Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

mohsinqureshii

-

Content Count

220 -

Joined

-

Last visited

Posts posted by mohsinqureshii

-

-

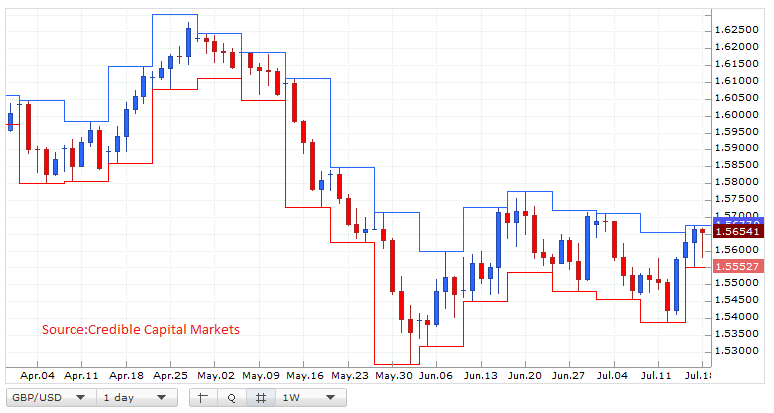

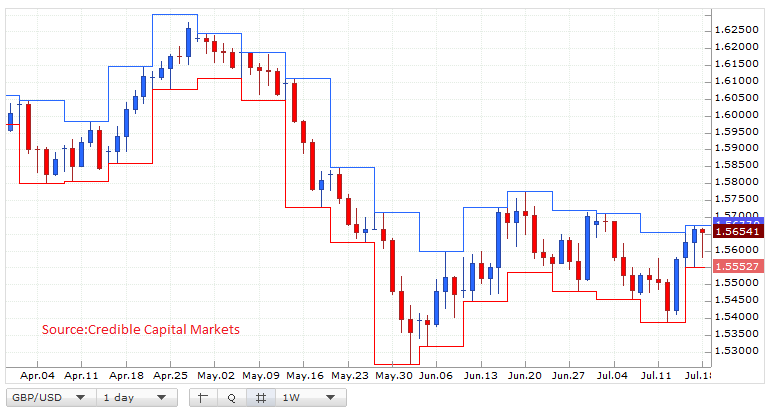

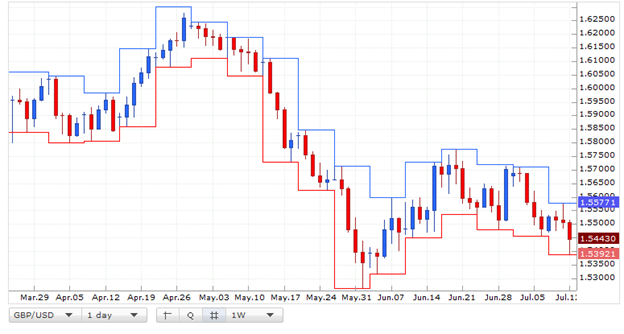

GBP/USD

After rising from the lowest level of previous days at 1.5392 GBP raise up to 1.5660 levels in previous few days. It seems like market has found some resistance level at this point where it can stay and it can be expected that after touching a higher level at 1.5670 market will move back and will fall up to the 1.5300 area.

Yesterday Market moved in a very narrow range as the opening and closing points were almost the same as after going down to the place 1.5586 market bounced back crossing its starting level to give a buying candle for the day.

Today market is expected to move in price area 1.5634 putting its support at 1.5603 and resistance at 1.5688.

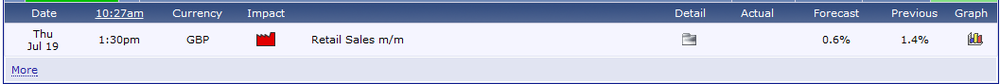

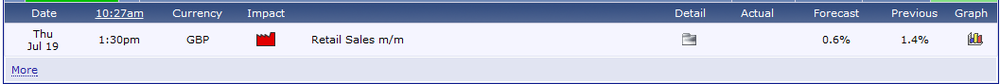

Fundamentals to Effect GBP

http://www.traderslaboratory.com/forums/attachment.php?attachmentid=29975&stc=1&d=1342684983

Chart Representation

http://www.traderslaboratory.com/forums/attachment.php?attachmentid=29976&stc=1&d=1342684983

