Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

59 -

Joined

-

Last visited

Posts posted by johnnycakes78704

-

-

On previous post, ended that week with a 144 ticks profit. Ended last week with 196 ticks profit while trading 1 contract, 3 trades per day. Didn't trade on Tuesday last week. Avg trade profit was 15 ticks. One losing trade in those 4 days.

The main difference is that I've been learning Price Action and applying that to my trading. Besides a volume pattern indicator, to tell me when big money is coming in or amateurs are playing around, that's all I'm utilizing.

Today was stopped out twice. Came back with a long that covered my losses and put me 12 ticks in the black.

-

-

Not trading live yet. Had a chat with another trader and he suggested I look at the TF. Started with that last week and, well, am doing ALOT better with that than the ES. I wasn't going to go live until absolutely certain of my platform. Thursday netter me 4.4 points, Friday was 2.2 points (couldn't get into office due to snow until the afternoon hours) and TODAY (!) I made 8.6 points.

I did cut back the trades I take to 2-4 a day, depending on long or short set ups. Doing great with this and we shall see how I do with this. Almost done funding the acct, so once I finish that to proper levels, I'll be going live.

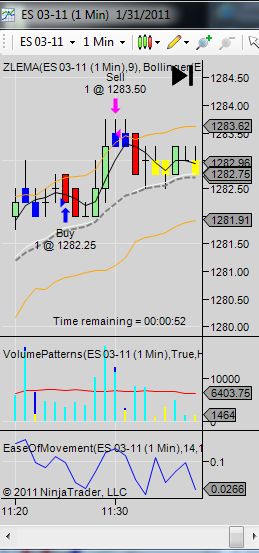

The image is a trade I made on the TF and YM. My stop was tight and a quick reversal closed out my trade. Reviewed it and everything seemed great so I took the trade with some great results but as you can see, I stayed in it for too long, at least on the TF.

-

-

-

Got stopped out on reversals today. Was able to get 3.75 points out today, almost covering losses. Ended the week positive. I should have closed out my final trade at 2.75 points though instead of waiting to see if it'll go to 3 points...it regressed to a 2 point gain.

-

Done ALOT of reading, backtesting, and review of methods and have defined my rules. Traded a bit over the holidays and came up ok.....just ok...not bad, not great. Due to circumstances out of my control (wife totaled the vehicles over the holidays) and schedule changes, my trading hours have been adjusted out of my control until at least 1 vehicle gets replaced, which should be by this weekend.

Started with my trading on the defined premises on Tuesday when we came back from the holiday.

1/4: Profit= .75 points

1/5: Profit= 1.75 points

1/6: Profit= 4 points.

All of my profit taking was on 1 point or smaller moves. No trying to break the bank. Also, there were trade losses each day.

-

Applied some earlier techniques using info from Bathrobe along with Support/Resistance and a trending indicator, resulting in better trades. Found video libraries on setting trailing stops in simulator to help out with P&L and will review them tonight.

-

Kiwi, thank you for the input. I am using a live sim, but not trading any account. I am still defining my methods. We shall see what this week of testing and application gives.

-

I am using the Keltner channel and candlesticks. Today I added the Chaikin Money Flow indicator as well. Not sure how well that is working.

I know I'm making too many trades given the live feed. I slowed it down to instead of 1 minute to 5 minute. Don't see a tick chart anywhere....

Attempts are at .75-1.25 points long and short side. Looking at this weeks performance, the shortside trade is my biggest detractor, and being unfamiliar with the software. For example, I accidentally pressed "Sell market" on a short position instead of buying and was caught up in a 2 contract reversal instead of a 1 contract reversal, doubling the loss upon closure.

Point wise, this week I did better as the week progressed.

Monday had a 1.25 point gain

Tuesday had a 2 point gain

Wednesday had a 3.25 point gain

Thursday had a 5 point gain

Friday had a 4 point gain.

Average gain is 3.1 points per day, exactly what Why? said it would be, roundabouts

The losses for the week were more significant due to ill timing, poor conditions, and being hardheaded thinking the market MUST go back up...Monday resulted in over half of the week's losses.

