Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

46 -

Joined

-

Last visited

Posts posted by TradeCuts

-

-

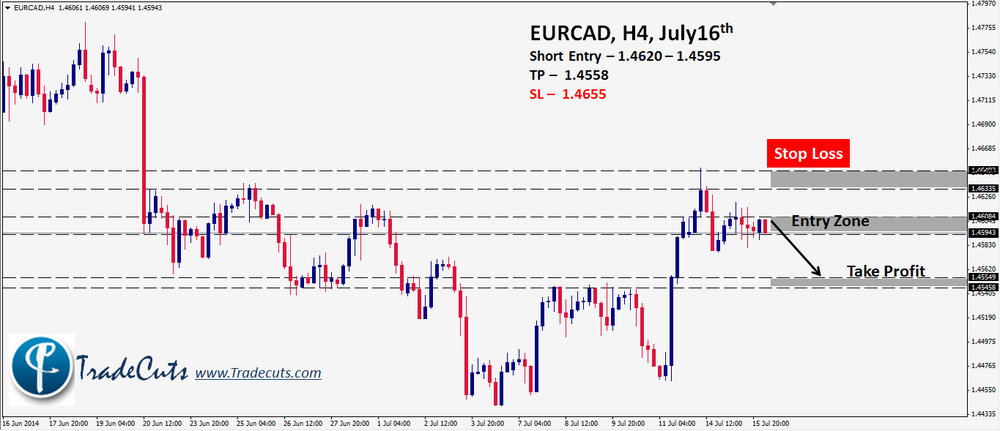

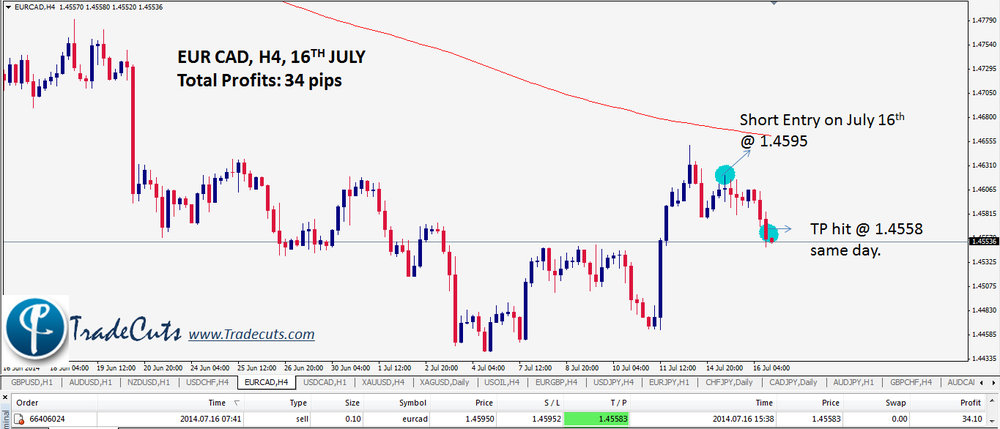

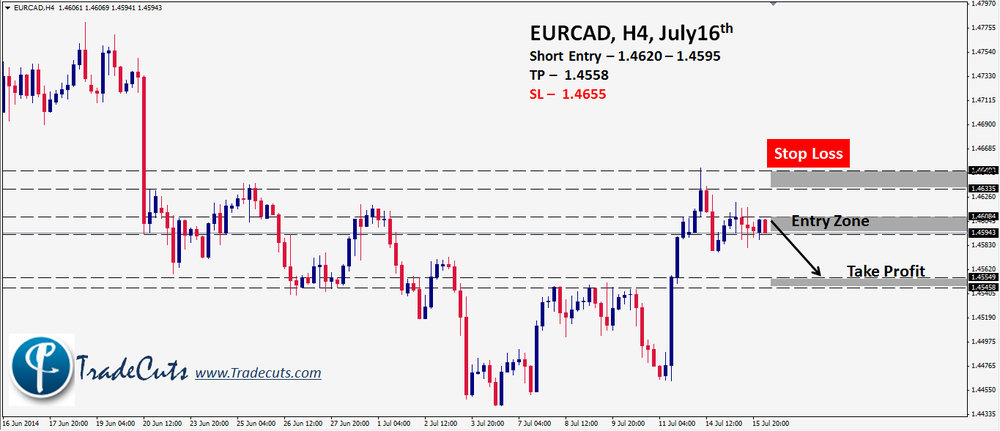

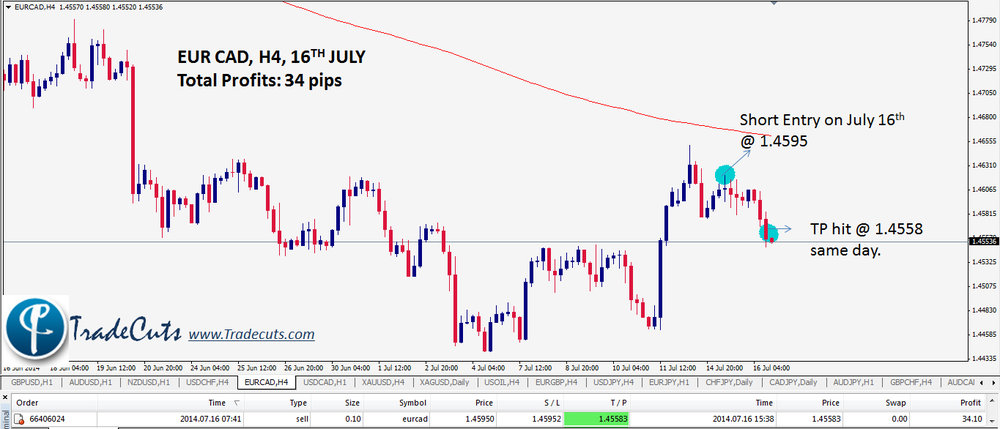

Minors: EUR/CAD, JULY 16TH.

Today's analysis was for the minor pair of Euro versus Canadian dollar. This trade has already played out and our take profit has been hit. Nonetheless, we would still like to post it as a good example of a trade well traded. In this Intra day trade, entry was nearly at the day's high and exit and stops predefined. Once the trade moved 25 points in our favor the trailing stop loss kicked in and from there on it was a risk free trade, till a few minutes back when our TP was hit giving us 34 green pips for the day.

At TradeCuts, no opportunity is ever lost. If one trade is missed , there are newer and fresher ones just round the corner.To take advantage of our analysis and precision entries and exits, do keep checking our updates on the Major, Minor and Commodity pairs. Feel free to write to us and read our blog articles for deeper insights into some of the happening pairs, the latest one being NZD/USD and dont forget to post your comments.

Best

TradeCuts.

-

Minors: EUR/CAD, JULY 16TH.

