Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

1399 -

Joined

-

Last visited

Posts posted by BlueHorseshoe

-

-

---------------------------------------------------------------------

---------------------------------------------------------------------

-

Hello,

I was wondering how other people respond to greater depth in the order book at a specific price level, particularly when they already hold a position?

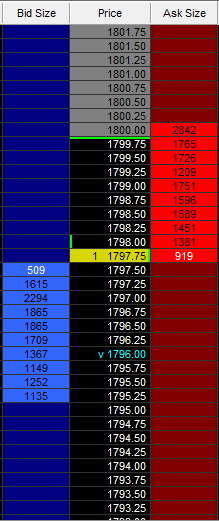

Take a look at the image below, for example.

There are a lot of sell limit orders sitting at the 1800 price. One would imagine this is partly due to the effect of longer term traders ("I'll short the S&P if it gets above 1800"), and it is also a tick above the high of the day at the time of this screenshot. But sometimes there is greater depth at a price level for no obvious reason.

So, if you were long at the time of the screenshot, what effect if any would the depth of price have on your position?

Some possibilities are:

- Have greater confidence that price will trade up to 1800 to seek out the liquidity there.

- Expect the market to initially struggle to break through the 1800 level due to the increased depth there.

- Doubt the validity of the current upwards price movement because lots of (passive, informed?) traders are looking to get short.

Any thoughts or experience are welcome . . .

BlueHorseshoe

-

Given GV does not support backtesting and this Chandelier Exit code uses GV, does this mean this Chandelier Exit cannot be used in backtesting?I haven't read the rest of this thread, but I can't imagine that there is any need to us global variables to program a chandelier stop for TS. I'm pretty sure I did this several years ago, as almost one of the first things that I did with EasyLanguage.

Explain what you are trying to achieve in a little more detail and I may be able to help?

Kind regards,

BlueHorseshoe

-

I am a student who traveled to Moscow to learn from the great trader Klaviskiborg of the remote viewing method to see tomorrows news paper today - but I still need more help because I seem to loose every single trade even after I see the news paper from the future.Instead of remote viewing tomorrows newspaper, try viewing the one for the day after that

BlueHorseshoe

-

Thank you BlueHorseShoe and MightyMouse! That was very helpful. I understand what you mean now. I was just curious what you meant, because I wasn't able to follow your line of reasoning. Now I can.Question... if I start with a 20k account, trading 2 contracts, what are some of the best ways to get consistently profitable as a beginner?

Trade gaps? Trade 2-3 hrs in the morning only (EST)?

What kind of setups and indicators is it best to use, and why are people using tick charts instead of candlesticks?

I realize these are loaded questions. Just trying to figure out where to get good quality info on how to get started with futures day trading. There seems to be an abundance of information and e-books, and "trading schools" but I don't know who's credible, and some are asking for a lot of money, or teaching platforms like Ninja Trading, which I never heard of. I was thinking of using ThinkorSwim. Is that okay for futures, or do I need to get something like TradeStation?

Lastly, I've heard conflicting opinions about whether or not to paper trade. Any thoughts?

Thank you in advance for any info you can provide.

Hello,

These are all very subjective questions (although I do realize that to you they probably seem perfectly reasonable).

You'll get as many different answers as people you ask.

Here are some bits of advice I would give you - they have very little to do with "becoming a consistently profitable trader" or "trading for a living", and more to do with how approach the long journey on which you about to commence . . .

Don't pay for anything in terms of educators, courses, any instructional stuff. Everything you need to know, and everything you can know, is already there in the data that you have at your disposal. All that makes the difference in the long run is your ability to analyze this.

Learn lots and lots of (relatively rudimentary) statistical analysis methods, and just as importantly, how to determine how robust your findings may be. By interrogating the data you can uncover general tendencies that will instruct your trading. You don't trade by reading about something in a book (or on a forum) and then doing it - you have to be cynical, assume everything is rubbish and focus your efforts towards trying to disprove it (proper scientific method), and treat your own ideas and insights in a similar fashion. With time, you will uncover a few diamonds in the rubbish tip. Be a scavenger. Be a cynic.