-

Research Analysis

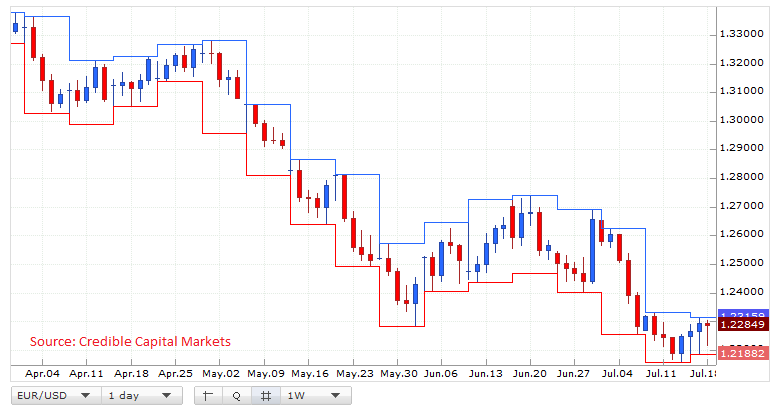

EUR/USD

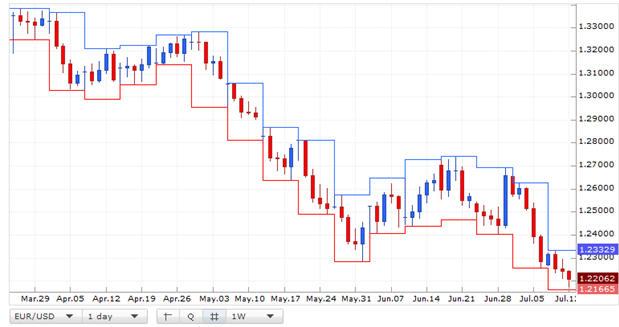

EUR is under pressure. . Most of the EUR crosses are still under tremendous pressure, with EURSEK reaching a new 12-year low; EURAUD and EURCAD at or within a few points of record lows; and EURGBP at levels not seen since 2008.

Market mood was downbeat after Federal Reserve Chairman Bernanke did not commit to any action, dashing market hopes of a quantitative easing in the immediate run. After showing a little rise and touching the upper point at 1.2315 in previous few days it is back to its down trend finding new support level to stay for a while.

Market is expected to move in a price range of 1.2267 putting its support at 1.2229 and resistance at 1.2319.

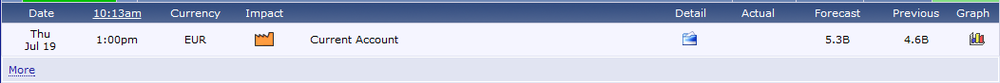

Fundamentals to Effect Euro Movement

Chart Representation

GBP/USD

After rising from the lowest level of previous days at 1.5392 GBP raise up to 1.5660 levels in previous few days. It seems like market has found some resistance level at this point where it can stay and it can be expected that after touching a higher level at 1.5670 market will move back and will fall up to the 1.5300 area.

Yesterday Market moved in a very narrow range as the opening and closing points were almost the same as after going down to the place 1.5586 market bounced back crossing its starting level to give a buying candle for the day.

Today market is expected to move in price area 1.5634 putting its support at 1.5603 and resistance at 1.5688.

