Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

147 -

Joined

-

Last visited

Posts posted by tawe trader

-

-

I may be back trying to submit a few more items for discussion here from time to time again. Been away for a while.Hey Aaron, I'm glad your still around, even if you've turned into a PDF file

Regards

Tawe

my first post but I see activity has subsided hin this thread. why this?Delta, activity did go a bit quiet on this VSA thread, a bit like the low volume mkts we've had this summer. I guess it's to do with most people taking time away from their screens, having a holiday and spending time with the family etc.

-

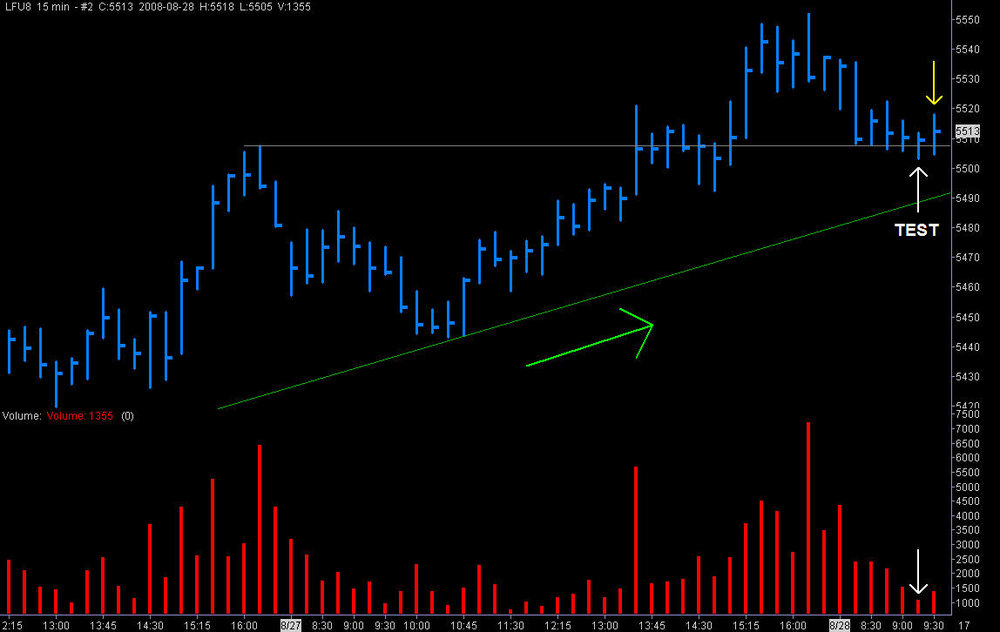

Seeing as we are currently discussing long tests, there was a 'classic' test in a rising mkt on the FTSE yesterday morning.

I have attached two 15 min charts of yesterdays action, the first chart is on the hard right edge, followed by 'what-happened-next'.

Chart #1

As you can see by the upsloping trendline, the mkt is currently in an uptrend. The mkt was taken down after the open, down to previous resistance which has now become support. On the white arrow we had a downbar (and lower low) but the volume is very low and less than the previous two bars. It looks like there is very little selling pressure or interest to the downside. The next bar (yellow arrow) closes up, which confirms this as a successful test. We now have an excellent, low risk, long entry point in-line with the 15 min trend.