Learn about money management. Money management is about stop-losses or anything like that. It's not about when to buy, sell, enter, or exit, but about how much to buy or sell. This is how wealth can be built from a limited capital base.

Learn about market micro-structure. Often ignored (used to be less relevant). I can show you numerous simple strategies that would rake in several thousand dollars per day on a single contract with a $5k account, before you've paid for liquidity (and with these costs deducted - i.e. reality - they will empty your account just as fast). Once you understand market-microstructure you can decide how to position yourself in terms of it.

I hope that helps.

BlueHorseshoe

-

MightyMouse, can you elaborate on this comment? I'm a newbie. I'm not sure I understand what you mean.If you have $25k, and you trade 2 contracts, how do you end up with 20 contracts, and how do you risk only 4 points for a 60 point gain?

Sounds great, but I'm just confused on how you would accomplish this.

Hi intothefutures,

Not certain what MM was meaning exactly, but . . .

Once you have an open profit on a position you can move your stop-loss to "lock in" profit. At this stage you have neutralized your risk but you still have a position with (theoretically unlimited) potential for profit. The "locked in" profit can now be used to fund further contracts to add to the position.

A few things that you need to be aware of are that this would generally only be appropriate for scaling into a more significant market movement (trying to drag stop losses up behind the market every few ticks on small scalping type day-trades will generally just lead to stops being hit by the "noise" of the market), and that any kind of adjustment to the position of a stop loss can and will alter the dynamics of the return of your strategy over time.

Here is a quick (simplified) example:

- You need $1128 to fund a single contract of ES. Your account balance is $2256.

- You buy 2 contracts at 1760.***

- The market moves to 1774, giving you an open profit of $1400.

- You move your stop-loss to 1772.

- You now have a guaranteed profit of $1200, and 2 contract position with an open profit of $1400.

- You buy another contract of ES at 1774. You can do this because your account balance is $1400 higher than it was when you bought your first two contracts. Although this is theoretically "open" profit, in actuality it is the same as closed out profit because your trailed stop loss prevents it being lost.

- The market trades up to 1782. Because your open profit above 1774 is now the product of a 3 contract position, you only need the market to move two thirds the distance it moved last time before you are able to add another contract.

Once a fourth contract is added, the market will only have to move in your favor by half as much as with two contracts, before the necessary profit is made to add a fifth.

Finally, note that this is pretty "advanced chess". I've never done it. Not even on swing positions where I could have. When you get it right and the market continues to run in your direction, it should result in outlier gains on single trades.

Hope that helps!

BlueHorseshoe

*** I am NOT suggesting that it would be appropriate to trade two contracts with this initial balance - a single tick of movement against you and you'd be below required margin!

- You need $1128 to fund a single contract of ES. Your account balance is $2256.

-

I'm going to have to think about it more, but I think it's possible to get it done in the evenings, maybe 6 sessions (though I could spend more time… it's family). Maybe I'll start a thread about the experience this summer.

That would actually be pretty interesting, I reckon. Does she have any idea at all about trading or what you do, or would she be a complete, start from the first step novice?

BlueHorseshoe

-

It was relatively early in the session, so short or long - might have been harder to judge (without the benefit of hindsight) than some other posts suggest . . .

What is a little more surprising is that you apparently found no other opportunity to enter (long, one would hope) during the remainder of the session?

All depends on what you're looking for though, I suppose.

BlueHorseshoe

-

Trading the ES I find that I wind up with a lot of small trades and only two or three decent trades most days.The signals for the decent trades quite often are weak and some of the small trades have strong signals.

Hi Horace,

There are people here who are far better qualified to answer your question, but here are a few thoughts . . .

Rather than trying to decide whether the next move will be big or small (i.e. anticipate the quality of a signal), it might be easier to try and decide whether the current move (when holding a position) will be big or small. In other words, enter with the signals but then begin immediately to assess the probabilities of a favorable continuation of the move. Ask "what is happening now?" rather than "what is going to happen in the future after I enter a position?"

What is the nature of the small trades? If you can scratch three or four trades and then make a decent profit from one or two good trades, then that's actually pretty good going in my book.

Finally, remember that the ES is a mean-reverting market, so hoping for lots of movement on a typical day is always likely to disappoint.

Hope that helps!

