Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

r3algood

-

Content Count

11 -

Joined

-

Last visited

Posts posted by r3algood

-

-

Gamera, hope your trading is going well.

Would love to see more journaling and updates from you.

-

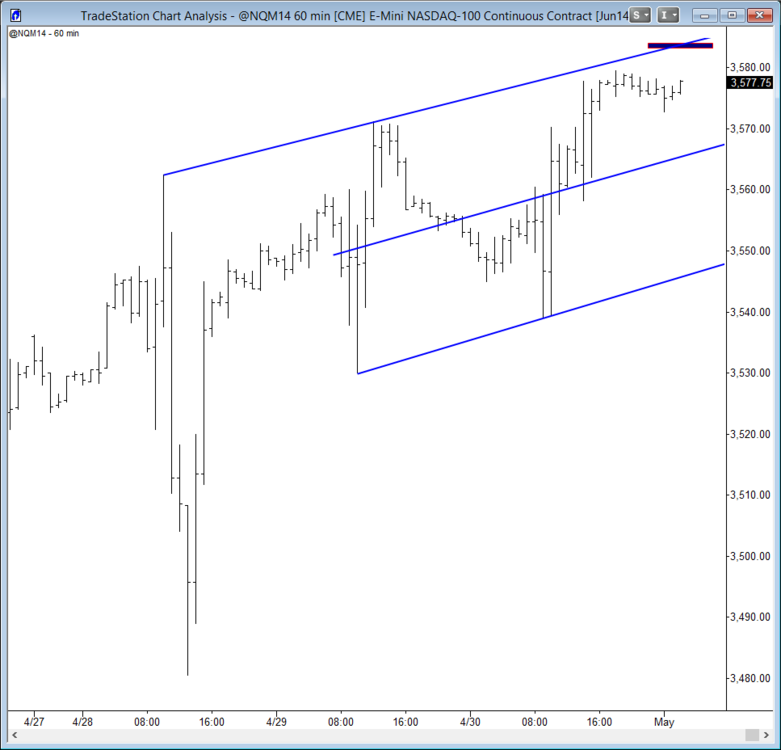

Great day SLA'ying the NQ.

Quick question Db, please refer to "QUESTION" attachment.

I was going along drawing my lines and letting price do its thing, then ran into this scenario... Couldn't keep the SL or draw a new DL so i figured we were in chop.

Question: I suppose I just wait for a breakout or breakout and retracement to enter and start a new line? Not a large enough chop zone or trading range to take reversals to me. Basically, I didn't know what to do with my lines there.

Thanks

-

Exit short at break (yellow), enter long after first retrace (green).

Drawing straight lines can be quite interesting.

Would love any advice Db for this series of posts!

Once I finished the book, I exited the advice business. Everything one needs to know is in there. However, you do appear to understand the basic concept of it, which is a giant plus. If so, you could do it yourself using Wyckoff's course, as I did. And that's free.

Db

-

-

Simply watching price today, no trades.

Watched as supply dried up and demand engaged here.

Entry could have been at 17, easily trailed along until 35 or possibly more.

I used to get so caught up in the lines and where to draw them, now I try and let the market show me where its going, and I just follow along.

-

An update on the "catch-up" chart posted above to show the line around which price is rotating.In the chart above (NQ Daily), could the failed breakout of the hinge be considered a dog that didn't bark? In my mind, it "should" have broken higher, but it didn't.

Always enjoy your SLA/AMT updates, keep them coming Db. Seeing the market in this objective, rational approach and framework has really enlightened my trading.

Thanks.

To me, no, because I didn't "expect" it to go higher than that swing high. These words like "expect" and "anticipate" are loaded and mean different things to different people. Their dictionary meanings are largely irrelevant. When trading price, it often has to be enough that the trader is simply aware. It is to be expected in an auction market that traders will look for trades beyond value once they've completed whatever business they have in the value area. How long price rises will depend on how long sellers can find willing buyers.

Therefore, if one is a breakout trader, he'd take the breakout from the hinge and hang around until that swing high is left behind. If he finds trouble, he'd already planned how to address that. If he didn't take the breakout, or any retracement shortly thereafter, then that swing high would represent a potential trading opportunity given that it is a potential obstacle. There is a difference between insisting on being right on the one hand and being frightened out of a position because one doesn't understand what's going on or because one isn't sufficiently prepared on the other. This is where rules come in. And the rules come from testing.

Db

-

PrepworkThe other possible course of action is to reverse above or around 60, and try to go back inside the hourly TC, In that case the stride of this downtrend form friday should be broken before we are back in bullish mode, that would happen around 75, from there we would need to take 82 and deal with the MP of the up TC, but if we can clear all that clutter we would be on our way to 604.

Remember to scratch and reenter when required, so to avoid fear and keep focus.

Approaching the mean (MP) now. Great prep

-

Nice bounce at mean of TC on hourly at 3580.

Can't post pictures yet on here (post number requirement?), but when I can I will upload a picture.

-

-

What else can I say, thank you Db, SLAAMTZEN, saved my day.Fantastic trading Niko, especially on those scratches!

I have been reading through all the old material and I have enjoyed seeing you progress in your trading over the various threads. If I may, I would say that you have gone from "timid" or "fearful" trading to solid, plan-backed trading with confidence. It's a truly remarkable journey.

Trading the SLA/AMT Intraday, Part II: Questions and Discussion

in The Wyckoff Forum

Posted

Failure at both ends of the range.

NQRangeFailures