Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

cnms2

-

Content Count

341 -

Joined

-

Last visited

Posts posted by cnms2

-

-

On 6/16/2013 at 6:29 AM, exbryan said:Why you say indicators fail and price action always works ?

This is a different thread to my previous thread called "with and without trading indicators". Recently I followed a price action course at 2ndskiesforex after reviewing forex peace army reviews. Actually that was great experience with Chris and I realized that price action powerful and always works. I spent thousnads of dolors on indicators and systems and finally down to free Moving averages with price action.

Would like to listen to similar stories here.........

Leaving aside the "always", indicators are based on price and / or volume, so as derivatives they filter out some information, and inherently include some delay relatively to price and volume.

-

Can anybody post a link where spydertrader writes about "bbt", "equal weight of all legs", or such?

-

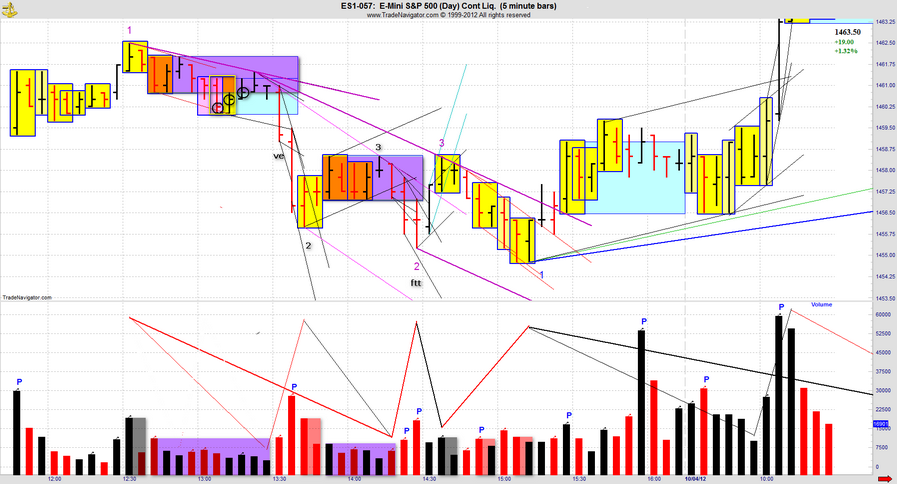

Jack wrote several times on the subject of the relation between ftts on different fractals:

"An FTT on level 3 is and FTT on level 2 and the FTT on level 2 is an FTT on level 1. what follows an FTT on level 1 is a BO of the level 1 RTL."Also, there is a discussion early in this thread between romanus and pointone about the ftt relation to pt1,2,3,ftt on other fractals.

-

This is why this thread died, and all attempts to restart it failed.That is not true, an internal with increasing volume are treated differently to internals with decreasing volume. This whole method is dependent upon volume and to simply ignore volume due to internals being price formations is reckless.In the Vegas conference Todd specifically differentiated between such cases.

-

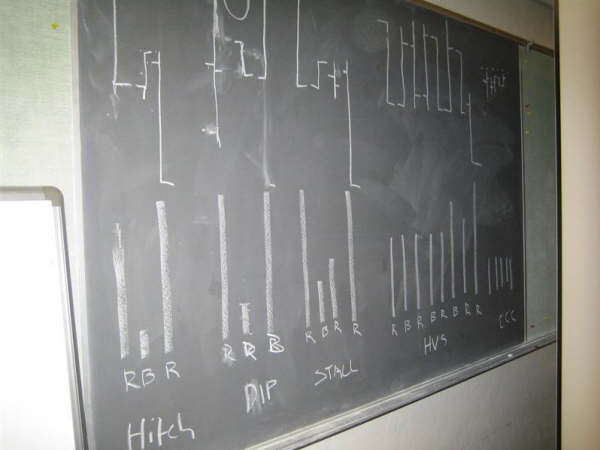

I don't think in terms of "flaws", but in terms of the "10 cases", of which only 2 are "translations"; the rest are "internals" (including the outside bar).Thanks 203NG, river, cnms2.I have over the years reviewed how Jack described these internal trend formations (hitch, dip, stall) occurring in dominant tape-like price movement in his Channels for Building Wealth document and a few very old posts.

