Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

carltonp

-

Content Count

168 -

Joined

-

Last visited

Posts posted by carltonp

-

-

Hello carlton:Sorry for the late reply but I'm just getting caught up on my reading.

If you decide to try this you will notice that the YM trails the DOW by a certain number of points and the two markets pretty much mirror each other but it is impossible to tell which one is leading the other.

Hope this helps.

Cheers

Thanks for responding. This is so true.

-

Now the million dollar question

Would you say algorithmic trading is identifiable trader behaviour?

I would love to know the answer to that question myself......

-

Seems like an interesting observation.Some questions to ask yourself:

Does this phenomenon capture trader behavior that is identifiable?

Does this phenomenon occur in other time intervals?

MM, thanks for responding. To be honest I don't the answer to your first question. I was hoping that other traders will shed some light on that.

I havent' tried other intervals.....

-

Hello Traders,

I wonder if someone could shed some light on the following scenario with comments.

I trade the mini dow. My executions and exits occur on the 5min interval.

My main strategy is to wait until I see a WRB (wide range bar) develop and if there is a pause for say 15 seconds or more before the current interval is about to change then prepare to enter on a pull back. Let me give you an example. Lets say I'm witnessing a bullish WRB and the time is 11:54:40, (the interval will change in 20 seconds and the new interval will be 11:55), however just before the end of the current interval the price has paused at say 11833 for 18 seconds. At the begining of the new interval I will be looking to enter a pullback (a short trade in this instance) at or around 11833.

My thoughts are that right up until almost the very end of the current interval there is a huge amount of bullish activity, but just before end of the interval the price pauses - no one will know for sure why the price has suddenly paused but it has.

I have found that there appear to be fairly high probability that after the pause the price will pullback in the opposite direction or simply gap up / down in the opposite direction in the new interval.

I would love to hear your comments.

Cheers

Carlton

-

Carlton,I trade live everyday with IB, and 95% of my entries are with a buy-stop or sell-stop. So maybe I can clear a few things up.

First of all, I see you're trading sim, so its possible you got a goofy fill that would not have been filled in a live account.

A typical buy stop is a market order placed above the current bid/ask. When the price you set your order at is printed (the last price) your order is sent to the exchange as a market order and your order is filled at the ask. If the market is moving fast, there's potential for slippage.

I don't trade the YM but I see it has decent liquidity, so the 6 tick slippage you received is probably unusual.

~Mike

Hey Mike, do you work for IB? (just joking). When I called their support team they virtually said what you mentioned. However, you're explanation made it really clear for my simple brain to comprehend.

As you use IB and TWS, can you tell me if its possible to place a 'buy stop limit order' as suggested by SteveH?

Cheers

-

SteveH,

That is a fantastic entry method - brilliant. I'm going to try and emulate it and see if it works for me.

Excellent

Cheers

-

Gents,

Thanks for responding. I'm putting a call through to IB now, will let you know what they have to say.

Cheers

-

what is the time zone of 14:00 - 16:00 ? New York time? Exchange time?The timezone is New York time ....

-

You are welcome. Glad I can help.Everybody starts at the same place, I was there once.

Hi Tam,

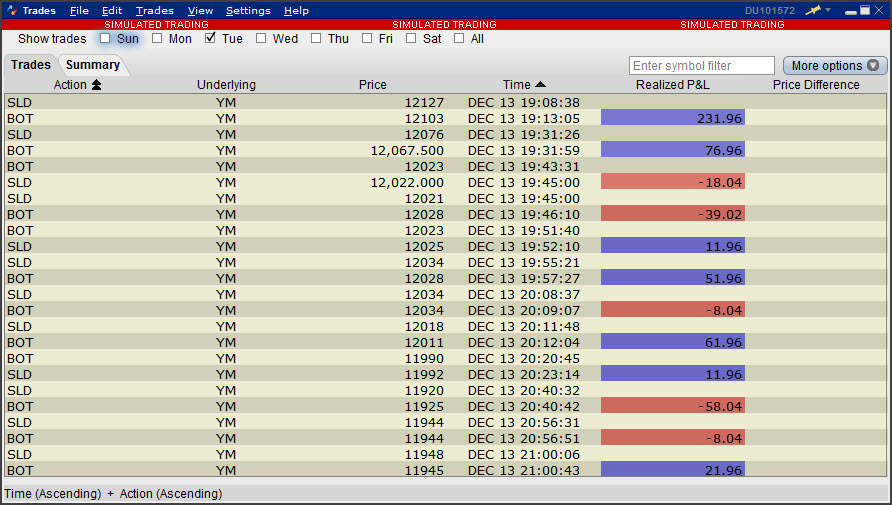

You may recall that I've been using Excel to develop a system based on trading at levels where price pauses. The attached is typical of the type of wining/losing trades I have been achieving using the system. I trade two hours a day - 14:00 - 16:00.