Fundamentals to Effect GBP

Chart Representation

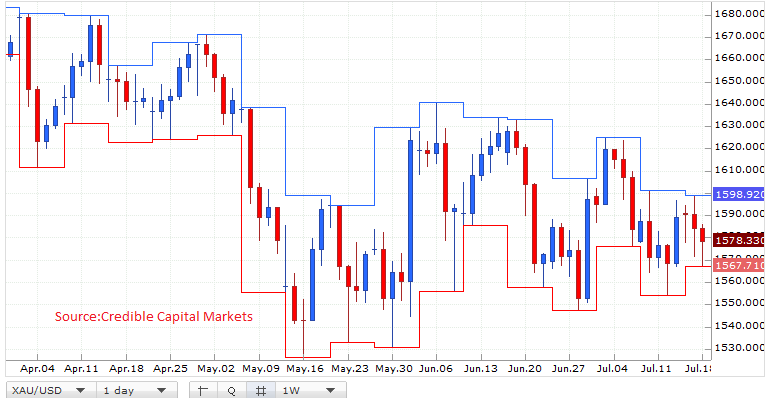

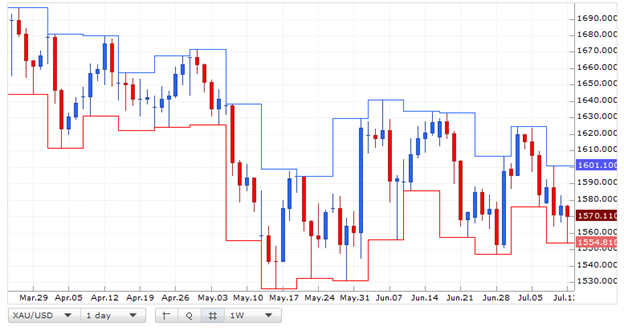

Gold

Gold continues its decline trading at 1567.80 down. The overall market sentiments were on the bleaker side following the testimony and as economic indicators from other major economies provided hardly any positive indications to cheer about. Gold and silver ticked lower weighed down by a weaker Euro and on uncertainty existing over additional monetary easing by the US Fed.

Gold value was increased in previous days when the sales data from US side was released weakening the USD and in result rising Gold touched 1598 level, as soon as this data removed its impact so was the so the value of gold decreased and now moving in narrow range it is moving at price range of 1560-1580 from previous few days.

Today Market is expected to move around 1575.5 putting its support at 4565.5 and resistance at 1583.2.

Fundamentals to Effect Gold

Chart Representation

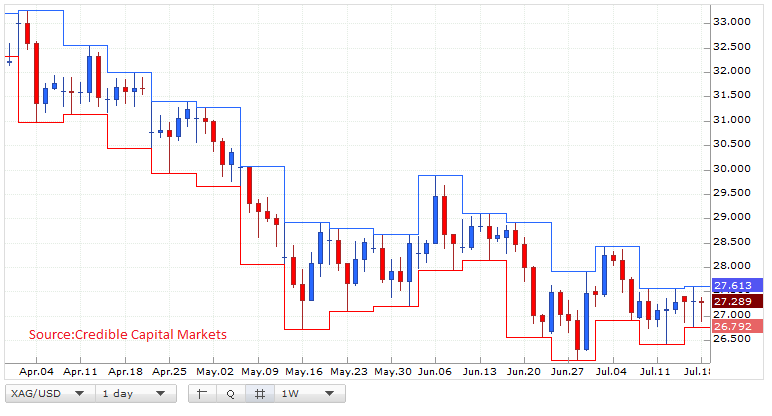

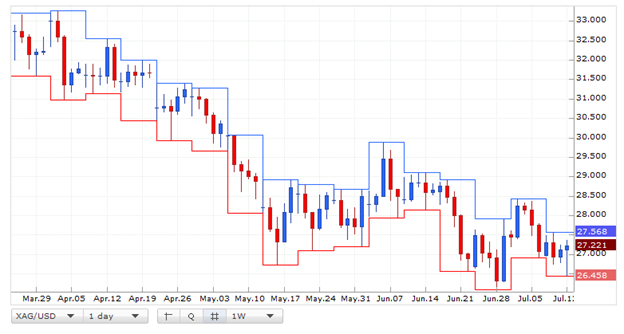

Silver

Silver is trading at 26.938 dipping in early trading. With little guidance or news flow markets have been relatively quiet. Fed Chairman Bernanke continues his third day of testimony but no news is expected. Gold is also down today, as markets were negative on precious and industrial metals.

Today market is expected to move around a price point 27.14 putting its support at 26.92 and resistance at 27.38.

Chart Representation

Crude oil

Putting a look on the Crude Oil movement from previous few days we come to know Crude oil is moving at higher notes and each new resistance becomes the support level form coming days. As we can see from the chart that Oil has shown a tremendous move from 85- 90 level in this week of July making an upward moving trend line.

For today Oil is expected to carry its upward movement as no new special data regarding oil is going to be released.

Today market is expected to move in a price range of 89.84 putting its support at 89.33 and resistance at 90.78.

Chart Representation

Dow Jones Index

DJI is moving in high notes if we consider its moves from previous few days as it started to climb up 12424 and is moving on upper sides and has reached a point 12893 yesterday and is expected further to carry its move.

