brief). Not always successful, but I'd rather soak up the excess at those outer boundaries if possible than get my shins bloddied toughing it out inside these busy corridors.

interesting to see how different folks play their hand.

-

appreciate the update.

place looks promising for sure.

important things first…..lets go check out this music thread.

by the way, between dodging eye surgery & water bombs, you made any money this week? We got us a 3 day weekend (drink fest) on the horizon & I doubt very much Ebbeee Krantz will be doling out bonus checks this early into the month.

-

When in the hell is the cavalry (Tessa) arriving. You’ll get your ass scolded good & proper then Mr Andre moody pants when she comes callin :haha:

Hey girl,

Kooochie koooo :smoking:

x

Busy Day Tomorrow

in Forex

Posted

aha, so you're the culprit?! :o

we had that one forwarded from our brother last week.