Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

phase21

-

Content Count

14 -

Joined

-

Last visited

Posts posted by phase21

-

-

EAS,

Can you elaborate on your "stop" methodology a bit further, pls. Your desciption sounds interesting, but I haven't quite grasped the concept.

Thanks,

-

Razz,

Have you selected the most appropriate interval per bar? If your system is currently based on 10min intervals, have you tried it on say 5 or 3min bars, with/out adjustment to the number of periods in you MA?

Have you looked at the time of day that you are trading - if you look at the volume and price movements on the TF, you'll see that most of th action takes place 8:30-11:00am and 2:00-4:00pm. The rest is just so choppy, unless there's been a major reaction to an announcement.

Have you looked at different data for the bars, eg using a fixed number of ticks per bar will give you whole different picture, than a fixed number of minutes.

Using tick data you can see all the false signals that happen mid bar. That is a real eye opener on many of the indicators. They do things that are totally unexpected during bar formation.Having traded YM, TF, and ES in real-time, I understand what you mean about intra-bar formations.

There was a time when I thought that reacting to intra-bar price movements was a good thing, but came to realize that it was a waste of time - I'd invariably get it wrong: bad fill, wrong direction, etc.

But, do you really want to react to thousands of (false) signals that occur during a bar, or, do you want to decipher and trade the main direction. Will you MAs give you the main direction? Is there something else that you need to use in conjuction with them?

I agree, Bandy's book doesn't cover real-time.

One of the things he does talk about though, is the difference between signal and "noise" - we want to trade the signal. If your signal is sound, and has statistical significance (which he outlines in QTS), then proceed to walk-forward testing, and then trade it if it still stands up.

Regards,

-

Hello Razz,

So much for back testing, I am not a fan of BT.You might want to have a look at : Quantitative Trading Systems

The book is an excellent resource for trading ideas, and especially the methodology for "walk-forward" testing, which has been integrated into AmiBroker.

Regards,

-

Message withdrawn - :crap:

-

Hi FT,

Can you share the method U use for determining your S/R lines?

Thanks,

-

-

Hello Minetoo,

The code I posted above is a direct copy from a function in Trade Navigator. I use TN for trading and quick prototyping of ideas. You can define functions in TN, but it doesn't have a programming language to speak of.

However, you should be able to plonk this code/algorithm into a template you use for defining functions in your favourite software, hence no "*.eld".

But, below is some code which does the same thing in AmiBroker. AB has a "C"-like programming language.

Define the function:

/*=============================================================================

Zero-Lag Moving Averages

This AFL contains functions to calc moving averages with minimal lag.

=============================================================================*/

//-----------------------------------------------------------------------------

function ZeroLagMovingAvg(ValToSmooth, BarsToUse)

/*

This AFL smooths the input data, and then removes as much lag as possible.

Note: Original source of the formula not known.

-----------------------------------------------------------------------------*/

{

// Declare local variables

local result ;

local MAOne ;

local MATwo ;

local MADiff ;

// Initialise the local variables.

result = Null ;

// Your code goes in here

MAOne = MA(ValToSmooth , BarsToUse) ;

MATwo = MA(MAOne , BarsToUse) ;

MADiff = MAOne - MATwo ;

result = MAOne + MADiff ;

// Declare which variable/value to be returned to the user/calling function

return result ;

}

Call the function:

/*=============================================================================

Zero-Lag Moving Averages

This AFL plotts the moving averages with minimal lag.

=============================================================================*/

#pragma nocache ;

#include_once <ZeroLagMovingAvg.afl> ;

ValToSmooth = ParamField("Price field", 3) ;

BarsToUse = Param("Bars to use", 13, 2, 1000, 1, 1) ;

SmoothedVal = ZeroLagMovingAvg(ValToSmooth, BarsToUse) ;

Plot(SmoothedVal, "ZeroLagMovingAvg", colorBlue, styleLine | styleDots | styleThick, 0, 0, 0) ;

Note: I tend to define things as componentised as possible, a-la building blocks, and draw them all together as late as possible/appropriate. That way I can separate the visuals from the calcs.