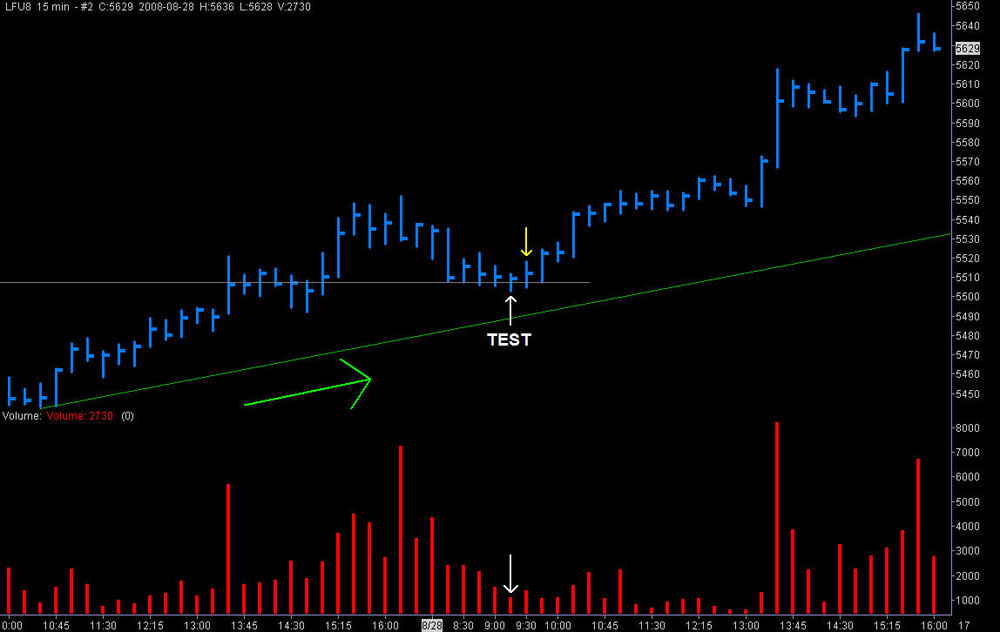

Chart #2

Need I say anymore, the mkt rallied over 130 pts from the morning low and test at 9.15am. Powerful stuff this VSA.............

Regards

Tawe

.

-

Hello Lars,

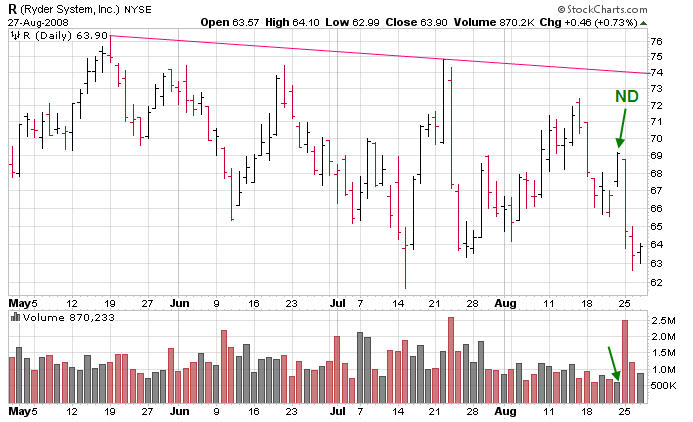

I think I have attached the correct chart for your Ryder System stock query.

For the last bar to be a no supply / test, you would need to see it confirmed by the following bar (todays 28th Aug) closing up. Also for a test bar you need to see it close down (but off it's low) on volume less than the previous two bars, yesterdays bar closed up.

I would be very wary in going long just yet, this stock still looks weak to me. Maybe wait for a confirmed daily 'test' or a successful test in a rising mkt before thinking about going long.

There was a fine ND - no demand a couple of days ago (confirms background weakness) and it looks like it was followed by heavy selling on the wide spread down. Yesterdays bar could just be the mkt having a rest before another down-leg or even another no demand bar.

I hope this is some help.

Regards

Tawe

.

-

Hello Flojomojo,

Welcome to the VSA club, we are a pretty friendly bunch who hang about around here.

This VSA stuff works and on all timeframes (from weekly down to 2 mins) and once you can see the supply and demand waves and the tricks the mkt play you'll understand how regular TA and indicators struggle to compete with VSA.

If you can read a chart via VSA you should be able to be on the right side of most of the mkt moves. If you see weakness in the background, look for a short entry and if you see strength, look for a place to go long. If your unclear, stand aside and don't trade.

I'm no Forex expert so I'm sorry I can't help you out in that department but Sledge may be able to although he is a busy man. I believe one of the keys to successful trading is sticking to the mkt you know and I mostly trade the FTSE.

If your interested I got some thoughts on successful VSA trading:-

1. Pick a timeframe (or multiple timeframes) that suits you.

2. Combine VSA with support and resistance

3. Be patient - wait for strength or weakness to be confirmed.

Regards

Tawe

.

-

a holiday as you call it. Greece is quite nice this time of year I heardandxg,

Greece, Turkey, even Iran ............ any-bloody-where has got to be better than the South West of the UK at the moment, nothing but cold, crappy rain and it's JULY. If this is global warming - they can stick it !

I'm going to pack my computer and emigrate somewhere warm.......all I need is an internet connection.

Have a good weekend

Tawe

-

Hey Sebwhats your next step after VSA or are you happy with where your at? on a personnel level I won't rest until a full understanding of all the games that are played is achieved...... might take a while tho..

all the best

Hello Sebastian,

Thank you for sharing your very honest thoughts in your reply to Speres. It's sounds like you have a motivation problem and I guess if your not money driven and you have mastered the art of chart reading then you are perhaps 'goalless.'