I wonder if I could ask you (or any trader willing to comment) to take a look at the trade log for 12/13/11 and let me know if that is typical of what traders would expect to be earning per day.

Without being condescending, Blue represents profits, Red represents losses.

Cheers

-

you should always study the contract specification before you start trading the instrument.The document is available at the exchange's website.

the market re-opens after RTH for the over night session, that's why your trade gets executed after close.

I thought I read that YM close at 15:15pm for maintenance and then re-opened at 15:30pm. Is that incorrect?

Cheers

-

Does it not reopen at 15mins later at 15:30?Cheers

Tams, am I correct in the above statement? Also, if YM closes at 15:15, how is it that I have traded YM after that time?

Cheers

-

you should pay attention to volume activitiesplease the volume bars on the bottom of your chart.

observe the volume level between RTH and after hours.

Once again, thanks Tams. You have been truly helpful with my journey.....

-

the rollover for index futures is 8 days before expiry.yes, you MUST change contract to the active month, which is Mar 2012.

the trading activity of the current month drops dramatically after rollover,

thus you see the extended "price pause".

you can call up both months and compare the volume difference.

see this article for info

Thanks ever-so-much Tams, that explains it for me.

Cheers mate...

-

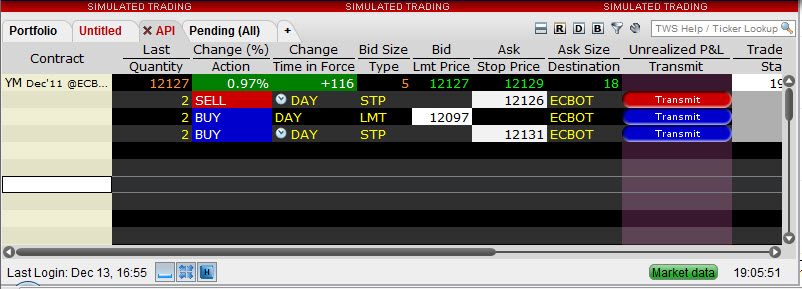

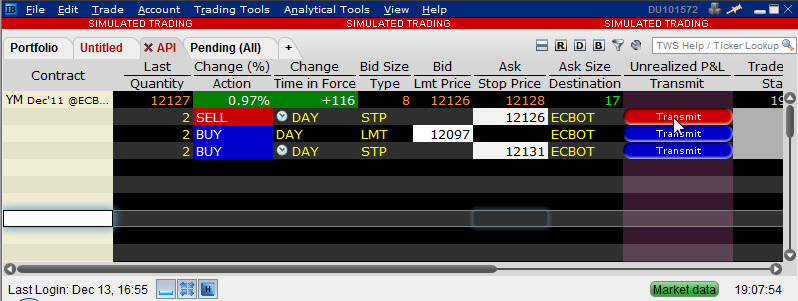

Tams, I've been looking at your quotes for 12/13/11, however I don't see any of my quotes listed. For example, just doing a search for YM price of12127, I'm not seeing anything in your attachment ......Tams, as you can see from the attachment, the price of YM at 19:05:51 GMT (14:05:51 EST) is 12127, for just over 2 minutes the price is still at 12127. However, I don't see that price in your attachment.....

-

You might want to enlighten us first:- what are you trading?

- what type of orders are you using?

- are you entering them directly on tws and if not do you know what was on tws?

and

- when you say the last price never reached x, the ask and your execution, what do you mean (what data are you looking at?)

Gents, thanks for responding.

