Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

35 -

Joined

-

Last visited

Posts posted by hunnybunny

-

-

My spelling is not the best today.We had a death in the family yesterday and everything is upside down.

Trying to get distracted from one reality using another one.

Gabe

Gabe, i am so sorry to hear that. Please accept my condolences ... and do take care.

And, Thales, i'm glad you're feeling better. Please do let us know the results of those tests. May God keep you and your loved ones in the pink of health.

-

-

It was just a matter of time before folks started to get in gear with the plus side of the equity curve.Next stop ... consistency.

When are we going to see some hunnybunny trades?

Best Wishes,

Thales

Working on it ... practising recognising your set up as it occurs real time but haven't been disciplined enough to do it consistently. mea culpa. also, i'm nowhere near being able to recognise S/R zones as astutely as others here. your BO set up works a treat in an S/R confluence, from the chart reading that i've done (although my chart reading is by no means extensive).

Working on it ... practising recognising your set up as it occurs real time but haven't been disciplined enough to do it consistently. mea culpa. also, i'm nowhere near being able to recognise S/R zones as astutely as others here. your BO set up works a treat in an S/R confluence, from the chart reading that i've done (although my chart reading is by no means extensive). i did attempt 2 trades - one EG, one EJ - and got stopped out before both went my way big-time :crap:ouch! i shoulda posted but was too sheepish to do so, as i figure it was probably because i mucked up the S/R zones ... and i was lax with the SL! :doh: i'm working on my entry and SL placement.

thanks very much for sharing your approach with us so freely. it is very good of you - after all, you have nothing to gain from it. sure, there'll be losing trades, but from the little i've observed, your approach should leave one net up if one follows it in a disciplined fashion (even sans occult ability

) and if one needs empirical evidence, then your joint account with your daughter furnishes more than proof, not that you need to provide any.

) and if one needs empirical evidence, then your joint account with your daughter furnishes more than proof, not that you need to provide any. -

In my experience, meteorologists have a worse track record than 50/50Gabe

and economists?

Great to see you folks making nice money on your trades!

-

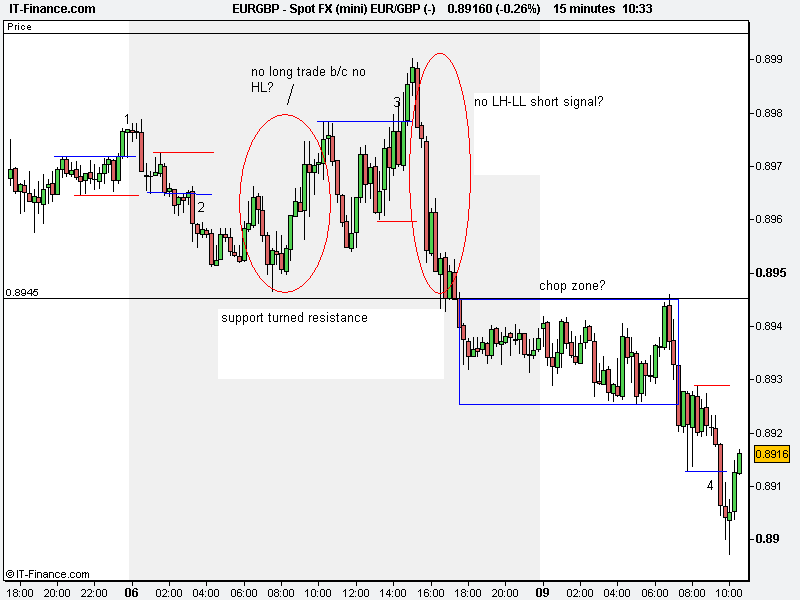

Just thought that it would be easier if the annotation would be on the chart.I hope you don't mind.

BTW Shouldn't #2 be SHORT trades and #3 LONG trades?

Gabe

Thanks very much, Gabe! Emm, about #3 being a long trade ... beats me

It looked like a B/O of the low at #2?