I'm no expert in this field but I guess you may be feeling what the majority of multi-millionaire lottery winners do a year or so after receiving the big cheque, jacking the job in and then going on a massive spending binge etc.

Maybe Eiger, being the expert ie the Clinical Psychologist could help you in this department, as myself and many others would hate to lose your VSA trading insights and observations.

I look forward to your book.

Regards

Tawe

-

Seeing as recent posts have been regarding no demands and I haven't posted for a while I thought I'd share a quick no demand short trade I carried out on the FTSE yesterday afternoon. This was also a multiple timeframe trade.

First chart is a 15 min, at 2.30pm (UK) when the US mkts open we have a possible weak bar.

Why is this weak ? even though it closes near the top, it has very high volume and as Tom W says 'mkts don't like very high volume up-bars, there could be hidden selling involved'. Also the next bar closes down, which confirms the weakness. (If it had been on lower volume and the next bar closed up, it would have been seen as a bullish bar and a 'test' in a rising mkt).

I am now looking for a no demand bar for my short entry. There is a borderline no demand at 3.15pm. I decide to drop down a timeframe to investigate further.

The next FTSE chart is a 10 min timeframe and at 3.20pm there was a clear no demand, so after seeing this I decided to go short with a target of 20 to 25 pts. I exited for a gain of 21 pts and the mkt never really went much lower for the remainder of the afternoon.

Tawe

-

Tests are always down bars (i.e., close below the previous bar's close). Ideal Tests have narrow spreads (compared to recent bars), have volume less than the previous two bars, and close in the middle or the high.Eiger,

Thanks for another very important and educational post.

Just to clarify things (if not for myself then for other novice VSA'ers), am I correct in assuming that a 'bullish' test is only seen as a positive test (ie signal to go long) AFTER the next bar closes up ?

Regards

Tawe

-

Brilliant post Bootstrap.

You deserve all your trading success and $$$$'s you make, for never giving up.

Do you have a $49 e-book for sale ? ................ only joking :o

As anyone with half a brain can see from bootstrap's history, there is absolutely no substitute or short-cut to trading profits apart from years and years of blood, sweat and tears, trial and error and mkt experience.

Tawe

-

That mean you do not need to trade everyday ? I think professional trader need to trade everyday. Are you full time trader ?Winnie,

If your a professional trader working for a large bank or hedge fund then I guess yes, you would need to trade everyday to justify your salary.

On the other hand you can be a home based full-time trader and not actually have to trade everyday to end up making a profit every week/month. The key here is PATIENCE.....having the patience to wait for the right (low-risk) setup. You could be watching and monitoring, Monday, Tuesday, Wednesday, trade Thursday, have a great win, make a week's pay and have the choice of having Friday off (as you have to keep the ol' greed emotion in check).

It's all about finding a trading style and timeframe that suits you, Sledge seems to have found his style, that's excellent and the way to go.

Regards

Tawe

-

One last thing, all who follow and use VSA owe a deep debt of gratitude to Tom Williams. I certainly do.Eiger,

I agree, us VSA'ers are very grateful to Tom W but I believe all of us (especially any new traders) on this thread, owe a great deal of gratitude to you also, for all your posts. They are truly educational, insightful and very helpful.

Plus you are giving up your free time and posting here for no financial gain to yourself. You are not trying to sell anything and in a world full of tricksters, con-artists and snake-oil salesmen (this trading business attracts them like no other), it is very refreshing and fantastic to see.

Anyway, I'd just like to say thank-you very much.

Tawe

-

WHAT'S HAPPENING WITH OIL ????

UPDATE

Following on from my post (1269) on oil, it looks like we may have seen a top (perhaps temporary). Powerful stuff this VSA, after seeing these signals it was a good time to go short or at the very least, exit any long trades and take profits.

From high to current low it's down nearly $12 in a couple of days, I guess that is what happens when there is weakness in the background.

Tawe

-

Thus, I must operate within the paradox that the market is relatively uncertain and unpredictable in the context of an individual trade; but over a large sample of trades, it is certain and predictable. This means that when I put on a trade, I do not have to know what is going to happen next in order to make money. What I do know is that over time with a large number of trades, the higher probabilities associated with my edge will prevail and I will make money.Therefore, it is always important to remember that being right about a trade has no meaning in my trading. Further, holding onto a bias about market direction is also meaningless. Maintaining an open mind and patiently waiting for my trade set-ups is the productive way to operate in the market. Winning trades are always in front of me. I know this because of my trading edge. It is never painful to take a small loss, and it is never a Mistake if the loss occurs as a result of a trade taken because it met my trade set-up criteria; it is just a cost of doing business.

