Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

12 -

Joined

-

Last visited

Posts posted by yom

-

-

[quote name=slick60;139882

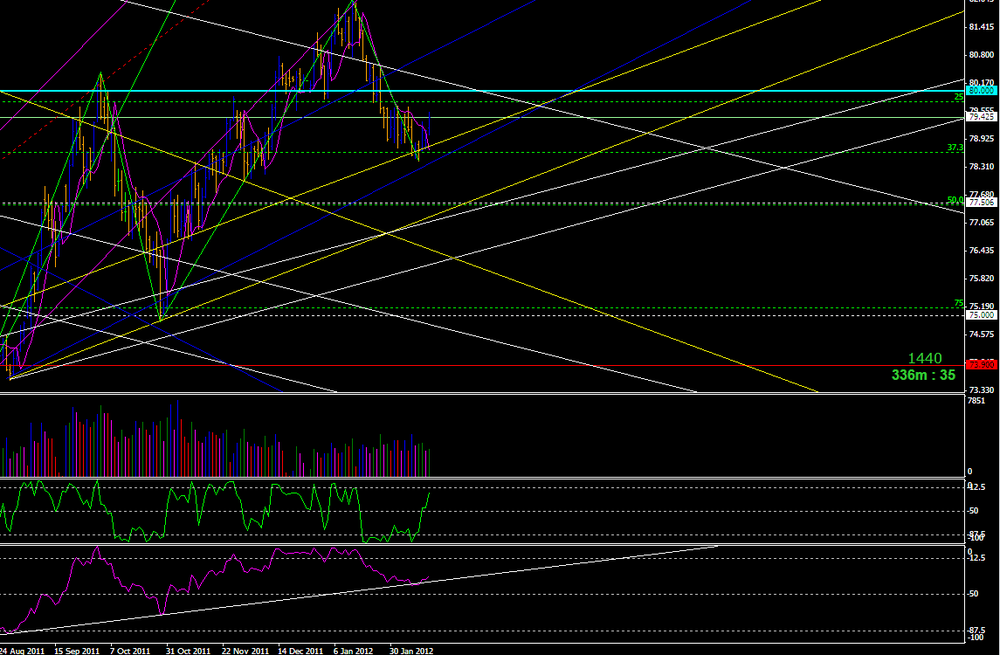

Both the EURUSD and the DX have now hit a 50% retrace of the move from Jan 13' date=' 2012. A logical point of support/resistance for them. Now to see if they "spike" them before reversing.[/quote]

Think they just absorbed a ton of supply down here

-

-

-

Hi yom,The forum is mostly self-moderated by the members to prevent spammers, etc. New member posts are also moderated for this purpose.

thanks,

MMS

I understand Thanks MMS, just need to get some content on board is all

-

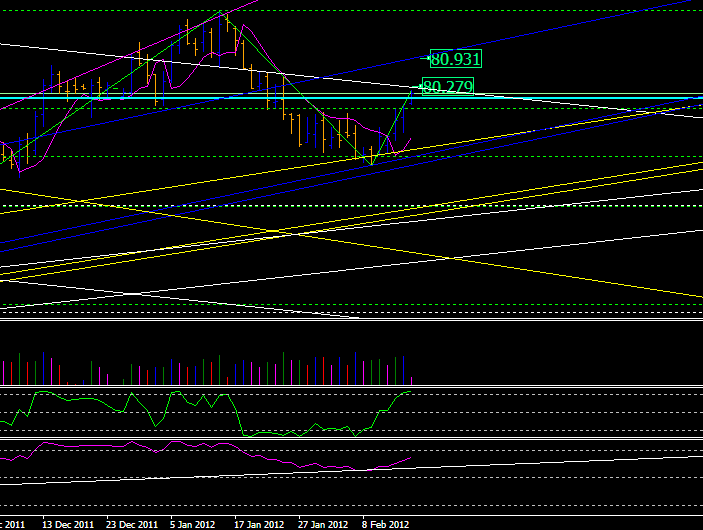

DX off to large Q + near term res on that descending white angle there

-

Sorry off topic BUT is every post under scrutiny of a moderator? If so thanks for the convo, i'll be going now