Today Market is expected to move in a price area 12823 putting its support at 12753 and resitance at 12961.

Chart Representation

-

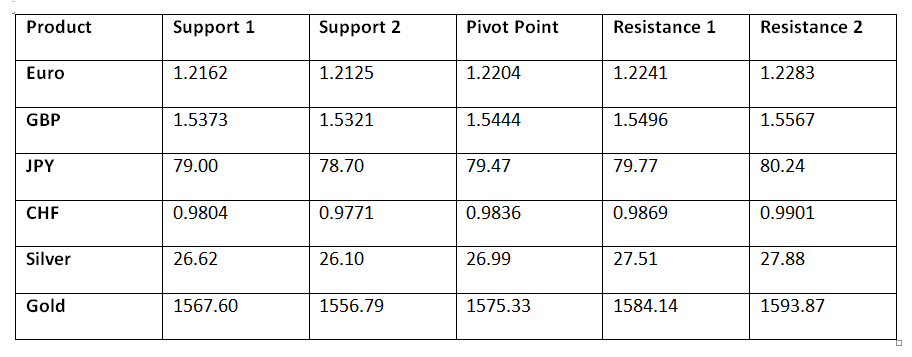

EUR/USD

Euro is still on a downtrend touching the support level of 1.2167. And a further decline can be foreseen finding new support at 1.2000 levels.

But considering in a long run Euro is expected to bounce back. This is at the level of the lower line of a bearish trend seen on the daily chart. A reversal in the price itself is all that is needed now for confirmation. The upside target would be the 1.2325 range highs. On the other hand a decisive break below 1.2200 would continue the bearish trend down, targeting the monthly pivot at 1.2105.

Today Market is expected to move in the price area of 1.2204 putting its support at 1.2162 and resistance at 1.2241.

Economic Indicator :

Italian 10-y Bond Auction

GBP/USD

GBP is carrying its downtrend movement. Yesterday touching its new support at 1.539 ,GBP indicated that a further downtrend is on the way on coming few days pointing new support at 1.5350 price area and if broken this level it may move down further.

Today market is expected to move in accordance with its trend line means will move down wards. Market will move around the point 1.5444 making its support at 1.5373 and resistance at 1.5496.

Economic Indicator :

CB Leading Index

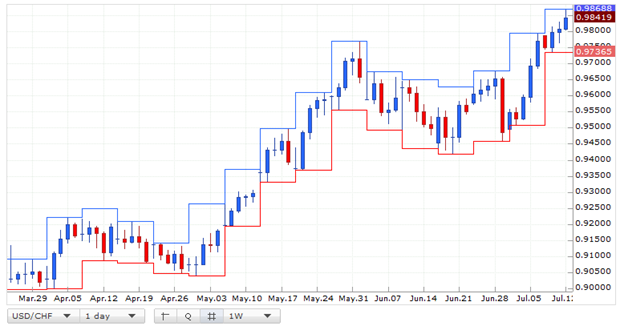

USD/CHF

CHF is moving upwards making its resistance its new support level. Market touched the point 0.9869 yesterday. That means market has potential to move even above this resistance level and putting its new resistance area at 0.9900 and if considering in long run it may touch 1.0000 in coming couple of days.

Looking into other side of the picture we can forecast that if after touching the 0.9869 level market falls back it will move down at some area near0.9680 as the market will be in control of bearish investors.

Today Market is expected to move in a price area 0.9836 putting its support 0.9804 at and resistance at 0.9869.

Economic Indicator :

PPI

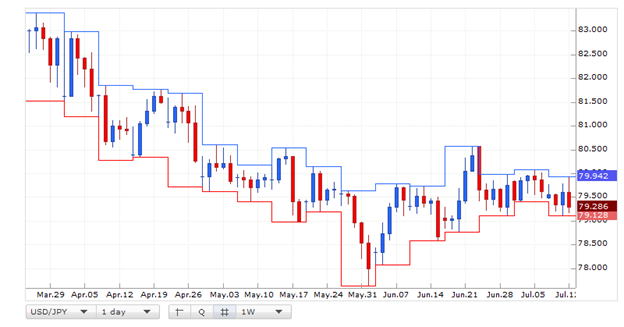

USD/JPY

JPY is being traded in range of 79.13 to 80.09. No unusual movement is seen where we can expect the JPY to move in bullish or bearish trend. It is moving in mixed way in a quite steady manner.