As I said, comments and ideas would be much appreciated.

Eiger,

Excellent advice, I try to trade this way everyday but it's easier said than done. Note to self - must try harder.

Trading is simple, but not easy...............which is why I presume, the majority don't make it.

I'm not sure if Marty Schwartz said the following but I have it written down in a notebook of mine, under one of his quotes:-

THE SOLE OBJECTIVE OF TRADING IS NOT TO PROVE YOU'RE RIGHT, BUT TO HEAR THE CASH REGISTER RING.

Regards

Tawe

-

European mkts and US futures are currently well down this morning.

There was a VSA 'clue' on the FTSE yesterday. The FTSE closed up on the day with a good rally to finish but there was ultra high volume on the upbar close.

This is a very good indication of potential weakness (this ties in with what Seb has mentioned above, on the ES) which has appeared today and the FTSE has dropped over 100pts (1.6%) from yesterdays close.

I closed out a profitable long trade at the mkt close yesterday and obviously with hindsight, I should have opened up a new short trade, to hold overnight. :crap:

Tawe

-

Hey Jeff, Master the Markets ebook or "the undeclared secrets that move the market" ebook (same book less TG advertising) is the best place to start really. These forums will complement that.Hello Jeff,

As JJ as pointed out, the books mentioned above are an excellent starting point. Master the mkts is currently being given away free on http://www.tradeguider.com/book.

There is an ton of priceless info on these two VSA threads but they could be a bit hard to follow without knowing the basics.

I suggest you read either one of these books and then come back to TLab.

Also any books to do with Richard Wyckoff are well worth reading (as VSA is based on Wyckoff principles). There is a nice (cheap) book called Charting the Stockmarket - The Wyckoff Method by Jack Hutson.

Regards

Tawe

-

... The best traders I have seen and worked with have a view, but are lightening quick to change that view when market conditions tell them to do so.George Soros springs to mind...............

I've read numerous interviews with traders who have worked with (and for him) and they all say that Soros is the world's best at changing his mind.

Perhaps he learnt many years ago, to leave his trading ego at home every morning.

Tawe

-

WHAT'S HAPPENING WITH OIL ????

Over the last couple of days the price of oil has been a regular item on non-financial British TV, radio, newspapers and websites. Could this mean a top of approx $133 per barrel is in ? I don't know (I usually only trade the FTSE and ES) but out interest I've had a look at the daily crude oil chart and noticed some classic VSA bars have been formed recently.

Looking at the July contract for Nymex Light Crude Oil:-

1. May 21st - wide spread upbar closing on the highs on very high volume, potential weakness ?

2. May 22nd - upthrust, new high but close down on the lows with ultra high volume.

3. May 23rd - no demand (up close and vol lower than previous two days) and inside day.

There was no trading on Monday but as you can see the price of oil has fallen away, quite quickly from the highs.

Regards

Tawe

-

Where I could find that book "The Undeclared Secrets that Drive the Stock Market" ?Winnie, you can use google to find it, like most things on the web.

If you can't find it, have a look at:- http://www.tradetowin.com/default/intro.php

Tradeguider are also giving away Master the Mkts as a free e-book:-

http://www.tradeguider.com/book/

Regards

Tawe

-

OK, enough trading psychology. This is, after all, the VSA threadEiger,

Please keep your psychology observations coming. I am very grateful for them and I am well aware that you are an expert in this field.

Being a proficient VSA'er is nothing without having the right mental make-up to go along with it, IMO this is where the trading holy grail can be found. ie combining the technical skills of VSA (or Wykcoff) with a sound and robust trading mindset.

As you know the 'edge' is inside our head and everyday (well for me anyway) it is a constant battle between our basic emotions of fear, greed, impatience etc.

I guess that if psychology didn't matter in this business, every person who has bought Tradeguider software over the years would now be a multi-millionaire trader.

Regards

Tawe

-

OK, enough trading psychology. This is, after all, the VSA threadEiger,

Please keep your psychology observations coming. I am very grateful for them and I am well aware that you are an expert in this field.

Being a proficient VSA'er is nothing without having the right mental make-up to go along with it, IMO this is where the trading holy grail can be found. ie combining the technical skills of VSA (or Wykcoff) with a sound and robust trading mindset.

As you know the 'edge' is inside our head and everyday (well for me anyway) it is a constant battle between our basic emotions of fear, greed, impatience etc.

I guess that if psychology didn't matter in this business, every person who has bought Tradeguider software over the years would now be a multi-millionaire trader.

