Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

2117 -

Joined

-

Last visited

Posts posted by Mysticforex

-

-

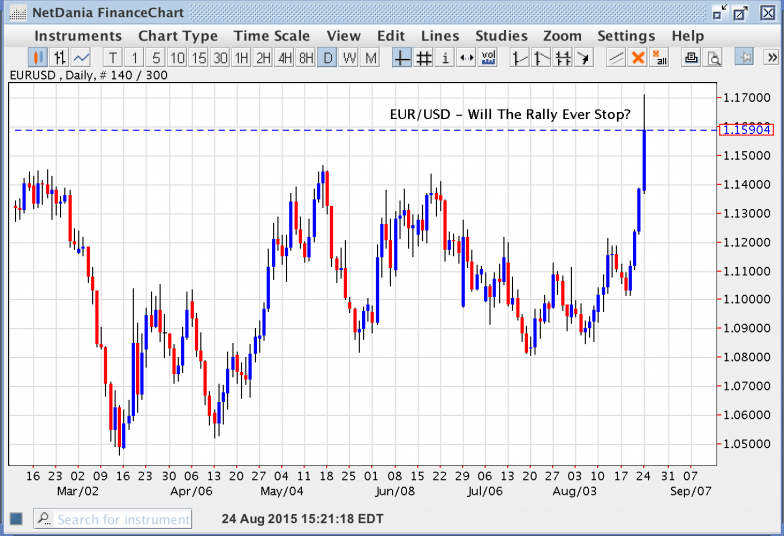

Over the past four trading days the EUR/USD is up an astounding 700 points or seven big figures. That's one of the sharpest rallies on record and is emblematic of just how wrong footed the market has been on the pair. The spike higher has been fueled by lack of liquidity, risk aversion flows and the merciless momentum of the algos which have wreaked havoc with many long term positions. The truth of the matter however is that fundamentally nothing has changed. The ECB are still on divergent monetary paths and the economic performance of US is far superior to that of Europe. No one that may matter in the short run however as currencies will continue to trade off equity flows. Once the risk aversion correlation establishes itself, it takes a while to go away. So the EUR/USD may indeed squeeze higher, but any further moves are likely to be more contained as most of the technical damage has already been done.

-

Technically, this is the first time in almost a month that EUR/USD closed above the 20-day SMA. However today’s rally stopped right at the convergence of the 50-day SMA, first standard deviation Bollinger Band and trend line resistance. This means that EUR/USD will either reverse from current levels and heads toward support at 1.0955 or break through resistance and march above 1.12.

-

For the better part of the past year 9400 has acted a rock solid support for AUD/CAD pair, but with Aussie slipping to 6 year lows this week the pair could finally break that key level. Last night the Aussie saw a mild bounce after the labor data came in better than expected, but despite beating market forecasts on all fronts the Aussie could not hold its rally highs. The reason for its weakness is the nagging belief that its just a matter of time that economy turns weaker and RBA will be forced to cut rates once again. Indeed some analysts predict that the AU rates will fall to 1.5% by the end of the year. In the meantime the loonie has also been under attack due to ever weakening oil prices, but crude appears to have stabilized at $50/bbl and the Canadian economy is less vulnerable to it price swings. Tomorrow's Canadian labor data, if it prints positive could be the catalyst that breaks the AUD/CAD 9400 level as markets begin to favor loonie at the expense of the Aussie.

