Welcome to the new Traders Laboratory! Please bear with us as we finish the migration over the next few days. If you find any issues, want to leave feedback, get in touch with us, or offer suggestions please post to the Support forum here.

-

Content Count

167 -

Joined

-

Last visited

Posts posted by ehorn

-

-

... :helloooo: :D

:D  :D

:D- Spydertrader

ROFL......... Nice!

-

Hey ehorn. Tell me that you nailed the PFC for yesterdy's open and I'll put you on my Christmas card list with possibly a tiny gift tacked on. All kidding aside, nice grab from the pool.No, I did not get that one correct. But by 9:50 am ET on 8/11 - things were a bit more clear to me.

-

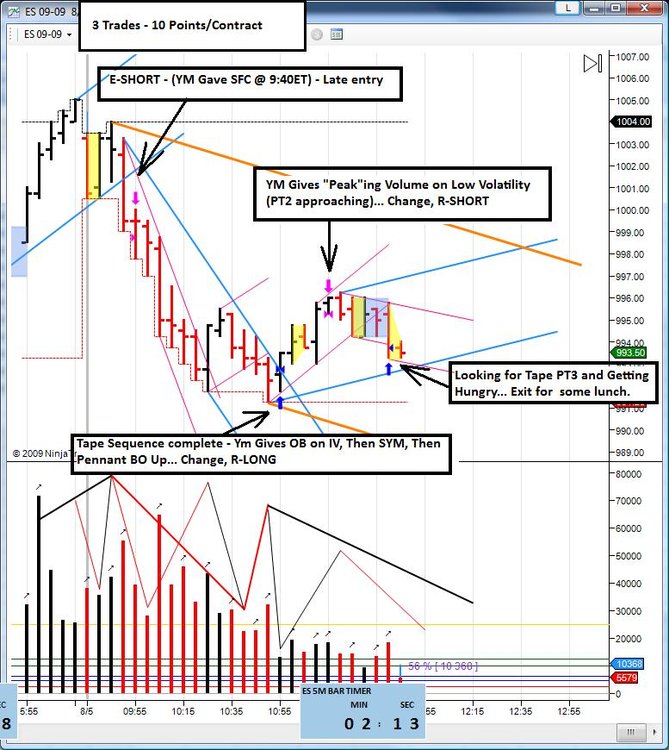

Tuesday, August 11, 2009.You just gotta love those A.M. rips to confirm your PFC...

-

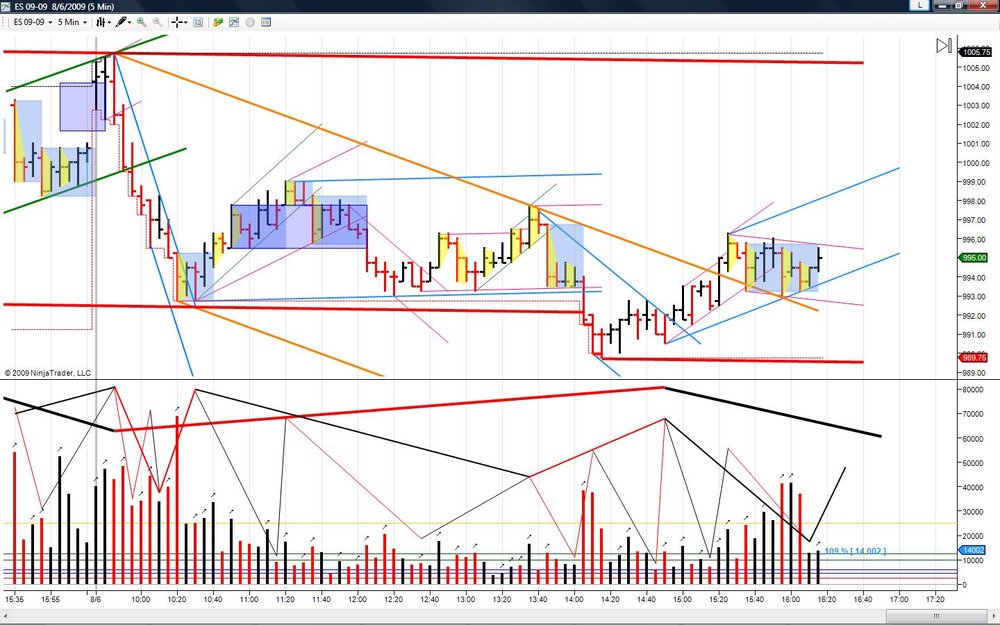

Here's my first chart posting. I want to thank everyone for participating in this thread. It has been enlightening and helpful for me. I want to especially thank Spydertrader for showing us the "how" and "where" of learning how to learn.I worked off of the beginning point that point 1 of the forming up traverse began 14:50 of 8/6. I saw point 2 as 13:35 of 8/7. That made the 9:35 bar today as point 2 of the forming down tape and bounded the rest of the day in the carryover tape. I was anticipating the completion of the down tape and a traverse point 3 which arrived at 14:20 today.

I need to do a review to see if this view has been confirmed or invalidated by the market.

+1 for this MADA...