It looked like a B/O of the low at #2? -

-

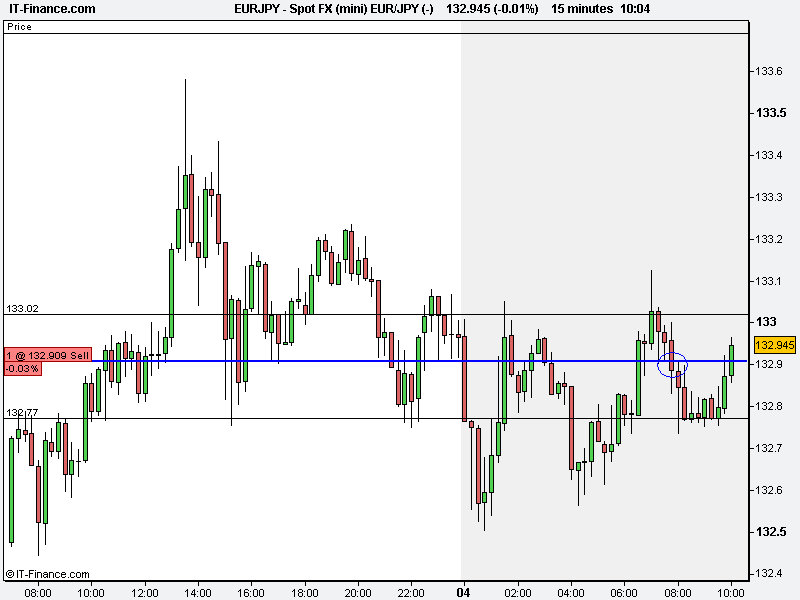

Hi, everyone. Sorry i'm late with my weekend homework. Here's my marked out EJ chart. Please correct my understanding where i'm wrong .. many thanks!

Here goes ..

(1) so that's 5 trades?

(2)1-3 is a long trade, with adds at 2 & 3?

(3) 4-6 is a short trade, with adds at 5 & 6?

(4) 7 is a short that would have been stopped out for a loss

(5) 8 is a long that would have been stopped out for a loss

(6) 9 is a nice big short that was almost stopped out?

Haven't done the math to work out the P/L. Will attempt to do that next time.

Learning lots doing this. Thanks for the suggestion. Will mark out S/R zones when i become more adept.

:missy:

-

Hello, everyone. I've been following this thread since i discovered TL a couple of months ago and wanting to join in. Thanks for starting this great thread to teach, Thales, and everyone here who is contributing to my learning.

I'm planning to mark up charts as Thales suggested and post when i can

I'm just months old at this, so please bear with me if i'm slow on the uptake.

I'm just months old at this, so please bear with me if i'm slow on the uptake. If i may begin with a question to Thales or anyone else who cares to answer, why was 1.4664 a buy setup when there was no BO?

Forgive me if the answer should be terribly obvious ..

Forgive me if the answer should be terribly obvious ..Thanks very much!

-

Hi Bunny,Just a short note about your point number 2. While many do say trade with the trend, it of course isn't the only way. There are many guys that do make solid livings from fading areas in a trend. Keep an open mind on that point, in fact, keep an open mind on anything about trading

Sorry to hear about the hard day. We've all been there many times, and probably continue to revisit it every now and then.

With kind regards,

MK

MidKnight, thanks very much for your kind note and advice

Searching for a thread on fading areas in a trend now :missy: The next time i feel inclined to throw myself in front of a train, it'll come in real handy!

Searching for a thread on fading areas in a trend now :missy: The next time i feel inclined to throw myself in front of a train, it'll come in real handy!

-

Trying to get back on the horse again.I have to work on my STAYING POWER

got out of a trade after almost 2 1/2 hours just to see it go even more my way (in a big move).

I moved my stop once but I was confident that the trade will work out well (famous last words

).

).Gabe

Great to see you back in the saddle, Gabe! It took a big man to post what you did about getting derailed

-

:haha:

I can see BR now...