-

-

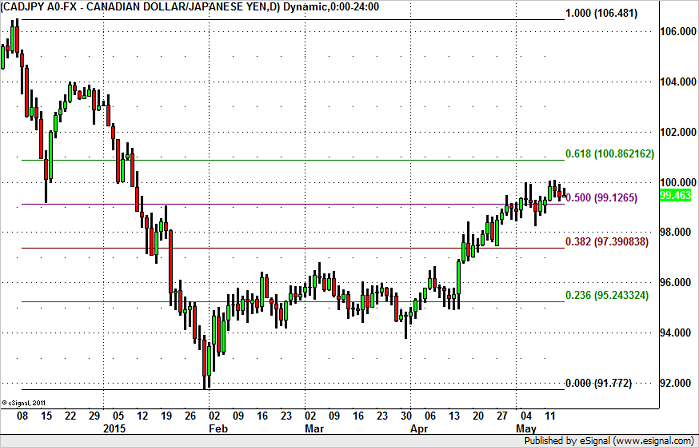

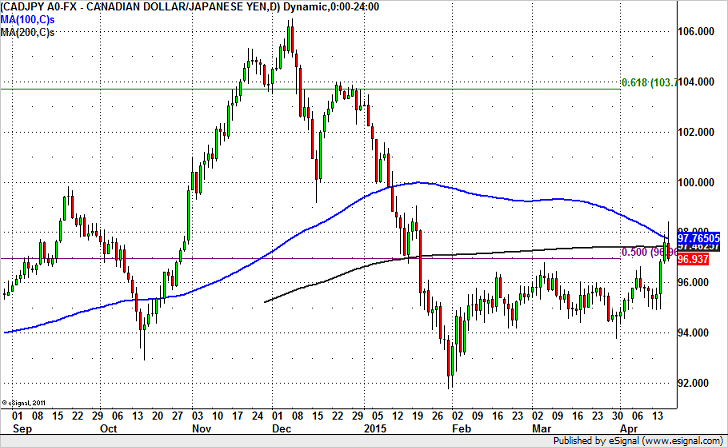

CAD/JPY

After dropping to a low of 91.75 in late January, CAD/JPY staged a dramatic recovery to trade all the way up to 100. The currency pair tested this level 4 times this month and is now itching for a break. While the rise has been largely driven by the turnaround in oil prices, in the long run, it is the improvement in economic data that will keep the Canadian dollar bid. The previous decline in oil prices hit Canada hard and now that prices are stabilizing, we should start to see positive economic surprises. In fact, the Bank of Canada already turned optimistic and is no longer looking to lower interest rates this year. Next week’s Canadian retail sales and consumer price reports will play a large role in determining whether CAD/JPY breaks this key psychological and technical level.

-

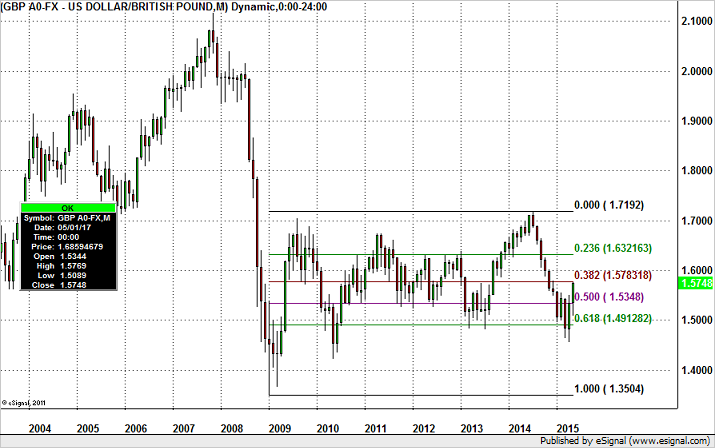

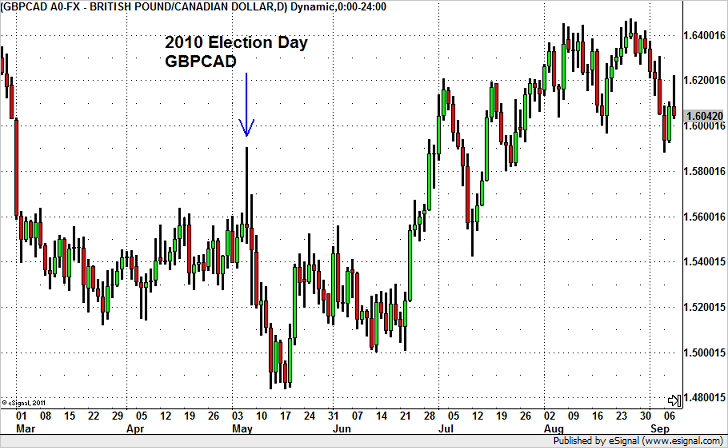

How High Can GBP Rise?

Sterling raced to its strongest level this year on the back of weaker U.S. retail sales, stronger U.K. wage growth and the residual boost from the Conservative Election win but with the Bank of England tempering the market’s expectations for tightening, how much further can GBP/USD rise? From a fundamental perspective, we know the U.K. economy is improving and we are still waiting on a turnaround in U.S. data but sterling has risen quickly in a very short period of time. The Bank of England also poured cold water on U.K. rate hike hopes by lowering their growth forecast for this year and next and warning that inflation could fall below zero before rising again. While the BoE is next in line to raise rates behind the Fed, it is looking more and more likely that they want to raise interest rates in 2016 and not 2015. U.K. data on the other hand continues to be firm with average weekly earnings rising at 1.9% versus the 1.7% forecast. Jobless claims dropped less than anticipated but the unemployment rate fell to 5.5% from 5.6%. Considering that inflation is nonexistent, the increase in wages is a net gain for U.K. consumers.

