Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

99 -

Joined

-

Last visited

Posts posted by ochie

-

-

Yeah it is a pretty piece. Done in 5/4 time.

-

MMS,

If your developer uses a version control system, that code in the prior release had the perfect placement, imo.

-

The only place I see it now is on the Forums page near the bottom.

-

After reading what you wrote again it's clear you must be confused. Why would IB flip this value over to the "Intraday Initial' under certain volatile conditions? Margins go UP under volatile conditions not down.Under certain volatile conditions IB has in the past moved the Overnight Initial Margin (which is higher) to the Intraday Initial Margin (which is lower). The Margin went up. Maybe “flip” wasn’t the best word to use but not confused.

-

Well, OK then. The $2813 Initial Intraday Margin for the ES is the same as day trading margin, as there is the word "Intraday".Yep. And the IB 'Overnight Initial' is the margin set by the exchange which for ES is currerntly $5625. IB in the past will flip this value over to the "Intraday Initial' under certain market conditions.

-

There isn't any that I'm aware of. Have you investigated using the 10-year (ZN) futures contract for inverse correlations/trade strategies?

-

I find that some of the best entry opportunities often occur right after a thrust/shakeout. I don't know what sort of strategy you use, but you may look at entering a trade only after a test/rejection of the opposite direction.-bbc

Yep. If price approaches a level without any kind of test or violation, it's tough to know if the level (top or bottom) is in and if your stop will live. It's better to see a 'peek' through the doorway and let PA show a rejection. Tim Morge (of MedianLine fame) spent some time documenting what needs to be seen and coined the term "Good Separation." He wrote a pretty good doc imo, which can be found here.

-

I'd like to add that after going through the market stats threads (as BF suggested) and the MP style is the one you want to go with, spend some time going through this MP thread James (Soultrader) put together. Actual trade setups were built on top of the analysis from what I remember. [MP] Trading with Market Profile

-

Another thing I do (and I think Jerry might be more disapproving of this one ) is look at a larger data sample for 'context'. Pretty similar to more traditional 'TA' where you look to a larger time frame for context.

) is look at a larger data sample for 'context'. Pretty similar to more traditional 'TA' where you look to a larger time frame for context. Yes. And it's also similar to the way a trader using MP might reference the previous day POCs from a 30 min to a faster TF (as I did in the past) although Jerry's previous session HUPs offer the levels but not the true context nor was there a step up in TF if memory serves. That said, it's still the best work on practical market stats I've seen.

-

You can check out this function as an example or call it as is. The key imo is seperating the intPortion from the fracPortion.

-

There is an architectural issue (which Andrew Kirillov confirmed) reported to the TS Support forum in 2009. It appears it has to do with the async reading of the CurrentBid/CurrentAsk while incoming ticks are still being processed. It was originally thought that the problem was with IntraBarPersist. Don’t know the current status of this and it may still be an issue. I moved to an alternative. Here is the link to that thread. Post subject: Why I don't trust "IntraBarPersist"

-

-

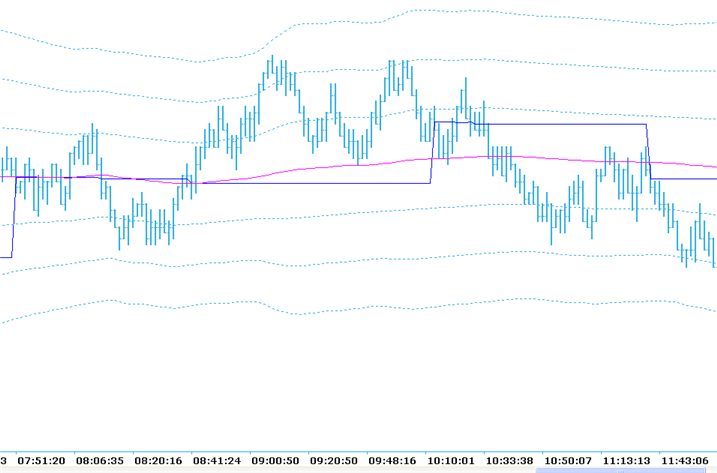

There is a PVP, VWAP and SD Band EL implementation that works with Multicharts that was coded and generously posted by a TL member a while back. You will need to search the Coding or Trading Indicator Forums.

-

It just may be the US Fathers Day weekend why this has not been addressed. It’s a simple task for the Web Dev. to modify or remove the floaters. Lets see if its taken care of today.