Regards,

-

Hi Chad,

I was interested in your method of determining divergence, but for Trade Navigator, and came up with the following.

Original code by Chad:

((RSI (Close , BarsToUse , False).(BarsToUse) - RSI (Close , BarsToUse , False)) * (Close > Close.(BarsToUse)) * (RSI (Close , BarsToUse , False) < RSI (Close , BarsToUse , False).(BarsToUse))) - ((RSI (Close , BarsToUse , False) - RSI (Close , BarsToUse , False).(BarsToUse)) * (Close < Close.(BarsToUse)) * (RSI (Close , BarsToUse , False) > RSI (Close , BarsToUse , False).(BarsToUse)))

Indicator independent version:

(((UserExprOne).(BarsToUse) - (UserExprOne).0) * ((UserExprTwo).0 > (UserExprTwo).(BarsToUse)) * ((UserExprOne).0 < (UserExprOne).(BarsToUse))) - (((UserExprOne).0 - (UserExprOne).(BarsToUse)) * ((UserExprTwo).0 < (UserExprTwo).(BarsToUse)) * ((UserExprOne).0 > (UserExprOne).(BarsToUse)))

Example of implementation with chart:

TLabQuantDiverg (Regression Value (Close , 7 , 0) , Regression Value (Momentum (Close , 7) , 7 , 0) , 7)

Note: the use of Regression is merely to smooth-out some of the wrinkle in the input values.

Regards,

-

Hi All,

Having looked at the thread on Hull MA, I thought this might be of interest to others.

When I got interested in technical analysis, I was very keen on using indicators, etc, like most newbies, and came across the following formula for significantly reducing the lag inherent in moving averages.

That was a while ago, and am now more interested in reading price and volume, but thought others might be able to make better use of it than I have.

The basic formula is:

&EMAOne := MovingAvgMethod (Close , Periods , 2)

&EMATwo := MovingAvgMethod (&EMAOne , Periods , 2)

&Diff := &EMAOne - &EMATwo

&EMAOne + &Diff

Replace "MovingAvgMethod" with whatever MA you prefer.

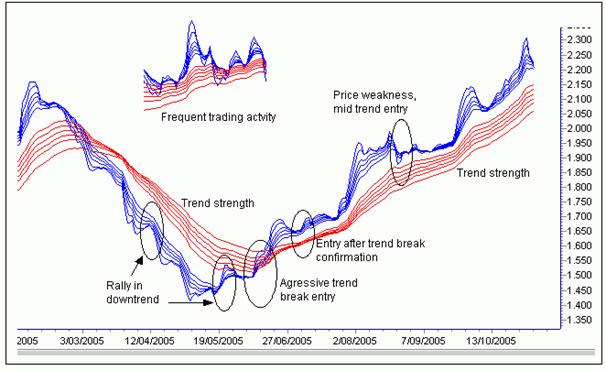

And here's a pic comparing several different MAs with/out Zero Lag, including Hull:

Regards,

-

Hi Aquarian and Figaro,

You may be interested in Guppy Multiple Moving Averages: Guppytraders.com - GMMA Guppy Multiple Moving Average

-

Nuh,

Sorry Tams, nothing really comes to mind.

It's just another way of defining a channel, where price might go.

I'll file it, and maybe something will register in a day or two.

Regards,

-

Hello Tams,

Interesting, but what's the point of it? How do you use it?

Regards,

-

Hello N57H,

I presume you used something like Excel to determine what the numbers were. If you could describe the methodology you used, that would be great.

How do you represent the numbers on your charts, or do you?

In regard to your question - I'm not sure how to respond just yet. Need more info.

Regards,

When Your Stop Loss Doesn't Execute

in Beginners Forum

Posted

JLJ,

Sometimes, your stop won't be excuted, even if price trades at or through your stop price - probably something to do with where your order is in the queue. This has happend to me on ES and TF, especially during fast periods.

Regards,