I'm now going over the data and the indicators to see where and how I won and where/how I lost to further refine my understanding. I'll be reviewing what worked and what didn't for a better week next week, at least for a few days.

-

I found some indicators I liked yesterday spending then and last night reading up on them. Today, using them I pulled 5 points but was too busy to really watch it so I lost all those points plus 2 more. I am not frustrated as I realize P&L are because the indicators are showing the movement and when I am available I am capitalizing on them. I need to be more diligent and ensure my positions are closed out when I am not at the screen.

Does your charting s/w show afterhours movement?

-

Broke even the past two days. Early day gains are 2-2.5 points. This was my first post FOMC trades for futures and for a quick minute my trade registered a 1.25 point gain, only to suffer a stop two points down, just about wiping me out of all of todays gains. Have a 66% positive trade ratio, but the two trades that went south went way south. Looks like massive profit taking late today and yesterday....this reinforces morning trading only.

I can definitely see the market moving sideways most days, appears that the conditions previously really suited my trading style. Gonna have to learn to profit from .75-1.25 point moves

-

Well, I may have misspoken with respect to you having a proven method when what I really meant to say was it's clear you've got something right going on (really, really right). Despite the interruptions.from periphereal matters, you continue to prove you have some special talents. There are a lot of people who can't trade profitably, even on paper. You come across as having done a lot due diligence and that makes me believe your are serious about letting loose those raw talents of yours so you can prove the thoughts invading your mind over the past few weeks; thoughts that slowly and ever more loudly have been growing and reiterating "this is doable" and "there's good money to be made". When I look at the 7 Ps, the one that stands out is performance; It's not by chance that all that work and diligence in tracking your paper profits has resulted in impressive performance. I think deep down, you know you were meant for this. And deep down you also understand that such talent needs to be let loosed to flourish. A forced reigning in of something you are meant to do, is not good for one's mental state and/or physical state. Maybe it's time to become a believer of the 10-Ts: true traders tackle temerity then tactically target tallying tremendous totals. Your time has come. Your time to tally some tremendous totals is now!. Let nothing stop you. Any reason Monday can't be your coming out day? Nobody expects you come out guns blazing. Just make a few trades to start out and book few hundred dollars in profit for 20 or 30 minutes of work and don't force anything. This would be a real solid way to "get your feet wet." You've got the talent. Here's rooting for you: :applaud:jack, thank you for the vote of confidence. However, this still does not sway me from my original thoughts as I still have more to learn and define in regards to my strategies. Raw talent, for any field, requires discipline and concerted effort to ensure future payoff.

Johnny Cakes,Earlier you said you were trading off news, where did you get your news? Also, and more importantly how did you deal with the scenario where a number beats wall street expectations by a lot and the market sells off (usually after a small rally to bring in retail)?

Finviz aggregates several news sources w/ title of article and a link.

In that scenario, I could short the market, buy at the bottomish of the sell off or wait for the correction. Given I am new to this trading platform, what is your way to benefit from this scenario?

Also, I must say, I never took anything you said as abrasive.

Isis, what an invaluable contribution! Thank you so much.

-

First of all, I am trying to help. Pretty much all I learned about futures trading, I learned on my own. Nobody helped me in the beginning. In fact, most were opposed to answering questions and most were treating me like an idiot.What you need, imo is to have self discipline and solid risk management.

You will not be aware of the level of difficulty in trading until you place a trade with real money. That is simply a fact.

I mean this with no disrespect or cynicism but the points you are saying you make each day as a beginner in the es makes it sound as though you are without a plan or a reason to trade (setup). Instead something like "it's moving, I better get in".

I know of 2 or 3 traders who in the beginning ran their account from 10k all the way to 50k in 3-6 months only to lose it all. I have a friend who started with 3k and was making about 5k a week for quite a while.

With 9 years of market experience you must have a risk management plan, if you do not, get one.

Bathrobe, my remarks were absolutely (!) not directed at you, instead two individuals who made comments that were in jest of my intentions. Thank you for your input.