-

You say that the Close is a key element of market psychology, but then say that you find the Open useless. To go back to the OP's point, the value in anything is whether others are also using it. You appear to be referencing daily bars with your statement, but most are referring to intraday; more of an agreement that on Daily and higher tf the Close has significance. But recognize that the daily open is a reference as to where price was for European session traders at that time. It's not a random place where the market opens. While you may choose to put less value on it than on RTH, it is something "of value". In fact, simply look at how price reacts to it intraday and you'll see that other traders do take note of it. Lastly, as we're seeing as I type this, the Daily Open is affected by news so often released at 8:30A ET, clearly an important issue, hence where price is as a reflection of that news should have some value.BTW: not referenced yet is the fact that two persons' computers may be synched slightly differently with respect to time, or have a faster/slower data feed, causing a :05 candle on each's (both started at RTH session start) to look differently.

Well i could not agree more when it comes to different time zone trading, It really all has significance depending on the type of trader a person is. the lack of value for some just shows the type of trader they are, Surely a guy who is playing a 30 year cycle is not even concerned with weekly closes or monthly for that matter, he just wants to buy more at a valued bargain. So all and all its really just subjective to the time your trading i guess

-

Here's a question: do any of you who trade using closing prices use a 'line on close' chart as opposed to bars, candlesticks etc?Nope i dont care about closes really,but it is useful infromation i think, i'll generally enter 10 seconds b4 the close im primarily a time trader, price is basically irrelevant, when times up the market will move regardless of price. And when time is up for a large spectrum TF player them current prices will not be seen again for some time IMO

-

I don't think a conclusion can be reached regarding order flow, accumulation or distribution from the closing price of an intraday bar. If we are talking about a daily bar, or a weekly bar, then I am more inclined to accept that.For someone to accept that the close of an intraday bar, be it a 5m, a 30m, or whatever, has significance, then he must also accept that the market places significance on that time.

I do feel that the first hour of trading, from 9:30 to 10:30, can be isolated and examined, in such a way that reasonable conclusions may be drawn about the state of the market that day. So, for me 10:30 is actually an important time to assess the first hour of trading.

But say you are watching a 30 minute chart, and at 1:00pm you notice that the close of the bar is near the lows. You are looking to short, but you wanted to wait for the bar to close near the lows. This gives you some validation or confirmation. This implies that the market (meaning other traders) view this particular time (1:00pm, or generally, every half hour) as an important time. It also implies that the 12:30 to 1:00 "window" of the market is more important to you than the 12:25 to 12:55 window, even though they are both half an hour. Also implied is that you are not so concerned with what happens from 1:00 to 1:05, since a 30 minute bar starting at 12:35 will be closing then. Finally, it's implied that you do not care if the market rallies strongly from 12:50 to 12:55, as long as it closes low AT 1:00. Not a second before, not a second after.

It follows then, that you are very concerned, ultimately, with one single quote: the last traded price at each half hour every day, or at least how it relates to the previous quote, and perhaps the high and low of that period. There's nothing wrong with that ultimately IMO, it's just the reality of accepting the closing price of an intraday bar as significant in some way.

If a trader believes that the market's goal is to get price to a certain place at a certain exact time during the day, then it follows that the closing price of an intraday bar will be significant to that trader. If a trader does not believe that, then why does he care about a snapshot of a price at an arbitrary time?

You have made a strong case, both the price players and time players are irrelevant at the intraday level, But it is also these both types of players which make the entire picture. The Long term players are there always as the makers of the market manipulate the structure to satisfy their desired positions to acquire. BUT even those guys are TIME players just in a macro sense. And this can be seen when many of them have the same view on the larger time frames. Intraday is a suckers game no doubt. Thanks for your reply Josh

-

What if you have no open or close, just hi and lo. no indicators, with 4 or 5 bars identical in range give or take. How could you make an assessment of the order flow, absorbing or distributing without a key element of market psychology present, the CLOSE regardless of time frames. For me the OPEN is useless, even if a gap the psychology of market conditions is present in the close.

-

Thankis for all your efforts Mr.Slick60 your going above and beyond

EURUSD Et Al Trading

in Forex

Posted

I agree up long enough to unload what they got, medium long term DOLLAR strong IMO

unloaded at LG Quarter