Today's analysis was for the minor pair of Euro versus Canadian dollar. This trade has already played out and our take profit has been hit. Nonetheless, we would still like to post it as a good example of a trade well traded. In this Intra day trade, entry was nearly at the day's high and exit and stops predefined. Once the trade moved 25 points in our favor the trailing stop loss kicked in and from there on it was a risk free trade, till a few minutes back when our TP was hit giving us 34 green pips for the day.

At TradeCuts, no opportunity is ever lost. If one trade is missed , there are newer and fresher ones just round the corner.To take advantage of our analysis and precision entries and exits, do keep checking our updates on the Major, Minor and Commodity pairs. Feel free to write to us and read our blog articles for deeper insights into some of the happening pairs, the latest one being NZD/USD and dont forget to post your comments.

Best

TradeCuts.

-

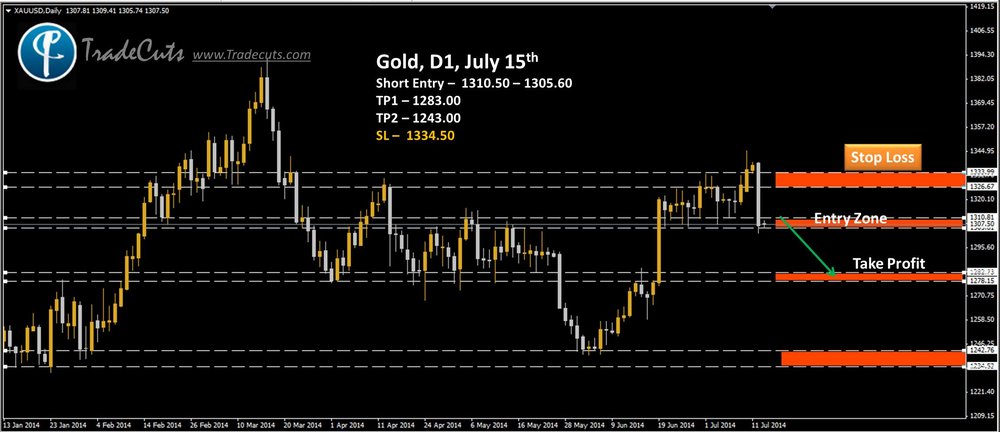

The month long bullish run of gold came to an end yesterday as the yellow metal lost it’s glitter by USD 32 (1336.78 to 1306.36).Currently gold is resting at 1310.50 – 1305.60 level which happens to be 38.2% Fib retracement. Considering current bearish momentum and next support level at 1282.75 – 1278.10, coinciding with 61.8% Fib retracement, it is expected that Gold will remain under pressure for the current week as it tests support levels, providing high probability setup for swing traders.