I know I am a beginner at this and my risk management plan is in development. With my experience being in a different field, the plan for futures has to be researched and with discipline, followed.

reduce that 4,5 points by 75% when going live with real money. if you can make your methodolgy work consistently at the 75% reduced performance level then the money is simply a question of trading size and being disciplined.good luck

Thanks so much! My methodology is in development now.

-

This week, with two days out of the market and a fluke on Monday night/Tuesday (based off a hunch for the Ireland bailout and a market overnight gain of 10 points), the net this week was 23.25 points, less than half of the first week. But now I'm using live feed, made some mistakes, and am getting back up to speed. Exclude Tuesday's overnight 10 point gain (which I admit is reckless) and the average gain was almost 4.5 points a day. That is more "normal", is it not? I wonder if this will quell the haters....

-

I think I found some indicators which I like, an zero lag exponential moving average and Support 1/2 and Resistance 1/2. Yesterday the contract was changed to the 03-11 whereas yesterday I was watching the 12-10 contract, resulting in a difference of price and mistakes on my behalf upon opening today. Was able to pull 3.5 from the market today with an 80% winning average. I took my eye off the ball for a few minutes and it smacked me as soon as I was away.

-

Proven track record? Uh, no. And there is no promise of future growth. I'm a firm believer in the 7P's. Proper prior planning prevents piss poor performance. But I'm sure you know this

-

I use no indicators in the sense that you mean.Find what works for you, if you can actually pull in 15 pts a day, I am confused as to why you are posting about paper trading.

The average market moves how many points per day? I'm doing this to learn and practice which is giving me a better opportunity to be profitable down the road, plain and simple.

No, for real, it doesn't appear you're missing a single thing. Glad to hear your with Mirus. NT is quite possibly the greatest trading platform out there. And, wow, with that Zen-fire connection, you'll be able to trade really, really, REALLY fast. And did you know that's unfiltered data! You've got all the bases covered. As it stands now, each day you wait you're actually losing money. When do you think you'll make your first trade? Tomorrow the market should be rockin! There's sure to be lot's of tradable moves.I'll begin trading when I have the platform figured out. As of now, it seems after hours data feed doesn't work. I'm not losing money, I'm taking steps to ensure future growth.

-

Tams, I already know I'm a rockstar

but I'm a solo artist :thumbs up:

but I'm a solo artist :thumbs up: Although, thanks for the vote of confidence... :doh:

-

Finally got the charts to load and am viewing the live feed, now trying to get a sense of the day's markets. Added the Bollinger Band, Buy/Sell Volume, and Momentum. Will be reviewing different indicators to see what makes the best indicators for the rest of today. Been WAY too swamped with over half our office out to pay any sort of close attention to the market, so I've kept out of it. Possibly may tomorrow as well, depending on how much time I can dedicate to this.

-

What indicators within the software are most applicable to you? What do you use? there's something I am missing, I'm connected to a live feed but the chart only loads to when I DL'd the program earlier yesterday, no current data is available......hmmm....

live demo/sim is paper trading. What were/are you calling paper trading?Using a delayed feed. Now it is a live feed, once I get it all configured.

LOL you gotta be only computer age trading. Semantics.

LOL you gotta be only computer age trading. Semantics.

-

Gone into live demo mode w/ Ninja trader and Zenfire from Mirus Futures. I've not used these systems before and there will be a bit of a ramp up for me with this platform while I play with it. will still be doing the paper trading while I get familiarized with this.

Thanks!

-

Like I said, just keep futzing around with your paper account until you have 5 days of losses. After you have another 10 straight days of profit, and then another 10 straight days and you can't seem to have a down day to save your life, you might begin to understand (but I doubt it) the limitation of paper trading. In looking closer at your results, I think your ready. Come on in, the waters fine.I understand the limits of paper trading, believe me. I've done paper trading for stocks before I put my money where my proverbial pen was.

My next step is to sign up for a demo account w/ live feed for two weeks or so and then fund the account to go live. I still have a few weeks before going live, and am anticipating a change within the trades and gains during this period which will require a tweaking of my approach. I'll see how my existing approach works first though and makes changes then.

@Why?