Nicely done today!!!

That's BR's secret! He's tapped into the Matrix! (which is what is showing on those screens )

)Chris, i have to say your numbers make me goggle :shocked: Congratulations on your new personal record!

Brownsfan, Subterfuge, Grey1 - way to go, you guys!

The consistent gains i see posted (the great company too!

) on this thread are what keep me going on this long lonely trek to becoming a true blue trader

) on this thread are what keep me going on this long lonely trek to becoming a true blue trader That you guys do it in a variety of approaches using different set-ups trading different instruments from each other makes it all the greater. (The one thing that you do have in common is your kindly desire to put novices on the right track!)

Yup, your results offer newbies massive encouragement to keep at it .. so don't let up please.

Grey1 does have a point about a P/L thread not necessarily showing the "how". This thread is primarily about the results and us newbies don't always get the "how it's done", which is not to say that contributors haven't been generous with their guidance.

Well, after all the waffling ... time for me to 'fess up. i violated so many of the cardinal principles the TL veterans kindly tried to save a newbie like me from learning the hard way that i can only hang my head in shame. Where do i begin? :crap:

Here's the list (by no means exhaustive):

(1) no set-up, much less a trading plan - i went long on the dow and the brent crude yesterday when the markets were coming off (surely the dow will go back to 10,000 ... was what i blithely thought)

(2) trading against the trend (catching a falling knife :doh: i might as well have thrown myself in front of a train) - as thales has pointed out elsewhere, trading against the trend doesn't make sense

(3) no stop-loss or cutting of losses on pullbacks

(4) doubling my position when the markets continued to come off and amplifying my losses - doubly (quadruply?) bad because the sizes were double my normal size to begin with

(5) holding the positions into today (when my goal was to be an intraday trader and close all positions at the end of the day)

(6) holding the positions into an economic data day (when the likelihood was great that the numbers would be bad?)

Boy, was i asking for it :helloooo:

To cut a long story short, i finally cut the positions today. Gave back all the gains from my winning trades since i started (which was a month or 2 ago, if anyone's asking) .. ouch. Sheer stupidity and recklessness ... ah well, it's back to square one for me

So, it's your trades, your gains and your stories which are keeping me going

-

Anyone still around besides a couple of us?

Hiya, Browns, Grey1, Chris, Brian! i'm here, for what it's worth. Good to see you guys posting and great to see your gains, as always

I'm in the red today and veeery vexed with myself :crap: Back later to 'fess up

-

:haha:

so far so good as the man said falling from a high rise buildingGrey1

Better trades next week, chaps

i'm just watching the markets with fascination. What a roller coaster!

i'm just watching the markets with fascination. What a roller coaster! -

Oh, and Brownsfan, clearly i wasn't watching the Russell as closely as i thought

Thanks for pointing out that its range was actually wider than the other indices.

Thanks for pointing out that its range was actually wider than the other indices. -

Hello, Larry. Nice to meet you too. KL's a great place - very happening

I hope the 3 of us run into each other at TL often!

-

Subterfuge, sorry you had a bad day

do you trade European futures only? Or do you also you look at Asian futures since you are in Singapore?

do you trade European futures only? Or do you also you look at Asian futures since you are in Singapore?Chris

It makes sense for me to look at the Asian stuff as they're in my timezone but they're not as widely-followed (?) ... and as a novice, i wanted to learn how to trade, so i thought i would look at what you good folks trade alongside you, as that would be the best way to learn to see trades through your eyes in as real-time a fashion as possible.

I hope to be smart enough to pick up some of the the wisdom so abundant at TL

Your trade blotter's impressive, Chris.

Your trade blotter's impressive, Chris.Grey1, it's always nice to have another person on the thread and another point of view ... but i guess you came off sounding a little .. unfriendly earlier? Congratulations on your nice gains.