But as the indicators and markets sentiments are indicating JPY if moved upward it will touch a price area of 82.00 and if the price comes down it will find its new support somewhere in a price area of 78.00.

Today Market will show a mixed trend. No unusual move is expected. Market will move around a point 79.47 putting its support 79.00 at and resistance at 79.77 level.

Economic Indicator :

Revised Industrial Production

BOJ Monthly Report

Gold

As the Euro and GBP being the counter currencies of USD are making some down moving trend line, so is gold moving. Yesterday Gold touched 1554.81 that is the lowest level as the July has started.

Gold is continuously moving downward and a further decline in its prices is expected. Gold can even move bolw1550.00 level as it possesses the potential of moving so. And if the price bounces upwards it will move to find its resistance at 1595.00 levels.

Today Market is expected to move in price area 1568.13 putting its support 1558.16 at and resistance at 1581.26.

Silver

Silver and other precious metals are under the influence of bearish investors taking the market downwards as the silver has crossed the price level of 26.48. And it is being forecasted that market will touch the 26.00 level in coming few days.

Today Market is expected to move in accordance to its trend line. Market will move around the point 26.99 putting its support at 26.62 and resistance at 27.51.

Support and Resistance Levels

-

Pivot Points always include in my favorite list. Your article is very good to understand this magical tool. Thanks for sharing such a nice article.

-

Trading Forex for a living from the comfort of your own home can be extremely profitale, but it can also drive you insane at times. So here i would like to offer my 6 top tips for keeping yourself sane when trading.

1) Check the day's economic calendar at the start of every session

There is nothing more infuriating than taking the time to find a good position which goes nicely into profit, before suddenly turning into a losing position due to economic data release or Ben Bernanke (FED Chairmen) opening his big mouth, for example, Which you'd completely forgotten about. So always check the scheduled announcements for the day before you do anything else, and make note of them so you're never caught out.

2) Visit trading forums and chat to other traders online.

trading from home is a lonely profession, and the frustrating thing is that you have no-one to share trading ideas with, so forums and trading rooms are great for this. obviously you don't want to spend too much time doing this otherwise you might miss some great opportunities, but they are worth visiting during quiet periods, of which there are many during the day.

3) Leave the house and speak to real people.

Following on from the last point , the loneliness factor is a very real one and for that reason I always say that you should make a point of going out and mixing with people as much as possible when you're not trading. If you are not careful, after long periods of time it is very easy to go out less and less and find yourself becoming more and more introverted, so try not to fall into this trap.

4) take plenty of exercise

It is an old saying, "A healthy body is a healthy mind" , and it is completely true. Apart from the fact that you need to be completely switched on when making trading decisions, sitting down starting at a computer screen for hours on end is really not good for your eyes, your back or your health in general, therefore you should take plenty of exercise during the day and in your spare time to keep yourself healthy.

5) Take regular breaks and reward yourself occasionally.

As well as exercising, it is also a good idea to take regular breaks during the day just to relax and chill out. trading can really get the pulse racing at times. and can be very stressful, so take a break occasionally. Also if you've made a highly profitable trade and achieved your daily target, If you have one, why not reward yourself with a DVD or a shopping spree, for example. After all there's more to lift than just making money.

6) Invest your profits into other areas.

Trading forex is great, but why spend all your time busting a gut trying to make more and more money. If you do become a successful trader, invest some of it int stocks and property and make your money work for you. This way you will take some of the pressure off of yourself and you can become a more relaxed trader knowing you have other sources of income.

-

In my opinion it's the first of these that leads to their downfall, their backtesting is not realistic, they look at the start and end of the trade without looking at what happens in the middle. Their sample data is too small and they focus solely on trying to make their system work rather than trying to break it.There are some people who say that you need to suffer a few blowouts (wiping out your trading account) before you can become successful.

I do not buy into this at all, simply because what this doesn't teach you is discipline, and if you want to become a successful Forex trader, then discipline is one of the key attributes you will need.

When starting out you should not just throw some money into a trading account and say to yourself, "Well it is the money i can afford to lose, so what the hell, lets go for it".

Instead you should protect that money as if it is your life saving and losing it all and being blown out is simple not an option.