Do you consider they might occur other than in pennant patterns or lateral formations in a price movement? I mean in translation case.

They can appear anywhere in a tape, and are price formations, independent of volume.

-

-

To those who still have difficulties using this method profitably, I suggest a RESET: put aside everything you know about it, then reread and assimilate ONLY Spydertrader's posts on this thread, starting with page 1. Pay attention to each word he wrote, and each line he drew!

Please be courteous and patient, or refrain from posting! Check your frustrations and pretentions at the door ...

-

-

I would like to hear from people trading using this method if full or in part?Which components do you find are the most useful (if any)

I have heard of people using the R2R or B2B component in option trading.

FTT, on all fractals.

-

Thanksgiving thanks giving.Could you please explain this post, why now? Spyder left 3 years ago.Thanks

-

You could google for: "jack hershey onepager pvt site:www.elitetrader.com"Yeah i know,thanks.By the additional info i meant the narration on how to read those columns,what the 18% scale actually represents,etc.I saw it somewhere on ET so long ago that i forgot.May be you can provide this information in this thread.Appreciate!This is one search result: Jack Hershey Method Since 2008 | Page 4 | Elite Trader.

-

-

-

Many Thanks to Jack Hershey and Spydertrader! & Best wishes!

-

-

@river: If you can't figure it out yourself, you can find out from vienna for $2 (for his time).

I pay more than $20 an hour my gardner ...

:)

:) :)!!!

:)!!!You figure it out...

-

It would be interesting to find out:

1. Who believes that the futures Hershey / Spydertrader method is profitable (not if you are profitable, but if you think it is profitable even if you don't know yet how)? It is.

1. a. Who believes it is wildly profitable? It is.

2. Who believes that any trading course will teach you a sure method of making money? I don't.

2.a. Who believes it will make you rich? I don't.

3. Who believes that somebody who charges to teach you trading is profitable trading? I don't.

3.a. Who believes it is wildly profitable? I don't.

-

-

That's really peanuts!Evidently $500. No word on whether or not that price includes a set of steak knives.-river

A quick calculation, if you master this method even slightly, and average 1 ES point a day:

- $12,500 a year

- 5 points a week, so you make $1,000 a month

- you can decide to double the number of contracts every $2,000, or 2 months, and use the power of compounding:

- in 2 months: 2 contracts ($25,000 a year)

- in 4 months: 4 contracts ($50,000 a year)

- in 6 months: 8 contracts ($100,000 a year)

- in 2*n months: 2**n contracts ($12,500*2**n)

- but, you can easily average 4-6 points daily in 1-3 trades

-

I can't understand why anybody who trades this method successfully would charge to teach it. He'd make more money trading it than teaching it. I understand if somebody doesn't want to fully share this method's indepth secrets, because he doesn't want to enable undeserving people, but to charge some unfortunate people who already spent a lot of time, energy, and hope seems to me wrong; a scam....People, don't buy it!

EDIT: I'm curious: how much does this class cost?

-

. .i am interested in the october seminar. Please send me details.... If there is any interest please pm me. Thx -

1. Probably free.What is the cost, is there going to be any live trading?2.

... what I'm considering is the possibility of a three-wknd Saturday (or Sunday) skyped seminar sometime in October? I'm thinking perhaps 5-6 hrs/day for three consecutive Saturdays? ... -

It's inside the lateral.

-

.thumb.jpg.da8a98ce3a53feb881473933caecffca.jpg)

Why You Say Indicators Fail and Price Action Always Works ?

in Beginners Forum

Posted

You realize that those who sell trading classes can't make their money from trading ... If they taught from the goodness of their hearts they would do it for free, not for the exorbitant prices they charge.