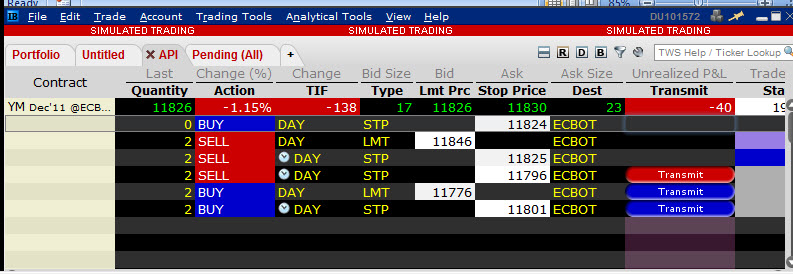

I'm trading mini dow(YM).

I'm placing buy-stop orders.

I'm entering them directly on TWS.

So, yesterday I placed a buy-stop order at 11824. The trade was executed at 11830. I don't have a problem with that. The problem is, the last price never reached 11830, however the ask price did. I've attached a snapshot of the exact trade as it happened yesterday. You will see that I have placed a buy stop at 11824. You will also see that the trade has executed at 11830 at the ask. However, you notice that the last price is 11826. What you won't we is that the actual last price never reached 11830. Normally, my the trades will be executed at the last price and not at bid / ask.

I hope this visual helps you to help me understand.

Thanks

-

in case you are not aware...1. YM RTH closes at 15:15

Does it not reopen at 15mins later at 15:30?

Cheers

-

here's my data from interactivebrokers.it is the same data you have, you can compare them to see if your ISP caused any discrepancies.

Tams, I've been looking at your quotes for 12/13/11, however I don't see any of my quotes listed. For example, just doing a search for YM price of12127, I'm not seeing anything in your attachment ......

-

are those exchange time you are quoting?which month you are tracking?

in case you are not aware...

1. YM RTH closes at 15:15

2. YM rollover was last Thursday

Hi Tams, as always thanks for responding (you are so helpful).

I have to admit, I wasn't aware that YM had rolled over last Thursday. I've been tracking December, 2011. Should I be tracking March, 2012?

Cheers

-

Hello Traders,

I'm using IB as my broker. For some reason, my trades were continually executed at bid/ask rather than last price. For example, I submitted a long trade to be executed at 11824. The trade was executed at 11830 at ask price, even though the last price never reached 11830.

Can someone please enlighten me.

Cheers

Carlton

-

Hello Traders,

I wonder if someone would be so kind as to tell me if they observed the price pausing for YM on 12/13/11 (and today) at the following times and prices:

On 12/13/11, YM paused at the times specified below at the stated prices.

PRICE START TIME END TIME TIME DIFFERENCE

12127 14:05:51 14:07:55 0:02:04

12126 14:08:37 14:09:22 0:00:45

12087 14:17:31 14:18:25 0:00:54

12025 14:58:40 14:59:45 0:01:05

Today, 12/14/11 YM paused at the prices stated below

PRICE START TIME END TIME TIME DIFFERENCE

11818 15:22:57 15:24:28 0:01:31

11845 15:53:12 15:22:00 0:01:48

So, for example, on 12/13/11 I observed the price for YM remain at 12127 for 2mins at 4 seconds. Did anyone see that?

Today, I observed the price for YM remain 11818 for 1min and 31 seconds and so on ... Again did anyone else notice that?

Please let me know, as I'm not sure if I this is common or should complain to Interactive Broker.

Really appreciate your feedback on this.

Cheers

Carlton

-

One of those things that's going to be different strokes for different folks, but where the Open-Close range is no less than say 95% of the High-Low range. That would do it for me.({[(H-L) - ABS(O-C)] / (H-L)}*100) <= (100-95) {or whatever your preferred percentage is}.

Hi can someone please tell me what 'ABS' stands for?

Cheers

Carlton

-

HiHave you allowed for the UK's change in daylight saving ?

The UK Daylight Saving ended on 30 Oct....The US does not do so until 6 Nov, after which the time difference between UK and US (est) will revert from the current -4 hrs to -5 hrs again.

Oops. Of course. Feel a bit silly now. Oh well

Thanks wyckoff

-

Hello Traders,

As I trade the mini-dow YM from UK I'm not always abreast of when the market for YM closes.

Can someone tell me what is the occasion in the US to close markets early today?

Cheers

Carlton

-

just for fun... here's the whole day of YMZ11ps. no guarantee to accuracy or completeness.

Excellent. I'm so meticulous, I will go through each pause :-)

Cheers Tams

June Contract for YM?

in Beginners Forum

Posted

Hello Traders,

Can someone tell me if we're now trading the June Contract for YM?

Cheers

Carlton