-

isnt the swap free accounts the islamic account!! i think its for people from muslim countries.They were setup up for people of Muslim faith. Not geographic location.

-

Hind sight is always great. Looking back only seven weeks ago when the EURUSD was trading about 600 pips lower, the chatter in the trade was when the euro was going to trade at parity. There was even one very large investment house projecting the euro would be trading in the low nineties versus the USD when we welcomed in 2016. How things have changed.

After nine months when the USD continually gained on the euro, the trend reversed as we have rallied close to the 1.14 handle. One expert claims if we trade to the top side of 1.14 we are headed for 1.20. Since this expert was bullish on the euro at 1.40 and remain so for months after the euro had topped I am wary following his trades, though sometimes it is helpful to remember those pundits who are usually wrong.

-

-

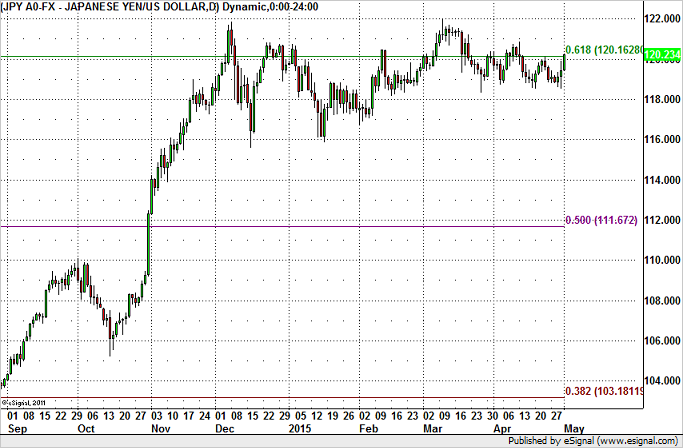

although 120 is an important psychological level for USD/JPY, there are many layers of resistance in the currency pair above current levels. First we have the 61.8% Fibonacci retracement of the 1998 to 2011 decline at 120.16, followed by the Feb high of 120.50 and the April high of 120.85. If the currency pair breaks above all of these levels, it would then face stiff resistance at the March high of 122. On the downside losses should be limited to the March low at 118.33.

-

One of the most interesting trends today was the massive divergence between the euro and the pound. While the former soared almost 200 points in one day the later treaded water. This all happened despite lackluster data out of Europe and promising political news from UK where the Torries opened up a 5% lead on Labor. In short today was momentum day in euro driven by massive short covering and end of month settlement flows. Typically such moves do not last. Tomorrow the market is going to get a glimpse of UK PMI Manufacturing as the cycle of reports begins for the pound. If the data remains relatively buoyant it will show that UK economy continues to outperform the continent and with Torries now more likely to retain power, the markets could warm to the pound once again. All of which leads us to conclude that the 7400 level will likely be a triple top. Technically the pair has made a nice W double bottom, but now faces stiff resistance at the 7400 level and further resistance at 7500 and is likely to consolidate the move for now

-

Technically, today’s move has taken AUD/NZD above the 100-day SMA for the first time since November. The next level of resistance is near the February highs of 1.0615. Above that is the year to date high just shy of 1.08. If AUD/NZD moves back below the 100-day SMA, now near 1.04, we could see a steeper slide down to 1.02.

-

-

From a fundamental and technical perspective, we have strong reasons to believe that USD/CAD will fall to 1.20. The Canadian dollar was the day’s best performer, rising to its strongest level against the U.S. dollar in over 3 months. What is interesting about the move was that no economic data was released from Canada and oil prices declined. However, last week’s positive news flow continued to boost the currency. The price of crude increased 20% this month, leading the Bank of Canada to drop its bias to lower rates. In fact, on Friday, Bank of Canada Governor Poloz said he is also very optimistic about the U.S. economy and believes that the adverse effect of lower oil prices will be gone by the second half of the year. The pickup in consumer spending and trade activity should lead to a stronger GDP report and it is one of the main reasons why we are looking for USD/CAD to hit 1.20.

-

-

-

RBA Governor Stevens said he would be surprised if the AUD/USD didn’t go do more. He also added that more rate cuts will come. How AUD/USD trades from here will be determined by tonight’s RBA minutes. If the minutes reinforce the Central Bank Governor’s dovish views, the currency pair will head back below 76 cents.

Technically, it appears that there is a triple top in AUD/USD. If the minutes are dovish and AUD/USD continues to trade lower, there is no support until 0.7550.