-

No vendor would have wanted to hang around for long after seeing the rubbish we used to post.Rubbish? Really? My time there was anything but….! Adding two additional markets to my daily trade possibilities put a damper on my participation early last year (or there about), or else I probably would have still been active.

-

Just curious if anyone else uses other markets as an indicator for oil or whatever they trade and if anyone sees any legitimacy to employing such a method.

]

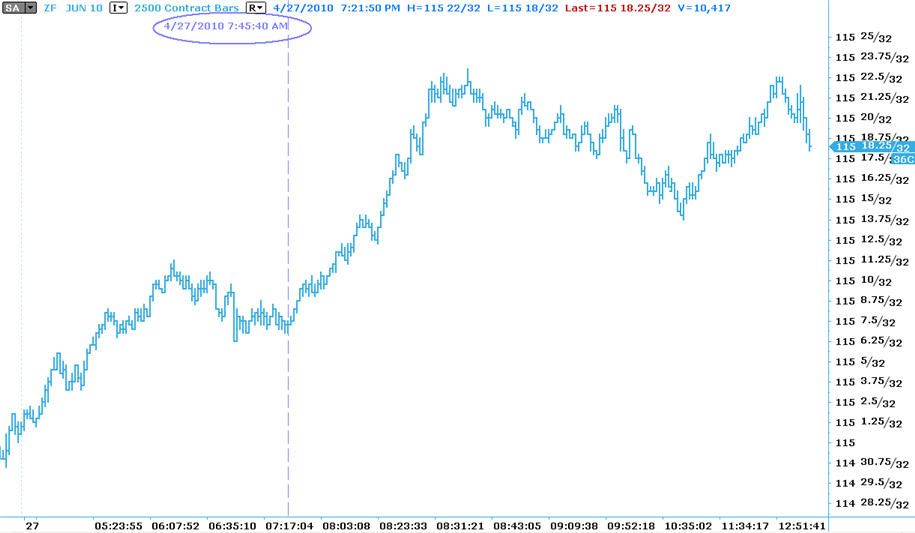

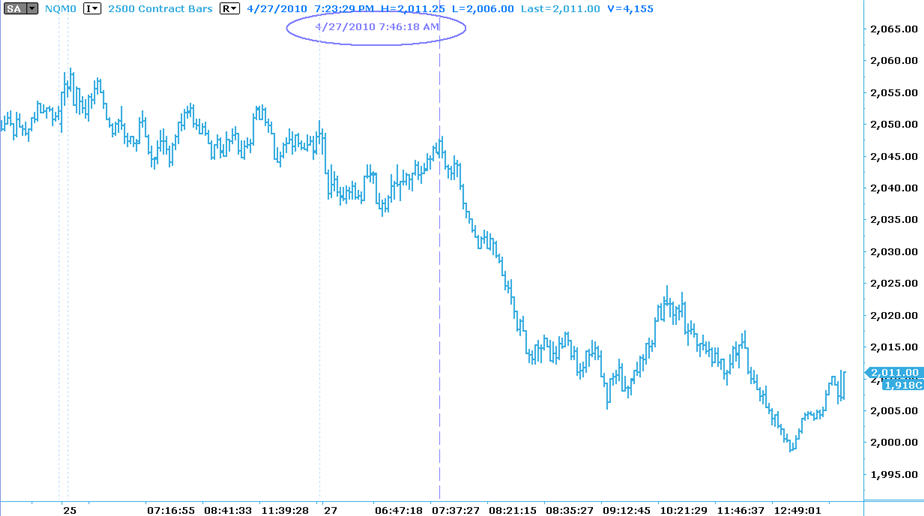

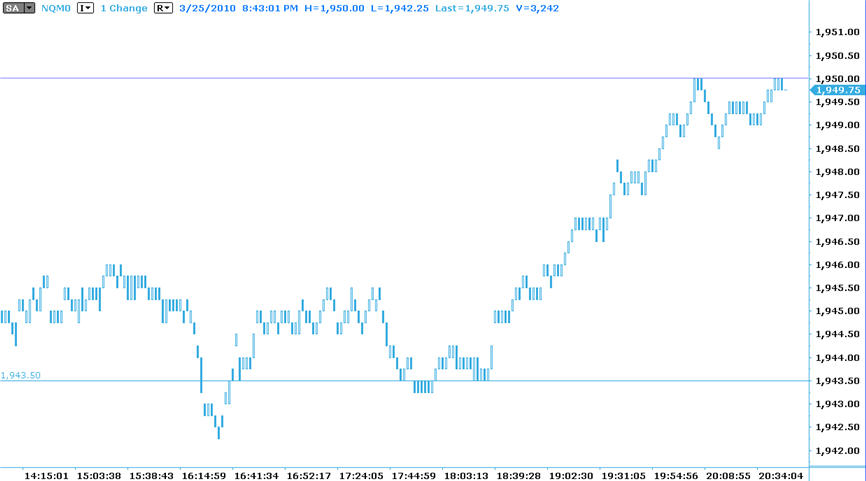

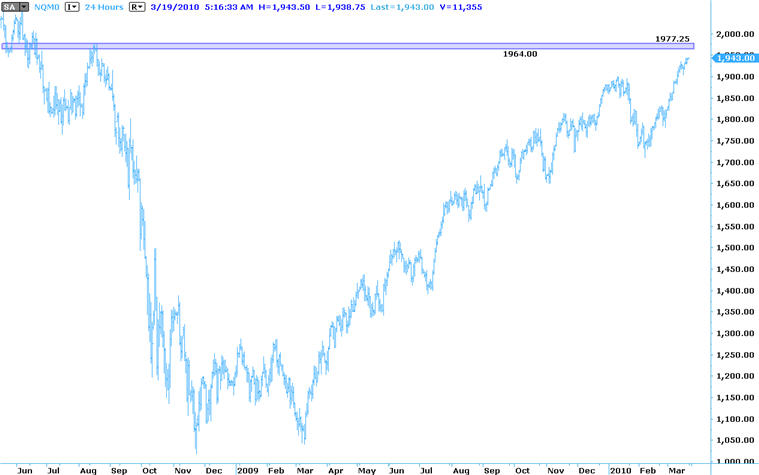

I'll post this one since you mentioned whatever someone else may trade, here is an example of inverse correlation between the Treasuries (ZF) and the Equities (NQ).today. BTW, Your Oil - Gold is a good one.

-

Issue fixed, thank you for reading.Would it be possible to create a short post with an explanation of the fix? It could help others in the future with a similar problem.

-

Did you consider creating a private thread under ’Invites Only’ for your posts here on TL as part of your setup?

-

-

-

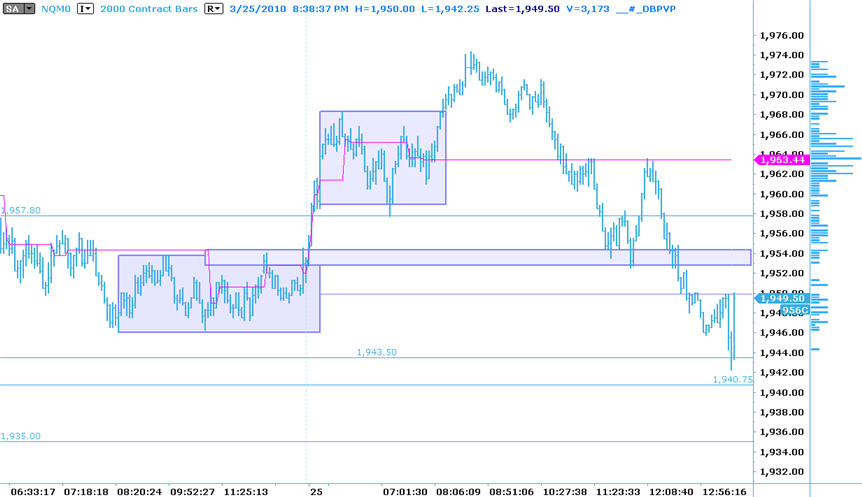

Follow up from my previous post:

Today NQ made a LH (within 4 points) from that high on 8/15/08 previously mentioned. That POC (also mentioned at 1964.00) appears to have had influence becoming today’s High VOL Level (magenta line) and producing two nice reactions later in the session.

Reaction appears strong off that high as we are currently trading below yesterdays low.

I see possible support levels tomorrow around 43.50 (prior POC), 40.75 and 35 but not thrilled about longs from what I see so far this evening.

-

For MC I have DLLs working in "\Program Files\TS Support\MultiCharts" for sure. Don't know about TS.

Edit: this is MC 6.0 beta 2 but also worked in the Ver. 5.

-

-

Id like to offer a thought if it’s ok. Correct, the values should not change when changing intervals If the start time remains the same. Check where the plot starts on the smaller intervals (more bars on chart) and see if the start time differs.

Market Profile in EL

in Coding Forum

Posted

I believe the reason you are receiving the "unknown symbol" errors is that you are most likely missing the 3 code functions mp_str32, curletstr and nutpstr. They were part of the original ELD as I remember. Getting it to compile in OEC would be a separate issue.