Regards

Tawe

-

A - wide range high volume bar; next bar is a doji ... hidden selling in A ?Hello Mike,

I would look at the bar you marked A as being bullish and not bearish.

Tom Williams would see this action as an indication of strength, pushing up through resistance (to the left). This is effort and demand to go up and normally it will be followed by a rest. Look for signs of strength (no supply / test) to confirm and then go long.

Hope this helps

Tawe

-

Tawe really I don't think it wise to wait for confirmation, the no demand is usually very narrow, very low volume (by definition) quite often an inside bar (not VSA I Know). The next bar is often a 'thrust' as it breaks out. i.e it is wide it opens one end closes the other. Actually seems that a fair few of the more WRB type guys are looking to exit right around there. If you wait for that bar you are going to get poorer trade location. Watching live on 'smallish' intraday timeframes you can see volume dry right up and price just hang there before it cracks. Each to there own of course.Blowfish,

I partly agree with you, I tend to enter after seeing a no demand and don't usually wait for the next bar to form and confirm. It depends on each traders own personal preferences for entry, if they are conservative or not, doesn't it ?

In this instance, if CW had waited (I know it's easy with hindsight) for confirmation (which never came) he wouldn't have gone short and had a losing trade.

CW did you see my question about what instrument that was?If you look on the chart I think it's EUR/USD.

Tawe

-

This part is after the fact, but look at the volume on the test bar a few bars later. That's really low volume. This brings up a question for the thread. How many wait for confirmation on no demands and test and the such?I have looked at the code on the other thread and it uses confirmation. Based on that, the candle marked no demand would not qualify because the next candle doesn't close lower. The test would qualify.

CW,

Thanks for posting your charts, it really is the trades that fail, that we learn the most from.

I have found some notes I took after watching TW commenting on a Gold video back in Jan.

In this example, after a down move on increasing volume, Gold goes on to make a lower volume test. The next bar is UP and Tom said the 'test is successful' and it is safe to go long.

We can flip this over for shorts. After seeing a no demand, we need to see the next bar close down (which confirms weakness) before going short.

On page 33 of MTM Tom says 'we need confirmation before shorting the market following an sign of no demand'.

At the end of the day, it is going to come down to the personality of the trader and/or what they have 'read' in the mkt background. Is the trader conservative and needs to see no demand's / no supply's / test's confirmed, or is the trader going to make a higher risk and potentially higher reward trade, by not waiting and entering before confirmation ?

Tawe

-

Tawe,Are you saying you entered on the 11:25 bar before it completed? Can you please explain how you saw the 11:25 bar as a weak bar?

I see a range, and yes, the 11:25 bar is sitting on the trendline, with volume declining in the last 4 bars. It's a down with the range really small, the volume is really low and the close is off the lows close to the middle. In my very limited VSA knowledge, I woudn't have entered on the 11:25 to go short. Please help me understand why you went short there.

Thanks,

Bert

Hello Bert,

Perhaps I should have said that I seen the mkt as being weak by looking at the background on the higher timeframe - the 15min chart.

Why did I see background weakness ? There was solid resistance overhead at 6032 from two days earlier, the mkt gapped up after the open followed by two upthrusts and the first upthrust was repelled by R1. What does Tom Williams say about upthrusts 'to trigger stops in a weak mkt'.

What I did, which was slightly higher risk was enter just secs before the 11:15 upthrust 15min bar was completely formed.

I was also watching the 5min chart and yes the 5min bar just sitting there on the trendline/demand line does look like a no supply bar BUT considering the background I decided the odds favoured a downside move.

So just to re-cap, I used the higher timeframe 15min chart as the main reason for my short trade but on seeing the 5min chart and the 5min bar location, decided to act quickly.

Regards

Tawe

[VSA] Volume Spread Analysis Part II

in Volume Spread Analysis

Posted

Lars,

The bars are testing to see if there is any more large scale supply on the mornings lows and in an area (5500-5510) that previously contained a high degree of supply in the previous two trading days.

Looking back at my chart, maybe I should have marked the bar as a no supply bar instead of a test. I personally don't like the sound of no supply as I believe there would still be some supply (by amateurs) on that bar during that 15 mins of mkt action. I prefer the idea of less supply or less selling pressure by the pro's.

If there is less selling pressure after a period of demand and buying (by the pro's) then the path of least resistance is up and the mkt is more likely to rise than fall. With very little selling pressure in the background it is a sign of strength and as the mkt rises it is unlikely that it is going to be hit with any large scale supply swamping the up-move and making life difficult for those pro's who are already long.

Tawe