It would be super if everyone here got along famously because you're a brilliant lot, obviously ... and i look forward to reading all your contributions

I have a Brent Crude chart on a trade i took and have a few questions i was hoping some of you would be kind enough to answer .. and was wondering whether to post that here or at Thales's "reading charts in real time" thread. I hope it's not too much of an imposition

Thanks very much, all, as always!

-

:oThe down side for me is that every night when we sit down to dinner she asks me "So, you shorted the ES at 1018 - how's that working out for you?"Nine year olds!

Best Wishes,

Thales

Brownsfan, i've been watching the Russell 2000 mini too but the intraday range has been tight? Won't it be tricky getting in and out, when the spread is 0.5 (at least, on IG)?

Chris, another good day for you!

-

Hello, William! It's nice to meet you. I'm from Singapore too and happy trading to you too!

-

Hello, 1pipatatime, i'm new to the forum and trading. I just stumbled across your thread today and think it's great. Great to know you haven't vanished. Thanks for starting this. Welcome back and i look forward to seeing more from you

-

Thanks for posting the video, James. I'm sure it's very instructive. The link is dead though. Would you be so kind as to post it again? Thanks, once again!

-

... but this is still 4x as good as it was in late September (this is on a 100 trade moving average - a trade could be a partial exit of a position).

Another thing that I a paying attention to is the size of my trade.

No more (or atleast I am trying). When in doubt I reduce my position size to a minimum. I have doubled up only twice in recent days. Once when I was profitable and once when I was not but I was convinced that my setup was valid but I may have entered too early. Both cases worked out in my favour.

The difference now is that I have a trading plan and I am fully devoted to my success in this field.

Gabe

Way to go, Gabe! :thumbs up:

-

The problem with trading is that we as humans have a special relationship with money.

The problem with trading is that we as humans have a special relationship with money.That is why we are reluctant to pay to study how to make it in trading and that is there are so many people who have no clue who try to teach others how to trade.

I doubt thta this will change but fortunately there are successful people around who are willing to share their wisdom and experience.

One just has to spend time and find those people and read their posts and practice, practice and practice more.

I am not where I want to be (prefectionist, you know

) but I am very close.

) but I am very close.I like to call trading THE NEXT NUT THAT I HAVE TO CRACK.

Take care

Gabe

Gabe, thanks very much for sharing your journey and the lessons you learnt. It's very kind of you to save us newbies the pain (and money!) of learning the hard way. Pleased to hear you've cracked it and are looking to perfect it - congratulations! And assuring to know that if we apply ourselves, we may one day crack it too

There's much we're learning from you, brownsfan, chris, thales (just to name a few). Thanks to you chaps for being generous with your time and tips. I see you're on Thales's thread "reading charts in real time" and will be following both this thread and that with avid interest.

Kicking myself furiously for not buying the Dec brent after the Nov expired :crap: How long before i learn not to be a twit?? :doh:

-

Thanks very much, Gabe, for saving me from learning the hard way. It's very kind! 20 days and a huge loss ... ouch. Sorry to hear about that .. it must have been rough on you.

-

Hello, Thales, i'm new to this thread and trading. It's great to see you back here (not that you know me from Adam)

On account of my being a novice, i've not got the parlance down pat yet, so please bear with me, everyone.

I've been chicken and not doing anything lately because everything was surging so strongly :doh: Finally decided to dive in yesterday when the Brent Crude pulled back. Stupidly bought 2 micro lots (yes, too chicken to buy the mini *squawk*) of the Nov at 7353, not realising it was expiring in a few hours, so at 02:30 Singapore time, it expired and was settled at 7441 for +88 :crap: Not very bright of me and i missed the rest of the move in Brent Crude.

Em, no set-up or anything, which was not smart either :\ Learning about set-ups, stop losses and money management from you wonderful people in this thread. Thanks a whole lot for sharing! One day, when i've learnt how, i will post charts with the set-ups.

Reading Charts in Real Time

in General Trading

Posted

Anyone know what triggered the sudden fall in stock indices and oil?