Alternatively, it is also possible that Gold completes its retrace at current zone and retains its bullish run of last month. In that case, expect gold to hit highs of earlier this year around 1391.00. Current price action along with support/resistance structure support bearish outlook but stop loss shouldn’t be ignored, in case Gold takes a U-Turn.

Regards

TradeCuts

-

Hello,

This is where you will find our posts for the 3 major commodity pairs, gold, silver and oil. Keep checking for our free signals here.

Regards

TradeCuts

-

As is seen from the chart, Aud/Chf has been moving inside a declining channel. Right now, its at the upper resistance, and at TradeCuts our analyst has marked 0.8365 - 0.8380 as the Entry Zone, with stops at 0.8425 and take profit levels at 0.8320. Initially a risk:reward of 1:1, but on a move of 25 points our trailing stop loss gets activated and price comes to break even.

For detailed information about how we take and manage our trades please write to us and visit us.

Regards,

TC

-

In this thread we will be posting our analysis for quite a few of the Minor pairs. To name a few:

1) Some of the YEN pairs: AUD/JPY, NZD/JPY, CAD/JPY, CHF/JPY & GBP/JPY

2) A few of the Euro ones: EUR/AUD, EUR/CHF, EUR/NZD, EUR/CAD

3) Some from the Pound basket: GBP/AUD, GBP/NZD, GBP/CHF, GBP/CAD

4) The Aussie and Kiwi minors: AUD/CHF, AUD/NZD, NZD/CHF, NZD/CAD

If I have left out any, will keep updating them. If you want to get the latest update on any of these pairs and more, do keep a look out and keep visiting this thread.

Regards,

Team TC.

-

As is seen from the chart, Aud/Chf has been moving inside a declining channel. Right now, its at the upper resistance, and at TradeCuts our analyst has marked 0.8365 - 0.8380 as the Entry Zone, with stops at 0.8425 and take profit levels at 0.8320. Initially a risk:reward of 1:1, but on a move of 25 points our trailing stop loss gets activated and price comes to break even.

For detailed information about how we take and manage our trades please write to us and visit us.