This will teach you to be disciplined both in your mind and in your trading where you should therefore be placing stop losses with every single trade to protect your capital in case you do incur any losses.

The key to becoming a successful profitable trader is to keep your losses small and contained and let your winners run, so your trading pot grows over time.

Unfortunately this is a lesson that even seemingly successful traders fail to learn.they may have built up large profits over a number of years, but if they do not use stop losses then eventually they can potentially be wiped out.

Indeed I know several traders who have sadly suffered this fate (mainly due to their ego and overconfidence) so please do not let this happen to you. Accepting a small loss when your stop loss is triggered is easy to swallow, but suffering a blow out and being completely wiped out due to not having controlled stop losses in place is not.

-

I just enjoy and cash the EUR/USD rallies. Short term trades are very useful. Just wait and short it on high. Market direction is very Clear,.

-

Bear Markets show that investors lack optimism on the strength of the economy and expect asset prices to for the medium to long term. Downtrend are generally defined as when prices continue to make lower highs and lower lows and when this happens in excess relative to the historical averages, markets are said to be in a bearish trend.

-

A Basket of Dollar Shorts shows that a trader is bearish on the US Dollar in relation to more than one currency. This investor is unsure which currency will be the strongest in the coming trend but there is a large degree of certainty that the US Dollar will weaken. This type of position is reflective of a general market stance that is usually based on macro economic fundamentals and is often seen in “risk taking” market environments.

-

Bar charts allow traders to see some parts of price behavior while isolating others. This enables technical analysis to take a more objective view of price activity and to not be distracted by external “noise.” Bar charts are often used by Elliott Wave traders rather than candlesticks because they feel it allows them to watch movements in the larger trend activity with more clarity.

-

Bad Fills can be frustrating for traders as they are often executed as a worse price than expected (too high in buy positions or too low for sell positions). There are generally two situations where this might occur. First is during times of excessive market volatility. Low liquidity levels can make it difficult for brokers to execute trades at specific prices. Other instances are seen when broker platform reliability is questionable. This situation is more avoidable, however, as long as a reputable broker is used.

-

Automated Currency Trading is a broad term that could refer to stop or limit orders that have been previously established by a trader, or in the algorithmic trading that defines trade parameters independently through mechanisms such as an Expert Indicator in MetaTrader. Automated trading can carry a higher risk of loss and position sizes should be lowered as a means of protection against adverse market movements.

-

The Australian Bureau releases macro economic data that can have a drastic effect of the price activity trends that are seen in the Australian Dollar. Data releases are scheduled for specific times on a monthly quarterly or yearly basis, and many traders base their position strategies based on the strength or weakness of the data that is made public. This information is also vital for the country’s central bank when monetary policy measures are being drafted.

-

The Australian Dollar is abbreviated in a number of ways, such as the AUD, A Dollar, or Aussie. Traders refer to the Aussie as a way of discussing the general strength or weakness of the currency. This comparison is usually made against the US Dollar but this comparison can be made to other currencies as well.

-

The AUD is the abbreviation used in forex pairs to define the value of the Australian Dollar relative to its counterparts. The AUD as a term, however, can be used to discuss the strength or weakness of the currency overall, and this would be apparent in phrases like “Today there was broad strength in the AUD across the board,” which would mean that the Australian Dollar gained in strength relative to all of its counterparts.

-

The*Guilder can be broken down into*100*cents, similar to the Dollar-denominated currencies. This is mainly because the currency was pegged to the Dollar in 1840 (at a value of 1.89) and this value has gradually been adjusted since then. Traders investing in the ANG currency hold an optimistic view of the country’s macro economic fundamentals and the value and allocation of the countries natural resources.

-

The Lek is the official currency of Albania, given value by the nation’s central bank. Traders investing in the ALL currency hold an optimistic view of the country’s macro economic fundamentals and the value and allocation of the countries natural resources. Price levels are heavily influenced by inflation rates, and the low liquidity levels of this currency make it unavailable in many brokerships.

-

One of the main tasks of financial institutions is to manage aggregate and limit exposure to adverse price swings. This can be seen in debt defaults, for example, and a financial manager’s job is to adjust position sizes so that excessive exposure is not seen at any one time.