-

-

So my daughter is watching Sesame Street this morning ...Sesame Street was brought to you today by the letter "W"

Sorry couldn't resist...

-

-

-

... How do you decide where to re-enter the market given that we are in up tape mode? Just anywhere and hold long or is there a specific point?TIA

How far down the rabbit hole does one wish to go...

A prudent entry is on the ES-5M tape FTT.

-

So where did romanus and me screw up?...And me...

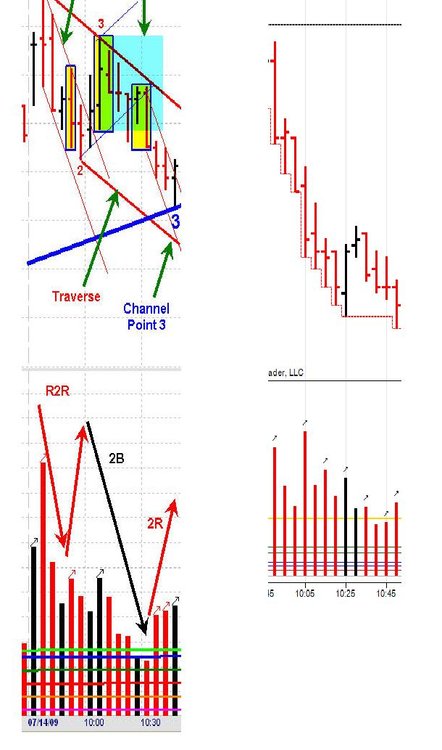

In RT I labeled the up move as a traverse. So my error occurred earlier in the day. And when you "think" you have built something - then you are looking for something else (despite the markets clarity).Was it in calling the entity which preceded the down tape, a traverse?

In RT I labeled the up move as a traverse. So my error occurred earlier in the day. And when you "think" you have built something - then you are looking for something else (despite the markets clarity).Was it in calling the entity which preceded the down tape, a traverse?For me... Yes

Just caught your morning so far ehorn. Congrats.Thanks, The template just goes right on over to the YM-2M and lets one see leading points of change... (where have I heard that before) lol!

Perhaps we should keep the focus on ES-5M for now though...

-

-

The market is very nice - it has told us this morning which way was the only correct way to annotate that snippet and so we can know WMCN

-

In the annotation drill snippet (across the first 9 bars) we go:

Stitch

FBP

OB

FTP

FBP

OB

What do we know about flaws?

@ 14:10 we begin moving up:

First bar DBV

Second Bar DBV

Is there something about tapes TO DV?

IBV does show up at 14:20...

How does it form?

If I review the sequences through here - I can only conclude one correct way to annotate this snippet which applies to every other thing on the same fractal.

-

-

-

Ehorn,Why did you terminate the 11:00 lateral at 11:20 or was that just a software artifact?

Hey LJ,

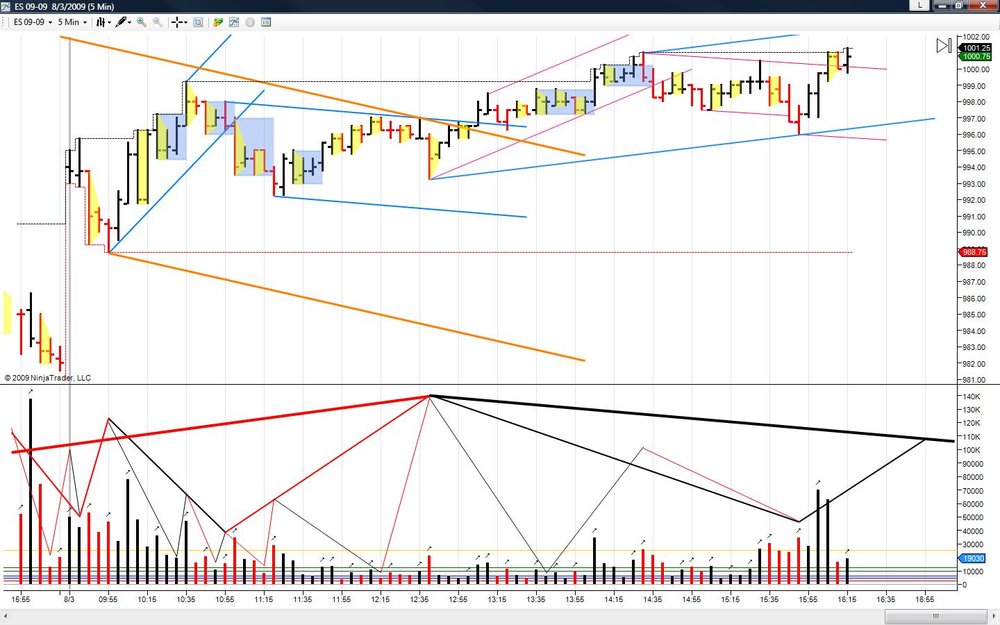

As configured, NT trunks the LAT shadowing with one bar out. To me, it appeared to be a dominant lateral. I believe dominant laterals take us to PT2 of something (I have annotated it as PT2 of the final DOM tape). I see a few possible ways to annotate the past few days (read I am lacking certainty here) and so tomorrow I will WAIT for certainty.