Regards,

-

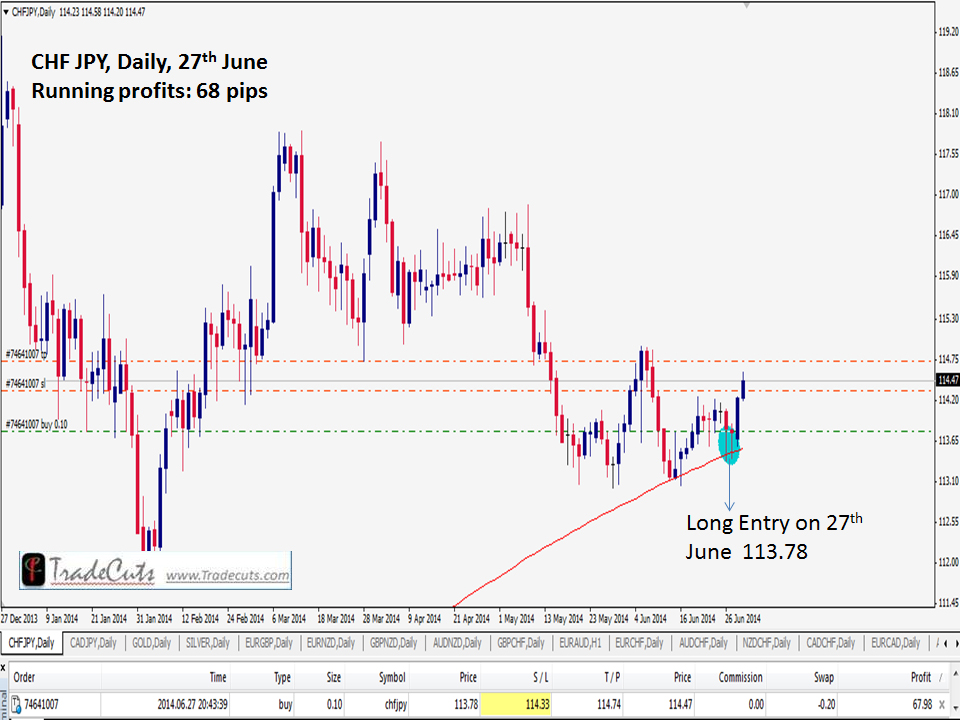

Quoting from Bloomberg.com " Interest rate swaps are signaling the Bank of Japan will lag far behind the Federal Reserve in ending record stimulus, adding pressure on the yen to weaken." Some of the valid points mentioned in the article are:

**The slide in borrowing costs shows investors are confident BOJ Governor Haruhiko Kuroda will maintain record stimulus even as the Bank for International Settlements warns global monetary authorities to avoid delaying an exit from emergency policies.

**“Exit in Japan is far, far away,” Yusuke Ikawa, a rates strategist in Tokyo at UBS AG, said.

At TradeCuts, we keep a keen eye on all these developments along with a strong look on technical analysis. As of now, we have two trades open in the YEN pairs: CAD/JPY and CHF/JPY. Here's a look at the trades which are entered with stop loss and take profit in place. Trailing stop loss is used to lock in profits.

-

-

Hello All,

As is our practice we bring to you a brand new Trade Setups at the beginning of every week. For this week of April 15th to 19th it is Aud/Cad. Here's our outlook for this pair for the week:

AUDCAD - Potential Trade Setup

High probability Short trade with trade quality of 75%

Double rejection at 1.07100 level provides us with "High Probability Short Setup." Candle formation suggests bears to gain momentum and test next support level at 1.05682.

Outlook – Short

-

-

-

-

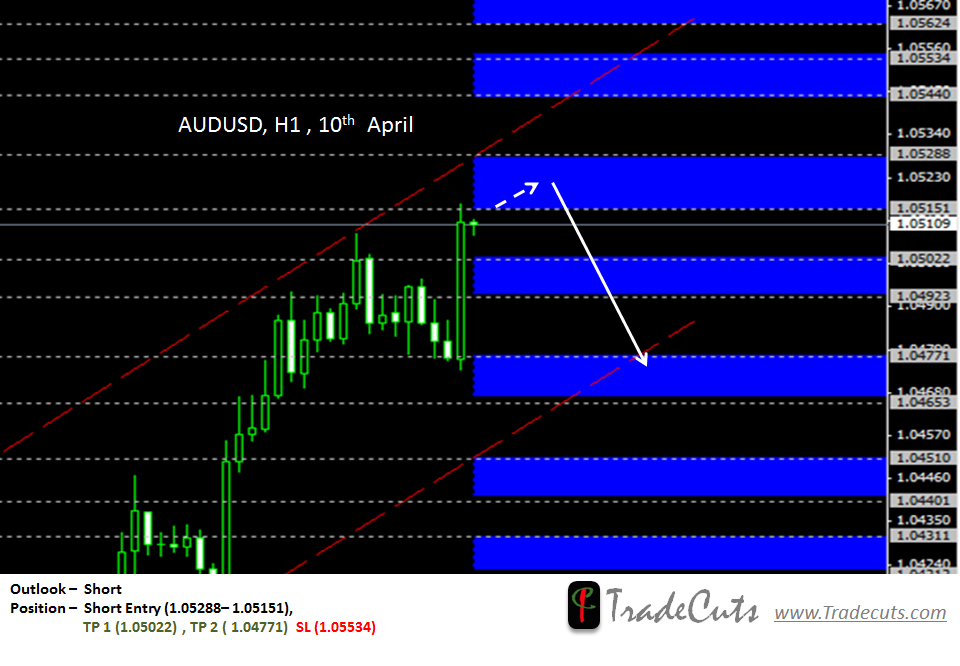

Yesterday our call on EUR/USD turned out quite profitable and hit our take profit giving us +45 pips. Today we take on the Aussie Dollar...

Since the last few days USD has weakened across the board. The current price action is testing some strong Resistance ahead. Considering strong resistance and weakening Bullish momentum corrective moves and reversal is expected for intraday traders.

Outlook for Aud/Usd is SHORT for Intraday trading, with a possibility of making 45-50 approximately

Best

TradeCuts.