BlueHorseshoe

-

How about a new drama called "trading bad" where a savvy wolf like trader exploits the new and destined to fail novice traders he meets on-line into giving them the best trades on the planet. Heres how it works: the wolf trader eggs on his new trading sheep friends to share their position entry/exits - a little ego stoking they will be happy to provide that. The only thing left to do is to take the exact opposite side of the trade. This will all but guarantee fast and big profits. As the profits grow quickly the wolfy trader gets greedy and realizes he needs a lot more sheep - so he opens his very own brokerage - to get in new sheeps he offers massive leverage and first 50 trades for free + free trading classes on some so called new instrument like currency pairs that is advertised to turn their $500 into millions.Aloha,

Dave

Hi Dave,

I think if you speak to Mitsubishi he's probably already got the script drafted, revised, proof-read, and ready to shoot for this. I can see the adverts now:

TRADING BAD

The only thing more addictive than crystal meth is Profit . . .

BlueHorseshoe

-

Would U mind 2 open the eld attached compiled with TS9 + 9.1 from MarkSanDiego ( a great EL programmer)

and 2 copy both functions + indics in 4 seperates texte files

and post them ?

Should be attached - haven't included the functions for the second indicator as the are presumably the same as for the first?

Have fun . . .

BlueHorseshoe

-

My understanding of the following code is that it should begin to plot at 0 with the open of a bar, and then increase with each tick until the close of that bar. The value of the "count" variable should reset to zero on the first tick of each bar; instead the variable remembers its value from the prior bar.

Any suggestions as to why?

BlueHorseshoe

vars: intrabarpersist count(0); If barstatus(1)=0 then count=0 else count=count+1; plot1(count);

-

What does consistently profitable mean ?It means that you make money consistently. Except during those periods when you don't. They don't count though, because they're consistently inconsistent, which is a form of consistency, especially if followed by a further period of consistent profitability.

Basically, as long as your equity curve is consistent with itself (or inconsistent with any other equity curve that is not itself), and you can't quite tell it from a straight upward sloping line drawn with a ruler . . . then you're consistently profitable.

You'll know it when you get there Zupcon - I find that it's normally about thirty seconds before the alarm clock sounds and my eyes blink open

BlueHorseshoe

-

In the trading room, we missed one of the only interesting set ups to go short during the session by 2 miserable ticks.Hi Michel,

For your posts to have much relevance to TL readers you'll probably need to give more information about what you're doing and why. This needn't be real-time (that's what your room is for), but other than that you were long twice and short once today, nobody can really see how you're trading.

Unless you do this your posts are just going to appear as adverts for your fee services, and that will tend to attract unpleasantness from people.

Hope that's helpful,

BlueHorseshoe

-

The only way to get real volume information, including up and down volume, in radar screen is to use the price series objects.Hello,

How accurate is the uptick/downtick data from TS?

I've seen references to it been less reliable than the MarketDelta data, but then such claims have come from vendors affiliated with the latter . . .

If TS uptick/downtick accurately represents trades executed at ask/bid, then it is pretty hard to imagine where the difference might lie between what can be calculated from that information, versus the MarketDelta products.

BlueHorseshoe

-

Having run various businesses for years that required people to do as instructed, I probably met 2 or 3 out of hundreds of thousands who could do as they where toldZupcon - I hope you weren't expecting people from Sheffield to do as they were told?

We never do

BlueHorseshoe

-

It might be useful to post a chart alongside these. The ES traded below the low of yesterday's value area pre-market, at which point the VAL from Friday at 1751 became far more relevant . . . A chart showing several day's values might make a better visual reference than just the prior day text you're currently providing.

Just a suggestion . . .

Regards,

BlueHorseshoe

-

We took 3 trades today:

1. Long 94.84 at 10:32am, exit 94.75 at 10:52am for a -9 ticks loss.

2. Short 94.66 at 11:18am, exit 94.45 at 11:34am for a +21 ticks profit.

3. Long 94.68 at 1:01pm, exit 94.77 at 1:06pm for a +9 ticks profit. Result: +21 ticks today

Hi Michel,

For your posts to have much relevance to TL readers you'll probably need to give more information about what you're doing and why. This needn't be real-time (that's what your room is for), but other than that you were long twice and short once today, nobody can really see how you're trading.