-

The Afghani can be broken down into*Pul, and is a relatively new creation (beginning circulation in 2003) now used as a replacement for the previously weak national currency. Traders investing in the AFA currency hold an optimistic view of the country’s macro economic fundamentals and the value and allocation of the countries natural resources.

-

The*Diram can be broken down into*100*fuloos (1 fil x 100). In many cases, this currency is written using Dhs or DH as its symbol. Traders investing in the AED currency hold an optimistic view of the country’s macro economic fundamentals and the value and allocation of the countries natural resources.

-

Also referred to as an “acquisition adjustment” this term refers to the premium a company is willing to pay above the book value (total assets) when buying a smaller company. When a company is willing to pay these higher prices, it is reflective of an overall assumption that the industry or the specific managerial team is well positioned and is currently undervalued.

-

Even though the currency is pegged to the currency of another nation, countries with an Adjustable Peg can adjust the value of their currency, plus or minus, within a narrow trading band. These decisions generally are implemented as a means for aiding that countries export companies, as a weaker currency encourages foreign buying.

-

The Andorran Franc was pegged by the country’s central bank to trade at an equal rate with the Franc used in France (prior to 1999). Andorra did not establish a formal currency union with France, so there was no need to create physical coins or bills. Traders with a focus on this country will now watch movements in the Euro, as this is the currency now used by the Andorran nation.

-

The Absolute Rate is shown in percentage form (not as a reference rate discount), and combines the reference rate and the discounted fixed percentage of an interest rate swap. So, with LIBOR rates at 2 percent and a fixed interest swap component of 6 percent, the Absolute Rate is calculated to be 8 percent.

Daily Market Analysis

in Market News & Analysis

Posted

Research Analysis

EUR/USD

It is more risky to trade in Euro, where other currencies GBP, JPY are showing a mild strength against USD, While Euro is flat and is moving downwards.

EURUSD is in consolidation of the downtrend from 1.2747. As long as the channel resistance holds, another fall is still possible, and the target would be at 1.2000. On the upside, a clear break above the channel resistance will indicate that the fall from 1.2747 has completed at 1.2162 already, and then the following upward movement could bring price back to 1.2500 areas.

Today market move is expected in a price area of 1.2277 putting its support at 1.2232 and resistance at 1.2325.

Fundamentals to Effect Euro

Chart Representation

GBP/USD

GBPUSD’s upward movement from 1.5393 extends to as high as 1.5735. Further rise is still possible after a minor consolidation, and next target would be at 1.5800 areas. Support is at 1.5600, only break below this level could signal completion of the uptrend.

The data going to be released today regarding public sector net borrowing will impact the Market and after its release market movement for further few days can be anticipated.

Today Market is expected to move in a price area 1.5697 putting its support at 1.5649 and resistance at 1.5759.

Fundamentals to Effect GBP

Chart Representation

Gold

Yesterday Gold moved on upper side breaking the trend made previous few days and touched the price level at 1591. This impact can be interpreted as a result of various factors such as expectation of monetary easing from China lifted the prices to this level.

Comments by the German Chancellor that the solution to the bloc’s problem was not yet in sight made investors to remain at guard.

Today market is expected to move in a price area 1581.6 putting its resistance at 1591.7 and support at 1570.1.

Chart Representation

Silver

Silver added 0.44 to trade at 27.59 following on the heels of gold as industrial metals and precious metals witnessed gain on more positive attitudes. With the US dollar weakened on poor eco data and negative comments from Fed Chairman Bernanke, silver was able to enjoy that weakness.

Yesterday silver showed a positive attitude in the market as it was the first day after a few when silver moved above 27.00 and no lower side move was witnessed.

Today Market is expected to move in a price area 27.31 putting its support at 27.03 and resistance at 27.55.

Chart Representation

Crude Oil

Crude oil kept on moving upwards as it is moving on higher notes from previous few weeks. Yesterday witnessed raise was up to 92.93 levels. And it can be forecasted it will carry its uptrend movement.

Today market is expected to move in a price area 92.01 putting its support 90.78 at and resistance at 93.86.

Chart Representation

Dow Jones Index

If we consider previous few days movement for DJI, It shows DJI is moving on higher notes is further forecasted to move upwards and to touch the level of 13000 in coming few days.

Today market movement for DJI is expected in a price level 12881 putting its support at 12827 and resistance at 12928.

Chart Representation

Support and Resistance