-

-

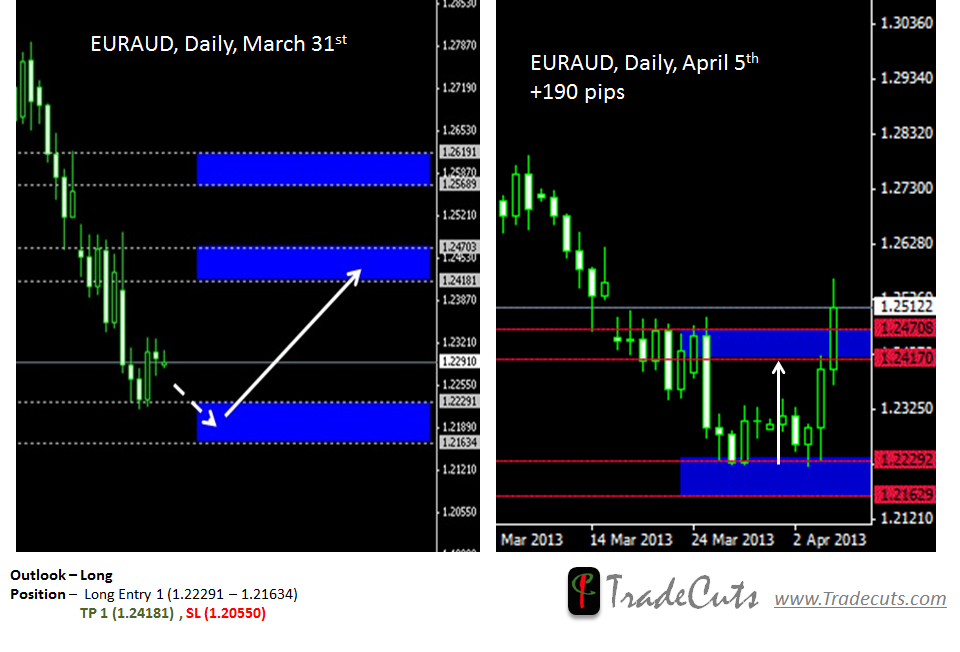

Last week we got some nice pips from EURAUD Long (+ 190 pips).

Looking at current price action and break out of strong resistance it seem EURAUD will stay Long. So lets ride along. Caution, small retrace is possible, thus we recommend to wait for proper buy entry.

Outlook – Long

Long Entry 1 ( 1.24092 - 1.24703)

Long Entry 2 (1.25689 - 1.26191)

TP 1 (1.26591)

TP 2 (1.27700

SL (1.22900)

Trade setup Quality 75%, at test of support

Best

TradeCuts

-

-

-

Hi,

As opposed to the other Yen currency pairs, today Usd/Jpy is forecasted to go long.

Yens continued their journey in descending channels and are testing the lower trend line. Current price action along with resistance and European currencies getting weaker, indicate at shorts in most pairs except Usd/Jpy.

Best

TradeCuts

-

Hello Everyone,

Markets resumed after Easter Holidays in NY session yesterday, as the European Markets were closed. Earlier trends from NY session indicate weakening USD against major pairs. Expect USD to weaken further against majors but there is resistance ahead. Keep your longs short.

Outlook – GBP/USD Neutral to Weak

Ifyou happen to take this trade do let us know how it turned out for you.