Unless you do this your posts are just going to appear as adverts for your fee services, and that will tend to attract unpleasantness from people.

You might find it is worth glancing at the Electronic Local blog over here:

Despite the fact that EL has described his methodology in considerable detail over the years, he is still able to attract seminar attendees at $5000 per time, plus whatever else he does in terms of DVDs and tuition - pretty much proof that giving away some free information can be beneficial to sales of your paid for product.

Hope that's helpful,

BlueHorseshoe

-

degree = absvalue(arctangent(Avg- Avg[1]));

Then you can 'categorize' flatness by using stddev of degree...

using dynamic / fuzzy or fixed brackets

Nice!

BlueHorseshoe

-

Yes, the help functionality has depended upon you being online for as long as I have used TS, I think.

Isn't there just a list of EL reserved words etc that you can access publicly somewhere online?

All the compiled html files are of a similar size to the one I attached.

BlueHorseshoe

-

Are you hoping to trade mean reversions off the bands?

Just a suggestion but . . . if you think that a rally off the lower BB is a likelihood when the bands are flat, then isn't it even more likely when they're upward sloping? And if you think a sell off from the top of the upper BB is a likelihood, then isn't it even more likely when the bands are downward sloping?

Can volume tell you anything at the times when the bands are flat? A flat MA could be interpreted as signifying that participants agree on fair value at that time. What would you expect to happen to volume when this agreement prevails? And when price moves away from an area of "fair value", is it likely to return to it? If the areas of fair value are successively higher and then price moves away from one to the downside, what is the probability that it will then return to this area?

I wouldn't concern myself too much with a dynamic "threshold" input - much more important to your success will be the value of the MA that you choose. Why is the degree of price agreement over 100 periods significant?

Certain markets like the ES spend a lot of time moving back toward the mean value of prior prices. Knowing which historical mean they are moving back towards is difficult.

You might find this article interesting:

TraderFeed: Trading By Mean Reversion

The "Bollinger on Bollinger Bands" book is worth a read (easy to find as a free pdf download) and I think that Larry Connors recently published something relating to the %BB indicator (which basically measure how close to the outer bands price currently is).

Good luck!

BlueHorseshoe

-

-

BlueHorseshoeThat's great!

Thank you for your help

Do you think it's possible to "automaticaly" determine threshold value depending of which stock ou future you trade?

It is possible, but you would need to decide how.

Having inputs that are dynamic in that way tend to be more robust, in my experience.

You could also have the input requiring a certain percentage change in the value of the average. In theory this would normalize it, but in practice you'll find that the percentage volatility of an instrument such as a smallcap stock is far greater than that of an instrument such as the ES. For that reason, unless you plan to trade a great number of instruments, it's probably better that you input the threshold value based on what you're hoping to identify, or according to what proves profitable in back-testing.

Regards,

BlueHorseshoe

-

BlueHorseshoehere a screenshot with a 100 moving average

in the rectangle the moving average is +/- flat

how to detect this situation with an indicator?

I see . . .

Well you're using MultiCharts, which I believe utilizes a variant of EasyLanguage, so I am guessing something like the following will work:

inputs:price(c),length(100),threshold(1); vars:myAVG(0),flatMA(false); myAVG=average(price,length); if absvalue(myAVG-myAVG[1])<=threshold then flatMA=true else flatMA=false; plot1(myAVG); if flatMA then setplotcolor(1,white) else setplotcolor(1,blue);

This should plot the blue average, and then colour it white when it is flat. 'Flat-ness' is determined according to how much the average has changed from its prior value - this is a user input that you will need to supply.

If you were trading the ES, for instance, you might consider that the average is flat if its value has changed by no more than a single tick from its prior value, in which case you would need to set the 'Threshold' input to '0.25'.

Let me know if this works for you.

BlueHorseshoe

Quit Job to Watch DOM.

in Futures

Posted

Hi Kuokam,

An interesting question!

I just posted this same query as a separate thread to see what thoughts people might share:

http://www.traderslaboratory.com/forums/day-trading-scalping/17662-dom-market-how-does-impact-your.html#post188369

BlueHorseshoe