A wise man once provided some great insight. When one is lacking certainty as to the accuracy of his/her annotations of the sequences, then the only correct decision/action is to WAIT.

WAIT until the market provides certainty for the trader.

-

-

-

Thank you so much for sharing your efforts! What is your definition of Stitch-DV? Stitch-IV (I noted that both the long and short stitches are thus labeled)? DOM and Non-DOM Laterals? Please, and how doyou build up the gausians? building from the smallest unit to the larger as they develop?yvw,

DV = Decreasing Volume - The second bar in the formation

IV = Increasing Volume - The second bar in the formation

Think of a flaw (i.e. pennant type) - What type of volume typically forms the second bar of the pennant? A stitch is also a flaw. IMO, The volume of the second bar gives clues as to what type of stitch we are observing (think increasing volume decreasing volatility - or the inverse).

With regards to laterals, I share a similar view as JBarnby describes in an earlier post where he describes the differentiation of laterals.

Gaussians are tracked and built from lowest fractal to highest (tape ---> traverse ---> channel). Sometimes there are more visible fractals on a 5M chart (sub-fractals) but we strive to focus on the 3 listed above.

I have attached my debriefed chart for today. On It, I use blue to indicate tapes, green (today) and orange to indicate traverse (5M level). Looks like tomorrow I will be using the orange...

Best wishes

-

-

... Volume tends to rise when price is moving with trend and Volume tends to fall with corrections....An eloquent summary of a key concept.

-

The problem, ehorn, is that no one who claims to have found success with your Jack Hershey Method has ever demonstrated to anyone anywhere in real time that such success is indeed enjoyed.I have asked for just such a demonstration. But nothing of the sort ever came from you or your fellow method members.

Likewise, Db has more than implied above that you or Spydertrader or Jack Hershey himself would be more than welcome to make an appearance in the TL chat room and provide a real time demonstration of your method. But I doubt you any other member of your gang will prove himself willing to provide that demonstration.

A problem for whom? you?..., DbPhoenix?..., <insert name here>

From my perspective, this is simply not a problem which requires a solution. A trader can examine his/her personal results and conclude something about performance and effectiveness. The market is always there and it is an excellent (only) resource for validating or invalidating solutions to problems.

Isn't it enough for you just to continue to post your charts in your own thread each day at 4:15 EDT telling your followers how well you did that day? Must you now troll all over TL for fresh victims? I say victims, because until your method is demonstrated at the proverbial hard right edge of the chart, you are indeed victimizing those whom you induce to commit their time and capital to learning this method. And you do induce them. You do so by asserting that your method allows for the absolute predictability as to where price is going to be and, if I'm not mistaken, when it is going to get there.Your accusations and responses portray a discomfort and unwillingness to allow sharing to occur in a community intended for just such a purpose. Trading is not about prediction. All trading accurs in the NOW, some methods do provide for a level of anticipation. I would not suggest that any learning trader commit any capital until they have sufficient testing and understanding of the methods they undertake.

You mock those who acknowledge trading as a game of probabilities. You promise your students certainty. If your method really allowed one to predict price, as you claim, rather than merely anticipate price, then you should have no fear of your ability to put on quite an impressive show.Believe me, if you or one of your followers would actually demonstrate your method in such a way as to validate the claims made on its behalf, I would readily be willing to change my opinion concerning your method, and to do so publically.

I am not interested in your opinion. Nor am I concerned with your assessment of the approach to which I subscribe. If you despise my views or feel they are out of line with your set of beliefs then feel free to put me on ignore and save yourself the hassle. I would recommend that for anyone who shares your views.

It appears the discussion has taken a fork in the road. My intent was to share my thoughts regarding the OP's inquiry. As senior members (read post count) - I would have anticipated a similar level of courtesy and respect towards fellow members who are making inquiries and/or contributions and sharing ideas about trading.

Peace.

-

...Why am I not surprised?

Many people are successful applying many techniques to trading. It is clear (and no surprise) that you and others do not agree with and/or have not experienced success or found value in the application of price/volume relationship. I am not compelled to try to convince you or anyone else of its efficacy. But I (as are you) are compelled to provide a response to the OP's inquiry (which is a great one) based on our own personal experiences and conclusions. Those experiences are clearly reflected in our differing responses.

With that - It is my personal experience that the principles are effective in giving a trader the tools needed to understand how markets operate and this information can be used to trade effectively and I am personally satisfied with the results it produces. You would disagree with this assertion (again, no surprise).

In civil discussions - It is ok (with me) that folks agree to disagree

Best wishes

-

And I'm sure that ehorn will be delighted to demonstrate the "truth" of all of this to you in real time in our chat room.Until then, keep your wallet in your pants.

LOL! Anyone is free to explore the concepts at their own convenience and make a determination if the information presented is valuable or not.

I have seen statistics approaching 4:1 which deny the facts represented in my post. In trading - it is good to be on the side of the minority.

Have a nice day

The Price / Volume Relationship

in Technical Analysis

Posted

I'll throw in my hat too...