Best

TradeCuts

-

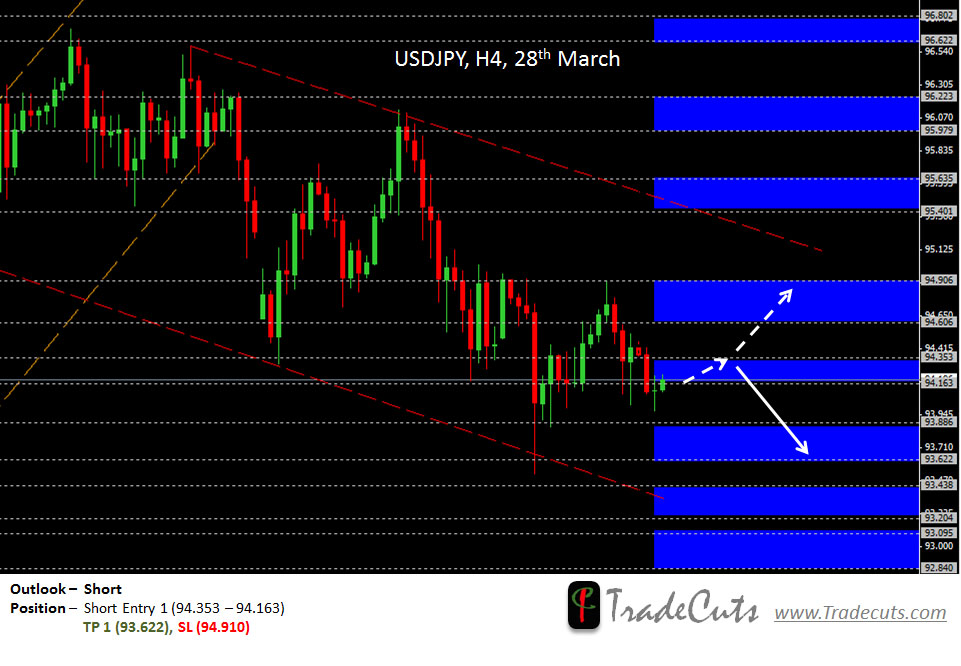

Yens continued their journey in descending channels and testing the lower trend line. Current price action suggest Bears are running out of momentum in JPY pairs. If you are Short keep your Shorts , Short otherwise look for nice Long Entries but don’t jump in too soon. Caution with Yens.

Our outlook for the Yen pairs is sideways. Here's a detailed look at Usd/Jpy for 28th March:

-

-

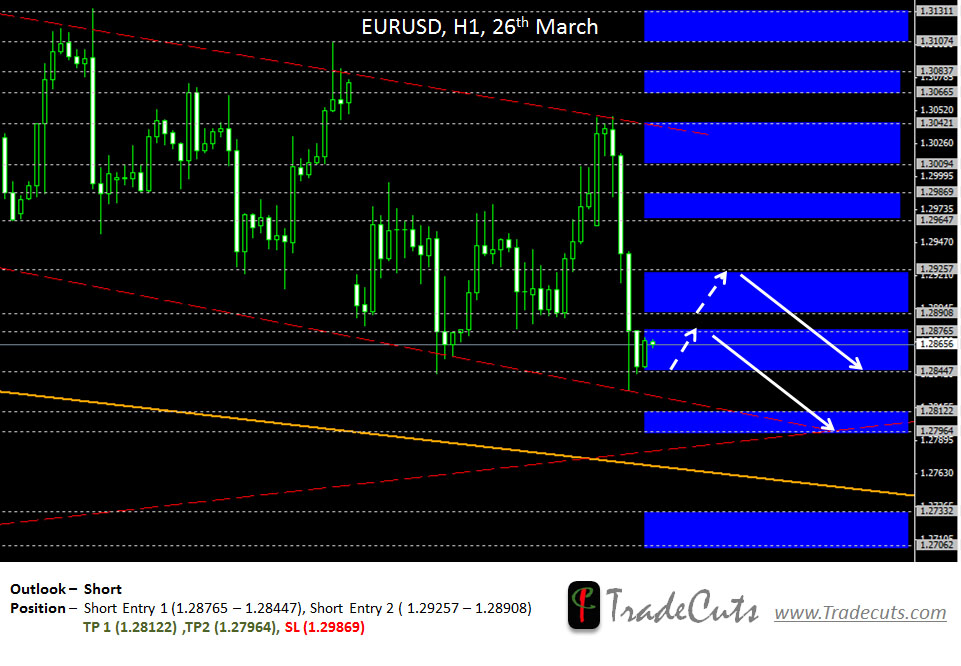

Yesterdays movement for Eur/Usd and Gbp/Usd was mostly sideways and we closed Eur/Usd with a modest +33 pips while Gbp/Usd hit take profit 1 and gave us +44 pips.

Best

TradeCuts

-

Hi Everyone,

Today we have for you two USD pairs. They seem a little of sync and after yesterday's reactions to Cyprus we are expecting mixed sentiments in the market today. Presenting to you Eur/Usd and Gbp/Usd today:

If you happen to take these trades let us know how they turn out.

Best

TradeCuts.

EURUSD Discussions

in Forex

Posted

Eur/Usd has fallen significantly in the past two days and currently price is hovering just above support of 1.3500. After the fall from 1.3620 to 1.3520 in the past couple of days, today's Asian & London session has been quiet and price has been moving in a tight range of 20 - 25 pips. We continue to hold a bearish bias in this pair till next support zone of 1.3485 to 1.3475. On the upside, resistance is at 1.3670 - 1. 3700.