-

the “smart” trade is to buy CAD/JPY on a breakout. The currency pair failed at a key resistance level below 98. The confluence of the 50% Fibonacci retracement of the 2007 to 2009 decline and the 100-day and 200-day SMA, makes 98 a very tough level to break. However if CAD/JPY manages to close above this level, then there is no major resistance until the September 2014 high of 99.82. Alternatively buying CAD/JPY at the range low near 94 may not be a bad idea but the risk is the fulfillment of the head and shoulders pattern.

-

-

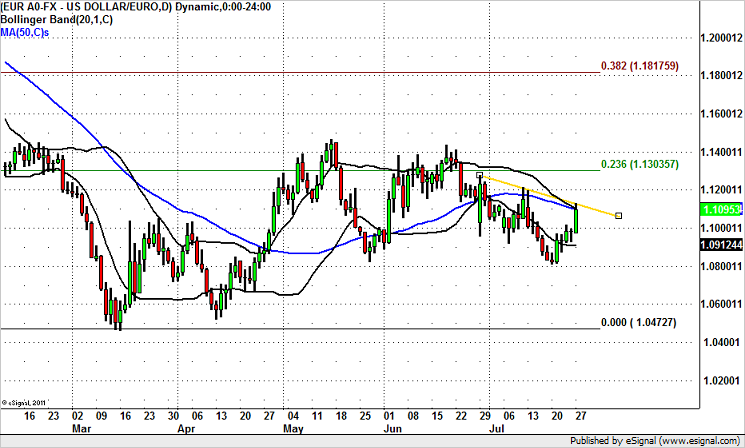

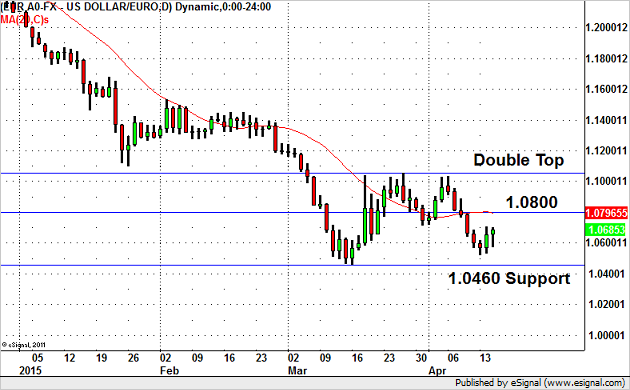

Euro Could Bounce to 1.08 After falling for 6 consecutive trading days and touching a low of 1.0520, euro has found a near term bottom versus the U.S. dollar. While we are long term bearish euros, we believe that the currency pair could bounce to at least 1.08 before reversing course and moving lower once again. The tone of today’s monetary policy press conference was decidedly more upbeat with ECB President Draghi saying that the recovery is broadening and strengthening. Earlier in the morning, the ECB left monetary policy unchanged and at the conference that followed Mario Draghi expressed his satisfaction with the smooth implementation of QE and the effectiveness of program thus far. He feels that improvements in the economy have diminished the economic risks and is moving the economy in the right direction. Draghi ruled a rate cut and instead said that the central bank can adjust QE if needed. European policymakers are happy with how Quantitative Easing is working and this optimism helped to stem the slide in EUR/USD and a further shot squeeze could drive the currency pair higher. Technically, there is a clear double top in the EUR/USD that we expect to hold. However the target for the current rally is the 20-day SMA at 1.0800. If EUR/USD struggles to break this level and starts to move back down, 1.0500 and then 1.0460 will be targets to the downside.

-

-

Give a man a gun and he can rob a bank. Give a man a bank and he can rob the World.

-

-------------------------------------------------------------------------------------------------------------------------------------

Welcome Brew23!

-

From a fundamental and technical angle, AUD/USD should be trading below 75 cents. The Reserve Bank of Australia made it clear that this is their comfort level for the currency and they would have no problems if AUD/USD dropped below this rate. Australia has 2 big problems – growth in China is slowing and the price of iron ore is falling. Earlier this year the RBA cut interest rates to provide cushion for the economy but with conditions deteriorating further since the February decision, they will need to lower interest rates again in May to avoid a downward

Chart of the Day

in Forex

Posted

Technically, a 1 big figure move is all EUR/USD needs to break 1.05. For the past 3 days 1.0550 has served as near term support for EUR/USD and once that’s broken the main focus will be on 1.05. Below 1.05 there is minor support at the 2015 low of 1.0459 and then no major support for the currency pair until 1.00 (parity). The main resistance on the upside is 1.0830.