I'll definitely begin small. 1 contract only until sufficient account size and experience warrants two contracts, and even then, will only do two on occasion until sufficient experience and funding is applied.

-

Yeah, it seems pretty obvious you're missing, not something, but a lot with respect to thinking your paper trading will emulate anything close to what you will get trading real money. Here's something simple to help you put it into perspective. I want you to keep paper trading and then report back when you have have lost money for at least five days straight. All I've seen you report is winning days. And since you can "game" your paper trading results, most end up doing this deliberately and/or unintentionally. You won't get cut that kind of slack (in fact, you won't get cut ANY slack) when trading live. Once you figure out how to lose paper money, then take another step, a real step. Set a goal of trading live for as long as you can until you have lost $1,000 in real money (consider it the first installment on your tuition because you will be paying it and probably lots more) and then have at it. You'll be humbled by how quick this drawdown happens and then you will begin to understand the gulf between paper and live trading. In the meantime, check out edabreu's post here...a thoroughly insightful post for you to chew on in the meantime.I'd be happy to provide you my logs of each in and out trade. As far as having only positive days, yes that is absolutely right, I've only had positive days for the past two weeks. I'm not gaming any trades and when I would make a trade, am immediately inputting it into my log. There have been losing trades, definitely.

In fact, here is the day number, trade day, date, daily points, number of trades, contracts traded per trade, daily profit, cumulative profit, and weekly points:

1 Wed 24-Nov-10 2.50 2 1 $118 $118 $-

2 Thu 25-Nov-10 0.00 0 0 $- $118 $-

3 Fri 26-Nov-10 2.25 1 1 $109 $227 $- 4.75

4 Mon 29-Nov-10 8.50 1 1 $422 $649 $-

5 Tue 30-Nov-10 11.50 3 1 $565 $1,213 $-

6 Wed 01-Dec-10 11.25 4 1 $549 $1,762 $-

7 Thu 02-Dec-10 8.00 6 1 $379 $2,141 $-

8 Fri 03-Dec-10 12.75 7 1 $613 $2,754 $- 52.00

9 Mon 06-Dec-10 4.75 6.5 1 $215 $2,968 $-

10 Tue 07-Dec-10 15.00 4.5 1 $734 $3,703 $-

I edited the log on the 1st of December to include my in's/outs and designate short/cover.

6.) Wed 01-Dec-10 1195 1200.25 1199 1201 1204.25 1207 1204 1205.25

7.) Thu 02-Dec-10 1204.5 1214 1215 1216 1216 1215 S 1221.25 C 1220.25

8.) Fri 03-Dec-10 1215.5 1220.25 1219 1221.25 1217.75 1219.5 S 1218.50 C 1217.50 1217 1217.75 1217.25 1218.75 1218 1219

9.) Mon 06-Dec-10 S 1218.50 C 1220(stopped) 1221.5 1222.5 1222.5 1223.5 1223.25 1224.5 1224.25 1224.75 S 1222.50 S 1220 1123.75 (long to next day)

10.) Tue 07-Dec-10 (long from previous day)1234.5 1233.75 1233.25 S 1229.50 1228.5 1228.5 1230.75 1229.75 1230

Perhaps you missed this earlier, especially given your comment of how I need to pay an installment loss, but I've traded stocks for many years, am licensed, and understand the mindset, had losses of several thousand on a day before and been down for weeks at a time, which was really rough. The emini is a new instrument for me and I am schooling myself to acquire the knowledge to do this for income, as, after all, isn't that what we all want?

News: Watch the Announcement Calendar the day before:do not be trading when the red or yellow stars are about to happen.

Supp/Res Lines:

Probably S1 and R1 should be of interest. S2 and R2 are the important lines:

Iris, I just saw the bloomberg calendar on a webcast about indicators and when to stay out of market and I definitely agree to stay out when market swaying news is about to be released.

Thank you for the S/R 1 and S/R 2 lines to watch.

Started E-mini Paper

in E-mini Futures

Posted

Ended this week with 230 ticks. Funding arrived in account today. Still stayed in sim to ensure everything was the same. Pulled 6.9 points on two trades. Going live next week.